All Activity

- Past hour

-

ampf started following optimalninja.com Joint Purchase

-

The only thread I found here is related only with the bars I would like to know who here would be interested on the Optimal Ninja Indicators Pack, the monthly cost are 100usd and if we could get 10buyers would 10usd each and try to get it educated here. https://www.optimalninja.com/ I would invite to take a serious look on the indicators that seem to be pretty good. Let me know what you think and if you would be interested

-

⭐ fryguy1 reacted to a post in a topic:

QuickTradeNinja

⭐ fryguy1 reacted to a post in a topic:

QuickTradeNinja

-

Cam always use these file upload places: https://fromsmash.com/ https://workupload.com/ https://anonymfile.com/

- Today

-

Look promissing

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

[b]Date: 1st August 2025.[/b] [b]Bank of England Rate Cut in Focus: Sterling Slips as Fed Holds Steady.[/b] The Bank of England (BoE) is widely expected to cut interest rates at its upcoming meeting on August 7, bringing the Bank Rate down from 4.25% to 4.00%. This decision would mark a continuation of the central bank’s cautious and gradual monetary easing cycle as the UK grapples with persistent inflation and sluggish economic growth. Although some Monetary Policy Committee (MPC) members had already called for a cut during the last meeting, the majority opted to wait, citing the need for a more measured approach. However, with inflation moderating and economic headwinds building, the conditions now appear more favourable for a rate reduction. BoE Monetary Policy Outlook: Gradual Easing Ahead BoE Governor Andrew Bailey is expected to reinforce the central bank’s steady approach to rate adjustments. So far in 2025, the BoE has acted every three months, a pattern likely to continue through the end of the year. Despite projections that headline inflation will rise to 3.7% by September, mainly due to energy base effects and regulated prices, the Bank anticipates that consumer price inflation (CPI) will fall back toward the 2% target in the medium term. A sluggish UK growth backdrop supports further easing, with an additional cut forecast in November 2025, and a terminal rate of 3.50% expected by February 2026. Still, uncertainties remain. The inflation and rate path will depend heavily on global economic developments, fiscal policy, and evolving UK–US trade dynamics. UK–US Trade Deal and Updated Growth Projections The upcoming BoE meeting will also include an updated Monetary Policy Report and revised economic forecasts. Investors will watch closely for how the UK’s new trade agreement with the United States affects the central bank’s growth outlook. While the impact of the 10% baseline tariffs may be limited in isolation, broader effects on global supply chains could influence inflation. Some economists argue that tariffs may reduce inflation if exporters cut prices to redirect goods away from the US, but significant supply chain disruptions could have the opposite effect. UK PMI Weakness Reflects Fragile Economic Sentiment Recent economic data points to weak momentum in the UK economy. The S&P Global flash PMI for July showed a drop in the Composite Output Index to 51.0, a two-month low. Although the manufacturing sector improved slightly, it remained in contraction territory, while the services PMI fell from 52.8 in June to 51.2, still in expansion, but signalling a slowdown. This decline in business activity suggests that growth is likely to remain soft, with businesses citing reduced new work and persistent caution following the fiscal tightening introduced in April. Labour Market and Wage Trends in the Spotlight The UK labour market remains a key variable for the BoE. Survey data from the services sector highlighted strong wage inflation, with businesses attempting to pass on the cost of increased National Insurance contributions and the higher minimum wage. These cost pressures have kept consumer prices elevated, even as demand cools. At the same time, businesses have started to shed staff, indicating that labour market slack may be building faster than previously anticipated. If this trend continues, it could help curb wage growth, offering additional disinflationary pressure. Household Savings Surge Underscores Consumer Caution Another factor reinforcing the case for further easing is the increase in household savings. Data from June revealed a sharp rise in deposits with banks and building societies, which climbed by £7.8 billion, compared to £4.3 billion in May, and significantly above the six-month average. Much of this increase was allocated to Individual Savings Accounts (ISAs), possibly due to concerns about potential changes in government policy on deposit allowances. The shift toward saving rather than spending suggests that consumers remain cautious, posing a risk to domestic demand and justifying further monetary stimulus. BoE Quantitative Tightening Policy Under Scrutiny In addition to interest rate decisions, the BoE's approach to quantitative tightening (QT) remains in focus. Unlike its global peers, the BoE has been actively selling assets in the open market, contributing to a rise in long-term yields and increasing government borrowing costs. While some policymakers have pushed for an end to active QT, most analysts expect the BoE to reduce the annual pace of asset sales from £100 billion to £75 billion in 2026. There are signs of tightening liquidity as well, with usage of the BoE’s long-term repo facility nearing record highs. The Bank’s new framework, which allows markets to bid for reserves, has created more uncertainty around reserve scarcity as the balance sheet contracts. Although no major announcement is expected on QT during the August meeting, Governor Bailey may offer early signals ahead of the final decision in September. GBPUSD Slips Amid Fed Hold and Strong US Data The British Pound weakened against the US Dollar on Thursday, as GBPUSD fell to 1.3214, down from an intraday high of 1.3281. This move followed the Federal Reserve’s decision to keep interest rates unchanged, with two dissenters favouring a cut. Despite speculation surrounding future easing, fueled in part by former President Trump’s comments, Fed Chair Jerome Powell provided no clear forward guidance, stating that decisions will be taken meeting-by-meeting. The US Dollar gained further support from strong economic data. Initial Jobless Claims came in at 218,000, lower than the 224,000 estimate, confirming continued strength in the labour market. Inflation data also surprised to the upside, with Core PCE rising to 2.8% YoY in June and Headline PCE climbing to 2.6%, both above forecasts. This divergence in monetary policy between the Federal Reserve and the Bank of England has placed additional downward pressure on GBPUSD. While markets see a 65% chance of the Fed holding steady in September, expectations for a BoE cut next week stand at 80%. The growing gap in policy stance has tilted the currency pair into bearish territory. GBPUSD Technical Analysis: Bearish Bias Builds Technically, GBPUSD has broken below its 100-day Simple Moving Average (SMA) at 1.3334, breaching key psychological support at 1.3300. The Relative Strength Index (RSI) has also shifted into bearish territory, reinforcing downside momentum. If the pair falls decisively below 1.3200, the next support level is found at 1.3100, with the 200-day SMA at 1.2977 offering further downside targets. On the upside, only a close above 1.3250 would signal a potential recovery toward the 1.3300 zone. Conclusion: All Eyes on August 7 BoE Meeting As the Bank of England prepares to cut rates, the combination of softening growth, persistent cost pressures, and cautious consumers strengthens the case for further easing. At the same time, the Fed’s steady stance, backed by robust US data, continues to drive GBPUSD lower as monetary policy divergence takes centre stage. Markets will closely monitor the BoE’s tone, the updated forecasts, and any hints regarding quantitative tightening adjustments. With volatility likely to remain high, traders should remain alert to shifts in inflation expectations, labour market dynamics, and central bank messaging. [b]Always trade with strict risk management. Your capital is the single most important aspect of your trading business.[/b] [b]Please note that times displayed based on local time zone and are from time of writing this report.[/b] Click [url=https://www.hfm.com/hf/en/trading-tools/economic-calendar.html][b]HERE[/b][/url] to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click [url=https://www.hfm.com/en/trading-tools/trading-webinars.html][b]HERE[/b][/url] to register for FREE! [url=https://analysis.hfm.com/][b]Click HERE to READ more Market news.[/b][/url] [b]Andria Pichidi HFMarkets[/b] [b]Disclaimer:[/b] This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

Avt reacted to a post in a topic:

NT8 Indicators collection

Avt reacted to a post in a topic:

NT8 Indicators collection

-

Bill A reacted to a post in a topic:

My Future Success

Bill A reacted to a post in a topic:

My Future Success

-

MOrosi started following QuickTradeNinja

-

QuickTradeNinja Version 2.0.12 has there own Licensing. Educatable ?! Thanks https://quicktradeninja.com/ QuickTradeNinja_v2.0.12.zip

-

yahoo is not working

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Gold (XAUUSD) strengthens despite pressure from the US dollar XAUUSD quotes are attempting to recover, supported by technical factors and sustained demand. Prices currently stand at 3,292 USD. Find more details in our analysis for 1 August 2025. XAUUSD forecast: key trading points Gold demand in Q2 2025 reached 1,080 tonnes Central banks reduced purchases but remain key buyers Jewellery consumption dropped to 2020 levels XAUUSD forecast for 1 August 2025: 3,375 Fundamental analysis XAUUSD prices are rising for the second consecutive day, with buyers keeping prices above the lower boundary of a large Triangle pattern. Despite this local recovery, the precious metal remains under pressure from a stronger US dollar, which gained after Donald Trump announced plans to impose higher tariffs on several countries. According to the World Gold Council, global gold demand in Q2 2025 reached 1,080 tonnes, up 10% from the same period last year. Central banks continue to play a significant role despite slightly lower purchase volumes. In contrast, the jewellery segment showed weak dynamics, with consumption nearly returning to 2020 pandemic levels. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 290 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

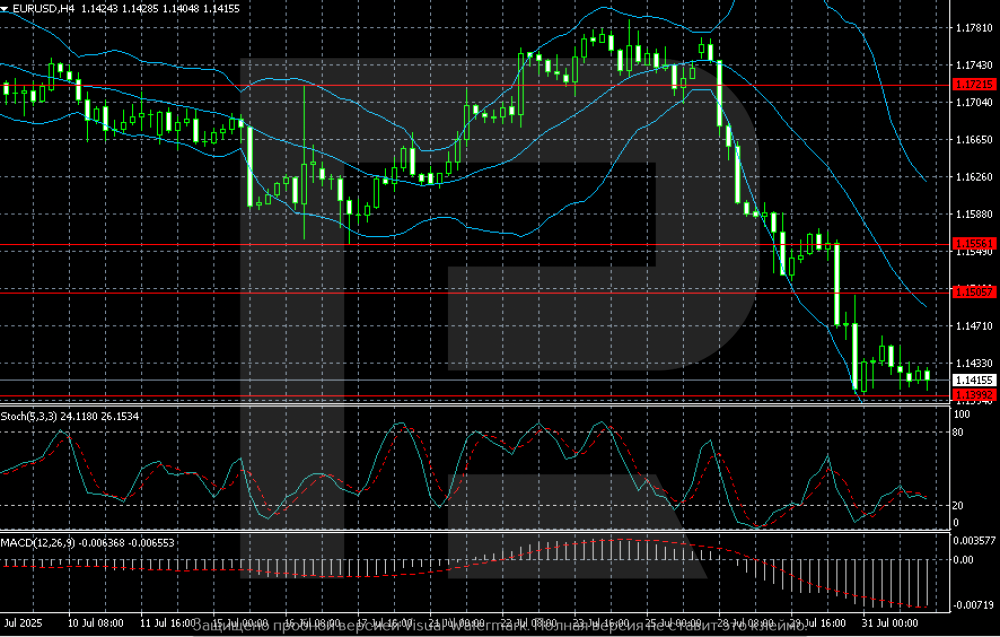

RBFX Support replied to RBFX Support's topic in Technical Analysis

EURUSD takes a breather: news supports the US dollar The EURUSD pair has paused around 1.1416 as the market continues to favour the US dollar. Discover more in our analysis for 1 August 2025. EURUSD technical analysis On the H4 chart, the EURUSD pair consolidates near 1.1415, holding the local support level at 1.1399. After breaking below the 1.1550-1.1505 area in late July, the downward move accelerated, with recovery attempts remaining weak. After a sharp drop, the EURUSD pair appears to have lost direction for the moment. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

icloudclub reacted to a status update:

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the

icloudclub reacted to a status update:

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the

-

To have the ultimate advantage, you need to do much as you can to educate yourself and fill yourself with knowledge. There are always more things to learn, like from youtube videos, broker webinars, for example from HFM, etc.

-

New version.. V5.1 Simple Market Metrics.txt

-

thank you @bassmark2, grateful for the share. was able to download and really helpful.

-

⭐ RichardGere reacted to a post in a topic:

NT8 Indicators collection

⭐ RichardGere reacted to a post in a topic:

NT8 Indicators collection

-

fxzero.dark started following NT8 platform

-

fxzero.dark reacted to a post in a topic:

NT8 platform

fxzero.dark reacted to a post in a topic:

NT8 platform

-

baio joined the community

- Yesterday

-

@Traderbeauty Thanks for guarding the forums - Grateful for this.

-

⭐ mangrad reacted to a post in a topic:

NT8 Indicators collection

⭐ mangrad reacted to a post in a topic:

NT8 Indicators collection

-

tibim71837 reacted to a status update:

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the

tibim71837 reacted to a status update:

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the

-

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

bassmark2 reacted to a post in a topic:

NT8 Indicators collection

bassmark2 reacted to a post in a topic:

NT8 Indicators collection

-

sorry if i sounded rude or impolite. there was a time when a lot of members uploaded stuff using nitroflare and other links the same. The problem with these links is that unless you pay them and becomes a premium member in that site it can take you few days to download each link - they let you download it for free but so slow.... The members that were posting that were making money somehow through these sites so thats when i put an end to it. but if you feel that this is legit then please put the attachement back- here is the download link but again- it might take forever for a free download. These indicators are very old and its not worth the wait or the money to become a vip member but obviously its your choice. Thanks again for sharing. https://scriptmafia.org/tutorials/566298-nt8-indicators.html

-

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

icloudclub joined the community

-

@bassmark2 Please DM the link. Let me look over.

-

The OP link was valid, took me to a site and was able to download just as he says. didn't need to sign up to anything

-

tibim71837 joined the community

-

There is no need to be rude. All the links are there, just need to wait for a few seconds for the Uploadgig or Nitroflare to generate the links, standard procedure. As for my reputation, I have contributed to this forum for years under my previous nick "bassmark". I hope it helps. Cheers.

-

this is BS- it takes you to bogus sites where you have to wait or sign up - i deleted it so please do not post it again.

-

pygmalion5000 reacted to a post in a topic:

NT8 Indicators collection

pygmalion5000 reacted to a post in a topic:

NT8 Indicators collection

-

traderhb joined the community

-

I just wanted to share a link to a huge 1.3GB collection of NT8 indicators, they are still available for download. I don't have any additiona l information on the package but I attached the list of files in the folder. The link is in the attachment. Enjoy. BM