All Activity

- Past hour

-

⭐ zbear reacted to a post in a topic:

TDU Dynamic Reversal Zones

⭐ zbear reacted to a post in a topic:

TDU Dynamic Reversal Zones

-

Sure, you can do it that way, but it's a lot of work. Unfortunately, the books are old, and there's no PDF version. Even if you have them, they're still a waste of time; you'll never make a profitable profit in trading. A while back (when I was young), I had some study material from a guy who followed Torreggiani and Migliorino, along with some settings for the WebSella platform, but I threw it all away. I don't know if you're just passionate about it or if you're studying something to make a profit on the stock market. Follow the TF 3-minute Supertrend on the MiniDax instead, but be careful, it's not as simple as it sounds.

-

⭐ laser1000it reacted to a post in a topic:

Sentient Trader 4.04.17

⭐ laser1000it reacted to a post in a topic:

Sentient Trader 4.04.17

-

Traderbeauty reacted to a post in a topic:

TDU Dynamic Reversal Zones

Traderbeauty reacted to a post in a topic:

TDU Dynamic Reversal Zones

- Today

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

US 500 forecast: index hits new all-time high and begins correction The US 500 index approached the 6,500.0 level, and with each new all-time high, the likelihood of a downward correction increases. The US 500 forecast for today is positive. US 500 forecast: key trading points Recent data: US NFP for July came in at 73 thousand Market impact: slower employment growth and a high unemployment rate create uncertainty, which may trigger volatility and investor caution Fundamental analysis The Nonfarm Payrolls figure came in at 73 thousand, significantly below the expected 106 thousand, although still above the revised previous value of 14 thousand. This reflects a slowdown in job growth and worsening hiring dynamics. The three-month average job growth is just around 35 thousand, marking the weakest level since the onset of the 2020 pandemic. This suggests a notable cooling in the labour market and could signal a broader economic slowdown. This serves as a negative signal for the US 500 index, since weak labour data often correlates with slowing economic activity and declining corporate earnings. The technology sector may come under pressure, as company growth depends heavily on a strong economy and robust consumer demand. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 292 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

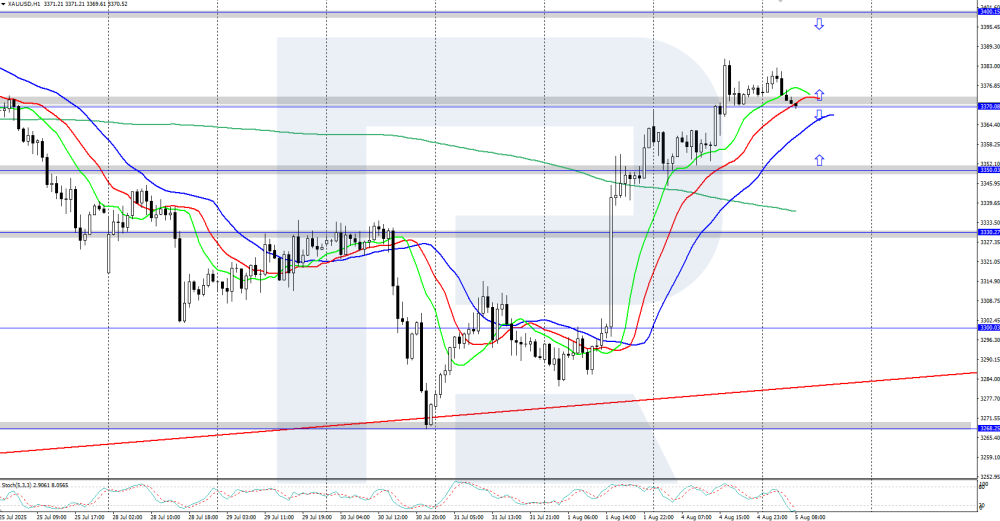

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Gold (XAUUSD) rises towards the 3,400 USD area XAUUSD prices continue to strengthen, taking advantage of the weaker dollar after disappointing US Nonfarm Payrolls data. Find more details in our analysis for 5 August 2025. XAUUSD technical analysis XAUUSD prices are rising after reversing upwards from the daily low at 3,268 USD. The Alligator indicator has also turned upwards, suggesting the possibility of continued upward movement after a brief correction. Gold has surged towards the 3,400 USD area amid dollar weakness following disappointing US labour market statistics. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

⭐ FFRT reacted to a post in a topic:

TDU Dynamic Reversal Zones

⭐ FFRT reacted to a post in a topic:

TDU Dynamic Reversal Zones

-

⭐ RichardGere reacted to a post in a topic:

TDU Dynamic Reversal Zones

⭐ RichardGere reacted to a post in a topic:

TDU Dynamic Reversal Zones

-

G. Migliorino's books: I cicli di Borsa and, above all, Il metodo Battleplan, are inspired by the 1970 book: The Profit Magic of Stock Transaction Timing by J. M. Hurst, which can be downloaded here: https://shorturl.at/XZpm6 or: hxxps://pdfcoffee.com/j-m-hurst-the-profit-magic-of-stock-transaction-timing-pdf-free.html ------------------------------ I have converted several books from English to Italian (with 10 pages a day for free, in 10 days you get to 100 pages, in 15 days 150 pages, etc... for free) and for me they were fine, just understand what is written, better than not being able to read the book for those who do not know Italian. 😉

-

@the_evil Were you the one who educated it? Thanks

-

kadi reacted to a post in a topic:

TDU Dynamic Reversal Zones

kadi reacted to a post in a topic:

TDU Dynamic Reversal Zones

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

[b]Date: 5th August 2025.[/b] [b]Markets Rebound as Earnings Roll In, Dollar Stabilises Amid Rate Cut Bets and Tariff Concerns.[/b] US stock futures edged higher on Tuesday, signalling a more stable open on Wall Street following last week’s turbulence and ahead of a crucial wave of corporate earnings. Futures tied to the Dow Jones Industrial Average and S&P 500 rose 0.2%, while Nasdaq 100 futures climbed 0.3%. The recovery momentum continued from Monday, when stocks bounced back sharply after a volatile Friday. The rally came despite lingering concerns over a weak US jobs report, fresh tariff threats from the White House, signs of persistent inflation, and the surprise dismissal of the head of the Bureau of Labour Statistics. Adding to the uncertainty, President Trump warned of potential tariff hikes on India, further unsettling global trade dynamics. Investors now turn their attention to a heavy earnings calendar, with AMD and Rivian reporting Tuesday, followed by McDonald's, Disney, Uber, Snap, Palantir, and others later this week. Palantir shares surged in after-hours trading after the company topped earnings expectations and reported over $1 billion in quarterly revenue for the first time. Despite the uncertainty, second-quarter earnings have largely surprised to the upside. According to FactSet, with 66% of S&P 500 companies having reported, average earnings per share are now expected to rise 10.3%, more than double the initial 5% forecast. Companies benefited from lowered expectations amid concerns about tariffs, high valuations, and economic headwinds. Several notable companies contributed to the rebound. Idexx Laboratories spiked 27.5% on better-than-expected results, while Tyson Foods rose 2.4% after beating profit forecasts. Wayfair gained 12.7% on accelerating growth, and Tesla added 2.2% following the approval of a massive restricted stock award to CEO Elon Musk, calming fears he might exit the company. On the downside, Berkshire Hathaway fell nearly 3% after reporting lower profits tied in part to a loss in its Kraft Heinz investment. Asian Markets Track US Gains; Oil and Commodities Stable Asian equities joined the global rally, with Japan’s Nikkei 225 up 0.6%, South Korea’s Kospi gaining 1.4%, and Shanghai’s Composite Index rising 0.5%. The Hang Seng added 0.3%, while Australia’s ASX 200 and Thailand’s SET both climbed 1.1%. India’s Sensex, however, dropped 0.5% as tensions with the US over Russian oil imports escalated. Dollar Finds Stability as Fed Cut Expectations Climb Meanwhile, the US dollar found its footing, rising 0.2% after last week’s sharp selloff triggered by soft jobs data and political upheaval. Traders are now weighing whether the increased likelihood of Federal Reserve rate cuts could help support risk appetite and offset the drag from new tariffs. According to the CME FedWatch Tool, markets now see a 92.1% chance the Fed will cut rates at its September meeting, up from 63% a week ago. Goldman Sachs expects three straight 25-basis-point cuts starting next month, and sees a 50-basis-point move as possible if unemployment rises further. San Francisco Fed President Mary Daly echoed the growing urgency, stating, ‘I was willing to wait another cycle, but I can't wait forever.’ Despite July marking the dollar’s first monthly gain this year, analysts remain cautious. Citi economists noted that USD/Asia is sitting in a ‘fragile equilibrium’ amid uncertainty about US economic resilience. Conversations with clients, they said, reveal many are questioning whether the narrative of US exceptionalism still holds true. The dollar index hovered around 98.816, recovering from a one-week low. The euro traded at $1.1559, down 0.12%, while sterling stood at $1.328. The yen was flat at 147.10 after the Bank of Japan signalled a potential return to rate hikes if global trade tensions ease. The Swiss franc extended losses, down 0.2% to 0.8092, as Switzerland seeks to negotiate a deal to avoid a 39% US tariff that could severely hit its export-heavy economy. A quick adjustment in supply chains is widely expected, but it might take 6 to 12 months to know who wins and who loses. Also, the ongoing weakness for the greenback could continue. Other currencies saw minor moves: The Australian dollar eased 0.1% to $0.6466 The New Zealand dollar slipped 0.1% to $0.5893 [b]Always trade with strict risk management. Your capital is the single most important aspect of your trading business.[/b] [b]Please note that times displayed based on local time zone and are from time of writing this report.[/b] Click [url=https://www.hfm.com/hf/en/trading-tools/economic-calendar.html][b]HERE[/b][/url] to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click [url=https://www.hfm.com/en/trading-tools/trading-webinars.html][b]HERE[/b][/url] to register for FREE! [url=https://analysis.hfm.com/][b]Click HERE to READ more Market news.[/b][/url] [b]Andria Pichidi HFMarkets[/b] [b]Disclaimer:[/b] This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. [b]Date: 5th August 2025.[/b] [b]Markets Rebound as Earnings Roll In, Dollar Stabilises Amid Rate Cut Bets and Tariff Concerns.[/b] US stock futures edged higher on Tuesday, signalling a more stable open on Wall Street following last week’s turbulence and ahead of a crucial wave of corporate earnings. Futures tied to the Dow Jones Industrial Average and S&P 500 rose 0.2%, while Nasdaq 100 futures climbed 0.3%. The recovery momentum continued from Monday, when stocks bounced back sharply after a volatile Friday. The rally came despite lingering concerns over a weak US jobs report, fresh tariff threats from the White House, signs of persistent inflation, and the surprise dismissal of the head of the Bureau of Labour Statistics. Adding to the uncertainty, President Trump warned of potential tariff hikes on India, further unsettling global trade dynamics. Investors now turn their attention to a heavy earnings calendar, with AMD and Rivian reporting Tuesday, followed by McDonald's, Disney, Uber, Snap, Palantir, and others later this week. Palantir shares surged in after-hours trading after the company topped earnings expectations and reported over $1 billion in quarterly revenue for the first time. Despite the uncertainty, second-quarter earnings have largely surprised to the upside. According to FactSet, with 66% of S&P 500 companies having reported, average earnings per share are now expected to rise 10.3%, more than double the initial 5% forecast. Companies benefited from lowered expectations amid concerns about tariffs, high valuations, and economic headwinds. Several notable companies contributed to the rebound. Idexx Laboratories spiked 27.5% on better-than-expected results, while Tyson Foods rose 2.4% after beating profit forecasts. Wayfair gained 12.7% on accelerating growth, and Tesla added 2.2% following the approval of a massive restricted stock award to CEO Elon Musk, calming fears he might exit the company. On the downside, Berkshire Hathaway fell nearly 3% after reporting lower profits tied in part to a loss in its Kraft Heinz investment. Asian Markets Track US Gains; Oil and Commodities Stable Asian equities joined the global rally, with Japan’s Nikkei 225 up 0.6%, South Korea’s Kospi gaining 1.4%, and Shanghai’s Composite Index rising 0.5%. The Hang Seng added 0.3%, while Australia’s ASX 200 and Thailand’s SET both climbed 1.1%. India’s Sensex, however, dropped 0.5% as tensions with the US over Russian oil imports escalated. Dollar Finds Stability as Fed Cut Expectations Climb Meanwhile, the US dollar found its footing, rising 0.2% after last week’s sharp selloff triggered by soft jobs data and political upheaval. Traders are now weighing whether the increased likelihood of Federal Reserve rate cuts could help support risk appetite and offset the drag from new tariffs. According to the CME FedWatch Tool, markets now see a 92.1% chance the Fed will cut rates at its September meeting, up from 63% a week ago. Goldman Sachs expects three straight 25-basis-point cuts starting next month, and sees a 50-basis-point move as possible if unemployment rises further. San Francisco Fed President Mary Daly echoed the growing urgency, stating, ‘I was willing to wait another cycle, but I can't wait forever.’ Despite July marking the dollar’s first monthly gain this year, analysts remain cautious. Citi economists noted that USD/Asia is sitting in a ‘fragile equilibrium’ amid uncertainty about US economic resilience. Conversations with clients, they said, reveal many are questioning whether the narrative of US exceptionalism still holds true. The dollar index hovered around 98.816, recovering from a one-week low. The euro traded at $1.1559, down 0.12%, while sterling stood at $1.328. The yen was flat at 147.10 after the Bank of Japan signalled a potential return to rate hikes if global trade tensions ease. The Swiss franc extended losses, down 0.2% to 0.8092, as Switzerland seeks to negotiate a deal to avoid a 39% US tariff that could severely hit its export-heavy economy. A quick adjustment in supply chains is widely expected, but it might take 6 to 12 months to know who wins and who loses. Also, the ongoing weakness for the greenback could continue. Other currencies saw minor moves: The Australian dollar eased 0.1% to $0.6466 The New Zealand dollar slipped 0.1% to $0.5893 [b]Always trade with strict risk management. Your capital is the single most important aspect of your trading business.[/b] [b]Please note that times displayed based on local time zone and are from time of writing this report.[/b] Click [url=https://www.hfm.com/hf/en/trading-tools/economic-calendar.html][b]HERE[/b][/url] to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click [url=https://www.hfm.com/en/trading-tools/trading-webinars.html][b]HERE[/b][/url] to register for FREE! [url=https://analysis.hfm.com/][b]Click HERE to READ more Market news.[/b][/url] [b]Andria Pichidi HFMarkets[/b] [b]Disclaimer:[/b] This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. [b]Date: 5th August 2025.[/b] [b]Markets Rebound as Earnings Roll In, Dollar Stabilises Amid Rate Cut Bets and Tariff Concerns.[/b] US stock futures edged higher on Tuesday, signalling a more stable open on Wall Street following last week’s turbulence and ahead of a crucial wave of corporate earnings. Futures tied to the Dow Jones Industrial Average and S&P 500 rose 0.2%, while Nasdaq 100 futures climbed 0.3%. The recovery momentum continued from Monday, when stocks bounced back sharply after a volatile Friday. The rally came despite lingering concerns over a weak US jobs report, fresh tariff threats from the White House, signs of persistent inflation, and the surprise dismissal of the head of the Bureau of Labour Statistics. Adding to the uncertainty, President Trump warned of potential tariff hikes on India, further unsettling global trade dynamics. Investors now turn their attention to a heavy earnings calendar, with AMD and Rivian reporting Tuesday, followed by McDonald's, Disney, Uber, Snap, Palantir, and others later this week. Palantir shares surged in after-hours trading after the company topped earnings expectations and reported over $1 billion in quarterly revenue for the first time. Despite the uncertainty, second-quarter earnings have largely surprised to the upside. According to FactSet, with 66% of S&P 500 companies having reported, average earnings per share are now expected to rise 10.3%, more than double the initial 5% forecast. Companies benefited from lowered expectations amid concerns about tariffs, high valuations, and economic headwinds. Several notable companies contributed to the rebound. Idexx Laboratories spiked 27.5% on better-than-expected results, while Tyson Foods rose 2.4% after beating profit forecasts. Wayfair gained 12.7% on accelerating growth, and Tesla added 2.2% following the approval of a massive restricted stock award to CEO Elon Musk, calming fears he might exit the company. On the downside, Berkshire Hathaway fell nearly 3% after reporting lower profits tied in part to a loss in its Kraft Heinz investment. Asian Markets Track US Gains; Oil and Commodities Stable Asian equities joined the global rally, with Japan’s Nikkei 225 up 0.6%, South Korea’s Kospi gaining 1.4%, and Shanghai’s Composite Index rising 0.5%. The Hang Seng added 0.3%, while Australia’s ASX 200 and Thailand’s SET both climbed 1.1%. India’s Sensex, however, dropped 0.5% as tensions with the US over Russian oil imports escalated. Dollar Finds Stability as Fed Cut Expectations Climb Meanwhile, the US dollar found its footing, rising 0.2% after last week’s sharp selloff triggered by soft jobs data and political upheaval. Traders are now weighing whether the increased likelihood of Federal Reserve rate cuts could help support risk appetite and offset the drag from new tariffs. According to the CME FedWatch Tool, markets now see a 92.1% chance the Fed will cut rates at its September meeting, up from 63% a week ago. Goldman Sachs expects three straight 25-basis-point cuts starting next month, and sees a 50-basis-point move as possible if unemployment rises further. San Francisco Fed President Mary Daly echoed the growing urgency, stating, ‘I was willing to wait another cycle, but I can't wait forever.’ Despite July marking the dollar’s first monthly gain this year, analysts remain cautious. Citi economists noted that USD/Asia is sitting in a ‘fragile equilibrium’ amid uncertainty about US economic resilience. Conversations with clients, they said, reveal many are questioning whether the narrative of US exceptionalism still holds true. The dollar index hovered around 98.816, recovering from a one-week low. The euro traded at $1.1559, down 0.12%, while sterling stood at $1.328. The yen was flat at 147.10 after the Bank of Japan signalled a potential return to rate hikes if global trade tensions ease. The Swiss franc extended losses, down 0.2% to 0.8092, as Switzerland seeks to negotiate a deal to avoid a 39% US tariff that could severely hit its export-heavy economy. A quick adjustment in supply chains is widely expected, but it might take 6 to 12 months to know who wins and who loses. Also, the ongoing weakness for the greenback could continue. Other currencies saw minor moves: The Australian dollar eased 0.1% to $0.6466 The New Zealand dollar slipped 0.1% to $0.5893 [b]Always trade with strict risk management. Your capital is the single most important aspect of your trading business.[/b] [b]Please note that times displayed based on local time zone and are from time of writing this report.[/b] Click [url=https://www.hfm.com/hf/en/trading-tools/economic-calendar.html][b]HERE[/b][/url] to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click [url=https://www.hfm.com/en/trading-tools/trading-webinars.html][b]HERE[/b][/url] to register for FREE! [url=https://analysis.hfm.com/][b]Click HERE to READ more Market news.[/b][/url] [b]Andria Pichidi HFMarkets[/b] [b]Disclaimer:[/b] This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

The converter is paid (the free version translates only 10 pages) but I don't think it solves the problem for those who don't know Italian, the file is too ugly

-

Hi how did you get it to work when using Ninja with license

-

it would take now more than 1k% there are a lot of high ranker on the demo contest currently, amazing results.

- 314 replies

-

- forex broker

- hotforex

-

(and 1 more)

Tagged with:

-

fxzero.dark reacted to a post in a topic:

masquetrading.com

fxzero.dark reacted to a post in a topic:

masquetrading.com

-

Here is this book by G. Migliorino (in Italian): - Il metodo Battleplan: hxxps://pdfcoffee.com/g-migliorino-il-metodo-battleplan-trading-cicli-pdf-free.html with eMule, by typing: Migliorino in the section: Search (or the titles of his other books), you can download Excel files in addition to the books. ------------------------------------------ The best Site to transform PDF files in OCR format, into Word (docx) files is: https://convertio.co/it/ocr/ select at the bottom: language italian. to translate Word files from Italian to English: https://www.onlinedoctranslator.com/translationform select at the bottom: language italian.

-

Scanned copies are difficult to translate

-

Torriggiani's book mentions two other software programs besides Battleplan. They are Oscilla and Pitagora.

-

Here is the Master Gann book (also in Italian): https://workupload.com/file/BQkpaPvxmFS

-

I'm working on the translation. Very tedious but I am about 2/3rds of the way through it.

-

⭐ FredUrble reacted to a post in a topic:

Sentient Trader 4.04.17

⭐ FredUrble reacted to a post in a topic:

Sentient Trader 4.04.17

-

⭐ Azazel reacted to a post in a topic:

Sentient Trader 4.04.17

⭐ Azazel reacted to a post in a topic:

Sentient Trader 4.04.17

-

please share mql4 data feed for sentienttrader

-

Thank you FredUrble for this new book. Here is the software of Giuseppe Migliorino "Battleplan program". https://e.pcloud.link/publink/show?code=XZfnnEZjCRxhqwPPFjrRSXLR5CQj8nBjyny

-

Thank you for sharing these indicators! Any luck with educating the Trend Bendor algo? I've tested the educated old SBS version and like everyone said it works great, until it doesn't. It often enters with 24 MNQ and doesn't respect my ATM to exit with just 8-12 ticks of profit. I guess the ATM is written inside the strategy code. The new SBS version apparently has more filters and patterns to choose, with pattern 2 seemingly to be quite successful. Would be interesting to get hands on the newer version whenever you guys have time. Many thanks!!!

-

raj1301 reacted to a post in a topic:

masquetrading.com

raj1301 reacted to a post in a topic:

masquetrading.com

-

fbvnn joined the community

-

From some quick research, I find that Giuseppe Torreggiani was a student of Guiseppe Migliorino, an engineer and highly regarded cycle analyst who published several books. Here is a link to his main cycles book, which unfortunately is also in Italian. https://workupload.com/file/p9ZLxCcepQZ He also published another book called Master Gann which I also have.

- Yesterday

-

Giuseppe Torreggiani book "Il metodo Torreggiani". It's in Italian. Please translate it in English by Internet. https://e.pcloud.link/publink/show?code=XZn2nEZNGzIu3CqPR5IiQAasQKpKbmJtpby

-

samfourtimes started following sentienttrader.com

-

Thanks for the detailed instructions.

-

Like the orb!

-

hybrid76 started following Collection of indicators

-

looks interesting!

-

ivan2007007 started following NinjaTrader Metatrader Bridge and Collection of indicators

-

I'll add indicators to the piggy bank. Some of them are working. I still haven't looked through them all. https://drive.google.com/drive/folders/1r0S1T-fXuIfkaDKOQLadFUysoXTrpvWk?usp=drive_link

-

Maybe someone has a bridge for sending trading orders from Ninjatrader to Metatrader 5. I found one option, but it requires a license. Please share. setup.3.7.2.zip setup.3.5.4.zip