⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Past hour

-

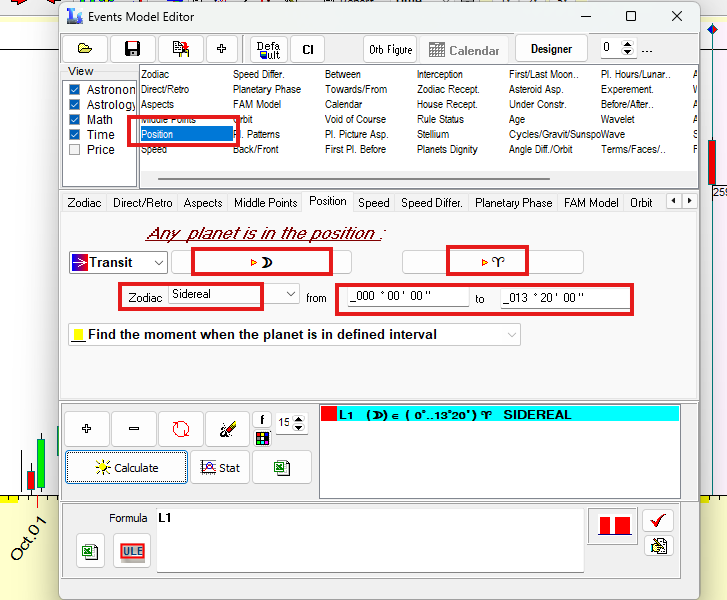

For users using TS for astrology see the attached screenshot for selecting "Ashwini" Nakshatra timings in TS, it is when Moon passes from ARIES 0 degrees to 13'20" Degrees. Similarly You can calculate for remaining 26. you can get other nakshatra degrees on google. Make sure to choose Viewing location "Bombay"

-

FIXED NT8 -NinjaTrader8 8.0.27.1 - 8.1.4.1

⭐ RichardGere replied to ngatho254's topic in Ninja Trader 8

Thank you very much. Will install this later and test out. I only use NT8 for analysis so will probably could not check out the its other functions. With this upload, I believe I do not need to upload version 8.0.27.1. 🙂😃 - Today

-

⭐ RichardGere reacted to a post in a topic:

FIXED NT8 -NinjaTrader8 8.0.27.1 - 8.1.4.1

⭐ RichardGere reacted to a post in a topic:

FIXED NT8 -NinjaTrader8 8.0.27.1 - 8.1.4.1

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

USDCAD is falling to new lows The CAD continues to strengthen ahead of the Bank of Canada and the Federal Reserve rate decisions, with the USDCAD pair testing the 1.3815 level. Discover more in our analysis for 8 December 2025. USDCAD technical analysis On the H4 chart, the USDCAD pair formed an Inverted Hammer reversal pattern near the lower Bollinger Band. At this stage, the pair may form a corrective wave following the pattern’s signal. The news backdrop favours the CAD. Read more -USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

AndresB joined the community

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date: 8th December 2025. A Key Week Ahead: What Traders Need To Know. Traders and institutions are preparing for a week where four Central Banks will confirm their interest-rate decision. In addition to this, the US will resume releasing economic and employment data. As a result, institutions expect the week to hold high volatility and potentially strong trends as firms position their portfolios. This week, the Federal Reserve, Swiss National Bank, the Bank of Canada and the Reserve Bank of Australia will announce their rate decisions. The main economic releases are: US JOLTS Job Openings, Weekly Unemployment Claims, Australian Employment Data and UK Gross Domestic Product. AUD - Reserve Bank of Australia Rate Decision The best-performing currency over the past month has been the Australian Dollar. The currency has also maintained bullish price movement as the Reserve Bank of Australia’s rate decision edges closer. Over the past week, the Australian Dollar Index rose more than 1.50%. Tomorrow at 03:30 (GMT), the RBA will hold its monetary-policy meeting. Given stable economic growth of 2.1% in the third quarter, a strong labour market with unemployment at 4.3% in October and employment rising by 42.2K, and an increase in the trimmed CPI to 3.3%, the regulator is likely to keep the interest rate at 3.60%. These conditions suggest that any significant policy changes will be delayed. A meaningful adjustment to borrowing costs is not expected before the second half of next year. If the RBA indeed keeps interest rates unchanged and indicates no adjustments in the first quarter of 2026, indeed the Australian Dollar could witness stronger bullish price movement. According to economists, inflation is not high enough to worry economists but is too high to warrant rate cuts. Particularly, as the Australian economy continues to grow. Lastly, Australia will also release the latest employment data on Thursday. If the Unemployment Rate remains at 4.3% and the country continues to add to its Employment Change, the currency may again find further support. HFM-AUDUSD Chart USD - Federal Reserve Rate Decision The main price driver for the week will be the Federal Reserve’s interest-rate decision and the press conference. Investors are clearly pricing in an interest rate cut as we can see from the bullish price movement within indices and the decline in the Dollar. This trend is continuing during this morning’s Asian Session. Tomorrow the US will release the latest 2 JOLTS Job Openings with the latest figure expected to show 7.14 million. The figure is lower than in previous months which further prompts a rate adjustment, but is not low enough to trigger recession fears. If the figures indeed read 7.14 million or lower, the US Dollar may witness a short-term spike downwards. If the Federal Reserve announces a rate cut to 3.50-3.75, the US Dollar indeed may witness a decline. But the medium to longer term trend will depend on how ‘split’ the FOMC was in their decision and the guidance given by the Chairman. If the split and guidance is deemed‘dovish’ the US Dollar potentially may decline back to 98.00. US Indices - JOLTS Job Openings & Weekly Unemployment Claims For US indices, such as the S&P500 and NASDAQ, the main price driver will be the Federal Reserve’s rate decision and forward guidance. However, the JOLTS Job Openings and Weekly Unemployment Claims are also likely to drive volatility. The Weekly Unemployment Claims have beaten expectations for 3-weeks straight. However, a higher figure potentially could have a positive impact, particularly if the Federal Reserve is clearly dovish. However, this would depend on the conditions set during the upcoming days. The VIX index is currently trading slightly higher as is the Put/Call Ratio. This is a slight concern for long positions, but investors will be watching to see whether both indicators decline later in the day. HFM - S&P500 Chart Key Price Takeaways: Four major central banks’ rate decisions are expected to create significant market volatility this week. Australia’s strong economy supports expectations the RBA will keep interest rates unchanged at 3.60%. Major RBA policy changes are unlikely before mid-2026, supporting continued Australian Dollar strength. Markets expect the Federal Reserve to cut rates, pressuring the US Dollar. JOLTS data and unemployment claims will influence short-term USD volatility and rate expectations. US indices may rise on a dovish Fed, though VIX and Put/Call ratios signal caution. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Michalis Efthymiou HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

setare reacted to a post in a topic:

decompile from Ex4 to Mq4

setare reacted to a post in a topic:

decompile from Ex4 to Mq4

-

Hello, anyone can upload the software pls.kindly assist me

-

just check files on the on the group to find the pakage

-

Harmonic_Indicator_User_Manual.pdf

-

⭐ traderwin started following autofuturestrading.com and Full Package Indicators (As Gratitude To The Forum)

-

TraderJoe reacted to a post in a topic:

Full Package Indicators (As Gratitude To The Forum)

TraderJoe reacted to a post in a topic:

Full Package Indicators (As Gratitude To The Forum)

-

Full Package Indicators (As Gratitude To The Forum)

TraderJoe replied to ngatho254's topic in Ninja Trader 8

-

https://t.me/megant8indicators @traderwin forwarded it to a new public group for everyone to access Thanks

-

its posted on a telegram group ,you would have to join it to download it. or someone drop their telegram username I forward it to them they upload it

-

Can't access it.

-

https://t.me/c/2130865682/66 Zip password on below message text Thanks

-

techfo reacted to a post in a topic:

FIXED NT8 -NinjaTrader8 8.0.27.1 - 8.1.4.1

techfo reacted to a post in a topic:

FIXED NT8 -NinjaTrader8 8.0.27.1 - 8.1.4.1

-

FIXED NT8 -NinjaTrader8 8.0.27.1 - 8.1.4.1

roddizon1978 replied to ngatho254's topic in Ninja Trader 8

I got my original copy but I could use it to run in my other computer TY. Maybe you could crack NexGen too -

techfo reacted to a post in a topic:

ninjacators robot lab

techfo reacted to a post in a topic:

ninjacators robot lab

-

Please daddypenguin can try to crack VimaminC for Metastock?

⭐ FFRT replied to ⭐ Atomo12345's topic in Trading Platforms

Very Old version (not with me) wa sworking with Metastock 11. -

I am not using it but will explore sometime in future.

-

⭐ FFRT started following FIXED NT8 -NinjaTrader8 8.0.27.1 - 8.1.4.1

-

techfo reacted to a post in a topic:

ninjacators signal lab

techfo reacted to a post in a topic:

ninjacators signal lab

-

techfo reacted to a post in a topic:

ninjacators signal lab

techfo reacted to a post in a topic:

ninjacators signal lab

-

raj1301 reacted to a post in a topic:

ninjacators aggressive order bundle

raj1301 reacted to a post in a topic:

ninjacators aggressive order bundle

-

fxzero.dark reacted to a post in a topic:

barsedgetrader.com

fxzero.dark reacted to a post in a topic:

barsedgetrader.com

-

techfo reacted to a post in a topic:

quantvue.io

techfo reacted to a post in a topic:

quantvue.io

-

fxzero.dark started following QuantVue QkronosEVO

-

@apmoo @kimsam https://workupload.com/archive/9vDGuL9LeN

-

NT 8.28.0 version STEP 0 : Stop Ninja Trader & Remove any ProfitwalaNTUnlocker dll that you may have from Documents\NinjaTrader 8\bin\Custom STEP 1 : Install NT 8.28.0 version if you are not alreay on that STEP 2 : Finish installation process STEP 4 : Copy your ProfitwalaNTUnlockerV2.dll and NTLic.licfile into Documents\NinjaTrader 8\bin\Custom Start NinjaTrader now and follow through instructions. Important things: 1. For AMP please use any key that starts with @AMP 2. Your ninjatrader is unlocked for almost all features and has a credit of 4500 for TT as well. 3. Ninjatrader is enabled for multi broker as well as order flow+ capabilties. 4. tradovate is also enabled for your NT version https://workupload.com/archive/N48qEYVvNb Thanks ,Keep uploading if you have any upper version this version works with all free trial indicators,paid low security indicators and should work with rithmic free data hack

-

That's nice and please if u have a solution for rithmic connection, specifically for those who are using windows 11 Anyone please have SecHex-Spoofy clean version without virus

- Yesterday

-

FIXED NT8 -NinjaTrader8 8.0.27.1 - 8.1.4.1

⭐ RichardGere replied to ngatho254's topic in Ninja Trader 8

I can reupload 8.0.27.1 for you. But will be Tuesday as I am away from my desktop now. -

Share up to 5GB. https://filefa.st/

-

@RichardGere lets see if anyone re uploads because I had the files I just cant find them,ill try it on windows but if anyone has a newer version kindly share

-

FIXED NT8 -NinjaTrader8 8.0.27.1 - 8.1.4.1

⭐ RichardGere replied to ngatho254's topic in Ninja Trader 8

Ah I see. You can't get it working because you are running a Mac. I installed in Windows 11 and it worked perfectly. Of course 8.0.27.1 may have some issues with new indicators that will require latest version of Ninjatrader. Better to go for the newer Ninjatrader if you can find them. -

@RichardGere I have mine stuck at initializing database sadly cant open if someone has a working version kindly re upload it doesnt have to be from the same educator Thanks