All Activity

- Past hour

-

Anyone please share ARC CWAP Algo h t tps://architectsai.com/product/cwap-algo/ and ARC BOSFib Algo h t tps://architectsai.com/product/bosfib-algo/ PLEASE thanks

-

Anyone using Grok? I think it is the answer to a lot of dreams .... ;--) Question to Grok and answer :: "are you able to translate code to ninjatrader c#" Answer :: Yes, I can help translate code into NinjaTrader's C# (NinjaScript) format, provided you share the source code or describe the logic you want to implement. NinjaTrader uses a specific subset of C# with its own classes, methods, and conventions for trading strategies, indicators, or other scripts. If you provide the code or a clear description of the functionality (e.g., a trading strategy, indicator, or condition), I can: 1. Translate code from another language (e.g., Python, Java, MQL4/5, etc.) into NinjaScript C#. 2. Adapt existing C# code to work within NinjaTrader's framework. 3. Write new NinjaScript code for NinjaTrader based on your requirements. ### Steps to Help You: - **Share the Code or Logic**: Provide the source code you want to translate or a detailed description of the functionality (e.g., "I want a strategy that buys when RSI crosses above 70 and sells when it crosses below 30"). - **Specify NinjaTrader Version**: Let me know if you're using NinjaTrader 7, 8, or 9, as the syntax and features differ slightly (e.g., NinjaTrader 8 introduced new methods and removed some older ones). - **Clarify Script Type**: Indicate whether you need a strategy, indicator, or other script type (e.g., market analyzer, drawing tool). - **Include Any Constraints**: Mention any specific NinjaTrader objects (e.g., `Close`, `Open`, `SMA`, `Trade`) or conditions you want to incorporate. ### Example Translation Process If you provide something like this (pseudocode): ``` If 50-period SMA crosses above 200-period SMA, buy 1 contract. If price drops 2% below entry price, sell. ``` I can translate it into NinjaScript for NinjaTrader 8 like this: ```csharp protected override void OnBarUpdate() { // Calculate SMAs double sma50 = SMA(Close, 50)[0]; double sma200 = SMA(Close, 200)[0]; double sma50Prev = SMA(Close, 50)[1]; double sma200Prev = SMA(Close, 200)[1]; // Check for cross above if (CrossAbove(sma50, sma200, 1)) { EnterLong(1, "LongEntry"); } // Exit if price drops 2% below entry price if (Position.MarketPosition == MarketPosition.Long) { double entryPrice = Position.AveragePrice; if (Close[0] <= entryPrice * 0.98) { ExitLong("LongExit"); } } } ``` ### Notes: - NinjaScript has specific methods like `EnterLong`, `ExitLong`, `SMA`, `CrossAbove`, etc., which I’ll use appropriately. - If you share code in another language, I’ll map it to NinjaTrader’s equivalent methods and structure (e.g., `OnBarUpdate` for per-bar logic). - If the code involves external libraries or complex logic, I may need clarification on how to adapt it, as NinjaTrader has limitations (e.g., no direct support for certain external APIs). - If you want real-time data or external data (e.g., from X posts or web searches), I can incorporate that if you enable DeepSearch mode, but NinjaTrader scripts typically rely on internal data (e.g., `Close`, `Open`). Please share the code or logic you want to translate, and I’ll provide the NinjaScript C# equivalent tailored to your needs! Cool!

- Today

-

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date: 20th August 2025. NASDAQ Slides Amid AI Profit Concerns: Will The Decline Continue?. The NASDAQ declines for a sixth consecutive day, measuring a total decline of 3.00%. The decline is largely due to the poor performance of NVIDIA, Broadcom, Palantir Technologies and AMD Stocks. Since April, the NASDAQ has enjoyed a strong run without experiencing a similar lasting decline. So what’s driving the pullback in the tech sector? Technology Stocks Drag The NASDAQ Lower The decline is primarily attributed to a speech by OpenAI CEO Sam Altman and a report from the Massachusetts Institute of Technology. The OpenAI CEO told journalists that the amount of demand which the technology sector is obtaining, mainly due to AI, could be a bubble. ‘When bubbles happen, smart people get overexcited about a kernel of truth,’ Altman said. However, experts advise that Mr Altman was not referring to all companies investing in AI. Mr Altman’s message, economists note, highlights a growing trend. Investors are actively pouring money into companies simply because they’re tied to AI, whether startups or struggling firms, assuming that AI involvement guarantees potential. However, Altman cautions that this belief is misguided. The report from the MIT (Massachusetts Institute of Technology) is of concern for the NASDAQ and the SNP500. The report revealed a troubling reality: 95% of companies are failing to generate returns from their generative AI investments, casting significant doubt on the technology’s profitability. Investors are concerned that the capital being invested ‘is not bearing fruit and will negatively impact the Return On Equity ratio. Lastly, traders should note that the decline is also partially due to poor economic data from the week before. This includes extremely high Producer Inflation and a lower Retail Sales figure. Of the most influential stocks, the stocks witnessing the largest declines are Palantir Technologies (-9.35%) and AMD (-5.44%). On Tuesday, only 35% of the most influential stocks saw a price increase. Will The NASDAQ’s Decline Continue? When looking at technical analysis, it is understandable that indicators and price action will provide a bearish bias due to the bearish momentum. The price is trading below the Moving Averages, the day’s VWAP and is not trading at any significant support level. However, on larger timeframes, the price is not forming more than a retracement, meaning traders should keep in mind a rebound is possible. The average size of retracements over the past 3 months is 3.56%. This also suggests that investors may still view the current downward price movement as a retracement or temporary pause. USA100 2-Hour Chart Another factor which investors will be keeping a close eye on is global political tensions. Ongoing negotiations between the US, Russia, the EU, and Ukraine have given investors hope for a potential peace agreement, though its details remain unclear. Experts see a possible trilateral summit between the US, Russia, and Ukraine to address key disputes. If this becomes more likely over the upcoming days, the market’s risk sentiment can increase, boosting the NASDAQ. Key Takeaway Point: The NASDAQ fell for a sixth straight day, dropping 3%, largely due to weak performances from NVIDIA, Palantir, and AMD. OpenAI CEO Sam Altman and an MIT report warn that much of the AI-driven investment is not generating returns. The development is raising doubts about the tech sector's profitability. High Producer Inflation and weak Retail Sales contributed to the tech sell-off, with only 35% of major stocks seeing gains. Technical indicators suggest the decline may be a temporary retracement, while ongoing US-Russia-Ukraine negotiations could improve market sentiment if progress occurs. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Michalis Efthymiou HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

Dear candyman,

I would like to use the refined elliott trader program, which was previously shared in this forum, for a study. However, I have not reached the full version of the program. I would be very grateful if you can share a version that I can analyze the end-of-day data without date limit. I ask for your support because I cannot download it because the anonfile server is not working.

thanks

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Gold (XAUUSD) falls ahead of the Fed’s Jackson Hole Symposium Gold (XAUUSD) prices continue to decline, moving towards 3,317 USD. Demand for safe-haven assets has weakened significantly. Find more details are in our analysis for 20 August 2025. XAUUSD forecast: key trading points Gold (XAUUSD) is edging down, preparing to reach a new three-week low Easing geopolitical tensions and a surging USD have drawn part of market interest away from gold XAUUSD forecast for 20 August 2025: 3,311 and 3,265 Fundamental analysis On Wednesday, gold (XAUUSD) prices fell to 3,317 USD per troy ounce, nearing their three-week low. Pressure on the metal came from expectations of easing geopolitical tensions and a stronger US dollar. Earlier, US President Donald Trump stated that he does not plan to send ground troops but admitted the possibility of air support as part of efforts to resolve the conflict with Russia. Investors now focus on the upcoming speech by Federal Reserve Chairman Jerome Powell at Jackson Hole. Additional market cues may also come from the FOMC minutes due later on Wednesday. Rate futures indicate the likelihood of two Fed rate cuts of 25 basis points each by the end of the year, with the first possibly coming in September. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 301 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

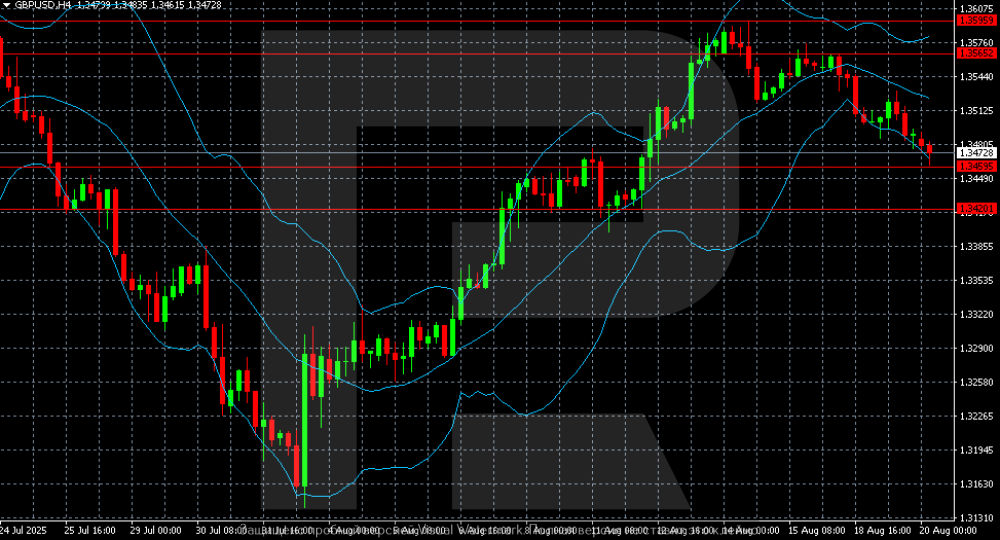

GBP awaits inflation, market assesses Bank of England policy outlook The GBPUSD pair dropped to 1.3472. UK inflation data will provide more clarity on the BoE’s policy outlook. Discover more in our analysis for 20 August 2025. GBPUSD technical analysis The GBPUSD pair is correcting after recent growth, trading near 1.3472. Earlier, the pair failed to hold above 1.3565 and rolled back, coming under selling pressure. The nearest support level is at 1.3420, and a breakout could open the way towards 1.3340. The GBPUSD pair is edging lower after recent gains. Read more - GBPUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Aurra Official joined the community

-

Here is one from 2019. Old version I think. I just copy this Google drive link from an old post in this forum. It is 6 GB and do note that folder 1 is missing. I am not sure if the missing folder 1 was removed deliberately or not. Probably some kind of introduction. https://drive.google.com/open?id=1GWnqORT8cb27-uL12BZ0FkLKf-CVqcDP

-

Even after using a demo account, i guess starting with small can be good to further test brokers processes as well.

-

Introduction to Fundamental Analysis...

bluemac replied to StefGrig's topic in General Forex Discussions

Some traders prefer fundamentals to trade while some of the traders use technicals, it depends on what you understand easily and follow for success. -

HappyHarry3 reacted to a post in a topic:

Timingsolution & Nifity page

HappyHarry3 reacted to a post in a topic:

Timingsolution & Nifity page

-

⭐ RichardGere reacted to a post in a topic:

Timingsolution & Nifity page

⭐ RichardGere reacted to a post in a topic:

Timingsolution & Nifity page

-

Well, I am still here, if you dont mind !

- Yesterday

-

Kmail reacted to a post in a topic:

https://12tradepro.com/

Kmail reacted to a post in a topic:

https://12tradepro.com/

-

Kmail reacted to a post in a topic:

https://12tradepro.com/

Kmail reacted to a post in a topic:

https://12tradepro.com/

-

Kmail reacted to a post in a topic:

https://12tradepro.com/

Kmail reacted to a post in a topic:

https://12tradepro.com/

-

Thanks for responding, I don't have the original file; I'm waiting for someone to share it with us.

-

do you have the original files?

-

Njabulo started following S & D strategy

-

Hello good people... Anyone who can share Alfonso Moreno Supply and Demand course. Thank you.

-

Njabulo joined the community

-

@kimsam @apmoo @dex @Ninja_On_The_Roof Hi community, recently I found a powerful trading Algo system called 12tradepro that gives good results, so if anyone has the Algo educated or not, just share it with us. Good regards.

-

setare started following decompile from Ex4 to Mq4

-

Who can extract the code of a simple indicator? The indicator has expired and is not working Please someone who can send me a message so I can send the indicator

-

I'm looking into this

-

If we can only edit but not delete, then we can delete the contents/body of the post to nothing which would then result in an empty post... So if the post itself cannot be deleted, the contents can be deleted!

-

ngatho254 joined the community

-

Dear Shawn,

I would like to use the refined elliott trader program, which was previously shared in this forum, for a study. However, I have not reached the full version of the program. I would be very grateful if you can share a version that I can analyze the end-of-day data without date limit. I ask for your support because I cannot download it because the anonfile server is not working.

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

US 500 forecast: prices approached resistance but failed to break through and reach a new all-time high The US 500 remains in an uptrend, which is highly likely to become medium-term. The US 500 forecast for today is positive. US 500 forecast: key trading points Recent data: the US Producer Price Index (PPI) came in at 0.9% in July Market impact: rising producer costs have a negative effect on the US stock market Fundamental analysis The US PPI for July rose by 0.9% from the previous month, well above the forecast of 0.2% and the previous reading of 0.0%. PPI growth is a significant signal, as it reflects higher producer costs, which may be passed on to the end consumer. Overall, this strengthens inflationary pressure and increases the likelihood that the Federal Reserve will adopt a more hawkish stance in monetary policy. Higher financing rates, in turn, can negatively affect the equity market by making stocks less attractive than bonds and increasing borrowing costs for businesses. For the US 500 index, the effect of such data is likely to be restrictive. Stronger inflation expectations could trigger a correction in the index, particularly in rate-sensitive sectors. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 301 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Brent surges upwards: correction may pave the way for a new price rally Geopolitical risks and possible production increases are playing a tricky role with Brent quotes, which may rise to 68.00 USD. Discover more in our analysis for 19 August 2025. Brent technical analysis Having tested the lower Bollinger Band, Brent prices formed a Harami reversal pattern on the H4 chart. At this stage, prices are following the signal, moving higher. The Brent forecast for 19 August 2025 suggests a growth target of 68.00 USD. The increase in oil production from September may reduce prices in the future, but for now, Brent technical analysis suggests growth towards the 68.00 USD resistance area. Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

[b]Date: 19th August 2025.[/b] [b]German Economy Between Tariffs and Investment Boost.[/b] Economic Contraction in the Second Quarter The German economy is once again showing signs of strain, with activity contracting in the second quarter of 2025. Revised production figures revealed deeper weakness than initially reported, underlining the persistent struggles of Germany’s flagship manufacturing sector. The newly signed trade agreement with the United States is expected to bring additional headwinds, especially for automakers, while Berlin’s recently announced investment boost in infrastructure and defence will take time to filter through into actual production growth. At the same time, the surge in spending across the European Union may force the European Central Bank (ECB) to rethink its monetary policy sooner than expected. Manufacturing Sector Under Pressure For much of the past year, Germany’s growth figures have been flattered by businesses front-running anticipated U.S. tariffs. While GDP expanded during the last quarter of 2024 and the first quarter of 2025, much of that momentum came from exporters rushing orders ahead of tariff deadlines. As many analysts warned, this left a demand gap that became visible in the second quarter, when the economy contracted by 0.1% quarter-on-quarter. To make matters worse, first-quarter growth was revised lower to 0.3% from the previously reported 0.4%, confirming that overall momentum in the first half of the year was weaker than thought. The industrial sector remains the hardest hit. Preliminary data point to a sharp contraction, with production plunging 1.9% in June. Adding to the gloom, May’s figures were revised drastically lower to just 0.1% growth from an initial 1.2%. This leaves industrial activity at its weakest level since May 2020. Much of the revision came from updated reports in the automobile sector, where uncertainty over tariff regimes has clouded output and investment decisions. Tariffs Challenge German Automakers It is worth noting that seasonal factors, such as Easter falling later in the quarter, may have slightly distorted the numbers. However, the broader trend is clear: Germany’s manufacturing sector continues to struggle. Purchasing Managers’ Index (PMI) readings confirm the weakness, and ongoing uncertainty over future trade relations with the U.S. has weighed heavily on sentiment. While some clarity has emerged since the deal was signed, the reality is that new tariffs will curb exports, particularly in the critical auto industry, while also disrupting supply chains that are central to German manufacturing. German automakers, including BMW and Mercedes, had hoped for exemptions given their extensive U.S. investments. Reports even suggested that industry representatives travelled to Washington to propose a reciprocal arrangement: tariff-free imports of EU-made cars in exchange for every U.S.-produced vehicle shipped to Europe. Yet, such proposals failed to gain traction, and manufacturers are now facing the reality of a 15% tariff on U.S. imports of German goods. Behind the scenes, lobbying efforts are expected to continue, but for now, automakers must prepare for a more challenging trade environment. Berlin’s Investment Boost in Infrastructure and Defence Against this backdrop, Berlin’s new government has attempted to counteract the drag with an ambitious fiscal program. Having taken office in March, the administration moved swiftly to abandon strict debt limits and pledge a sweeping investment boost, with a particular focus on defence and infrastructure. These efforts build on the rearmament drive that began under the previous government in response to Russia’s invasion of Ukraine, but have now accelerated with additional funds. The results are already visible in the orders data, although volatility remains high due to the presence of large-ticket defence and infrastructure contracts. In June, orders fell by 1.0% month-on-month, following a 0.8% decline in May. Yet, thanks to large-scale contracts, overall orders rose by 3.1% in the second quarter, offering some hope for stronger growth later this year. Stripping out these large orders, however, paints a more modest picture, with demand rising just 0.1% quarter-on-quarter. This suggests that any positive impact on GDP may not be immediate. Orders Data Show Mixed Signals A closer look at orders data reveals the deep impact of tariffs and shifting trade relations. Orders from abroad fell by 3.0% month-on-month in June, driven by a sharp 7.8% plunge in demand from non-Eurozone countries. By contrast, orders from within the Eurozone rose 5.2%, while domestic demand increased by 2.2%. The divergence underscores Germany’s growing dependence on European and local demand to cushion against the decline in U.S.-linked trade. Fiscal Expansion and ECB Policy Outlook The central question now is whether government spending can compensate for the tariff shock. If fiscal stimulus is supported by structural reforms and measures to encourage private investment, it could set the stage for a recovery. However, if higher public spending is not matched by efficiency gains and red-tape reduction, Germany’s fiscal expansion risks backfiring. Bond markets are already signalling concern, with the 30-year German yield climbing to its highest level since 2011. For the ECB, the shifting policy landscape complicates the outlook. The combination of higher German yields, broader EU defence spending, and resilient inflation pressures could force policymakers to halt the easing cycle earlier than planned. While another rate cut in December remains on the table, markets are increasingly speculating that the ECB may be compelled to raise rates again in the second half of 2025. Germany at a Crossroads In short, Germany finds itself at a crossroads. Tariffs and global trade shifts are undermining its traditional export model, while domestic investment is only just beginning to gain traction. Whether the government’s spending spree can offset external headwinds remains uncertain, but the stakes are high—not just for Germany, but for the entire Eurozone economy. [b]Always trade with strict risk management. Your capital is the single most important aspect of your trading business.[/b] [b]Please note that times displayed based on local time zone and are from time of writing this report.[/b] Click [url=https://www.hfm.com/hf/en/trading-tools/economic-calendar.html][b]HERE[/b][/url] to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click [url=https://www.hfm.com/en/trading-tools/trading-webinars.html][b]HERE[/b][/url] to register for FREE! [url=https://analysis.hfm.com/][b]Click HERE to READ more Market news.[/b][/url] [b]Andria Pichidi HFMarkets[/b] [b]Disclaimer:[/b] This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.