⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Past hour

-

⭐ goldeneagle1 reacted to a post in a topic:

Xtrend Algo

⭐ goldeneagle1 reacted to a post in a topic:

Xtrend Algo

-

⭐ goldeneagle1 reacted to a post in a topic:

MBOX Wave Like It or Dislike It ?

⭐ goldeneagle1 reacted to a post in a topic:

MBOX Wave Like It or Dislike It ?

-

⭐ goldeneagle1 reacted to a post in a topic:

lpmdttrading.com

⭐ goldeneagle1 reacted to a post in a topic:

lpmdttrading.com

-

⭐ goldeneagle1 reacted to a post in a topic:

marketxero.com

⭐ goldeneagle1 reacted to a post in a topic:

marketxero.com

-

⭐ goldeneagle1 reacted to a post in a topic:

marketxero.com

⭐ goldeneagle1 reacted to a post in a topic:

marketxero.com

-

⭐ goldeneagle1 reacted to a post in a topic:

marketxero.com

⭐ goldeneagle1 reacted to a post in a topic:

marketxero.com

-

⭐ goldeneagle1 reacted to a post in a topic:

rizecap.com

⭐ goldeneagle1 reacted to a post in a topic:

rizecap.com

-

⭐ goldeneagle1 reacted to a post in a topic:

rizecap.com

⭐ goldeneagle1 reacted to a post in a topic:

rizecap.com

-

⭐ goldeneagle1 reacted to a post in a topic:

rizecap.com

⭐ goldeneagle1 reacted to a post in a topic:

rizecap.com

-

fxtrader99 reacted to a post in a topic:

tradinghabitually.com

fxtrader99 reacted to a post in a topic:

tradinghabitually.com

- Today

-

Evobe joined the community

-

The fear and greed can only be overcome by trading a demo and having a proper trading plan so if the goal is achieved or not we should not do over trading and rather review our performance for improvements.

-

PAMM is also good but the new innovation these day is the copy trading and some also term it as social trading where the experts can showcase their skills and make additional money by offering copy trades to the beginners.

-

Scarxx joined the community

-

This I can confirm that the file is infected with a virus. I had read online this virus is particularly malicious but silent. I run it only on my spare laptop (bought 2nd hand Surface GO) that I use for such purposes. The laptop uses it's own LTE. I don't do any financial transaction or store any documents with this laptop. Only run suspicious programs. My Bitdefender has automatically blocked off the camera and mic which indicates this virus tries to use these resources. Scanning showed at least 2 files were further infected with the same virus. So use this program with caution and at your own risk. Hopefully, some masters here can look into it and remove the offending virus.

-

https://workupload.com/file/7v5UYm5gKeG Thanks

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

AUDUSD in correction: a pause needed before the next growth wave The AUDUSD pair declined to 0.6540. Australian statistics remain highly mixed. Find more details in our analysis for 2 September 2025. AUDUSD technical analysis The AUDUSD H4 chart shows a strong rebound after the decline in the second half of August. Quotes reached the 0.6550-0.6560 area, from where a minor correction is observed. Support forms at 0.6500-0.6520, while resistance is located around 0.6565-0.6570, where local highs are clustered. The AUDUSD pair entered a mild correction after five days of growth. Read more - AUDUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

US 500 forecast: after rebounding from support, the index aims to renew its all-time high The US 500 once again hit a new all-time high within the ongoing uptrend. The US 500 forecast for today is positive. US 500 forecast: key trading points Recent data: The US core PCE price index came in at 2.9% in July Market impact: for the US stock market, this has a mixed effect in the medium term Fundamental analysis The latest figures for the core PCE price index in the US show a yearly increase of 2.9%, in line with forecasts and slightly above the previous 2.8%. This index excludes food and energy components and serves as the Federal Reserve’s preferred inflation gauge when assessing inflation risks and shaping monetary policy. Meanwhile, the cash allocation of US mutual funds has dropped to a record low of 1.4%, below the 1.5% level seen before the 2022 bear market. After a short-lived rise in April, fund cash positions resumed their more than three-year downtrend. For context, between 2008 and 2020, the average cash share was roughly twice as high. With funds almost fully invested and lacking significant reserves to buy on potential pullbacks, the market remains vulnerable if sudden volatility spikes occur. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 310 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date: 2nd September 2025. Is Gold About To Retrace Downwards? Gold reaches a new all-time high, rising to $3,508, meaning Gold has risen in total almost 28% in 2025. If Gold holds onto its recent gains, it will be set for its second-strongest performance in the past decade. The upward price movement is being driven by market expectations of rate cuts in September. The market also believes the Federal Reserve will cut rates more frequently in 2026. However, another key concern for investors is the bond building between Russia, China and India, which may put geopolitical tensions on edge. Gold Reaches New All-Time High The reason for Gold’s upward trend is more clearly laid out in the ‘What’s Driving Gold’s Bullish Trend And Will It Hit a New High in 2025’ article. Monday was a national holiday, with financial institutions closed and trading volumes light. However, the day was not shy of developments prompting Gold to witness higher demand. Investors are processing Friday’s US Court of Appeals ruling, which declared tariffs imposed by President Donald Trump illegal. The court ruled that officials had improperly invoked the International Emergency Economic Powers Act (IEEPA), noting that only Congress has the authority to apply this framework. For this reason, most tariffs could now be removed, excluding sector-specific ones, reducing taxed imports from 69% to 16%. This is expected to ease inflation pressures and shape future Federal Reserve policy. However, an appeal remains possible until October 14th, with Trump warning on Truth Social that the decision will place unprecedented strain on the US economy. Gold And The Upcoming NFP Report A big factor which is also starting to test Gold is the risk of a recession and the new alliance in the east (Russia, China and India). Regarding the possibility of a recession or general economic slowdown, the US employment data will be key. Analysts again expect the NFP Employment Change to read below 100,000 for a second consecutive month. The NFP change has not read below this level for two consecutive months since 2021 due to COVID. If the NFP figure indeed remains low and the Unemployment Rate increases to 4.3% or above, recession concerns are likely to return. As a result, Gold may continue to see higher demand for the upcoming weeks. In addition to this, weak employment data will likely trigger a rate cut in September, October and December. Currently, the possibility of 3 rate cuts in 2025 is 37.00%, but this may change if employment data deteriorates. For this reason, whether investors will deem Gold as slightly overbought and if consequently a retracement will form, depends on this week’s employment data. The NFP data will determine how many rate cuts we are likely to witness and if the US economy is indeed at risk of a recession. However, a concern for day traders is the rise in the US Dollar Index, which may trigger a short-term decline. In addition, the market is currently showing signs of a ‘risk-off’ appetite with all US indices declining as the European Trading Session opens. Gold (XAUUSD) - Technical Analysis Gold’s price is trading at the day’s open price as the asset declines as the European Session starts. The decline is currently forming a retracement, but is not indicating a new bearish trend. The price remains above the 75-Bar EMA, and the wave pattern continues to support buyers, maintaining control. However, the price is below the VWAP, which points to a potential retracement. Based on the Moving Average, a retracement could potentially decline to the range between $3,425.60 to $3,446.30. However, if the price rises above $3,493.90, the price movement will start to indicate bullish momentum. XAUUSD 12-Hour Chart Key Takeaways: Gold hit a record high of $3,508, up nearly 28% in 2025, driven by expectations of Fed rate cuts. US tariffs imposed by Trump were ruled illegal, easing inflation risks but raising economic uncertainty. Upcoming NFP data will be crucial; weak job numbers could boost recession fears and increase Gold demand. Despite short-term retracement risks, Gold’s overall trend remains bullish, supported by technical indicators. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Michalis Efthymiou HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

i can confirmed mine is not working. My TI is always locked if i upgrade. bro mizir can share the TSA and Terra update files which you use to create the activation. Many thanks. Like you i dont use the AI but i use the TI.

-

Bambang Sugiarto started following Is trading analysis or just pure speculation?

-

can anyone do clean patch of mbox ?

-

complete collection of Trojans VirusTotal - File - 808a07bd366580b2ab119d00cb4deb7c4dd5397b8f7a86e2c3d3ffcddca280ff

-

Extract the ZIP first. Reset clock to year 2024 or any month earlier than Sept 2025 per @RichardGere. 1. Run "MBoxWaveLic.exe" and click OK. 2. Don't close "MBoxWaveLic.exe" 3. Reset clock to present date/time 4. Run NT8. 5. Done. MBoxWaveV3025.zip

-

So far a few members have reported that the TI works if you just the login box but for me, it fails to work and that's the reason I posted the announcement. I have a serial myself and it failed for me. I wanted the cr@acked versions to work but that too failed. In fact I made a brand new installation and tested with the cr@acks but failed. Lets see how many users have the TI menu enabled. Based on the feedback, will take it forward.

-

This works fine if you have a valid serial key If you don't have one make one using olly debug there was a nice video on here about 10 yrs ago explaining it. TI is active - AI is not working but that's Ok never used it anyway At the login screen just use any username and any password press login. You will get an error Press Ok Then hit X on the login screen TI will be working now

- Yesterday

-

kaidp joined the community

-

Can someone reupload MBox 3025 please

-

Try resetting the computer clock to year 2024 before running the licence emulator.. It works for me. But wouldn't know how long will this workaround last or if it cause any other problems. 1. Reset clock to year 2024 or any month earlier than Sept 2025. 2. Run MBoxWaveLic.exe. 3. Reset clock to present date/time 4. Run NT8

-

I subscribe to a telegram channel for $100 lifetime membership of a forex trader group and bought another lifetime membership $100 a copier trade software from Telegram to transfer their trade to my IG-MT4 platform. Why bother studying the complex world of Forex trading when a group of expert forex trader , can do it for you.

- 3 replies

-

- forex

- forex forum

-

(and 1 more)

Tagged with:

-

The .DLL it places in the NT8 directory, someone could probably take his .exe code out of it. MBoxWaveXE_64.7z

-

I got 80% from free YouTube, but my risk management only clicked after a structured course from HFM forced me to journal and get feedback. If budget’s tight, pair YT with a strict plan + public journaling for accountability

- 3 replies

-

- forex

- forex forum

-

(and 1 more)

Tagged with:

-

hybrid76 started following Did Not Find Marker Plus 2025

-

Is their an NT8 version ?

-

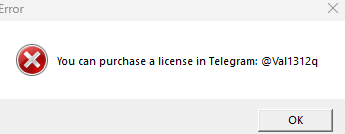

same here .... same dialog to purchase license

-

I had Val's MBox 3025 installed, and it stopped working today. When I tried to run MBoxWaveLic.exe, it gives me this message. Is anyone experiencing the same issue? If someone has this issue fixed, please share the fix.