[b]Date: 11th July 2025.[/b]

[b]Demand For Gold Rises As Trump Announces Tariffs![/b]

Gold prices rose significantly throughout the week as investors took advantage of the 2.50% lower entry level. Investors also return to the safe-haven asset as the US trade policy continues to escalate. As a result, investors are taking a more dovish tone. The ‘risk-off’ appetite is also something which can be seen within the stock market. The NASDAQ on Thursday took a 0.90% dive within only 30 minutes.

Trade Tensions Escalate

President Trump has been teasing with new tariffs throughout the week. However, the tariffs were confirmed on Thursday. A 35% tariff on Canadian imports starting August 1st, along with 50% tariffs on copper and goods from Brazil. Some experts are advising that Brazil has been specifically targeted due to its association with the BRICS.

However, the President has not directly associated the tariffs with BRICS yet. According to President Trump, Brazil is targeting US technology companies and carrying out a ‘witch hunt’against former Brazilian President Jair Bolsonaro, a close ally who is currently facing prosecution for allegedly attempting to overturn the 2022 Brazilian election.

Although Brazil is one of the largest and fastest-growing economies in the Americas, it is not the main concern for investors. Investors are more concerned about Tariffs on Canada. The White House said it will impose a 35% tariff on Canadian imports, effective August 1st, raised from the earlier 25% rate. This covers most goods, with exceptions under USMCA and exemptions for Canadian companies producing within the US.

It is also vital for investors to note that Canada is among the US;’s top 3 trading partners. The increase was justified by Trump citing issues like the trade deficit, Canada’s handling of fentanyl trafficking, and perceived unfair trade practices.

The President is also threatening new measures against the EU. These moves caused US and European stock futures to fall nearly 1%, while the Dollar rose and commodity prices saw small gains. However, the main benefactor was Silver and Gold, which are the two best-performing metals of the day.

How Will The Fed Impact Gold?

The FOMC indicated that the number of members warming up to the idea of interest rate cuts is increasing. If the Fed takes a dovish tone, the price of Gold may further rise. In the meantime, the President pushing for a 3% rate cut sparked talk of a more dovish Fed nominee next year and raised worries about future inflation.

Meanwhile, jobless claims dropped for the fourth straight week, coming in better than expected and supporting the view that the labour market remains strong after last week’s solid payroll report. Markets still expect two rate cuts this year, but rate futures show most investors see no change at the next Fed meeting. Gold is expected to finish the week mostly flat.

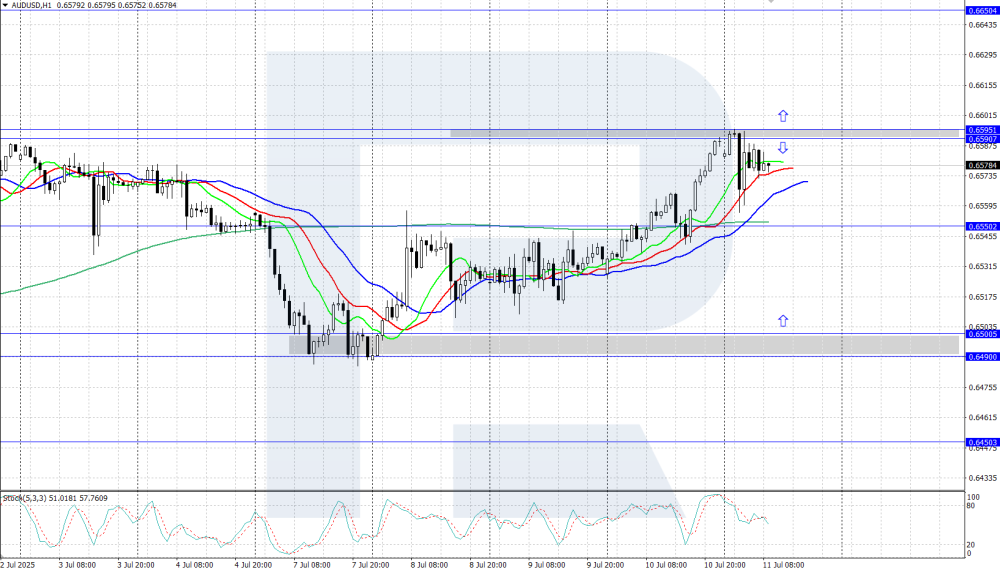

Gold 15-Minute Chart

If the price of Gold increases above $3,337.50, buy signals are likely to materialise again. However, the price is currently retracing, meaning traders are likely to wait for regained momentum before entering further buy trades. According to HSBC, they expect an average price of $3,215 in 2025 (up from $3,015) and $3,125 in 2026, with projections showing a volatile range between $3,100 and $3,600

Key Takeaway Points:

Gold Rises on Safe-Haven Demand. Gold gained as investors reacted to rising trade tensions and market volatility.

Canada Tariffs Spark Concern. A 35% tariff on Canadian imports drew attention due to Canada’s key trade role.

Fed Dovish Shift Supports Gold. Growing expectations of rate cuts and Trump’s push for a 3% cut boosted the gold outlook.

Gold Eyes Breakout Above $3,337.5. Price is consolidating; a move above $3,337.50 could trigger new buy signals.

[b]Always trade with strict risk management. Your capital is the single most important aspect of your trading business.[/b]

[b]Please note that times displayed based on local time zone and are from time of writing this report.[/b]

Click [url=https://www.hfm.com/hf/en/trading-tools/economic-calendar.html][b]HERE[/b][/url] to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click [url=https://www.hfm.com/en/trading-tools/trading-webinars.html][b]HERE[/b][/url] to register for FREE!

[url=https://analysis.hfm.com/][b]Click HERE to READ more Market news.[/b][/url]

[b]Michalis Efthymiou

HFMarkets[/b]

[b]Disclaimer:[/b] This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.