Date: 31st October 2025.

Meta Sell-Off Drags S&P 500 Lower, Could Friday Bring a Rebound?

The US Dollar Index rose to a three-month high, while the S&P 500 struggles as investors digest the latest earnings reports. Apple and Amazon's earnings per share exceeded expectations, but will Meta’s stocks halt demand? The S&P 500 has fallen for two consecutive days despite earnings while the NASDAQ continues to show bullish trends. Earnings data supported growth on Thursday, aided by Netflix’s latest announcement.

S&P 500-Earnings Reports, AI Ventures, and Stock Splits

S&P500 1-Hour Chart

Meta and Alphabet stocks were one of the key reasons why the S&P 500 fell on Thursday. During the Asian session, Alphabet’s stocks rose almost 8% providing early support for the S&P 500. However, during the European and US session the stock lost momentum and ended the day only 2.45% higher. For this reason, the alphabet’s strong earnings report had limited impact on demand even though it significantly improved sentiment.

Furthermore, Meta stocks, which fell more than 11% were the main contributors to the S&P 500 ending the day 0.35% lower. Regarding Meta, the market is struggling to absorb the level of expenses that the company is facing, particularly in relation to AI, taxes, and penalties. According to Meta’s CEO, the company is looking to significantly invest in AI and expenses in the next 2 years are likely to rise.

Overnight, Meta also announced that the company will issue $30 billion in corporate bonds to fund its expansion into AI. The stock is trading 1.20% higher during this morning’s Asian session, however, Meta’s performance will depend on whether the company can convince investors that the ‘venture’ can be successfully monetised.

Amazon is this morning’s best-performing stock after the company beat its earnings expectations. Amazon stocks, which are the 5th most influential within the S&P 500, are trading 13% higher this morning. In addition to this, Apple is also trading slightly higher (2.35%) after beating both earnings and revenue expectations. Apple’s earnings per share came in at $1.85, $0.21 higher than the same period last year.

Lastly, Netflix stocks, which have fallen more than 9% in the past month following its earnings report, are regaining momentum this morning. The stock has risen more than 3% as the company is announcing a 1-for-10 stock split to lower the stock price from $1,089 to $108. The company has stated that the move aims to make the stock more attractive to employees and retail investors. Reports also suggest that Netflix is considering acquiring Warner Bros Discovery, though this has not yet been confirmed.

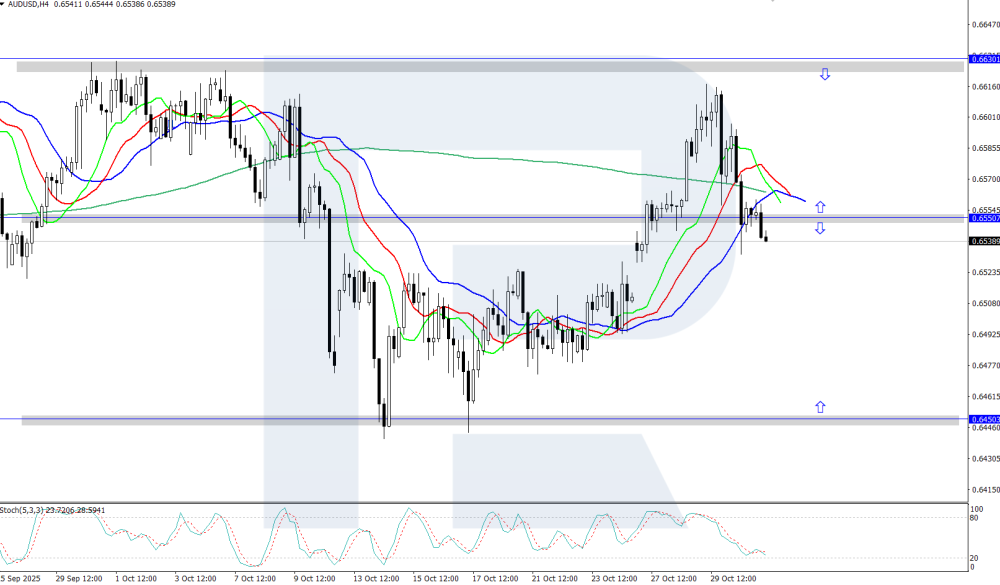

US Dollar Strength-Are The Fed Bluffing?

The US Dollar Index has risen for three consecutive days as the Federal Reserve adopted a more hawkish tone. Investors should note that the Federal Reserve was not necessarily ‘hawkish’, the central bank remains ‘dovish’. However, the comments made were simply not as ‘dovish’ as the markets had hoped. As a result, the US Dollar Index rose higher, particularly as one of its main competitors, the Japanese Yen, fell due to monetary policy weakness.

US Dollar Index Daily Chart

Ten members of the Federal Open Market Committee (FOMC) voted to ease monetary policy, while two opposed the move. Board member Stephen Miran supported a larger 50-basis-point cut, whereas Kansas City Fed President Jeffrey R. Schmid preferred to keep rates unchanged amid persistent inflation concerns.

Following the meeting, Federal Reserve Chair Jerome Powell suggested the Fed may pause further policy changes in December, despite investor expectations for another rate cut before year-end. Powell noted that many FOMC members believe it is important to pause and assess economic conditions before easing further. His comments disappointed markets, and the CME FedWatch Tool now shows that the probability of a December rate cut has fallen from 90% to 67%. Therefore, a cut is still likely, but is not guaranteed as previous thought.

The US Dollar has been this week’s best-performing currency followed by the Australian Dollar. The worst performers so far are the British Pound and Japanese Yen.

Key Takeaways:

The US Dollar Index hit a three-month high as the Federal Reserve hinted at a possible policy pause in December.

The S&P 500 fell for a second day, pressured by Meta’s 11% decline despite strong results from Apple and Amazon.

Meta plans to issue $30 billion in bonds issuance to fund AI expansion, though investors remain sceptical about its profitability.

Amazon surged 13% and Apple rose 2.35% after both companies beat earnings expectations.

Netflix gained 3% after announcing a 1-for-10 stock split aimed at attracting retail investors and employees.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Michalis Efthymiou

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.