⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Past hour

-

⭐ osijek1289 reacted to a post in a topic:

VP or Bisask displays a single candlestick chart and features improved filtering capabilities.

⭐ osijek1289 reacted to a post in a topic:

VP or Bisask displays a single candlestick chart and features improved filtering capabilities.

-

⭐ osijek1289 reacted to a post in a topic:

IndicatorManagerUI

⭐ osijek1289 reacted to a post in a topic:

IndicatorManagerUI

-

Ninja_On_The_Roof reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

Ninja_On_The_Roof reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

-

Ninja_On_The_Roof reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

Ninja_On_The_Roof reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

-

Ninja_On_The_Roof reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

Ninja_On_The_Roof reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

-

Ninja_On_The_Roof reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

Ninja_On_The_Roof reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

-

Ninja_On_The_Roof reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

Ninja_On_The_Roof reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

-

Ninja_On_The_Roof reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

Ninja_On_The_Roof reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

-

Ninja_On_The_Roof reacted to a post in a topic:

VP or Bisask displays a single candlestick chart and features improved filtering capabilities.

Ninja_On_The_Roof reacted to a post in a topic:

VP or Bisask displays a single candlestick chart and features improved filtering capabilities.

-

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

ampf replied to Ninja_On_The_Roof's topic in Ninja Trader 8

@Ninja_On_The_Roof please reupload first posts. -

Core feature: Add a "UI" button to the chart toolbar to manage the display/hide of all indicators on the chart. IndicatorManagerUI.zip

- Today

-

If you want live trading stuff. You can watch this dude. I am not in any shape or form, associated with this dude. Thought it might give you an edge, watching him trading live, every trading day. Who knows, you could learn a thing or two watching him, or, hey now, you could also use his entries or exits. This is all about being patient, disciplined and wait for the right setups to come. Best of luck.

-

anyone can share this indi please pack Scalping agresivo

Ninja_On_The_Roof replied to TRADER's topic in Ninja Trader 8

Try Quaderr stuff. The Scalper one. -

The Ninza NoboCloud should be quite sufficient for this purpose. Or, if you want, use the Ninza MACross. Change settings to whichever numbers you want for your MA or whatever input other than MA. It comes with a list of different types of MAs. So you dont enter on false/bad signals.

-

As far as for all Ninza indies, add your 50 or 100 or 200 EMA to the chart. Take Ninza signals accordingly with the EMA. You would eliminate bad or false signals. Dont take signals for long if signals are generated below your 20, 50, 100 or 200 EMA. Vice versa, dont go short if signals are above your EMA. Try it. You shall find many false signals which you shouldn't enter.

-

I really wonder that many of the new traders treat trading as casino and some of them also keeps winning for some time before blowing their accounts.

-

difficult to trade in here without a strategy

bluemac replied to Jesus D. Mallory's topic in General Forex Discussions

Learning always required discipline and patience or these traders always learn it in a hard way losing money and blowing accounts etc so we can use a demo account for practice our learned skills without risking any real money. Demo accounts can be downloaded from any brokers like hfm, octa, xm, exness, lmfx etc without depositing any money with these. -

They'll probably release Flix now... 😆

-

Oana SSS started following ORS Fusion and Axios

-

anyone can share this indi please pack Scalping agresivo

wahabdeen2 replied to TRADER's topic in Ninja Trader 8

up -

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

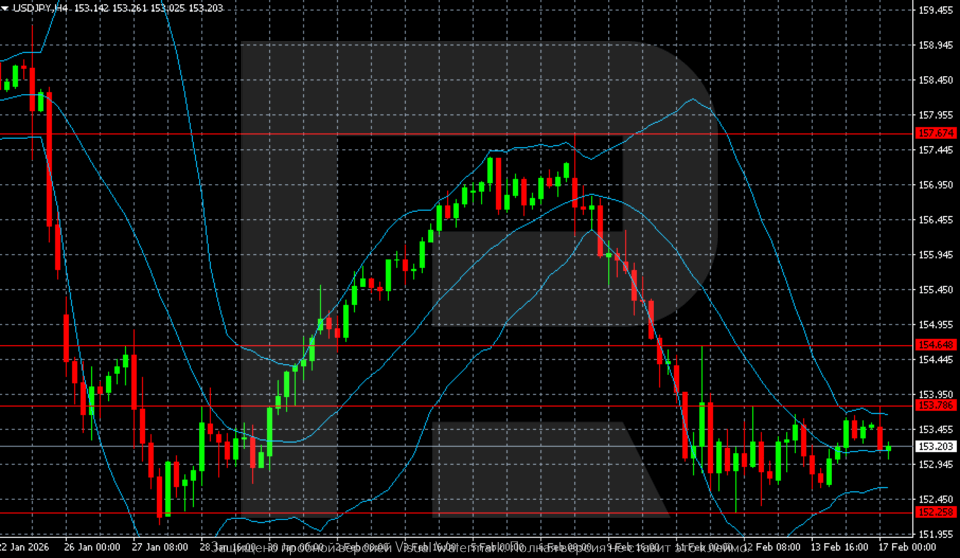

USDJPY: everything is complex and dynamic The USDJPY pair dipped to 153.20, with the market monitoring monetary policy and incoming data. Find out more in our analysis for 17 February 2026. USDJPY technical analysis On the H4 chart, the USDJPY pair is trading around 153.20 after a sharp decline from 157.50–158.00. The chart clearly shows a shift in momentum: after a failed attempt to consolidate above 157.50, an accelerated sell-off began, with the price breaking below the middle line of Bollinger Bands. The USDJPY pair maintains a moderately bearish sentiment. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

US 500 forecast: the index is trading sideways The US 500 tested the support level and entered a sideways channel, although the downtrend still prevails. The US 500 forecast for today is negative. US 500 forecast: key takeaways Recent data: US Nonfarm Payrolls increased to 130 thousand in January Market impact: the data negatively impacts the equity market Fundamental analysis The release of January US employment data forms a moderately positive yet mixed signal for the US 500 index. Job growth of 130 thousand versus an expected 66 thousand, along with a decline in unemployment to 4.3%, confirms economic resilience. This is important for the equity market, as a strong labour market typically supports consumer demand, corporate revenues, and earnings expectations for the coming quarters. At the same time, this report reduces the likelihood of rapid monetary easing. Stronger employment and lower unemployment imply that the Federal Reserve has fewer reasons to move quickly towards rate cuts. This may be accompanied by higher Treasury yields and an increased cost of capital for businesses. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 420 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Oh geez, how many of the F...VWAP Ninza needs. Flex this and Flux that... And, how do you even trade using this? No need to educate it. It works just fine.

-

https://www.4shared.com/rar/wR540rVC/fibonacci_galactic_trader.html?ref=amp https://www.4shared.com/zip/tDVf0IhS/Fibonacci_Galactic_Trader_40_R.html

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date: 17th February 2026. Market Wrap: Tech Weakness Extends as AI Fears and Geopolitics Weigh on Sentiment. Global markets reopened Tuesday with a cautious tone as investors returned from the US Presidents’ Day holiday to find risk appetite still fragile. Equity-index futures signalled further downside in US technology stocks, while bond markets attracted renewed demand amid geopolitical uncertainty and shifting expectations around monetary policy. US Futures Point Lower as Tech Slide Deepens Futures linked to the S&P 500 declined roughly 0.4%, while contracts on the Nasdaq 100 dropped nearly 0.8%, indicating that the recent pullback in growth and AI-linked names may not be over. The technology sector, which had driven much of the market’s upside momentum in recent months, continues to face pressure as investors reassess valuations and the longer-term implications of AI disruption. Last week’s inflation data complicated expectations for Federal Reserve rate cuts, and traders now await further signals from upcoming Fed commentary and minutes from January’s policy meeting. Bonds Gain as Safe-Haven Demand Returns US Treasury yields edged lower, with the 10-year yield slipping to around 4.02%, reflecting defensive positioning. The Japanese yen, traditionally viewed as a safe-haven currency, strengthened against the dollar, reinforcing the shift toward caution. In Japan, government bonds rallied across the curve following stronger-than-expected demand at a five-year auction, suggesting that expectations for near-term tightening by the Bank of Japan are softening. Asia Quiet, Europe Under Pressure Trading volumes in Asia were subdued as markets in China, Hong Kong, and several regional centres remained closed for the Lunar New Year. Elsewhere in the region, equity performance was mixed, with Australia and India posting modest gains. European markets have prepared for a weaker open. In the UK, the pound weakened after unemployment climbed to a near five-year high and wage growth moderated, data that could influence the Bank of England’s rate trajectory in the coming months. Middle East Tensions Back in Focus Geopolitical risks re-emerged as a key driver of market tone. Iran’s recent naval drills near a critical shipping route heightened concerns ahead of renewed nuclear discussions with the United States. Diplomatic efforts are ongoing, but rhetoric has intensified. Former President Donald Trump has warned of potential military action should negotiations fail, adding another layer of uncertainty to an already fragile environment. Oil prices held relatively firm amid these developments, though broader commodity markets reflected risk-off sentiment. Precious Metals and Crypto Pull Back Despite geopolitical tensions, precious metals retreated. Gold slipped toward the $4,900 per ounce level, while silver and platinum recorded sharper losses. The decline suggests profit-taking after recent rallies rather than a full unwind of safe-haven positioning. Cryptocurrencies also softened, with Bitcoin trading near $68,300. The pullback comes amid broader volatility across speculative assets as traders recalibrate exposure to high-beta trades. The “AI Cannibalisation” Debate Intensifies Artificial intelligence remains a central theme driving cross-asset volatility. While earnings growth in the US remains resilient, with companies delivering approximately 13% growth this season, concerns are building around what some strategists describe as “AI cannibalisation.” The debate centres on whether AI adoption will enhance productivity or disrupt entire business models, particularly in software, media, and business services. Investment banks are already structuring thematic baskets that go long companies poised to benefit from AI adoption while shorting those potentially vulnerable to workflow displacement. This divergence is adding dispersion within equity markets and amplifying stock-specific volatility. Corporate Movers Several notable corporate developments added to the narrative: BHP Group shares surged after reporting a more than 20% rise in half-year earnings, supported by strong copper prices. Apple Inc. announced a March 4 product launch event, fueling anticipation for new device announcements. Danaher Corporation is reportedly nearing a $10 billion acquisition of Masimo. Alibaba Group unveiled a major upgrade to its flagship AI model, intensifying competition in China’s fast-moving AI race. Advanced Micro Devices announced collaboration plans with Tata Consultancy Services to expand AI data-centre capabilities in India. The Bigger Picture Markets are navigating a complex intersection of themes: Slowing but persistent inflation Uncertainty over the timing of Fed rate cuts Renewed geopolitical risks Earnings resilience versus valuation concerns Structural disruption from artificial intelligence With liquidity thinner due to global holidays and catalysts limited early in the week, volatility may remain elevated as investors look toward fresh economic data and central bank commentary for direction. For now, the tone is defensive. Whether this develops into a deeper correction or merely a consolidation phase will likely depend on upcoming inflation readings, Fed communication, and the sustainability of corporate earnings growth. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Andria Pichidi HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

blackhex started following https://purealgocapital.com

-

https://purealgocapital.com/indicators/ anyone has these indicator file ? please share them

-

Whether Bitcoin reaches 100k depends on adoption, liquidity, regulation, macro conditions, and market cycles. Strong demand, ETF inflows, network growth, and favorable policy can push prices higher, while tight liquidity and risk-off markets can delay targets. No outcome is guaranteed. Long-term investors focus on fundamentals, position sizing, and patience rather than fixed price milestones.

-

Cryptocurrencies and gold serve different roles, but taking a position in crypto offers higher growth potential in a digital economy. Gold protects against inflation and uncertainty, while crypto benefits from innovation, network adoption, and global liquidity. A forward-looking strategy favors crypto for long-term upside, with disciplined risk management and diversification to navigate volatility and changing market cycles.

-

Chasing coins thoughtfully means tracking trends, volume shifts, and project updates to sharpen timing and discipline. When done with rules, it builds market awareness, faster decision-making, and risk control. Pair momentum strategies with fundamentals and diversification. Balancing established assets with emerging projects like the LMGX token can broaden exposure while keeping a structured, long-term investing approach.

-

TradingSecretsAIChannels_NT8_1008b needs to fix

Ninja_On_The_Roof replied to TRADER's topic in Ninja Trader 8

I recall this one was educated and posted long ago. -

Please share, thanks

-

thanks but i already had the trial…i need a non time restriction version

-

You should also mention the crack creator.