⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Past hour

-

⭐ RichardGere reacted to a post in a topic:

Educate request: thetradeengine.com/products/momentumtrack - files attached

⭐ RichardGere reacted to a post in a topic:

Educate request: thetradeengine.com/products/momentumtrack - files attached

-

⭐ osijek1289 reacted to a post in a topic:

Educate request: thetradeengine.com/products/momentumtrack - files attached

⭐ osijek1289 reacted to a post in a topic:

Educate request: thetradeengine.com/products/momentumtrack - files attached

-

The first minute after CPI/NFP usually has the widest spreads and patchy liquidity; waiting for the second leg often cuts slippage. What are your slippage stats on HFM around NFP when using stop vs. limit entries?

-

Traderbeauty reacted to a post in a topic:

Educate request: thetradeengine.com/products/momentumtrack - files attached

Traderbeauty reacted to a post in a topic:

Educate request: thetradeengine.com/products/momentumtrack - files attached

-

Hi Yoshi99, Can I please have this course ? Sarj

-

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

My results wtih HFM changed only after I kept a detailed trade journal—entries, exits, emotions, screenshots. I also review weekly expectancy and cut risk to 0.5–1% per trade whenever the equity curve wobbles.

-

PK2 reacted to a post in a topic:

Educate request: thetradeengine.com/products/momentumtrack - files attached

PK2 reacted to a post in a topic:

Educate request: thetradeengine.com/products/momentumtrack - files attached

- Today

-

Educate request: thetradeengine.com/products/momentumtrack - files attached

dex replied to MaxNguni's topic in Ninja Trader 8

@MaxNguni Can you explain what you mean by it works with kiss order flow on NQ? Thanks -

dex reacted to a post in a topic:

Educate request: thetradeengine.com/products/momentumtrack - files attached

dex reacted to a post in a topic:

Educate request: thetradeengine.com/products/momentumtrack - files attached

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date: 3rd October 2025. US Government Shutdown: Market Fallout, Dollar Outlook, and Gold's Rally. Investors Brace for Economic Fallout The United States government has officially entered its first shutdown in nearly seven years after the government failed to agree on a funding bill. The development has unsettled global investors, with US equity futures slipping and the Bloomberg Dollar Spot Index dropping 0.1% after the midnight deadline passed. Federal agencies have been ordered to suspend nonessential services, putting hundreds of thousands of employees on hold and creating uncertainty across vital public programs. Unlike past shutdowns that ended quickly, this standoff looks more severe and could inflict lasting damage on the US economy. Labor Market and Economic Data Risks The most immediate challenge is the suspension of government data releases . Reports on jobless claims, factory orders, and September payrolls will not be published, depriving markets of key signals to assess economic growth and the Federal Reserve's interest rate path . “This shutdown could prove more disruptive than usual because of the heightened stakes leading into it,” said Steve Sosnick, chief strategist at Interactive Brokers. Market Reactions So Far Nasdaq 100 futures fell 1% and S&P 500 contracts dropped 0.8%. The 10-year Treasury yield rose one basis point to 4.16%. The Cboe Volatility Index (VIX) jumped to 17.28, signaling higher risk aversion. With stock valuations already stretched after a long bull run, analysts warn that any sharp downturn could trigger forced selling , amplifying losses. Safe-Haven Demand: Gold, Treasuries, and Currencies If the shutdown drags on, investors may seek refuge in defensive assets: Gold prices have surged to record highs near $4,000, supported by dollar weakness. The Japanese yen and the euro could benefit further if the dollar continues to retreat. Long-dated Treasuries may attract buyers on expectations of weaker growth. “ Given high yields, US Treasuries remain attractive, and we advise clients sensitive to shutdown risk to increase exposure ,” said Monica Guerra of Morgan Stanley Wealth Management. Sector-by-Sector Impact Defense : Defense giants such as RTX, L3Harris Technologies, and AeroVironment have benefited from strong federal spending. While analysts expect little direct impact, investor sentiment could cool. General Dynamics was recently upgraded to a “buy” on the view that any pullback may present an entry opportunity. Government Services & Airlines Consulting firms like Booz Allen Hamilton, Leidos, and CACI International often see revenue delays during shutdowns. Airlines , which rely on government travel for up to 2% of annual revenue, could be hit harder. Reduced leisure travel by unpaid federal workers may further weaken the industry. Cyclical Sectors: Industrials and financials are especially vulnerable if growth slows and unemployment rises. Caterpillar, Deere, and major banks like JPMorgan Chase may face volatility, while consumer-focused firms such as Affirm Holdings could see sharper swings. Bloomberg Economics projects that 640,000 federal workers could be furloughed , pushing unemployment to 4.7% . Permanent job cuts, as threatened, may keep joblessness elevated even after operations resume. Outlook: Volatility Ahead Historically, shutdowns have had limited long-term impact on Wall Street. On average, the S&P 500 has barely moved during the last 20 shutdowns . However, near-term volatility is expected, particularly if data releases are delayed. Private reports, such as ISM manufacturing and services surveys , will likely gain importance for traders navigating uncertainty. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyze the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Andria Pichidi HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

⭐ ralph kabota reacted to a post in a topic:

Educate request: thetradeengine.com/products/momentumtrack - files attached

⭐ ralph kabota reacted to a post in a topic:

Educate request: thetradeengine.com/products/momentumtrack - files attached

-

⭐ laser1000it reacted to a post in a topic:

Metastock 18 end of day c*****d.

⭐ laser1000it reacted to a post in a topic:

Metastock 18 end of day c*****d.

-

Bambang Sugiarto started following Stop Loss Hunting

-

Allegations that brokers deliberately shift prices to trigger clients' stop losses. Have you ever experienced this? If so, please name the broker. Thank You

-

PK2 reacted to a post in a topic:

request TPO indicator help

PK2 reacted to a post in a topic:

request TPO indicator help

-

PK2 reacted to a post in a topic:

https://www.alphaautotrading.com/

PK2 reacted to a post in a topic:

https://www.alphaautotrading.com/

-

PK2 reacted to a post in a topic:

HFT@SPECTRE@LITE@V23 New ..

PK2 reacted to a post in a topic:

HFT@SPECTRE@LITE@V23 New ..

-

Re-upload please, thank you so much!

-

Can someone send the original please Thanks

-

Did anyone able to fix the issue?

-

Educate request: thetradeengine.com/products/momentumtrack - files attached

PK2 replied to MaxNguni's topic in Ninja Trader 8

Interesting indicators, many thanks to everyone who is sharing, and especially to @kimsam and @apmoo for the work and time dedicated. Trading is not only difficult but also expensive, so thank you very much for the immense effort you are making -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

AUDUSD consolidates around 0.6600 The AUDUSD rate settled around the 0.6600 level amid ongoing uncertainty over US government funding. Discover more in our analysis for 3 October 2025. AUDUSD forecast: key trading points Market focus: the US Department of Labor postponed the release of unemployment rate and Nonfarm Payrolls statistics Current trend: range-bound trading AUDUSD forecast for 3 October 2025: 0.6577 or 0.6630 Fundamental analysis Treasury Secretary Scott Bessent warned on Thursday that the government shutdown could negatively impact GDP growth, while President Donald Trump threatened mass federal worker layoffs to pressure Democrats. The shutdown has also delayed key economic data as the Department of Labor postponed Friday’s release of the September Nonfarm Payrolls report. The Australian dollar received support from the Reserve Bank of Australia after policymakers warned of higher-than-expected inflation. Markets are now pricing in only about a 45% chance of a rate cut at the 4 November meeting, compared to nearly 100% odds priced in a month ago. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 333 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Gold (XAUUSD) will quickly return to growth Gold (XAUUSD) prices are hovering around 3,860 USD. The correction was needed, but it changes nothing: the rally will continue. Discover more in our analysis for 3 October 2025. XAUUSD technical analysis On the XAUUSD H4 chart, prices remain near all-time highs. After a sharp rise from the 3,627 area, gold tested the 3,897 resistance level, where a local top formed. This was followed by a pullback to the 3,819 zone, which now acts as the nearest support. Gold (XAUUSD) has corrected slightly but remains in a strong position. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

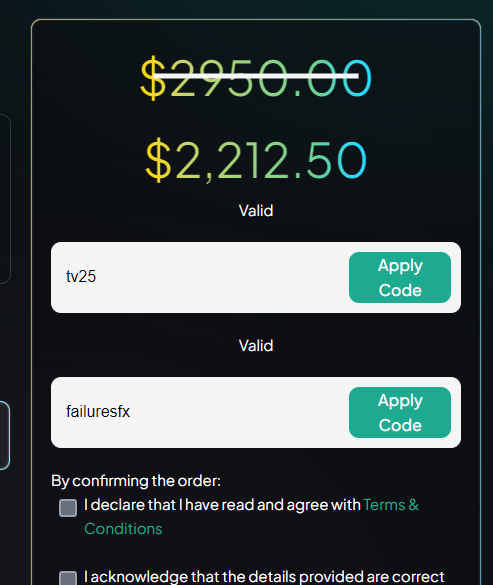

Trading View Platform (Exclusive Promo Code) For all types of accounts. Please make sure to select all the options first before applying affiliate code code first and then the discount code. The affiliate code provides 15% discount and discount code is applied on top of it should it has higher discount. ‘‘40% Off’’ on all available accounts up to 50k with the code: TV40 ‘‘25% Off’’ on all available accounts of 75k & above with the code: TV25 Offers are valid till 9th October (Midnight EST) Use failuresfx as affiliate code + the discount code.

-

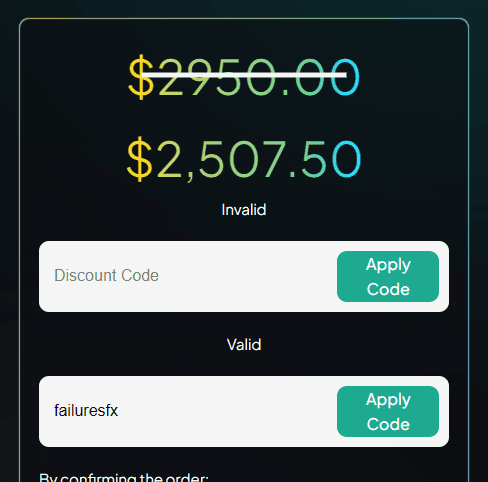

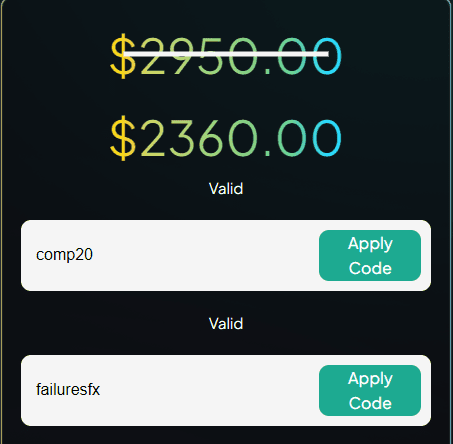

Receive up to 35% discount! Affiliate code: failuresfx (Permanent 15% discount) For all types of accounts. Please make sure to select all the options first before applying affiliate code code first and then the discount code. The affiliate code provides 15% discount and discount code is applied on top of it should it has higher discount. comp20 as discount code to get 20% discount for all accounts. You can use the affiliate code alone or with any other discount codes for extra discount along with the affiliate code. Whichever of the two gives the higher discount will be applied. Register here https://trader.fxify.com/purchasechallenge?affiliateId=5127 Check out newest code at the link below on forexfactory. https://www.forexfactory.com/thread/1305042-fxify-discount-code

-

First of all, thank you for the crack. Are any add-ons unlocked in this version?

-

fx17a joined the community

-

Latest versions of some Ninz@ indicators 2 (They need to be educated)

kimsam replied to PK2's topic in Ninja Trader 8

I'm already fixed some.. will share soon

.thumb.jpg.29f0702bcfc038b995e9a241c434fd24.jpg)