⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Past hour

-

RamAli reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

RamAli reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

-

I think sticking with the demo for a minimum of six months before jumping to the live trades or else we can burn our live funds which could be saved if choose to stay on a demo while learning.

-

Cryptocurrencies and gold: You need to take a position

bluemac replied to fahdforex's topic in General Forex Discussions

Looks like both of the commodities looking for a deep correction and then may go up again since for now it looks like blood bath making panic among those who bought it at the top. - Today

-

What software did Patrick Mikula use to draw?

⭐ RichardGere replied to setare's topic in Ask For Help

I can't post right now as I don't have my archives with me. Will do it when I return to work. -

II VIP Membership - FREE upgrade for OLD and ACTIVE Members

Traderbeauty replied to MrAdmin's topic in Announcements

The VIP is not active at all , there is nothing there for now. Once I get it started I will add all the members that have been around for a long time. -

fxtrader99 reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

fxtrader99 reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

-

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

st4nd4rt reacted to a post in a topic:

TradeSaber Predator X 3.0.1.1 LT

st4nd4rt reacted to a post in a topic:

TradeSaber Predator X 3.0.1.1 LT

-

mmicro reacted to a post in a topic:

Praedox 2.0 - Trader's Assistant

mmicro reacted to a post in a topic:

Praedox 2.0 - Trader's Assistant

-

paulharee reacted to a post in a topic:

Full Package Indicators (As Gratitude To The Forum)

paulharee reacted to a post in a topic:

Full Package Indicators (As Gratitude To The Forum)

-

paulharee reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

paulharee reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

-

st4nd4rt reacted to a post in a topic:

https://thetradeengine.com/ needs to educate

st4nd4rt reacted to a post in a topic:

https://thetradeengine.com/ needs to educate

-

Hello I am in Search of The Active Trader Program by Safety in The Market. https://safetyinthemarket.com.au/product/active-trader-program-online-training-coaching/ I am in dire need of this one, as my mentor has asked me to check this before moving ahead with Gann Trading. If Anyone has it please Share, I hold 3 Astro Books of Jenkins, I can share them with you if you help me out.

-

Hi RichardGere, Could you please repost a working link?

-

Cryptocurrencies and gold: You need to take a position

binaryowner replied to fahdforex's topic in General Forex Discussions

I also see crypto competing with gold for attention, but for me gold still works as a risk hedge when stress hits markets. I prefer having a small position on hfm in both and sizing it so I can sleep -

Shido Itsuka joined the community

-

Maybe Forecaster Terminal from forecaster.biz .

-

Is it actually still possibie?

-

II VIP Membership - FREE upgrade for OLD and ACTIVE Members

paulharee replied to MrAdmin's topic in Announcements

Hi I've been around since 2011 also with 53 posts if can upgrade me, please. Tthanks. -

FCScalper reacted to a post in a topic:

www.whaletrailtrading.com

FCScalper reacted to a post in a topic:

www.whaletrailtrading.com

-

@Ninja_On_The_Roof Congratulations on a major accomplishment ! If you intend on tackling the Hello-Win products I really hope you can overcome the roadblocks encountered and unresoved by the major unblockers, even the ones that charge big bucks for their product. Again, Thank You for your great work.

-

⭐ rcarlos1947 reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

⭐ rcarlos1947 reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

DE 40 forecast: the index resumed growth after correction The DE 40 stock index continues to recover after the correction, with the uptrend remaining intact. The DE 40 forecast for today is positive. DE 40 forecast: key takeaways Recent data: Germany’s industrial production fell by 1.9% in January compared to December last year Market impact: the data creates a negative backdrop for the German equity market Fundamental analysis German industrial production data represents a significantly weaker-than-expected result, coming in at −1.9% m/m compared to expectations of −0.2% and the previous reading of +0.2%. For the DE 40 index, this typically implies a short-term deterioration in sentiment, as the indicator is directly linked to business activity, capacity utilisation, and future corporate earnings trends in an industry-oriented economy. The short-term impact on the DE 40 is likely to be restraining. The index includes large companies that depend on the industrial cycle, external demand, and business investment activity. Weak output data increases the likelihood of downward revisions to profit expectations in cyclical sectors, which is typically reflected in a more cautious valuation of equities. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 414 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Huge thanks for putting this together! It is rare to find someone who not only shares these indicators but also takes the time to troubleshoot the backend conflicts that usually give the rest of us a headache. The tip about ZoneGPTFromTheFuture acting as the 'foundation' for the rest of the pack is incredibly helpful, that’s the kind of insider knowledge that saves hours of reinstalling and panic. Thank you for the clear, step-by-step instructions and for making sure the VWAPFlux plays nice with the rest of the suite. I really appreciate the effort you put into maintaining this setup for the community!

-

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date: 09th February 2026. Japan Sees Record-Breaking Election Victory. Japan’s political developments are evolving quickly and are having a direct impact on financial markets. The NIKKEI 225 rose to all-time highs and has already risen more than 16% in 2026 alone. In addition to this, the Japanese Yen also rises 0.80% after the market open. Japan’s snap elections have come to a halt with the Liberal Democratic Party coming out as the winner. The Prime Minister's party won more than two-thirds of the lower house, giving her a stronger mandate to push through her policies. Sanae Takaichi’s Historic Victory On Sunday, the LDP won 316 of 465 lower-house seats on its own, giving it more than a two-thirds supermajority. The LDP, with its coalition partner, will now control over 350 seats (75% of the house). That result is the largest single-party majority since the LDP’s founding in 1955 and the most seats ever won by any party in postwar Japanese elections. Analysts were expecting Mrs Takaichi’s party to easily win the elections due to high approval ratings. The Prime Minister's high approval ratings were the main reason behind the snap elections. The victory indicates the public’s support for more growth-oriented economic policies. Why is the NIKKEI 225 The Best Performing Index? The NIKKEI 225 is 2026’s best-performing index, rising 16% this year so far. The NIKKEI 255 in the past 12-months has risen 46%, 33% higher than the second-best-performing index. The figures can easily indicate the strength of the index and its trend. Investors are increasing their exposure to the NIKKEI 225 as inflation returns to Japan for the first time in decades. The lack of inflation was one of the key reasons for investors limiting their exposure to the Japanese markets. However, the latest and strongest price driver is the elections and the Prime Minister's victory. Japan’s Prime Minister is a clear supporter of an expansionary policy and strong ties with the US. She campaigned on and is expected to pursue policies that emphasise government spending to stimulate economic growth, including fiscal measures aimed at boosting domestic demand and strengthening long-term growth prospects. NIKKEI 225 - Technical Analysis HFM - NIKKEI 225 1-Hour Chart The price of the NIKKEI 225 opened on a bullish price gap measuring 1.98% and then rose a further 1.75%. However, the price soon after came under pressure and fell back to Friday’s closing price. Considering the strong overbought indications from the RSI and MACD, the selloff was not a surprise. Nonetheless, the buy signal remains relatively strong despite the retracement forming. This is also partially due to the strong bullish price movement from Friday. The NIKKEI 225 rose more than 5% on Friday alone. On the 1-hour chart, price action continues to show bullish indications, with the price holding above previous highs. The recent decline appears consistent with earlier temporary pullbacks rather than a trend reversal. The price also remains firmly above key Moving Averages and on the positive side of the RSI and MACD. However, the price movements on smaller timeframes seem less positive as the price retraces. If the price returns above 56,499.3 and thereby crosses the 200-bar SMA, the buy signals potentially may return. The Japanese Yen The best performing currency of the day is the Japanese Yen due to the results of the elections. The worst-performing currencies are the US Dollar and the British Pound. The Japanese Yen is increasing in value as sentiment towards the currency partially improves. Though another key reason for this is investors' expectations of more inflation due to any upcoming expansionary policy amendments. Investors are hoping that the policy and higher inflation will prompt the Bank of Japan to continue increasing interest rates throughout the year. However, regardless of the JPY’s bullish reaction to the elections, technical analysis indicates a bumpy ride as the price struggles to maintain momentum. HFM - USDJPY 1-Hour Chart Key Takeaways: Historic LDP win gives PM Takaichi a strong mandate for growth-focused policies. NIKKEI 225 hits all-time highs, up 16% in 2026 on political and inflation tailwinds. Technical signals remain bullish, with recent pullbacks seen as temporary retracements. Japanese yen strengthens on improved sentiment and expectations of higher inflation. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Michalis Efthymiou HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

undercovertomato joined the community

-

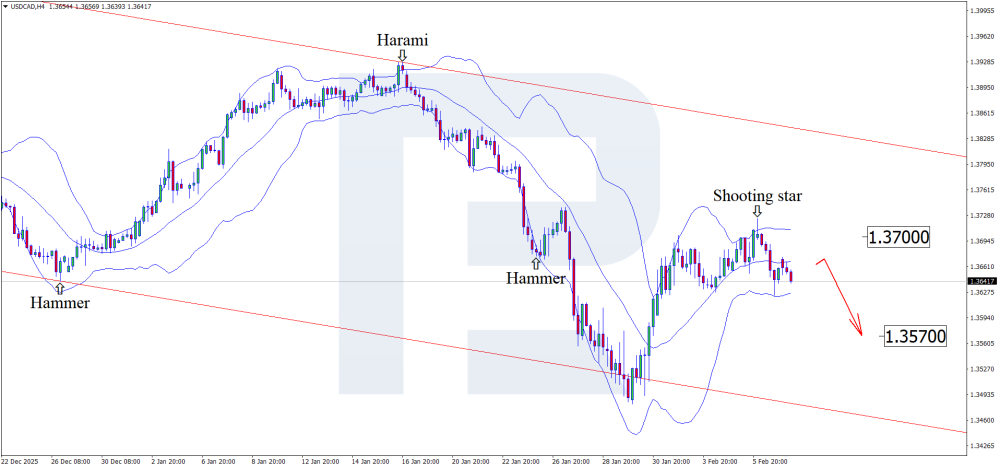

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

USDCAD is falling: what factors could strengthen the CAD Increased volatility in oil prices impacts the USDCAD rate significantly, with quotes testing the 1.3640 level. Discover more in our analysis for 9 February 2026. USDCAD technical analysis On the H4 chart, the USDCAD pair has formed a Shooting Star reversal pattern near the upper Bollinger Band and may continue its downward movement following the pattern’s signal. Since prices remain within the descending channel, a decline towards the nearest support level at 1.3570 can be expected. Risk factors for further USDCAD growth include a potential decline in global risk appetite and sharp fluctuations in oil prices, which may add to pressure on the currency pair. Read more -USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Both still working for me on regular NT8.1.2.1

-

I am back... Assuming that you guys have already done your part, laying down the foundation and have imported all Ninza indicators from the NINZA INDICATORS PACK and just recently now, we also were able to add another paid NinzaVWAPFlux to the list. Here's another paid one to add to your Ninza indies. The RenkoKings_GPSSatellite. https://workupload.com/file/WMkK3bPXWDq Thank you and enjoy!