All Activity

- Past hour

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

[b]Date: 8th August 2025.[/b] [b]Global Markets Struggle for Direction Amid Tariffs, Fed Expectations, and Weak Jobs Data.[/b] Wall Street Ends Mixed as Economic Signals Remain Conflicted Global markets endured another hesitant session on Thursday, with investors balancing disappointing U.S. labour data, central bank actions, and renewed trade tensions. Last week’s weak jobs report and an increase in unemployment claims reinforced expectations of a more dovish Federal Reserve stance in the months ahead. Bond market sentiment turned bearish after a poor 30-year Treasury auction capped a weak August refunding, while a hawkish interest rate cut from the Bank of England earlier in the day also weighed on confidence. An unexpected rise in U.S. productivity provided only a modest lift. Meanwhile, reciprocal tariffs went into effect at various levels, keeping trade policy firmly in focus. Apple’s announcement of a significant U.S. manufacturing investment helped Wall Street open with moderate gains, but momentum faded as dip-buying interest cooled. By the close, the NASDAQ finished 0.35% higher—well off session peaks—while the Dow Jones Industrial Average fell 0.51% and the S&P 500 slipped 0.08%. The CBOE Volatility Index (VIX) eased 1.25% to 16.56, and Treasuries ended mixed. Asian Markets Mixed; Nikkei Nears Record High In Asia, Friday’s trading was mixed. Tokyo’s Nikkei 225 surged 2.2% to 41,977.65, approaching record highs, after Japan confirmed it had resolved a dispute with Washington over tariffs on Japanese goods. The duties, implemented Thursday, initially exceeded the agreed 15% level, but Japan’s chief trade envoy confirmed the U.S. had agreed to make the necessary adjustment. Automakers were among the top performers, with Toyota Motor Corp. rising 3.9% and Honda Motor Co. gaining 4%. Elsewhere, sentiment was softer. Hong Kong’s Hang Seng declined 0.7% to 24,916.15, the Shanghai Composite Index edged up less than 0.1% to 3,642.10, South Korea’s Kospi lost 0.7% to 3,206.86, and Australia’s S&P/ASX 200 slipped 0.2% to 8,813.70. Taiwan’s Taiex gained 0.2%, while India’s Sensex fell 0.5%. Stephen Innes of SPI Asset Management described market momentum as unpredictable, warning that early-week trends can reverse sharply by Friday. Tech Sector Gains Offset by Intel Troubles Technology stocks provided the strongest lift in the U.S. session. Apple rose 3.2% after CEO Tim Cook joined President Donald Trump at the White House to announce an additional $100 billion investment in U.S. manufacturing over the next four years. Semiconductor stocks also advanced after Trump imposed 100% tariffs on imported chips but promised exemptions for companies with substantial U.S. operations. Advanced Micro Devices surged 5.7%, while Nvidia added 0.8%. Intel, however, fell 3.1% after Trump demanded the immediate resignation of CEO Lip-Bu Tan, accusing him of being “highly conflicted” due to his ties with Chinese firms. Tan responded by confirming that Intel is in active talks with the U.S. administration to address concerns and ensure accurate information is provided, while reaffirming the company’s focus on turning around its struggling operations. Oil Prices Head for Steepest Weekly Losses Since June Oil prices were little changed in early Asian trading on Friday but were poised for their sharpest weekly declines since late June. Brent crude futures dipped three cents to $66.40 a barrel at 0050 GMT, on track to fall more than 4% for the week, while U.S. West Texas Intermediate crude slipped six cents to $63.82, set for a weekly loss of over 5%. ANZ Bank analysts warned that the latest U.S. tariffs, which came into force Thursday, have raised fears of slower global economic growth and reduced oil demand. Prices were already under pressure after OPEC+ announced last weekend that it would fully unwind its largest tranche of output cuts in September, months ahead of schedule. WTI futures have now fallen for six consecutive sessions, matching a losing streak last seen in December 2023. A decline on Friday would mark the longest streak since August 2021. Geopolitical Developments Add to Market Uncertainty The Kremlin confirmed on Thursday that Russian President Vladimir Putin will meet U.S. President Donald Trump in the coming days, fueling speculation of a potential diplomatic breakthrough in the war in Ukraine. The U.S. also imposed new tariffs on India over its purchases of Russian crude oil, though analysts at StoneX noted the measures are unlikely to significantly disrupt Russian oil flows to global markets. Trump also indicated that China, the largest buyer of Russian crude, could face similar tariffs. Currency Market Moves In currency trading, the U.S. dollar edged up to 147.16 yen from 147.13, while the euro eased to $1.1660 from $1.1667. With trade disputes intensifying, central banks adjusting policy, and commodity markets under pressure, volatility remains a defining feature of the current global market landscape. [b]Always trade with strict risk management. Your capital is the single most important aspect of your trading business.[/b] [b]Please note that times displayed based on local time zone and are from time of writing this report.[/b] Click [url=https://www.hfm.com/hf/en/trading-tools/economic-calendar.html][b]HERE[/b][/url] to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click [url=https://www.hfm.com/en/trading-tools/trading-webinars.html][b]HERE[/b][/url] to register for FREE! [url=https://analysis.hfm.com/][b]Click HERE to READ more Market news.[/b][/url] [b]Andria Pichidi HFMarkets[/b] [b]Disclaimer:[/b] This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. - Today

-

A Powerful Tool for Daily and Weekly Bias Analysis 🔍📈

bluemac replied to ahmed777's topic in General Forex Discussions

Does it works with HFM's mt5 as well..? -

dex reacted to a post in a topic:

Need help decompiling

dex reacted to a post in a topic:

Need help decompiling

-

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDJPY remains in a narrow range for five consecutive sessions The USDJPY rate remains in a narrow range amid disagreements within the BoJ over the timing of future rate hikes. The current quote is 147.33. Find out more in our analysis for 8 August 2025. USDJPY forecast: key trading points BoJ members are split over the timing and pace of future rate hikes BoJ raised its inflation outlook and improved its economic forecast Growth in household spending in Japan slowed sharply in June USDJPY forecast for 8 August 2025: 150.50 Fundamental analysis Today, the USDJPY rate is rising slightly, while remaining within the range that has held for five consecutive trading sessions. Buyers continue to defend the key 146.65 support level. The US dollar is strengthening after the release of the BoJ’s July meeting minutes, which revealed that board members are divided on the timing and pace of future rate hikes. The central bank kept its interest rate at 0.5%, raised its inflation forecast, and presented a more optimistic assessment of the economic outlook. Some BoJ officials warned of rising inflationary pressures and supported a gradual rate hike to avoid abrupt tightening. Others argued for maintaining the current accommodative stance, citing significant uncertainty over whether economic forecasts will materialise. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 294 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

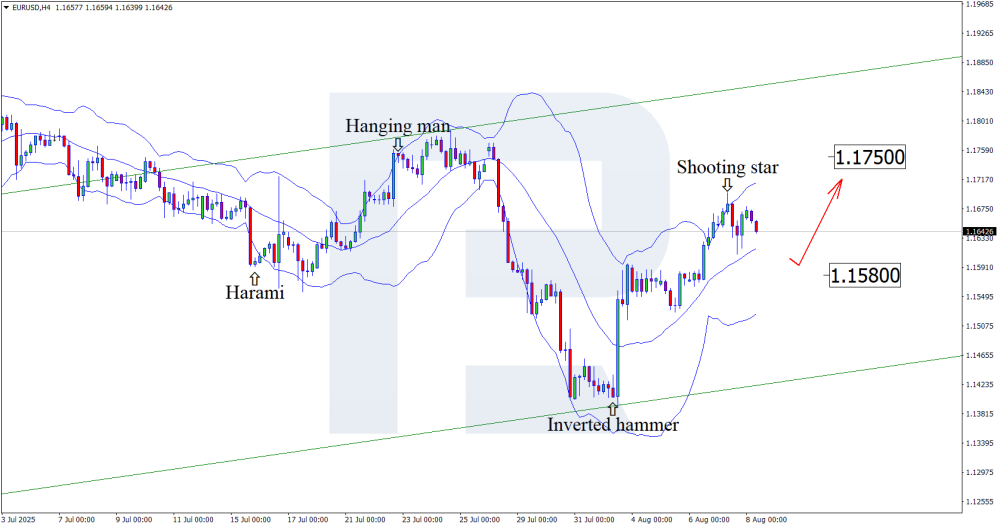

EURUSD holds its breath: what will the ECB decide in September? The USD continues to lose ground against the euro, and with the ECB’s upcoming decision, the EURUSD rate could soar towards 1.1750. Discover more in our analysis for 8 August 2025. EURUSD technical analysis On the H4 chart, the EURUSD pair has formed a Shooting Star reversal pattern near the upper Bollinger Band. At this stage, the pair may continue a corrective wave in line with this signal. Considering the recent sharp rise in quotes, a pullback towards the nearest support level at 1.1580 is possible. A rebound from this support would open the way for a continued upward movement. The appointment of Stephen Miran to the FOMC Board and expectations of Federal Reserve monetary policy easing weigh on the USD. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

i always told people that Mining Stocks are good investment, but you need to be professional in trading and understand market. I think if this is your case you need to try yourself in this niche

-

volumetrade2022 reacted to a post in a topic:

Discretionary Trading - Random Thoughts

volumetrade2022 reacted to a post in a topic:

Discretionary Trading - Random Thoughts

-

minerhomer joined the community

-

Numbelley joined the community

-

Then my previous point is taken! And yep, youtube is full of videos of RipperX AI Pro, taking trading with contract size in 40. Thus, profits would be showing in thousands of dollars in a few minutes. It is intended, I truly believe, a psychological strategy to screw and mess up with new traders. Seeing that kind of gains, it messes up your brain. And so, you get itchy and excited. You feel the need to look for it. I have it. I put it on. Tried it. Unsintalled it in days. Just crap!

-

⭐ FFRT reacted to a post in a topic:

Sentient Trader 4.04.17

⭐ FFRT reacted to a post in a topic:

Sentient Trader 4.04.17

-

@dex Configuração testada BTC 15 min, Ohlc4,16,16,1,1, 2,8,6. Tente usá-lo para entrada e saída de comércio manual, mantendo o limite em 2,8. Se o limite for superior a 2,8%, não entre na negociação (para melhores resultados). Testando_16_16_1_1_2.8_6_15 min (3).txt

-

@fxzero.dark Please can you send me the tradingview script? Thanks

-

fxzero.dark reacted to a post in a topic:

sentienttrader.com

fxzero.dark reacted to a post in a topic:

sentienttrader.com

-

fxzero.dark started following HFT_SPECTRE_LITE_V21

-

fxzero.dark reacted to a post in a topic:

https://scalpershideout.com

fxzero.dark reacted to a post in a topic:

https://scalpershideout.com

-

fxzero.dark started following the_evil

-

fxzero.dark reacted to a post in a topic:

https://scalpershideout.com

fxzero.dark reacted to a post in a topic:

https://scalpershideout.com

-

fxzero.dark reacted to a post in a topic:

https://scalpershideout.com

fxzero.dark reacted to a post in a topic:

https://scalpershideout.com

-

I have a script that I believe is this indicator, but it's for TradingView. If anyone is interested, I can send it to you.

-

https://ultimatescalper.kartra.com/page/oDN287 Has anyone come across latest version of this one?

-

I'm interested as well to learn. Have no clue. Any tips and pointers would be helpful. Thanks

-

volumetrade2022 reacted to a post in a topic:

TachEonTimeWarpAurora needs to fix

volumetrade2022 reacted to a post in a topic:

TachEonTimeWarpAurora needs to fix

- Yesterday

-

volumetrade2022 reacted to a post in a topic:

trader-algoritmico.com

volumetrade2022 reacted to a post in a topic:

trader-algoritmico.com

-

@kimsam Can you please see why is this happening? Thank you.

-

This looks like something I made last year... wasn't good

-

The SHReversalBar is what is part of the package. The bar size is in the "eyes of the beholder" and is adjusted to your risk tolerance and profit goal by the parameters "Tick Size" and Reversal Bars". This app will not work wit any other bar type. Hope this helps.

-

⭐ RichardGere reacted to a post in a topic:

Sentient Trader 4.04.17

⭐ RichardGere reacted to a post in a topic:

Sentient Trader 4.04.17

-

Custom, comes with the indicator.

-

can anyone upload Sentient Trader cycle analysis program, version 4.04.17. to mediafire regards antony

-

What Bar Type and Size are these?

-

Anyone was able to test it?

-

If not you then for the newbies! No issues at all. Thank you though for the file. I shall break it down and see what is inside of the source coding and Agile. Much appreciat it@dex. We are currently trying to educate some that most are desiring for as QuantAlpha, Breakout and VolumeTank Army, Hello Captain Optimus, SuperJumpBoost from NinzaCo, and the one and only, RipperX AI Pro... Just to name a few. Thanks again@dex.

-

These are my server met to update the server.met from address. http://upd.emule-security.org/server.met http://www.gruk.org/server.met http://update.adunanza.net/servers.met http://edk.peerates.net/servers.met Saluti.

-

Almost all Supertrends are the same with settings of ATR/Multiplier. You can change the Multiplier of default 2.5 to a smaller number, let's just say, 1.5 to have them closer to your candles or further away with bigger number of Multiplier, let's just say, 2.7, or even 3. Many use them to enter and to trail their stoplosses. The closer of setting, the more you would see more signals of every moves and whipsaws. The further away, you would capture bigger moves trailing. However, if I recall it correctly, there is one floating out there and they call it a Supertrend on steroid, a beast, a bulls eye! Ahh, found it. https://ninjatraderecosystem.com/webinar/supertrend-on-steroids-auto-optimizing-trend-trading/