-

Posts

520 -

Joined

-

Last visited

Content Type

Profiles

Forums

Articles

Posts posted by RBFX Support

-

-

EUR continues to fall: the US dollar is to blame. Overview for 17.06.2024

The EURUSD position appears weak on Monday. The current EURUSD exchange rate stands at 1.0702.

The EUR faces serious pressure due to the political imbalance in Europe and a rather mixed outlook. The euro-dollar exchange rate has declined by 0.8% over the last week, marking the maximum weekly fall since April and giving a reason for a detailed forecast for EURUSD on 17 June 2024.

The market is speculating on the risks of a budget crisis in the eurozone. This pertains to the situation in France, where the confrontation between the right and left parties is reaching a new level ahead of snap parliamentary elections, with increasing pressure on President Emmanuel Macron’s centrist administration.

All these factors increase the likelihood of implications for the economy in the heart of the eurozone. This situation appears significant and dubious and is unlikely to be resolved soon.

A fall in the euro rate indirectly benefits the US dollar.

Despite a massive sell-off in the French financial markets last week, the European Central Bank does not plan to initiate an emergency purchase of French bonds.

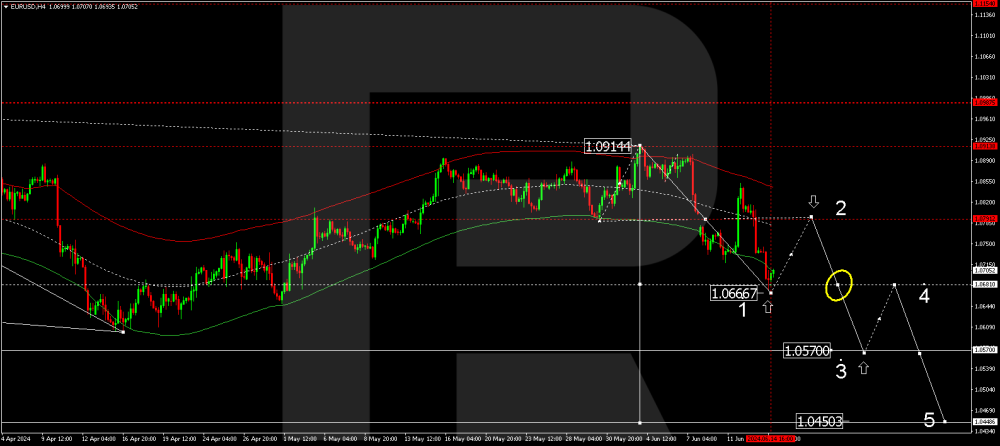

Technical analysis EURUSD

As the analysis for 17 June 2024 shows, EURUSD is developing another decline wave towards 1.0450. On the H4 chart, the market formed the first structure of this wave, with a target at 1.0666. Today, a consolidation range is expected to form above this level. With an upward breakout, a correction towards 1.0790 might follow. Once the correction is complete, a new decline structure in the EURUSD exchange rate could start, aiming for 1.0680. A breakout of this level will open the potential for a decline wave towards the local target of 1.0570. With a downward breakout of the range, a decline wave to 1.0570 is possible. Technically, this scenario is confirmed by the Elliott Wave structure and a wave matrix with a pivot point at 1.0680. The market has completed a decline to the lower boundary of the Envelope, with a rise to its upper boundary being expected.

Read more - EURUSD

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.Sincerely,

The RoboForex Team -

Murrey Math Lines 14.06.2024 (Brent, S&P 500)

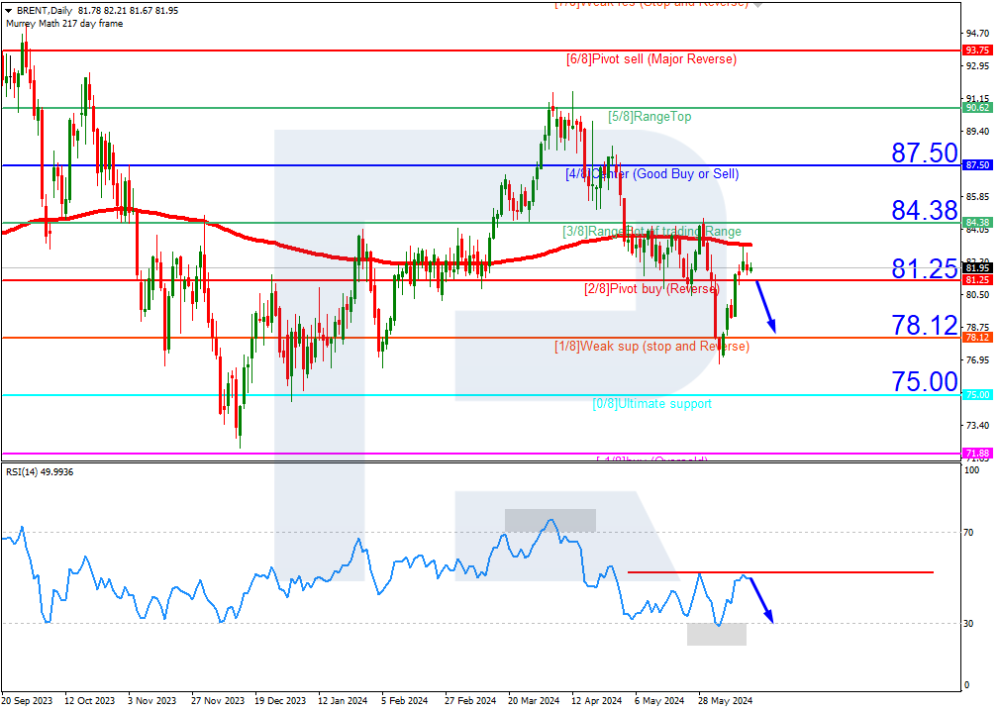

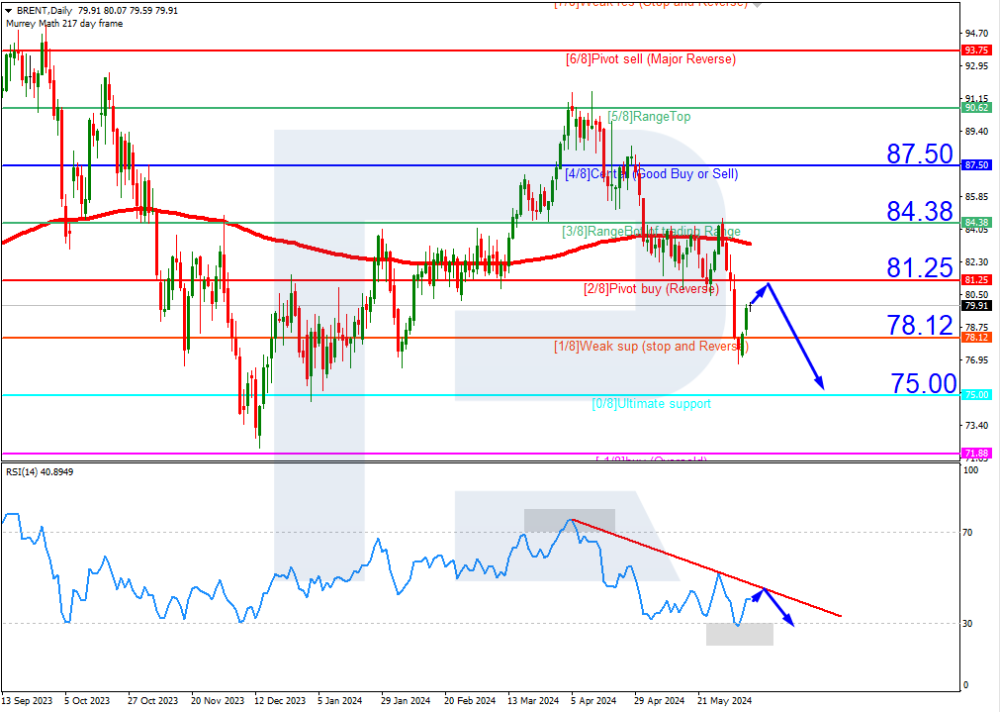

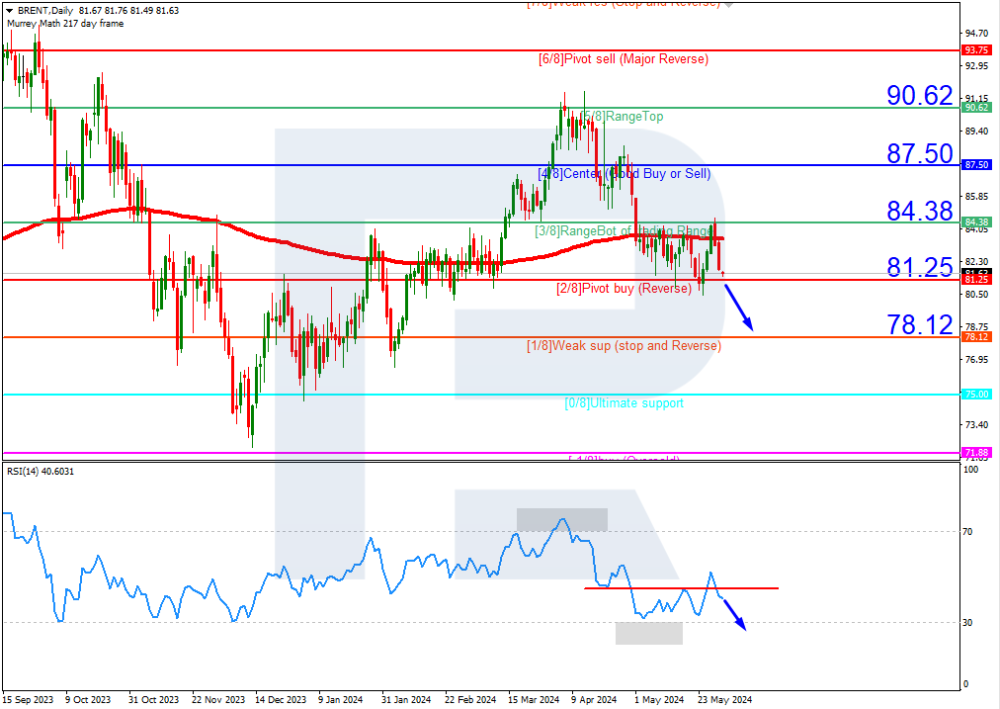

Brent

Brent crude oil quotes are below the 200-day Moving Average on D1, indicating a prevailing downtrend. The RSI is testing the resistance line. In this situation, the price is expected to break the 2/8 (81.25) level, rebound, and fall to the support at 1/8 (78.12). Surpassing the 3/8 (84.38) level could invalidate this scenario, propelling the quotes to the resistance at 4/8 (87.50).On M15, a breakout of the VoltyChannel lower line will provide an additional signal for a price decline.

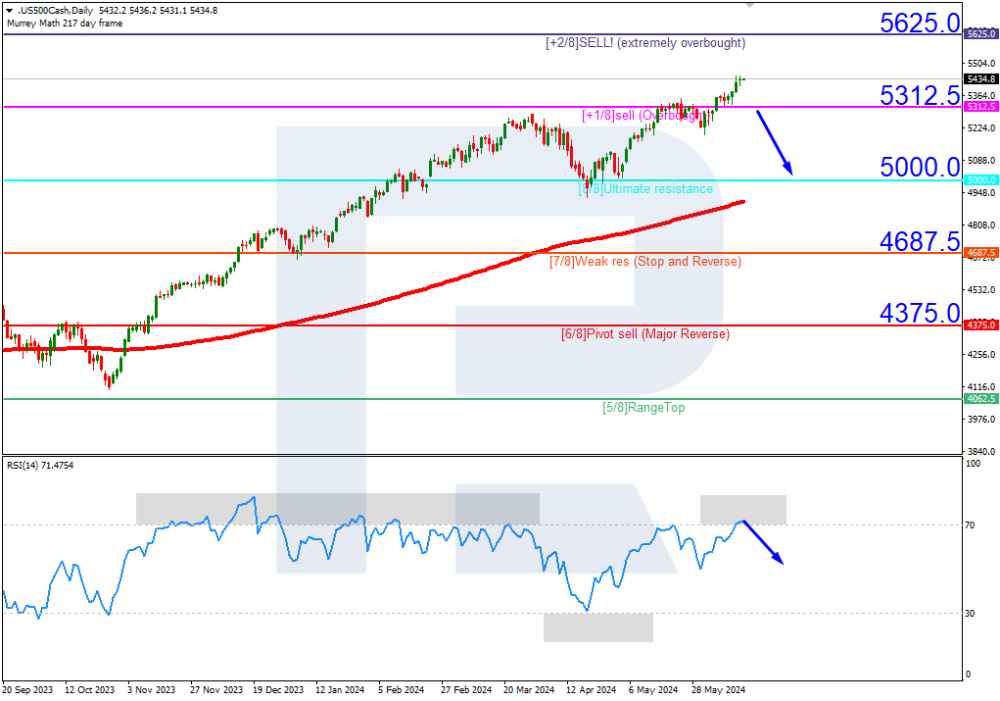

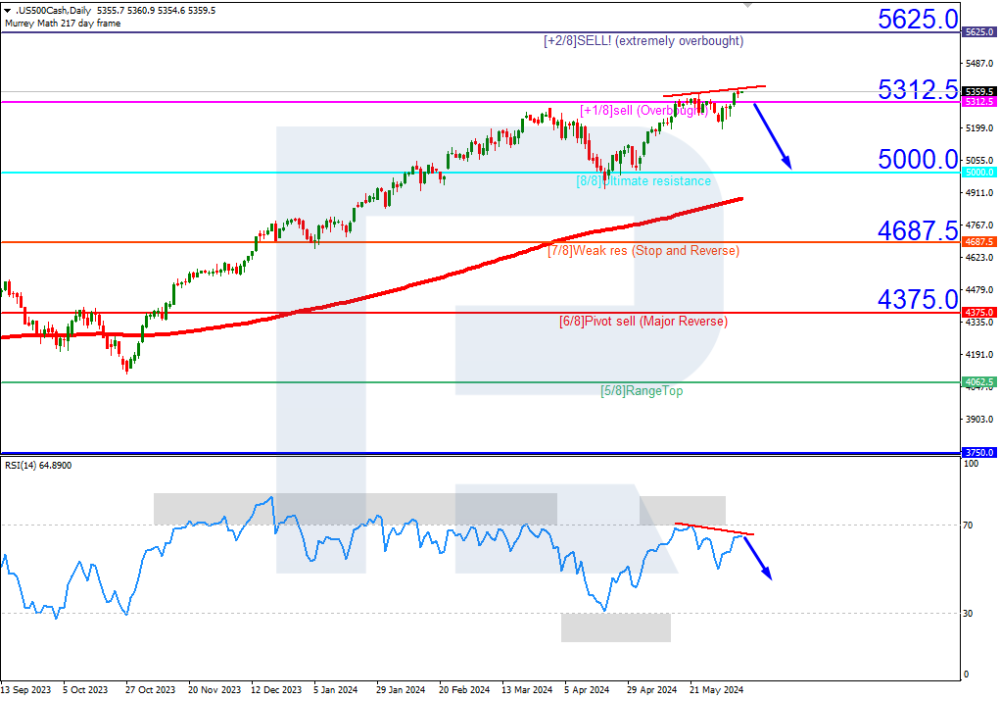

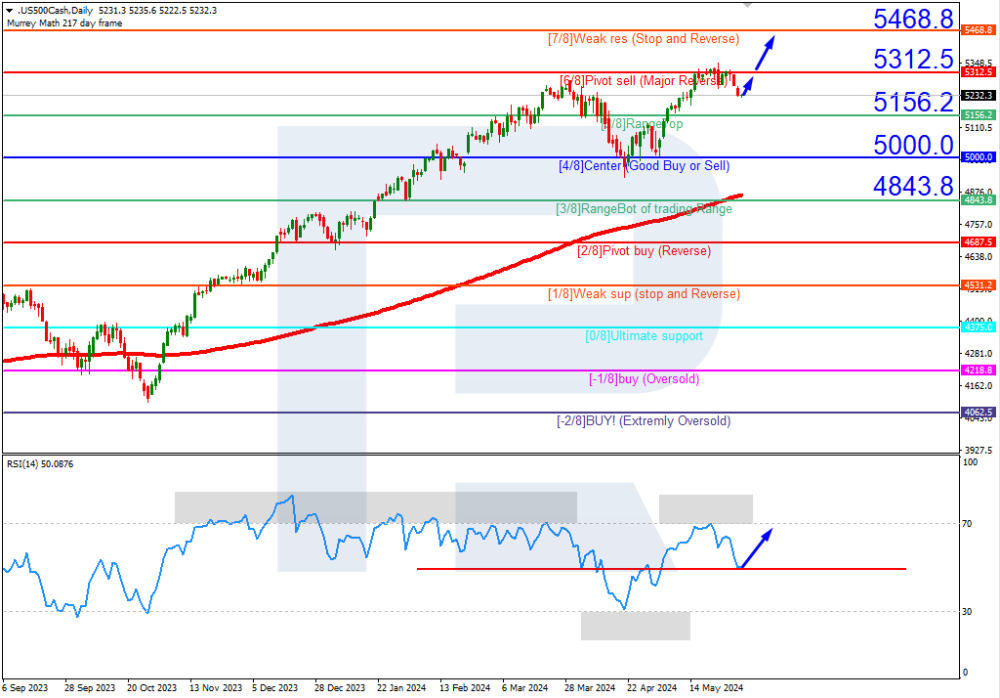

S&P 500

S&P 500 quotes and the RSI are in the overbought areas on D1. In this situation, the price is expected to breach the +1/8 (5312.5) level and decline to the 8/8 (5000.0) support level. The scenario could be invalidated by surpassing the +2/8 (5625.0) level, which might reshuffle the Murrey indication, setting new price movement targets.Read more - Murrey Math Lines (Brent, S&P 500)

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.Sincerely,

The RoboForex Team -

JPY is under pressure. Overview for 14.06.2024

The Japanese yen is declining against the US dollar on Friday. The current USDJPY exchange rate stands at 157.85.

The Bank of Japan concluded its meeting, opting to maintain its current monetary policy structure, keeping the interest rate at zero. In its comments, the BoJ stated that it would maintain the parameters for purchasing Japanese government bonds at the levels agreed in March.

This disappointed investors who were expecting signals towards a reduction in bond purchases. Previously, the Governor of the Bank of Japan did not rule out a gradual reduction of its enormous balance sheet in the form of government bonds but did not specify any timelines.

In March 2024, the Bank of Japan tightened monetary policy for the first time in seven years, moving the interest rate from negative territory to zero.

Fundamental analysis for other instruments can be found in the section "Forex Forecasts and Analysis" on our website.

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.Sincerely,

The RoboForex Team

-

Ichimoku Cloud Analysis 13.06.2024 (GBPUSD, XAUUSD, USDCHF)

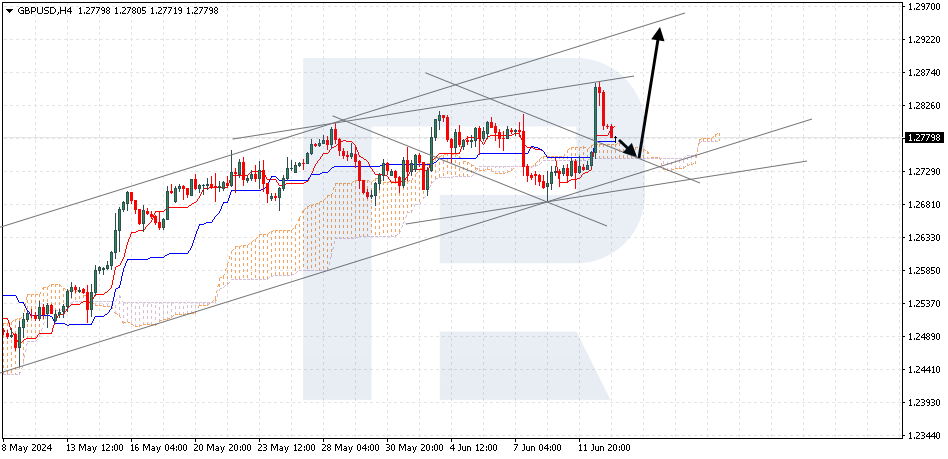

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD is correcting after rebounding from the upper boundary of the bullish channel. The pair is moving above the Ichimoku Cloud, suggesting an uptrend. A test of the Cloud’s lower boundary at 1.2745 is expected, followed by a rise to 1.2925. A rebound from the upper boundary of the bearish channel would be an additional signal confirming the increase. The scenario could be cancelled by a breakout of the Cloud’s lower boundary, with the price securing below 1.2715, indicating a further decline to 1.2625.

XAUUSD, “Gold vs US Dollar”

Gold is bouncing off the resistance level. The instrument is moving below the Ichimoku Cloud, suggesting a downtrend. A test of the Cloud’s lower boundary at 2340 is expected, followed by a decline to 2230. A rebound from the upper boundary of the bearish channel would be an additional signal confirming the fall. This scenario could be cancelled by a breakout above the upper boundary of the Cloud, with the price securing above 2355, indicating a further rise to 2395. Conversely, a decline could be confirmed by a breakout below the lower boundary of the ascending channel, with the price gaining a foothold below 2300.

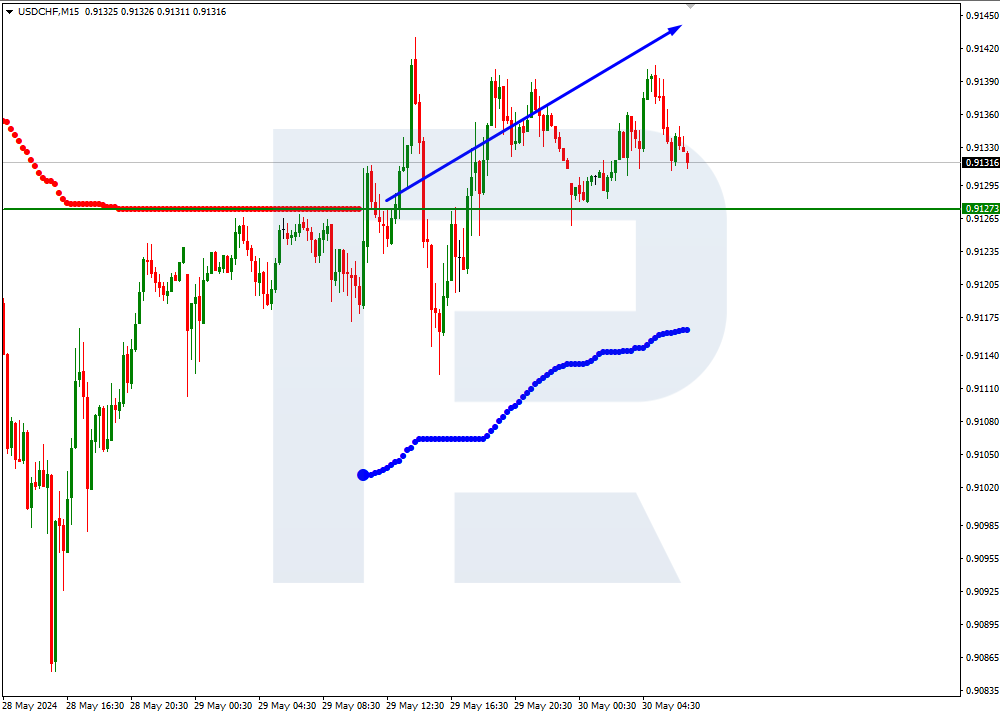

USDCHF, “US Dollar vs Swiss Franc”

USDCHF is rising after rebounding from the lower boundary of the Head and Shoulders reversal pattern. The pair is moving inside the Ichimoku Cloud, indicating a sideways trend. A test of the resistance area at 0.8960 is expected, followed by a decline to 0.8795. A rebound from the upper boundary of the bearish channel would signal the decline. The scenario could be cancelled by a breakout of the upper boundary of the Cloud, with the price securing above 0.9055, indicating a further rise to 0.9145. Conversely, a decline could be confirmed by a breakout below the lower boundary of the Head and Shoulders pattern, with the price establishing itself below 0.8865.

Read more - Ichimoku Cloud Analysis (GBPUSD, XAUUSD, USDCHF)

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.Sincerely,

The RoboForex Team -

EURUSD experienced significant volatility. Overview for 13.06.2024

The primary currency pair is looking for support after a turbulent rise on Thursday. The current EURUSD exchange rate stands at 1.0805.

Yesterday, the EURUSD pair faced a massive flow of data from both the US Federal Reserve and statistical reports. The Fed’s June meeting ended neutrally, with the interest rate remaining at 5.25% per annum, which was in line with expectations. However, the Federal Reserve’s comments, hinting at a rate cut this year closer to December, and the perceived aggressiveness of the Fed’s rhetoric regarding steps in 2025, have left the market in a state of anticipation for an active interest rate reduction.

The US Consumer Price Index dropped in May, exceeding forecasts. Inflation stood at 3.3% year-on-year, remaining flat on a month-to-month basis. Core inflation decreased to 3.4% year-on-year from the previous 3.6%. This development indicates the easing of price pressure, a positive signal for the economy and the Federal Reserve.

The market has become overly sensitive to statistical data releases. The US Federal Reserve created this foundation, having previously stated that it planned to gather as much data as possible to identify patterns.

Fundamental analysis for other instruments can be found in the section "Forex Forecasts and Analysis" on our website.

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.Sincerely,

The RoboForex Team -

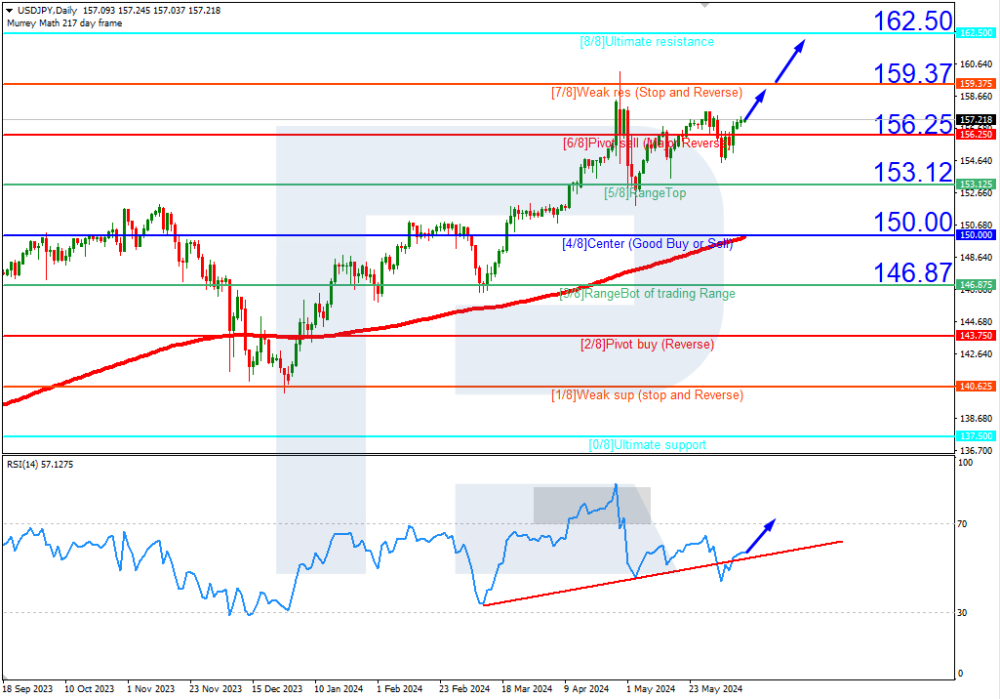

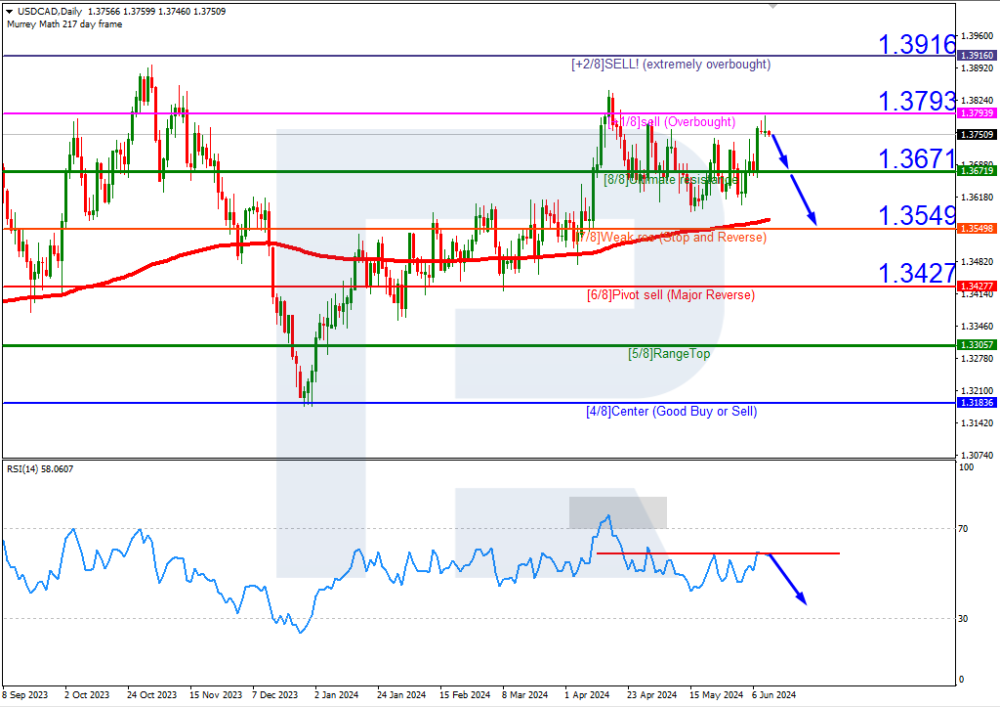

Murrey Math Lines 12.06.2024 (USDJPY, USDCAD)

USDJPY, “US Dollar vs Japanese Yen”

USDJPY quotes are above the 200-day Moving Average on D1, indicating a prevailing uptrend. The RSI has breached the resistance line. In this situation, the price is expected to test the 7/8 (159.37) level, break above it, and rise to the resistance at 8/8 (162.50). A breakout below the 5/8 (153.12) support level could cancel this scenario, leading to a potential decline to 4/8 (150.00).On M15, a breakout above the upper line of the VoltyChannel would provide an additional signal supporting the price increase.

USDCAD, “US Dollar vs Canadian Dollar”

USDCAD quotes are in the overbought area on D1. The RSI is testing the resistance line. In this situation, the price is expected to break the 8/8 (1.3671) level and decline to the support at 7/8 (1.3549). Surpassing the +1/8 (1.3793) level could cancel this scenario, leading to a potential rise to the +2/8 (1.3916) resistance level.Read more - Murrey Math Lines (USDJPY, USDCAD)

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.Sincerely,

The RoboForex Team -

EURUSD declines. Overview for 12.06.2024

The primary currency pair is dropping lower on Wednesday. The current EURUSD exchange rate stands at 1.0740.

Political instability in France is significantly impacting the euro. President Emmanuel Macron’s position has become shaky following the far-right party’s victory in the European Parliament elections. Rumours are circulating that Macron might also lose the forthcoming elections, which would jeopardise France’s financial stability. This factor is now adding to the euro’s imbalance.

The US Federal Reserve meeting is underway. The decision on the interest rate will be announced on Wednesday evening, and it is expected to remain unchanged at 5.25% per annum. The market is keen for fresh and relevant assessments of the economy and outlook.

The most crucial information the financial world awaits is the timing of the first easing of monetary conditions, with general forecasts currently referring to November.

Fundamental analysis for other instruments can be found in the section "Forex Forecasts and Analysis" on our website.

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.Sincerely,

The RoboForex Team

-

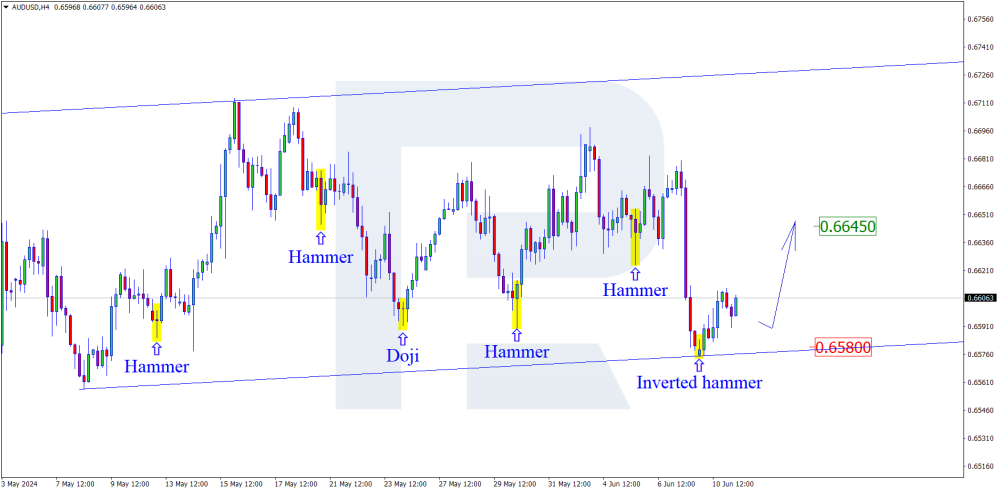

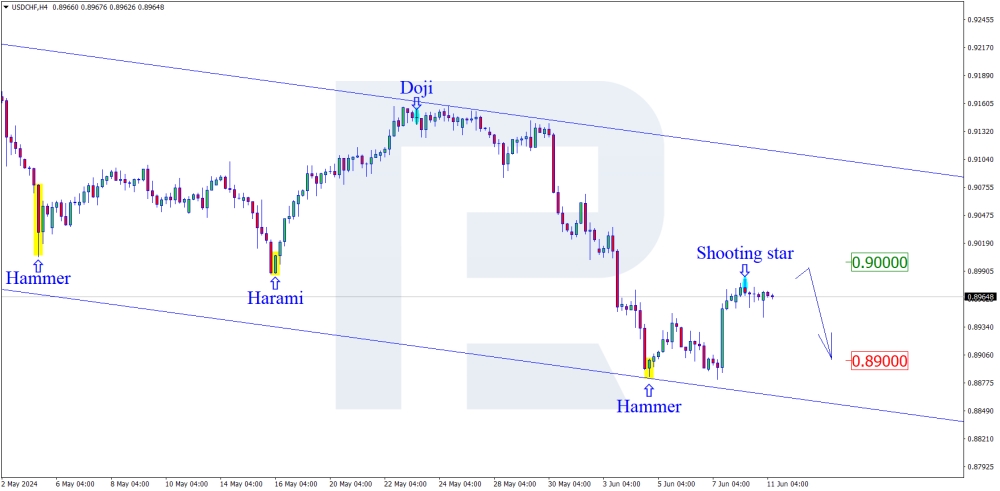

Japanese Candlesticks Analysis 11.06.2024 (USDCAD, AUDUSD, USDCHF)

USDCAD, “US Dollar vs Canadian Dollar”

USDCAD has formed a Hanging Man reversal pattern on H4. The instrument is currently following the reversal signal in a descending wave. The decline target could be 1.3730. Next, the price might rebound from the support level and continue its upward momentum. However, the quotes could rise to 1.3800 without a correction.AUDUSD, “Australian Dollar vs US Dollar”

AUDUSD has formed an Inverted Hammer reversal pattern on H4. The instrument is currently following the reversal signal in an ascending wave. The growth target could be 0.6645. After testing the resistance level, the quotes could break above it and maintain their upward trajectory. However, the price might pull back to 0.6580 before rising.USDCHF, “US Dollar vs Swiss Franc”

USDCHF has formed a Shooting Star reversal pattern on H4. The instrument is currently following the reversal signal in a descending wave. The decline target could be 0.8900. After testing the support level, the price might breach it and continue to develop a downtrend. However, the price could correct to 0.9000 before declining.Read more - Japanese Candlesticks Analysis (USDCAD, AUDUSD, USDCHF)

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.Sincerely,

The RoboForex Team -

GBP attempts to rise. Overview for 11.06.2024

The British pound sterling is trying to rise against the US dollar. The current GBPUSD exchange rate stands at 1.2736.

The pound has stabilised after hitting a new local low last week. The UK employment market data, industrial production, construction activity, and trade balance figures are due for release. The data are expected to confirm an economic slowdown in April.

The unemployment rate will likely remain at 4.30%, and average earnings are anticipated to increase by 5.70%.

At its next meeting on 20 June, the Bank of England will likely keep the interest rate unchanged at 5.25% per annum, its peak since 2008. UK inflation is clearly reducing, but not fast enough.

Additionally, there is some uncertainty about the country’s elections in early July, which may exert pressure on the pound.

Fundamental analysis for other instruments can be found in the section "Forex Forecasts and Analysis" on our website.

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.Sincerely,

The RoboForex Team -

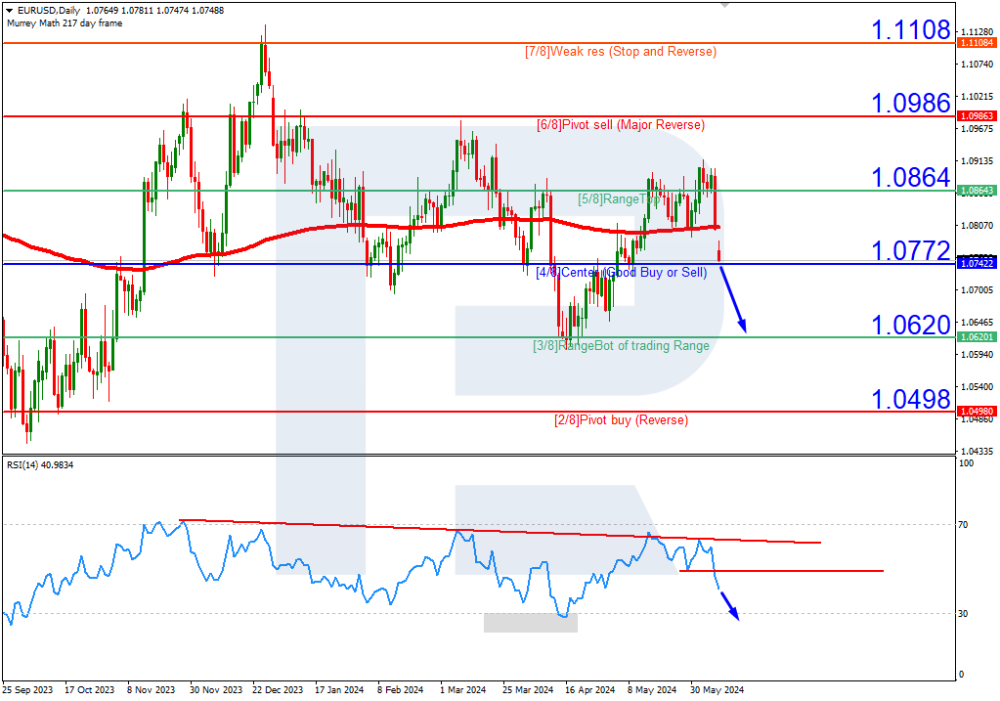

Murrey Math Lines 10.06.2024 (EURUSD, GBPUSD)

EURUSD, “Euro vs US Dollar”

EURUSD quotes have broken below the 200-day Moving Average on D1, indicating a potential downtrend. The RSI has breached the support line. In this situation, the price is expected to break below the 4/8 (1.0772) level and decline to the support at 3/8 (1.0620). The scenario could be cancelled by a rebound from the 4/8 (1.0772) level, which might lead to a rise to the resistance at 5/8 (1.0864).On M15, the lower line of the VoltyChannel is broken, which increases the probability of a price decline.

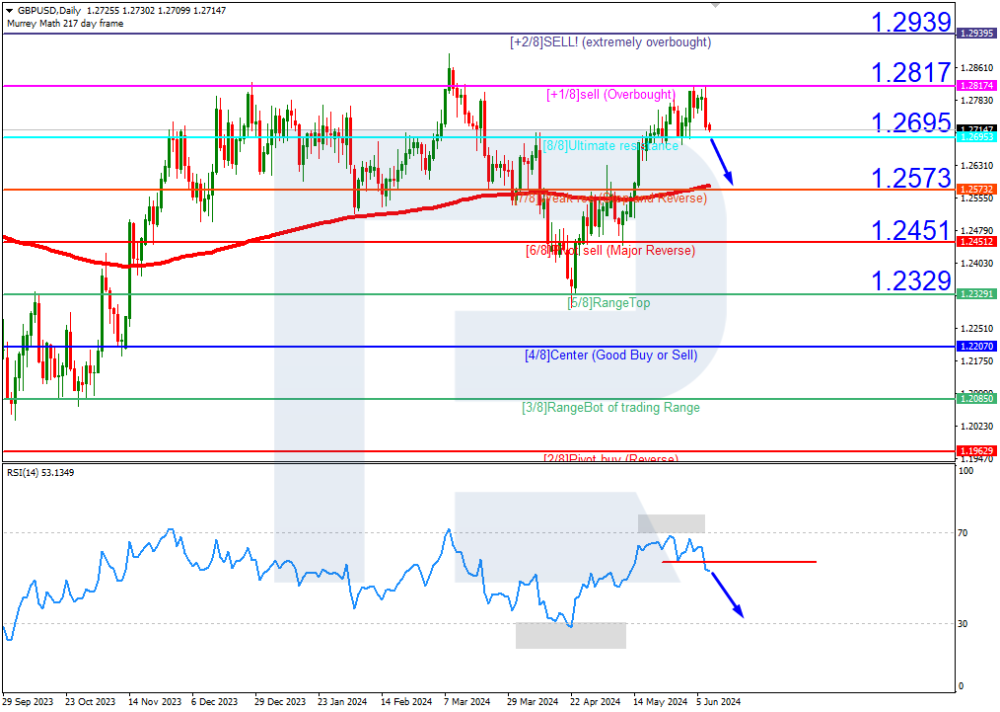

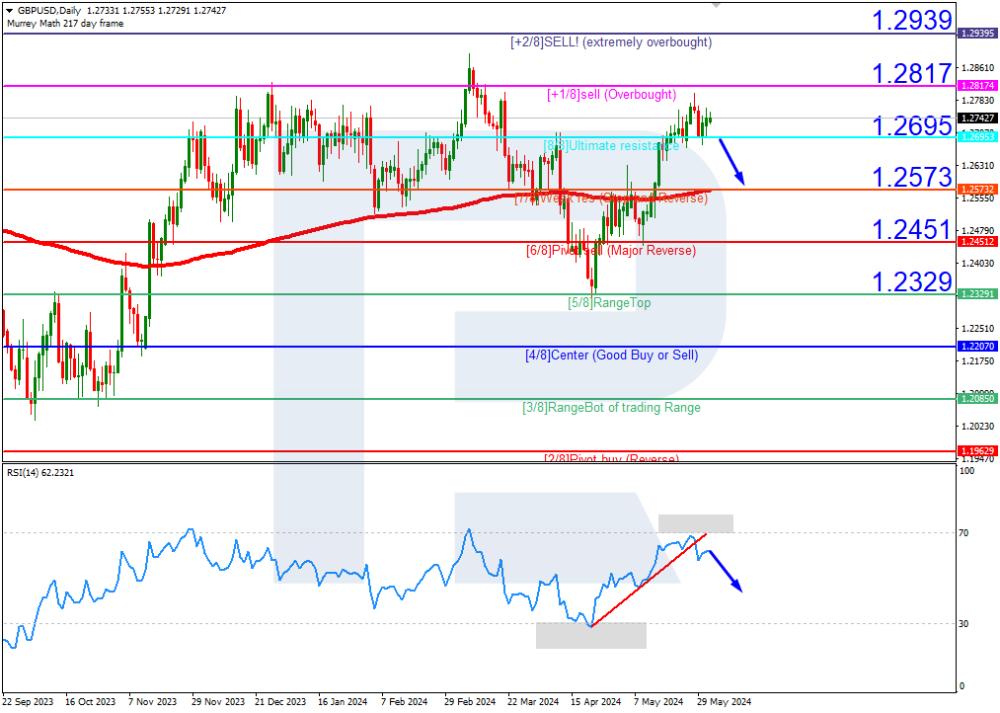

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD quotes remain in the overbought area on D1. The RSI has breached the support line. In this situation, the price is expected to break below the 8/8 (1.2695) level and decline to the support at 7/8 (1.2573) support. The scenario could be cancelled by surpassing the +1/8 (1.2817) level. In this case, the pair might rise to the resistance at +2/8 (1.2939).Read more - Murrey Math Lines (EURUSD, GBPUSD)

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.Sincerely,

The RoboForex Team -

EUR fell to a four-week low. Overview for 10.06.2024

The primary currency pair continues to plummet on Monday. The current EURUSD exchange rate stands at 1.0795.

The euro faced two substantial pressure factors. Firstly, there were political developments in France, where the pro-presidential forces lost the European Parliament elections to the far-right. French President Emmanuel Macron called snap elections after his party’s defeat to Marine Le Pen’s far-right, which crushed it by nearly half.

Secondly, investors have adjusted their expectations about the Federal Reserve interest rate trajectory following Friday’s US employment market statistics. In anticipation of the Federal Reserve meeting this week, the impact of such a driver is considerably strong.

Non-farm payrolls expanded by 272 thousand last month from the previous 165 thousand, while the unemployment rate increased to 4.0% from 3.9% in April. Average hourly earnings rose by 0.4% m/m in May, twice as high as the April reading.

The EURUSD pair will experience very high volatility this week.

Fundamental analysis for other instruments can be found in the section "Forex Forecasts and Analysis" on our website.

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.Sincerely,

The RoboForex Team -

Murrey Math Lines 07.06.2024 (Brent, S&P 500)

Brent

Brent crude oil quotes are below the 200-day Moving Average on D1, indicating a prevailing downtrend. The RSI is approaching the resistance line. In this situation, the price is expected to test the 2/8 (81.25) level, rebound, and fall to the support at 0/8 (75.00). Surpassing the 2/8 (81.25) level could invalidate this scenario, propelling the quotes to the resistance at 3/8 (84.38).On M15, a breakout of the VoltyChannel lower line will provide an additional signal for a price decline.

S&P 500

S&P 500 quotes are in the overbought area on D1, with divergence on the RSI. In this situation, the price is expected to breach the +1/8 (5312.5) level and decline to the 8/8 (5000.0) support level. The scenario could be cancelled by a breakout of the +2/8 (5625.0) level, which might reshuffle the Murrey indication, setting new price movement targets.Read more - Murrey Math Lines (Brent, S&P 500)

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.Sincerely,

The RoboForex Team -

JPY takes a pause. Overview for 07.06.2024

The Japanese yen is stable against the US dollar on Friday. The current USDJPY exchange rate is 155.57.

Investors refrain from making significant decisions ahead of next week's BoJ meeting. The regulator is expected to maintain interest rates unchanged. The market is closely monitoring monthly bond purchases. A potential reduction in figures could signal a gradual tightening of monetary policy.

Bank of Japan Governor Kazuo Ueda confirmed this week that the central bank will gradually reduce its extensive balance sheet. The timing of such an undertaking remains uncertain.

In March 2024, the Bank of Japan phased out its negative interest rate policy, which had been in place for eight years. At the same time, it scrapped its yield curve control program as Japan set its sights on normalising monetary policy.

Fundamental analysis for other instruments can be found in the section "Forex Forecasts and Analysis" on our website.

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.Sincerely,

The RoboForex Team -

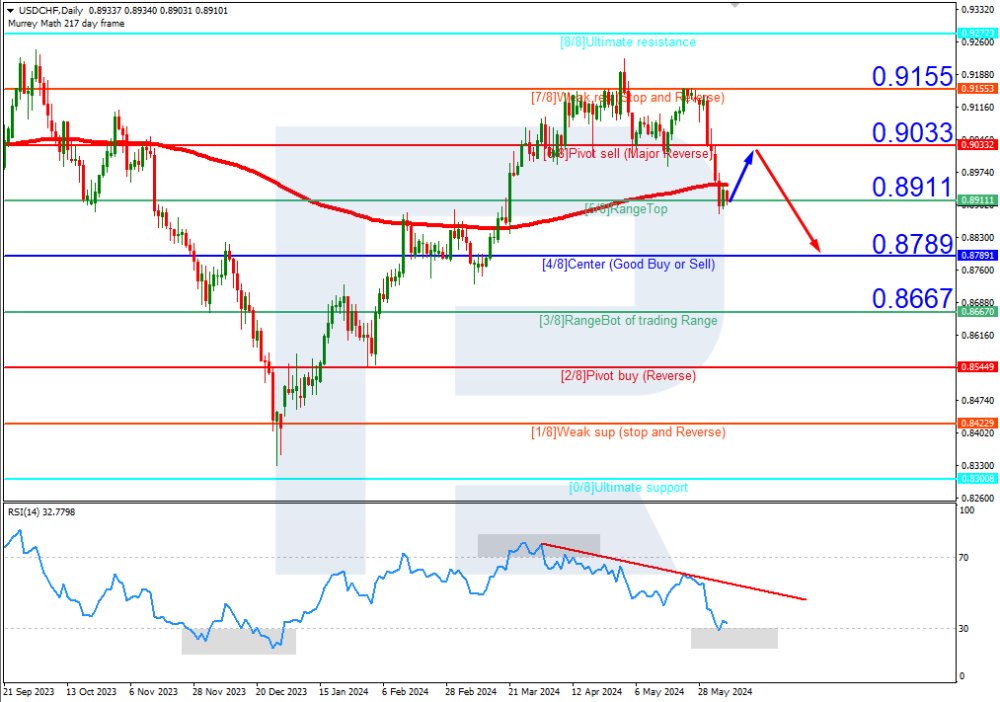

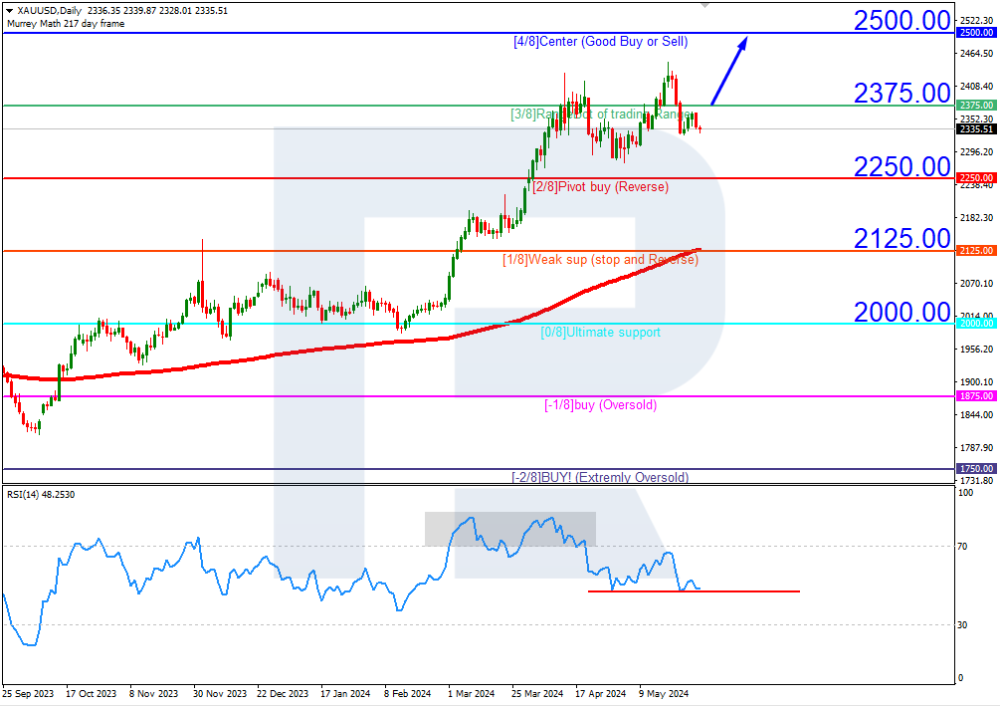

Murrey Math Lines 06.06.2024 (USDCHF, XAUUSD)

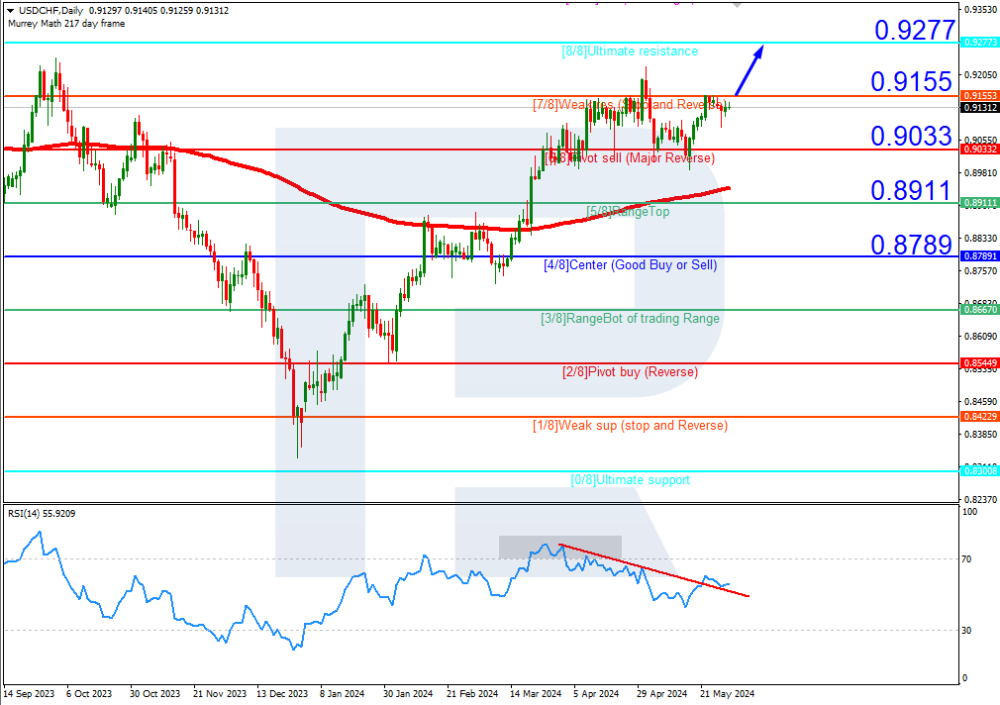

USDCHF, “US Dollar vs Swiss Franc”

USDCHF quotes have broken below the 200-day Moving Average on D1, indicating a potential downtrend. However, the RSI has reached the overbought area. As a result, in this situation, the price is expected to rebound from the 5/8 (0.8911) level and rise to the resistance at 6/8 (0.9033). A breakout below the 5/8 (0.8911) level could cancel this scenario, pushing the pair further down to the support at 4/8 (0.8789).On M15, the price rise might be additionally supported by a breakout of the VoltyChannel upper line.

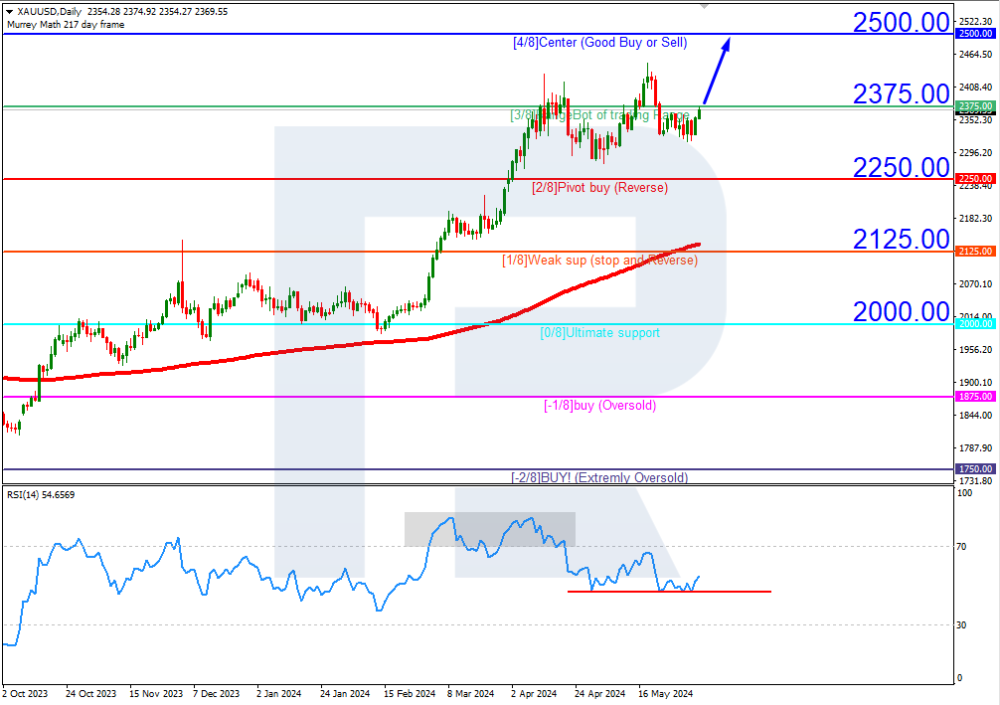

XAUUSD, “Gold vs US Dollar”

Gold quotes are above the 200-day Moving Average on D1, indicating a prevailing uptrend. The RSI has rebounded from the support line. In this situation, the price is expected to surpass the 3/8 (2375.00) level and rise further to the 4/8 (2500.00) resistance level. A rebound from the 3/8 (2375.00) level could cancel this scenario, leading to a potential decline to the 2/8 (2250.00) support level.Read more - Murrey Math Lines (USDCHF, XAUUSD)

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.Sincerely,

The RoboForex Team -

CAD has strengthened. Overview for 06.06.2024

The Canadian dollar, paired with the US dollar, has strengthened. The current USDCAD exchange rate stands at 1.3678.

In the medium term, the pair remains within a wide sideways channel.

Yesterday, the Bank of Canada reduced the interest rate for the first time in four years to 4.75% per annum from the previous 5.00%. The regulator cited the progress achieved in its battle against inflation as an argument for this decision. According to the Bank of Canada’s press release, the core Consumer Price Index is declining, providing a reason to abandon restrictive monetary policy.

At least four inflation components improved significantly, including core inflation, the core price index with its median and average values, and the 3-month moving average.

Some CPI components rose by over 3%, close to a historical average value.

Fundamental analysis for other instruments can be found in the section "Forex Forecasts and Analysis" on our website.

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.Sincerely,

The RoboForex Team -

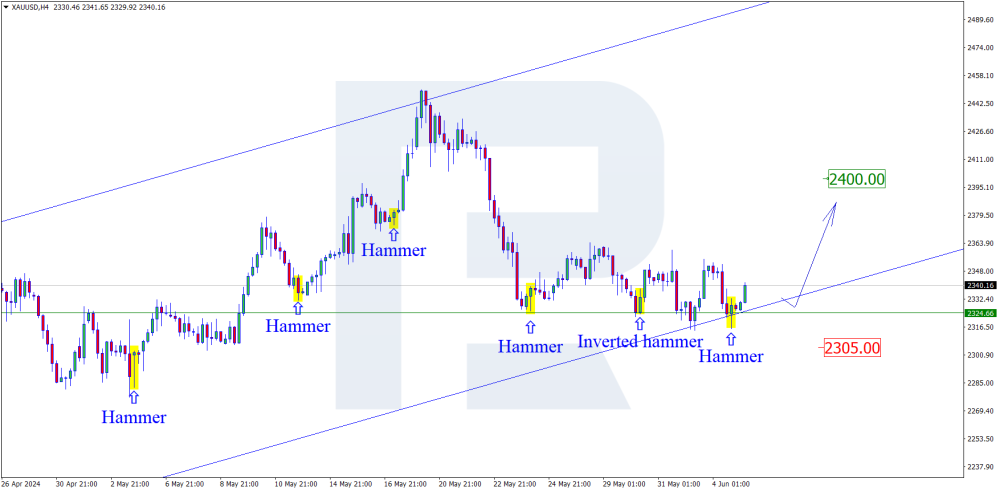

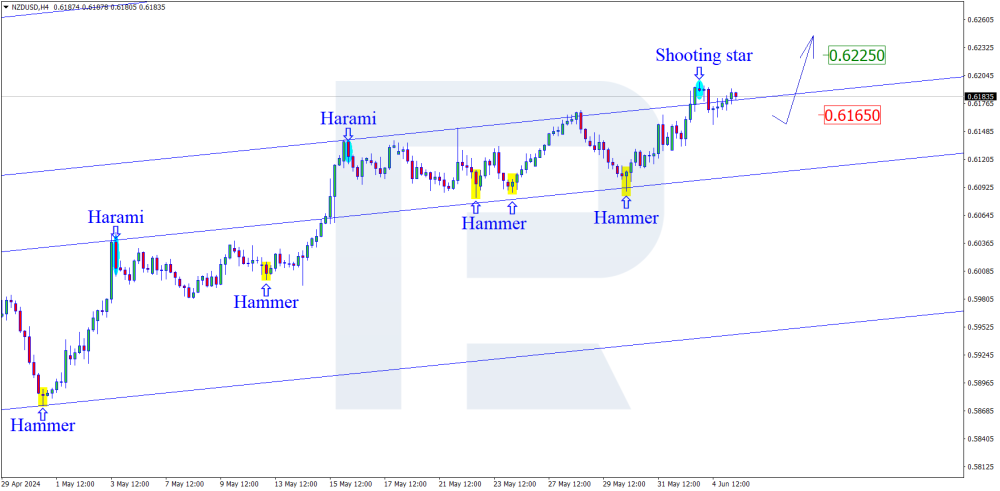

Japanese Candlesticks Analysis 05.06.2024 (XAUUSD, NZDUSD, GBPUSD)

XAUUSD, “Gold vs US Dollar”

Gold has formed a Hammer pattern. The instrument is currently following the reversal signal in an ascending wave. The growth target could remain at 2400.00. After testing the resistance level, the price could break above it and continue its upward momentum. However, the quotes could correct to 2305.00 before rising.NZDUSD, “New Zealand Dollar vs US Dollar”

NZDUSD has formed a Shooting Star reversal pattern on H4. The instrument is currently following the reversal signal in a descending wave. The target for correction could be 0.6165. After testing the support level, the quotes might continue the uptrend. However, the price could rise to 0.6225 without a pullback.GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD has formed a Hanging Man reversal pattern on H4. The instrument is currently following the reversal signal in a descending wave. The target for correction could be 1.2725. However, the price might rise to 1.2860 and maintain its upward trajectory without testing the support level.Read more - Japanese Candlesticks Analysis (XAUUSD, NZDUSD, GBPUSD)

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.Sincerely,

The RoboForex Team -

EURUSD corrected itself. Overview for 05.06.2024

The major currency pair stabilised on Wednesday after surging earlier. The current EURUSD exchange rate stands at 1.0877.

The market is gathering strength ahead of Friday’s US employment market report. Investors are currently interpreting isolated signals, with the previous day’s surprising data from the April job openings report still fresh in their minds. The report revealed a significant drop, reaching its lowest level in three years.

Specifically, JOLTS statistics showed that job vacancies decreased by 296 thousand, totalling 8.059 million, the lowest value since February 2021.

Investors usually do not pay much attention to such a release, but it has gained attention because the market is concerned about the tone of Friday’s data on the labour market. Non-farm payrolls (NFP) are expected to have risen by 185 thousand in May compared to April’s 175 thousand.

A weak employment report is good news for the US Federal Reserve, providing more arguments for a rate cut.

Fundamental analysis for other instruments can be found in the section "Forex Forecasts and Analysis" on our website.

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.Sincerely,

The RoboForex Team -

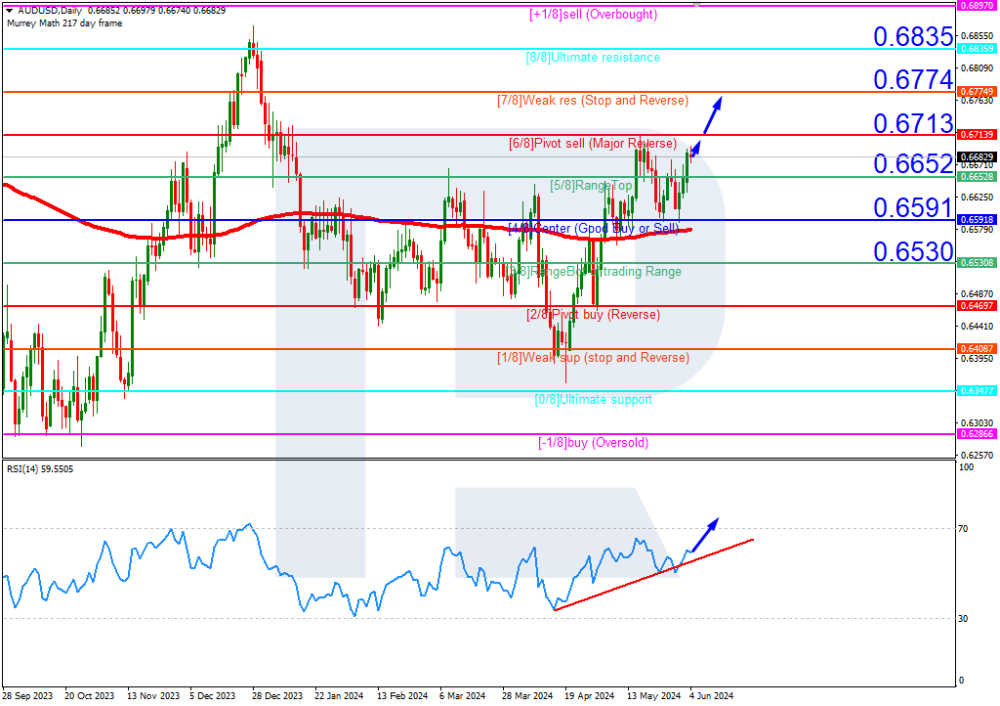

Murrey Math Lines 04.06.2024 (AUDUSD, NZDUSD

AUDUSD, “Australian Dollar vs US Dollar”

AUDUSD quotes are above the 200-day Moving Average on D1, indicating a prevailing uptrend. The RSI has rebounded from the support line. In this situation, the price is expected to surpass the 6/8 (0.6713) level and rise to the resistance at 7/8 (0.6774). A breakout below the 5/8 (0.6652) level could cancel this scenario, potentially causing the quotes to drop to the 4/8 (0.6591) support level.On M15, the upper line of the VoltyChannel is broken, which increases the probability of a further price rise.

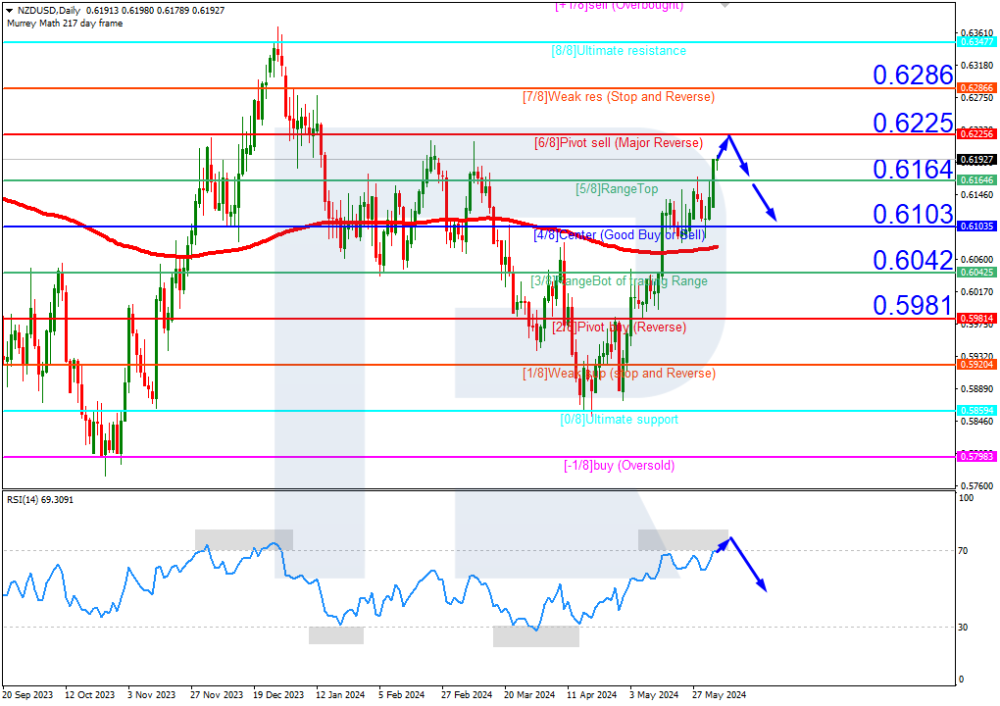

NZDUSD, “New Zealand Dollar vs US Dollar”

NZDUSD quotes are above the 200-day Moving Average on D1, indicating a prevailing uptrend. However, the RSI has reached the overbought area. As a result, in this situation, the price is expected to test the 6/8 (0.6225) level, rebound, and decline to the support at 4/8 (0.6103). The scenario could be cancelled by surpassing the 6/8 (0.6225) level. In this case, the quotes might rise to the resistance at 7/8 (0.6286).Read more - Murrey Math Lines (AUDUSD, NZDUSD)

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.Sincerely,

The RoboForex Team -

EUR has surged. Overview for 04.06.2024

The primary currency pair continues to climb higher on Tuesday. The current EURUSD exchange rate stands at 1.0908.

The US dollar has retreated to its lowest value since 21 March as signs of persisting weakening in the US economy strengthen arguments for an imminent interest rate cut by the US Federal Reserve. The US ISM manufacturing PMI in May decreased to 48.7 points from the previous 49.2, falling short of expectations.

According to the LSEG monitor, the likelihood of a Federal Reserve rate cut in September is currently estimated at 59.1% compared to 55.0% on Friday. This anticipation is further heightened by growing expectations, which were no more than 50.0% early last week. The employment market data for May, particularly the wage parameters, which are significant in the context of inflation, will be crucial this week.

The Federal Reserve’s next meeting will conclude on 12 June, and the latest consumer price data will be released that day. Although no risk is expected at this meeting, the Federal Reserve must update its economic forecasts.

Fundamental analysis for other instruments can be found in the section "Forex Forecasts and Analysis" on our website.

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.Sincerely,

The RoboForex Team -

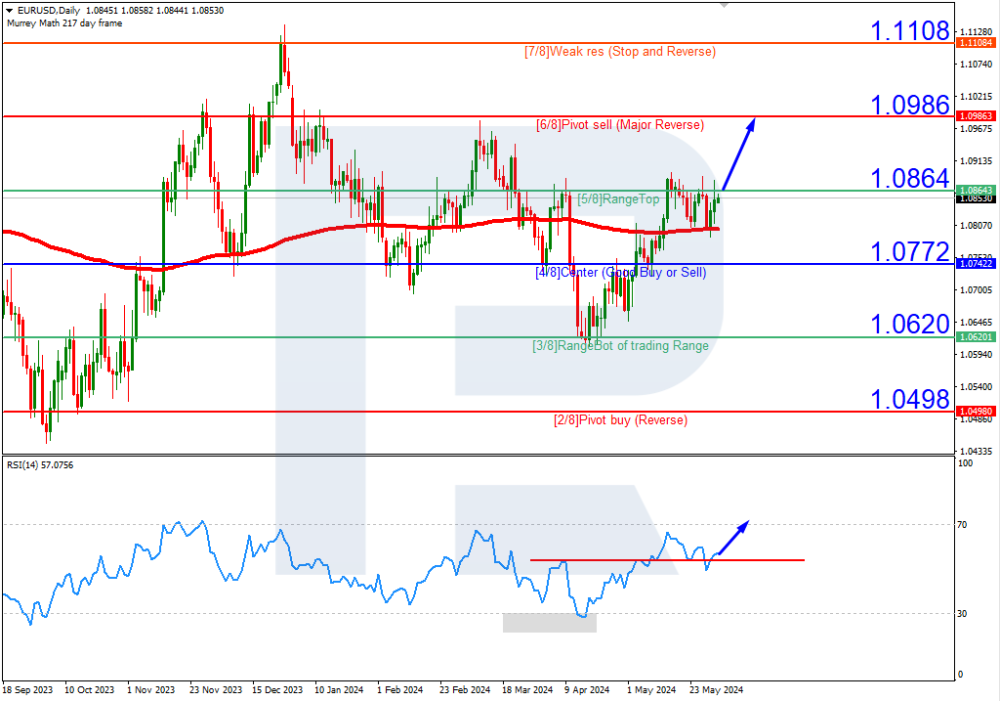

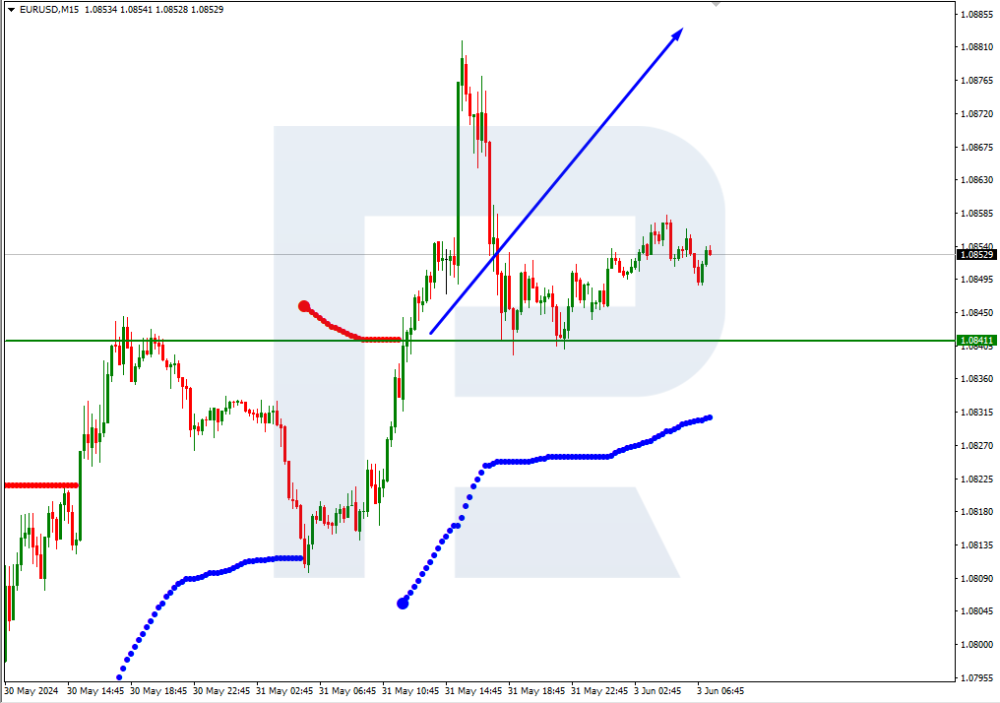

Murrey Math Lines 03.06.2024 (EURUSD, GBPUSD)

EURUSD, “Euro vs US Dollar”

EURUSD quotes are above the 200-day Moving Average on D1, indicating a prevailing uptrend. The RSI has rebounded from the support line. In this situation, the price is expected to surpass the 5/8 (1.0864) level and rise to the resistance at 6/8 (1.0986). The scenario could be cancelled by a breakout of the 4/8 (1.0772) level, which might lead to a trend reversal, pushing the pair to the 3/8 (1.0620) support level.On M15, the upper line of the VoltyChannel is broken, which increases the probability of a price rise.

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD quotes are in the overbought area on D1. The RSI has breached the support line. In this situation, the price is expected to break below the 8/8 (1.2695) level and decline to the support at 7/8 (1.2573) support. The scenario could be cancelled by surpassing the +1/8 (1.2817) level. In this case, the pair might rise to the resistance at +2/8 (1.2939).Read more - Murrey Math Lines (EURUSD, GBPUSD)

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.Sincerely,

The RoboForex Team -

NZD continues its ascent. Overview for 03.06.2024

The New Zealand dollar is rising against the US dollar. The current NZDUSD exchange rate stands at 0.6142.

Trading volumes for the NZD appear relatively small at the beginning of the week due to the market pause in observance of the King's Birthday.

The main support for the NZD now is the weak US dollar. The US Personal Consumption Expenditures index, Core PCE, for April, released on Friday, was in line with expectations at 2.7% y/y, allowing the US Federal Reserve to lower the interest rate this year. The dollar has naturally weakened while other currencies have risen.

Maintaining high interest rates in New Zealand supports the NZD's position despite some weakening in the domestic economy.

Earlier, the RBNZ reaffirmed its hawkish stance on monetary policy, surprising many by considering an interest rate hike. Meanwhile, inflation expectations remain unchanged, slightly reducing the likelihood of monetary policy tightening.

Fundamental analysis for other instruments can be found in the section "Forex Forecasts and Analysis" on our website.

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.Sincerely,

The RoboForex Team -

Murrey Math Lines 31.05.2024 (Brent, S&P 500)

Brent

Brent crude oil quotes are below the 200-day Moving Average on D1, indicating a prevailing downtrend. The RSI has crossed the support line. In this situation, the price is expected to break through the 2/8 (81.25) level and subsequently fall to the 1/8 (78.12) support level. A breakout above the 3/8 (84.38) level could invalidate this scenario, leading to a trend reversal and a rise in quotes to the 4/8 (87.50) resistance level.On M15, the lower line of the VoltyChannel indicator is breached, increasing the probability of a price decline.

S&P 500

S&P 500 index quotes are above the 200-day Moving Average on D1, indicating a prevailing uptrend. The RSI is testing the support line. In this situation, the price is expected to surpass the 6/8 (5312.5) level and rise further to the 7/8 (5468.8) resistance level. A breakout below the 5/8 (5156.2) level could invalidate this scenario, potentially causing the quotes to drop to the 4/8 (5000.0) support level.Read more - Murrey Math Lines (Brent, S&P 500)

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.Sincerely,

The RoboForex Team -

EUR is growing, but the dollar is gloomy. Overview for 31.05.2024

The primary currency pair is gaining on Friday. The current exchange rate for EURUSD is 1.0817.

The US dollar stabilised by today, but it noticeably weakened the evening before. This development was attributed to the publication of the second estimate of the US GDP for Q1 2024. The data do not rule out the possibility of US Federal Reserve interest rate cuts this year.

The statistics showed that GDP increased by only 1.3% y/y in January-March, while the first estimate reflected a 1.6% rise. This deterioration in the data has opened the door for the Fed to consider at least one rate cut by the end of the year. The market's current assessment of the likelihood of monetary policy easing at the September meeting stands at 55%, compared to 51% a day earlier.

Today, the market focuses on the Core PCE, the Fed's preferred inflation component. By this evening, the market will have more data on which to base speculations about the Federal Reserve's monetary policy outlook.

Fundamental analysis for other instruments can be found in the section "Forex Forecasts and Analysis" on our website.

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.Sincerely,

The RoboForex Team -

Murrey Math Lines 30.05.2024 (USDCHF, XAUUSD)

USDCHF, "US Dollar vs Swiss Franc"

On the M15 timeframe, USDCHF quotes are currently above the 200-day Moving Average, indicating a prevailing uptrend. The Relative Strength Index (RSI) has breached the resistance line. In this scenario, further upward movement is anticipated towards the nearest resistance at 7/8 (0.9155), followed by a price increase to resistance at 8/8 (0.9277). However, a breakout below the 6/8 (0.9033) support level could invalidate this scenario, potentially leading to a decline towards 5/8 (0.8911).On the M15 timeframe, the upper line of the VoltyChannel indicator was breached, increasing the likelihood of further price appreciation.

XAUUSD, “Gold vs US Dollar”

On the D1 timeframe, gold prices are currently above the 200-day Moving Average, indicating a prevailing uptrend. The RSI is testing the support line. In this scenario, we anticipate a breakthrough above the 3/8 level (2375.00), followed by a further price increase towards the resistance at 4/8 (2500.00). However, a breakout below the 2/8 level (2250.00) could invalidate this scenario, potentially leading to a decline towards the 1/8 support level (2125.00).Read more - Murrey Math Lines (USDCHF, XAUUSD)

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.Sincerely,

The RoboForex Team

Market Technical Analysis by RoboForex

in Technical Analysis

Posted

Gold is correcting, facing pressure from a strong US dollar

Gold prices continue to correct after reaching an all-time high of 2,450 USD per troy ounce. Pressure mostly comes from the strengthening US dollar, which has received support after last week’s Federal Reserve meeting. The interest rate remained unchanged at 5.5%, and comments indicated that economic activity continues to increase steadily, with job gains remaining high and the unemployment rate low.

Although market participants hoped for a signal from the Federal Reserve about an upcoming interest rate reduction amid slowing US inflation, this did not occur. Analysts anticipate one interest rate cut of 0.25% by the end of the year. Meanwhile, gold has experienced steady growth of approximately 12.5% since the beginning of the year. This rise is driven by fundamental factors: the US treasury bond market is gradually losing its share as the main global reserve asset, with world central banks partially selling US treasury bonds and purchasing gold instead.

XAUUSD technical analysis

On the H4 chart, gold quotes are experiencing a correction within a descending price channel after reaching a high of 2,450 in May. The price is currently hovering near the 2,320 mark, with a Triangle technical pattern forming on the chart. The direction of the price movement out of this pattern may indicate the near term.

According to the forecast, if the quotes exit the Triangle pattern upwards and secure above 2,340, this will open the potential for growth towards the 2,388 resistance level. If the price of gold declines, dropping below the lower line of this pattern, a fall might continue towards a strong support area between 2,285 and 2,277.

Read more - Gold

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

Sincerely,

The RoboForex Team