⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Past hour

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDCAD hits a four-week low after strong GDP The USDCAD pair dipped to 1.3980 as the market fully priced in strong Canadian data. Discover more in our analysis for 1 December 2025. USDCAD forecast: key trading points Market focus: the USDCAD pair fell to a four-week low after Canada’s GDP release Current trend: the Canadian dollar appears strong thanks to active oil exports USDCAD forecast for 1 December 2025: 1.3937 Fundamental analysis The USDCAD rate fell to a four-week low after stronger-than-expected quarterly GDP data. These figures reduced expectations of additional easing from the Bank of Canada. Over the past week, the CAD gained about 0.9%, marking its best performance since May. The recent weakening of the US dollar also supports demand for the CAD, as markets are betting on a Fed rate cut in December. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 373 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Gold storms the market: XAUUSD is poised for a big move after fresh US data Gold continues to strengthen, with XAUUSD prices crossing the psychological threshold of 4,200 USD and now trading around 4,240 USD. Find more details in our analysis for 1 December 2025. XAUUSD technical analysis On the H4 chart, XAUUSD prices formed an Inverted Hammer reversal pattern near the lower Bollinger Band. Quotes currently continue an upward wave following this signal. Since XAUUSD remains within the ascending channel, the next upside target could be 4,300 USD. The USD is losing ground ahead of the Federal Reserve’s interest rate decision. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

issalam started following Sirius astrology software 4.1

-

Does anyone have these software?

-

Installa prima Metastock 19 real time. Esegui come amministratore il crack. In DataFeed seleziona ReutersDataLink,cosi' funzionano sia il System Tester che l'Explorer. Clicca su Build offlinecache e Metastock 19 real time viene attivato. Ciao! First install Metastock 19 real time. Run as administrator the crack. In DataFeed, select ReutersDataLink so that both System Tester and Explorer work. Click on Build offlinecache and Metastock 19 real time will be activated. Bye!

- Today

-

XandarT started following Full ncat signal lab

-

I have the files and videos for Signal Lab (2.2 GB), but the first 7z file out of three seems to have some issues. I tried with 7-Zip and WinRAR but wasn't able to fix it. If anyone can help me, I am happy to share them with the group. Thanks in advance.

-

Thanks for this stuff anyway but I don't understand how to use and works this cache builder works

-

issalam joined the community

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date: 1st December 2025. December Opens Strong: Stocks Up, PMIs Down, Oil Rebounds. December opens with a surprisingly firm tone across global financial markets. Equities remain solidly positive for the year, with the MSCI World Index still trading just below its record highs from October. Despite concerns that higher global tariffs would damage economic activity, the impact has been more limited than feared. Supportive central banks and renewed optimism around artificial intelligence continue to underpin sentiment. At the same time, attention is shifting toward consumer and holiday spending, an important indicator of how resilient demand remains amid affordability concerns and broader economic uncertainty. Early readings suggest holiday spending will be strong. Salesforce estimates global online Black Friday sales at $79 billion, while Adobe reported record online spending throughout the long weekend, including $11.8 billion on Black Friday alone. The National Retail Federation expects US November–December sales to exceed $1 trillion for the first time ever. Central bank policy remains a key theme into year-end. The Federal Reserve and Bank of England are widely expected to cut rates by 25 basis points, while the ECB, BoC, BoJ and SNB are expected to hold steady. US Outlook: Markets Fully Reprice a December Fed Cut US markets have shifted decisively back toward expectations of a December rate cut after weeks of uncertainty. Implied rates currently reflect roughly 20 bps of cuts for December and nearly 30 bps for the January meeting. Dovish remarks from NY Fed President Williams, combined with softer economic data, have outweighed the more hawkish tone from Chair Powell earlier in November. This week brings a busy economic calendar with PCE price data, personal income and spending figures, ISM manufacturing and services reports, jobless claims, ADP employment, consumer sentiment, industrial production, and corporate layoff announcements. Notably, there is no Non-Farm Payrolls release this week due to the calendar structure. Holiday spending remains a central focus. Despite inflation and a cooling labor market, consumers were highly active throughout the Black Friday and Cyber Monday period. Adobe expects Cyber Monday to reach $14.2 billion in online sales, while online spending over the weekend remained consistently strong. Retailers such as Macy’s, Kohl’s, Abercrombie & Fitch and others saw mixed performance as investors try to gauge how durable consumer demand will be going into 2025. The December 10 FOMC meeting may still be contentious. Powell is expected to aim for broad consensus on a 25 bps cut, with some members, such as Miran, leaning toward a larger move. A signal of a likely pause in January may help minimize dissent within the committee and maintain policy credibility. Historically, more than two dissenting votes are rare, making Powell’s messaging especially important. Mixed Markets and Persistent Manufacturing Weakness Asian markets began the week with a mixed tone. Japan’s Nikkei 225 fell nearly 2% after weaker corporate investment figures and another month of contraction in the Manufacturing PMI. The PMI rose slightly to 48.7, but remained below the 50 threshold for the fifth straight month, reflecting soft domestic and global demand. China’s factory activity also contracted for the eighth consecutive month, highlighting ongoing economic challenges despite an extended trade truce with the US. Elsewhere, Hong Kong’s Hang Seng rose nearly 1%, supported by gains in tech, while the Shanghai Composite, Australia’s ASX 200, Taiwan’s Taiex, and Korea’s Kospi delivered modest or flat moves. Weakness in regional PMIs reflects the lingering impact of US tariffs and weaker global manufacturing demand. However, exports in several Asian economies have shown signs of recovery in recent months, offering a partial offset to domestic softness. US Equities: AI Momentum Continues Despite November Tech Volatility US stock indices ended the post-Thanksgiving session higher, with the S&P 500, Dow Jones, and Nasdaq all advancing. Still, the tech sector was volatile through November. Nvidia closed the month with a double-digit loss, while Oracle and Palantir also posted steep declines. In contrast, Alphabet recorded a nearly 14% monthly gain on the back of excitement surrounding its Gemini AI model, reinforcing that AI developments remain a major driver of sector leadership. Oil Market Update: Prices Rebound as OPEC+ Holds Output Plan Oil prices rose more than $1 per barrel early Monday after OPEC+ reaffirmed its intention to keep production hikes on hold during the first quarter. Brent traded above $63, while WTI hovered near $60. However, November marked the fourth consecutive monthly decline for crude as expectations of a substantial supply surplus in 2026 weighed on sentiment. At the same time, geopolitical tensions, including US rhetoric toward Venezuela, Middle East instability, and damage to Kazakhstan’s pipeline infrastructure, continue to limit the downside and keep markets on edge. FX Market: Dollar Softens on Rate-Cut Expectations The US dollar weakened against major currencies, with USDJPY sliding to 155.33 and the EURUSD rising slightly to $1.1609. Rate-cut expectations, shifting risk appetite, and improving global equity sentiment all contributed to the dollar’s softer tone. Crypto Markets Face Heavy Liquidations as Volatility Intensifies Crypto markets experienced sharp losses after nearly $646 million in leveraged positions were liquidated across major exchanges. Bitcoin fell over 5% to around $86,000, while Ethereum dropped more than 6% to the $2,815 level. Altcoins such as Solana, XRP, BNB and Dogecoin also saw declines between 4% and 7%. The majority of liquidations were long positions, indicating the move was driven primarily by forced unwinding rather than fundamental shifts in sentiment. Open interest in BTC and ETH futures fell further, suggesting the leverage accumulated during the October rally continues to wash out. With liquidity still thin and macro uncertainty elevated, intraday volatility is expected to remain high. Conclusion: A Strong Start to December, but Risks Remain The first days of December offer a picture of resilient consumer spending, strong global equity performance, and cautious central banks preparing for year-end policy decisions. Yet challenges remain: Asian manufacturing continues to weaken, tech stocks are navigating renewed volatility, oil markets face conflicting forces, and crypto remains exposed to leverage-driven swings. As the month progresses, markets are likely to remain sensitive to inflation data, central bank guidance, and holiday-related consumer trends. For now, the balance of risks suggests a cautiously optimistic tone, but with the potential for sharp moves across asset classes. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Andria Pichidi HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

Oana SSS reacted to a post in a topic:

NQ Ultra - Futures Trading Bot // https://tradegreater.com/

Oana SSS reacted to a post in a topic:

NQ Ultra - Futures Trading Bot // https://tradegreater.com/

-

⭐ traderwin reacted to a post in a topic:

NQ Ultra - Futures Trading Bot // https://tradegreater.com/

⭐ traderwin reacted to a post in a topic:

NQ Ultra - Futures Trading Bot // https://tradegreater.com/

-

Night reacted to a post in a topic:

quantvue.io

Night reacted to a post in a topic:

quantvue.io

-

Dimdium reacted to a post in a topic:

Can someone please unlock the indicator?

Dimdium reacted to a post in a topic:

Can someone please unlock the indicator?

-

NQ Ultra - Futures Trading Bot // https://tradegreater.com/

Night replied to luludulu's topic in Ninja Trader 8

Say if the bot enters long, then I will wait for a pullback to some FVG or orderblock to enter long at a better price. Sometimes, I miss the boat, other times I get a better entry. -

NQ Ultra - Futures Trading Bot // https://tradegreater.com/

⭐ traderwin replied to luludulu's topic in Ninja Trader 8

Hi, One question. If you do manual entry, what do you use the bot for? Could you please elaborate? Thanks! -

⭐ traderwin reacted to a post in a topic:

NQ Ultra - Futures Trading Bot // https://tradegreater.com/

⭐ traderwin reacted to a post in a topic:

NQ Ultra - Futures Trading Bot // https://tradegreater.com/

-

I think I found the reason, u need to open tick replay for previous candles to show, however there is still a jump in price for me, not sure how to fix that, but its better than having nothing to show

-

[Req]Mastering Tradestation for Automated Trading

⭐ FFRT replied to ⭐ sapperindi's topic in Tradestation Forum

Long time back i was using the TS (cured version) but it could not read Metastock EoD data beyond 250-255 symbols. -

dex reacted to a post in a topic:

NQ Ultra - Futures Trading Bot // https://tradegreater.com/

dex reacted to a post in a topic:

NQ Ultra - Futures Trading Bot // https://tradegreater.com/

-

Thanks for this, I tried it, it works, BUT not entirely, The issue I am facing, is it only shows the candles that formed only I open the chart. Any ideas on how to fix it?

-

Rimuru reacted to a post in a topic:

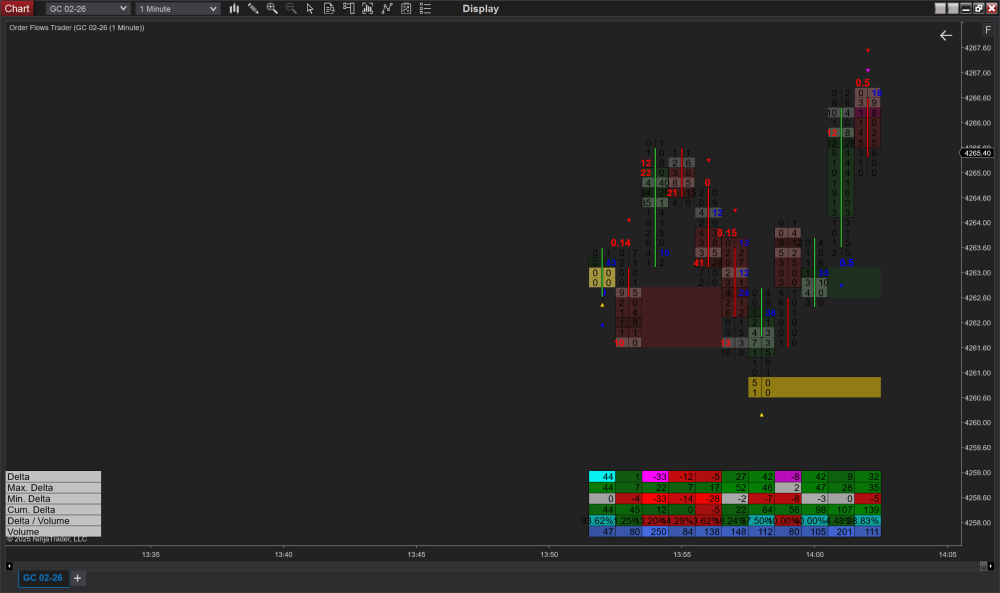

OrderFlows Trader 7

Rimuru reacted to a post in a topic:

OrderFlows Trader 7

-

⭐ htn4653 reacted to a post in a topic:

Can someone please unlock the indicator?

⭐ htn4653 reacted to a post in a topic:

Can someone please unlock the indicator?

-

⭐ monkeybusiness reacted to a post in a topic:

Traderlion Unlock the Secret of Contrarian Trading

⭐ monkeybusiness reacted to a post in a topic:

Traderlion Unlock the Secret of Contrarian Trading

-

NQ Ultra - Futures Trading Bot // https://tradegreater.com/

Night replied to luludulu's topic in Ninja Trader 8

As usual, no bot is perfect. That's where you need to judge if a trade is going to be valid or not (for example, if the bot enters a trade near a S/R level), take profit, keep it run when there is continuation. I run all my bots continously on SIM accounts , replicate to real accounts, cross order to micros, rotate accounts to spread risk. Or I use it for manual entry, in that case, I will try to get a better entry. -

⭐ timein reacted to a post in a topic:

Can someone please unlock the indicator?

⭐ timein reacted to a post in a topic:

Can someone please unlock the indicator?

-

NQ Ultra - Futures Trading Bot // https://tradegreater.com/

Night replied to luludulu's topic in Ninja Trader 8

I use it on GC, NQ and YM. Attached are my templates https://limewire.com/d/eamyp#F5c1ER5g8y I cannot upload more files. Reached some limit. For NY session, I tend to remove the TP in case there is some good trend, that's when you need to maximize profits. -

NQ Ultra - Futures Trading Bot // https://tradegreater.com/

AllIn replied to luludulu's topic in Ninja Trader 8

@Night are you using on NQ mostly? was trying some gold settings, not super consistent. what setup are you using with NQ? The 5 min HA default seems ok. Any good templates to share would be awesome! -

Interested in this also. Thanks

-

Can someone please cracked

-

wertamido joined the community

-

NQ Ultra - Futures Trading Bot // https://tradegreater.com/

Night replied to luludulu's topic in Ninja Trader 8

It seems to work all fine for me. Thank you so much!! -

Dmitriex started following trader-dale.com

-

Found these two somewhere else, @apmoo can you educate these? Please TDVolumeProfile-2.0-2.zip TDOrderFlow-2.0-5-23-23.zip

-

Traderlion Unlock the Secret of Contrarian Trading

⭐ fryguy1 replied to roddizon1978's topic in Ninja Trader 8

Re-Up https://filefa.st/9BA2b/traderlion-unlockthesecretsofcontrariantrading.7z -

https://workupload.com/file/XecxeCUeXbW Thanks

- Yesterday

-

new indi from abc123 indicators needs to crack

Traderbeauty replied to TRADER's topic in Ninja Trader 8

APMOO You are AMAZING. I gave you all the possible crowns and points . Thank you soooooo muchhhhhhhh. Everyone and Traderbeauty -

Traderlion Unlock the Secret of Contrarian Trading

roddizon1978 replied to roddizon1978's topic in Ninja Trader 8

too anybody shared it when somebody request, I may closed my Google drive ,it is limited , I have to used it for something else