All Activity

- Today

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

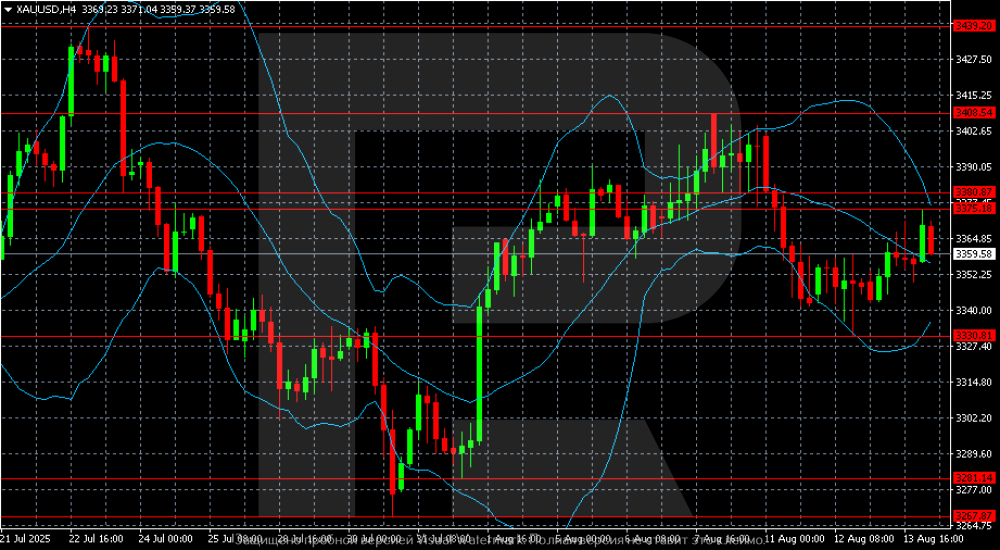

Gold (XAUUSD) targets 3,380: Fed rate outlook supports prices Gold (XAUUSD) prices have been rising for the third consecutive day, hovering near 3,359 USD. Investors are betting on Federal Reserve policy easing and awaiting Friday’s news. Discover more in our analysis for 14 August 2025. XAUUSD technical analysis On the H4 chart, XAUUSD quotes remain within the 3,330-3,380 range. After falling from the July peak of 3,439, prices hit a low of 3,267 at the end of the month, from which recovery began. In early August, gold broke above 3,330 and tested 3,408 but failed to consolidate higher. Gold (XAUUSD) has shown solid growth and retains the potential to climb higher. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

btc just hit its ath today at 124k. alt coin season is kicking off strong..

- 315 replies

-

- forex broker

- hotforex

-

(and 1 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

JP 225 forecast: the index has formed an upward channel and targets a new all-time high The JP 225 stock index hit a new all-time high and continued its upward trajectory. The JP 225 forecast for today is positive. JP 225 forecast: key trading points Recent data: Japan’s current account for July totalled 1.348 trillion JPY Market impact: overall reaction for the broad equity market is neutral to restrained Fundamental analysis While the current account remains in surplus, it is significantly lower than both the consensus and the previous reading. The decline signals less favourable external conditions and higher import costs, which may limit corporate profit margins. At the same time, a likely soft yen partially offsets the effect by supporting exporters. As a result, the balance of factors for the index is mixed: there may be heightened sensitivity to news about global demand and energy prices. For the JP 225, this means a mixed backdrop: export-oriented industries benefit from a weaker yen in the short term, while energy-intensive and import-dependent segments face shrinking margins. The index’s further trajectory will depend on global trade trends, energy price dynamics, yen movements, and the Bank of Japan’s assessment of the balance between policy normalisation and support for economic growth. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 298 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

jquiroz75 reacted to a post in a topic:

HFT@SPECTRE@LITE@V23 New ..

jquiroz75 reacted to a post in a topic:

HFT@SPECTRE@LITE@V23 New ..

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date: 14th August 2025. Investors Flock to Riskier Assets After Soft US Inflation Data. Asian equity markets were mixed on Thursday, taking a pause after several sessions of strong gains driven by expectations of lower US interest rates. US stock futures also edged slightly lower, while Bitcoin surged over 3% to a new all-time high above $123,000, according to CoinDesk. Asian Markets Pause After Rally Japan’s Nikkei 225 fell 1.4% to 42,657.94, as investors took profits following its record-breaking run. The yen strengthened after US Treasury Secretary Scott Bessent told Bloomberg that Japan was “behind the curve” in raising interest rates, prompting speculation the Bank of Japan may be forced to act sooner. The dollar slipped to 146.55 yen from 147.39 yen, while the euro eased marginally to $1.1703. Across the region, Hong Kong’s Hang Seng Index dipped less than 0.1% to 25,597.85, while China’s Shanghai Composite rose 0.2% to 3,690.88. South Korea’s Kospi slipped 0.3%, Taiwan’s TAIEX dropped 0.4%, and India’s Sensex inched up 0.1%. In Australia, the S&P/ASX 200 gained 0.5% to 8,871.80. Stephen Innes of SPI Asset Management summed it up with a colorful metaphor: “Asian markets opened today like a party that ran out of champagne before midnight, the music still playing, but the dance floor thinning out.” Dollar Weakens on Rate Cut Bets The US dollar lingered at multi-week lows against major peers as traders ramped up bets that the Federal Reserve will resume cutting interest rates next month. The greenback fell the most against the yen after Bessent suggested the Bank of Japan may need to raise rates again soon, while the Fed should move aggressively in the opposite direction. The dollar dropped as much as 0.7% to 146.35 yen, its weakest since July 24. Sterling reached its highest level since late July at $1.3590, while the euro traded at $1.1703, just below Wednesday’s peak. Traders now see a Fed rate cut on September 17 as a near certainty, with some even pricing in a 50-basis-point move. Analysts say the shift in sentiment comes as signs of a cooling US labor market meet political pressure for policy easing. President Donald Trump has repeatedly criticized Fed Chair Jerome Powell for not cutting rates sooner, while Bessent openly called for “a series of rate cuts” beginning with a half-point move. Australia’s Labour Market Surprises Australia’s job market strengthened in July, with employment rising by 24,500 in line with forecasts, while the unemployment rate dipped to 4.2% from a 3½-year high of 4.3%. Full-time positions surged by 60,500, driven largely by record female participation. The stronger data lifted the Australian dollar to as high as $0.65685 before trimming gains. With wage growth steady at 3.4%, well below 2023 peaks, inflationary pressure from pay remains limited. This reduces the urgency for the Reserve Bank of Australia to cut rates again in September, although markets still expect a 25 bps reduction in November if inflation cools further. Wall Street Extends Record Run US equities continued their rally on Wednesday, buoyed by expectations of a September rate cut. The S&P 500 rose 0.3% to a record 6,466.58, the Dow Jones jumped 1% to 44,922.27, and the Nasdaq added 0.1% to an all-time high of 21,713.14. Falling Treasury yields supported rate-sensitive sectors, with homebuilders PulteGroup and Lennar each gaining more than 5%. In a major market debut, cryptocurrency exchange Bullish surged 84% on its first trading day after a $10 billion IPO, closing at $68 a share. Still, some analysts warn that valuations may be overstretched after the steep gains since April, with tariff-driven inflation risks lingering in the background. Bitcoin Leads Risk-On Sentiment Bitcoin climbed to $124,480.82 in the latest session before settling near $123,000, marking its first record high since mid-July. The rally has been fueled by expectations of Fed easing, a weaker dollar, increased institutional inflows, and a friendlier regulatory climate under Trump, who recently signed an executive order allowing crypto assets in 401(k) retirement accounts. Ether also gained, trading near its highest since November 2021. Year-to-date, ether is up 42%, outpacing bitcoin’s 32% advance. Analysts say a sustained break above $125,000 could open the door for a move toward $150,000. Looking Ahead Markets are awaiting US wholesale inflation figures for July, expected to rise slightly to 2.4% from 2.3% in June. In Europe, traders will monitor the eurozone’s flash Q2 GDP and the UK’s preliminary Q2 GDP. Attention will also turn to Fed Chair Jerome Powell’s upcoming speech at a central bank symposium in Wyoming, where investors will be looking for clues on the September policy decision. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Andria Pichidi HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

⭐ laser1000it reacted to a post in a topic:

Need help decompiling

⭐ laser1000it reacted to a post in a topic:

Need help decompiling

-

Binance will be the leader for quite sometime and that might be because of the others like poloniex, bittrex, cryptopia, ftx etc failed and some went bankrupt as well.

-

Gold already making higher highs and who know where it go now, how much is your analysis's expected drawdown so i can think about testing it on my HFM's demo account.

- Yesterday

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

[b]Date: 13th August 2025.[/b] [b]Investors Flock to Riskier Assets After Soft US Inflation Data.[/b] US Dollar Retreats as Markets Price in Fed Rate Cuts Global investors have moved into higher-risk assets after US inflation data came in softer than expected, easing stagflation fears and pushing the US dollar (USDindex) lower. The USDIndex dropped reflecting expectations of a near-certain 25-basis-point Fed rate cut in September. Some traders are even speculating on a larger reduction as markets reassess monetary policy. The USDIndex has fallen 0.4% so far today to 97.72, marking its second consecutive day of declines after headline CPI data eased concerns about persistent inflation. Markets are now pricing in a 90% probability of a 25-basis-point cut next month, with some traders even speculating on a larger, 50-basis-point move. The drop in yields and dovish shift in rate expectations have weighed on the greenback, prompting broad gains in other major currencies: EURUSD has risen to 1.1700, GBPUSD is trading at 1.3570, and USDJPY has eased to 147.41. Oil prices corrected as markets focus on the supply outlook, and the front end WTI contract is down -0.8% at USD 62.66 per barrel. Gold benefited from the decline in rates and is trading at $3362.70 per ounce - a gain of 0.4%. The dollar’s retreat was further reinforced by Tuesday’s broad market optimism. Lower inflation reduced stagflation fears, supporting a shift into riskier assets — from equities to cryptocurrencies — while haven flows into the dollar and gold moderated. Equities Soar on Inflation Optimism and Strong Earnings US equity markets are riding a wave of optimism. The S&P 500 has hit fresh record highs, buoyed by resilient corporate earnings and the prospect of looser monetary policy. The index is up almost 30% since April’s trade shock sell-off and 12% since Trump’s election in November. Small-cap stocks, measured by the Russell 2000, are on track for a fourth consecutive month of gains, showing a broad-based recovery beyond large-cap tech. Tech stocks are leading the charge. The “Magnificent Seven,” including Nvidia and Microsoft, have climbed nearly 50% since April, reversing earlier losses and benefiting from renewed interest in artificial intelligence. Megacap tech alone contributed roughly 90% of S&P 500 profit growth in Q2, according to Deutsche Bank strategists. Volatility indicators underscore market confidence. The VIX is at its lowest since December, while bond market volatility, measured by the MOVE Index, is at levels not seen since 2022. FX implied volatility is also at a one-year low, highlighting strong investor appetite for risk. Commodities and Cryptocurrencies Gain Support The risk-on sentiment has extended to commodities and alternative assets. Gold gained 0.6% to $1,366 per ounce, supported by weaker US dollar and declining bond yields. Silver rose 1.8%, and oil prices corrected slightly after the US API reported higher crude inventories, signaling that the summer demand peak may be fading. Cryptocurrencies have also rebounded, with Ether up 55% over the past month and meme stocks regaining popularity. Fed Policy and Market Outlook While markets lean heavily toward near-term easing, the Federal Reserve remains divided. Fed Schmid, a voting member, described policy as “appropriately calibrated” but remains vigilant for signs of weakening demand. Futures markets are pricing in additional rate cuts, while traders await the Jackson Hole symposium for further guidance on monetary policy. Still, futures markets are discounting -23 bps for September, -60 bps by December, and -127 bps in cuts by end-2026. Political pressure is also intensifying. Meanwhile, President Trump continues to push for immediate rate cuts and criticized Fed Chair Powell, adding a political dimension to market uncertainty. Treasury Secretary Scott Bessent added that the Fed should remain open to a larger cut next month. Conclusion The combination of softer US inflation data, expectations of Fed rate cuts, and resilient earnings has fueled a wave of optimism in global markets. Traders are rotating into equities, commodities, and cryptocurrencies, while the US dollar remains under pressure. While risks from geopolitical tensions and rising yields persist, investor confidence remains high, setting the tone for continued market rallies in the near term. For now the confidence that soft inflation and resilient growth will keep risk appetite alive, at least until the September decision forces the next big rethink. [b]Always trade with strict risk management. Your capital is the single most important aspect of your trading business.[/b] [b]Please note that times displayed based on local time zone and are from time of writing this report.[/b] Click [url=https://www.hfm.com/hf/en/trading-tools/economic-calendar.html][b]HERE[/b][/url] to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click [url=https://www.hfm.com/en/trading-tools/trading-webinars.html][b]HERE[/b][/url] to register for FREE! [url=https://analysis.hfm.com/][b]Click HERE to READ more Market news.[/b][/url] [b]Andria Pichidi HFMarkets[/b] [b]Disclaimer:[/b] This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

Please explain how to use it thanks.

-

alodante reacted to a post in a topic:

Evolve AI Trading BOT

alodante reacted to a post in a topic:

Evolve AI Trading BOT

-

Why you are spreading false informations? There are no withdrawal fees and I can see your spam all over the internet. You published the same information all over the forums, about multiple brokers, in the past few days. It's a pure spam.

-

⭐ RichardGere reacted to a post in a topic:

Need help decompiling

⭐ RichardGere reacted to a post in a topic:

Need help decompiling

-

Jean Luc Groschard reacted to a post in a topic:

Timingsolution & Nifty Updates - 3

Jean Luc Groschard reacted to a post in a topic:

Timingsolution & Nifty Updates - 3

-

⭐ Caoln reacted to a post in a topic:

Sentient Trader 4.04.17

⭐ Caoln reacted to a post in a topic:

Sentient Trader 4.04.17

-

⭐ Caoln started following Sentient Trader 4.04.17

-

I've been a member of the old indoinvestasi forum for several years(11 years) I see users with few posts and unknown to the old indoinvestasi forum, asking for the link to download the mysterious, expensive, and unobtainable decompiling software. Do you think people here are stupid or what?

-

⭐ QuBit reacted to a post in a topic:

HFT@SPECTRE@LITE@V23 New ..

⭐ QuBit reacted to a post in a topic:

HFT@SPECTRE@LITE@V23 New ..

-

same here

-

indo-investasi

-

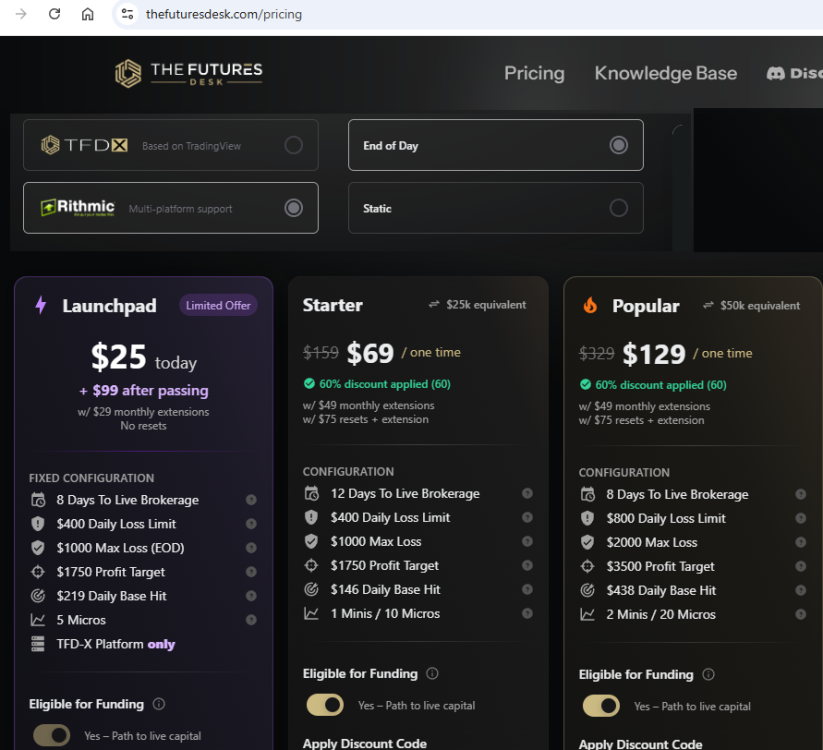

Using a minimal cost prop trading provider could be an option. And it can serve as an incentive to try and get some form of funded account. There are some very cost effective options out there. Oneuptrader had a $19/month special with a Rithmic datafeed and L2 enabled. (The 'sale' is no longer on.) They call it a $25K account, one can trade up for 30 micros, and try to attain $1500 profit. Another currently cheap option is TheFuturesDesk offering a similar account for $25/month, and then $29/month extensions. They too offer 'free' L2 Rithmic. I'm only offering these as alternatives to paying for a monthly L2 datafeed, with I believe are all over $60. I used to use CQG free trials, constantly renewing them biweekly or monthly, by going to a landing page like this, under a VPN that changed the location they saw I was applying for, and then use different names & email addresses, and you should be able to constantly renew. https://www.ampfutures.com/why-amp/cqg-data-quality Here's that current $25/$29 offer from TheFuturesDesk:

-

Whats the Password?

-

yes 8.028 is not able to reset the PC after the Rithmic demo is over. I am looking for the reseter also

-

fxtrader99 reacted to a post in a topic:

HFT@SPECTRE@LITE@V23 New ..

fxtrader99 reacted to a post in a topic:

HFT@SPECTRE@LITE@V23 New ..

-

Please reupload. Does it work entry on bar close? thanks

-

⭐ fryguy1 reacted to a post in a topic:

HFT@SPECTRE@LITE@V23 New ..

⭐ fryguy1 reacted to a post in a topic:

HFT@SPECTRE@LITE@V23 New ..

-

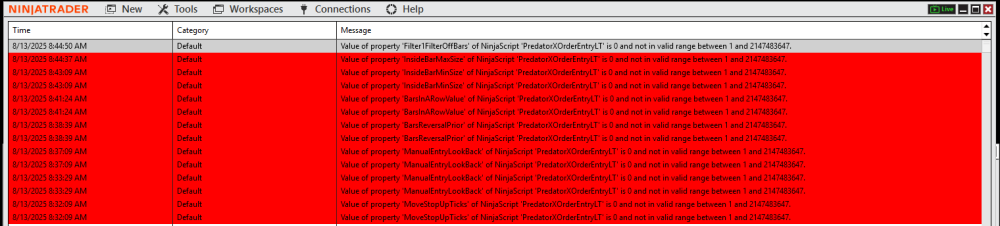

Thank you @kimsam. Facing errors as @rcarlos1947 mentioned.

-

lets not forget this important tool

-

Evidently many of the parameters have been zeroed out causing these errors on my install. Anyone else have similar results ?

-

what is password for file

-

tested in playback only marks arrows and doesn't take trades

-

indo-investasi

-

pass: indo-investasi Seems to load. Quick replay gave no trades. NT8 crashes.

-

you can download pics from discord and make a zip file share the link here