⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Past hour

-

UnivDatos joined the community

-

Bene reacted to a post in a topic:

Ninza Request Thread

Bene reacted to a post in a topic:

Ninza Request Thread

- Today

-

https://t.me/icemkk677 write me pls.

-

Can we get in touch on Telegram, Boka?

-

automated-trading ICT Concepts Indicator[Advanced] Ver 1.5.0.2

ngatho254 replied to nanop's topic in Ninja Trader 8

@kimsam there good indicators kindly re upload them thanks -

automated-trading ICT Concepts Indicator[Advanced] Ver 1.5.0.2

TRADER replied to nanop's topic in Ninja Trader 8

https://workupload.com/archive/9xSUFs6nbY u can verify these files please -

automated-trading ICT Concepts Indicator[Advanced] Ver 1.5.0.2

kimsam replied to nanop's topic in Ninja Trader 8

I think already fixed.. need to check my files -

nanop reacted to a post in a topic:

automated-trading ICT Concepts Indicator[Advanced] Ver 1.5.0.2

nanop reacted to a post in a topic:

automated-trading ICT Concepts Indicator[Advanced] Ver 1.5.0.2

-

booster reacted to a post in a topic:

TradeTerminator

booster reacted to a post in a topic:

TradeTerminator

-

automated-trading ICT Concepts Indicator[Advanced] Ver 1.5.0.2

TRADER replied to nanop's topic in Ninja Trader 8

https://workupload.com/archive/9xSUFs6nbY @apmoo -

automated-trading ICT Concepts Indicator[Advanced] Ver 1.5.0.2

TRADER replied to nanop's topic in Ninja Trader 8

@apmoo list indi automated tradind need to educated please -

automated-trading ICT Concepts Indicator[Advanced] Ver 1.5.0.2

⭐ aniketp007 replied to nanop's topic in Ninja Trader 8

https://automated-trading.ch/NT8/indicators/ict-concepts-indicator apmoo, @kimsamplease take a look -

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

GBPUSD in tension: the budget question remains open The GBPUSD pair remains stable near 1.3138. Investors are watching the budget story closely. Discover more in our analysis for 19 November 2025. GBPUSD technical analysis On the H4 chart, the GBPUSD pair is hovering within a narrow sideways range near 1.3135, consolidating after a deep sell-off at the end of October. The current structure remains neutral to bearish, with no impulse for recovery and attempts to grow consistently limited by the resistance level. The GBPUSD pair is moving within the 1.3084–1.3218 range with weak recovery potential. Read more - GBPUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDJPY confidently holds above 155.00 The USDJPY rate is rising, having consolidated above 155.00. Today, the market focuses on the minutes of the latest US Fed meeting. Find out more in our analysis for 19 November 2025. USDJPY forecast: key trading points Market focus: the minutes of the October Federal Reserve meeting will be published today Current trend: upward momentum USDJPY forecast for 19 November 2025: 156.00 or 154.00 Fundamental analysis On Tuesday, the Japanese government proposed an additional budget exceeding 25 trillion yen to finance Prime Minister Sanae Takaichi’s economic stimulus program – a figure far above last year’s supplementary budget of 13.9 trillion yen. Meanwhile, Bank of Japan Governor Kazuo Ueda informed the prime minister that the central bank is gradually raising rates to maintain inflation at 2% while supporting stable growth. Ueda also told reporters that the prime minister did not make any specific requests regarding monetary policy. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 365 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Universal trader joined the community

-

loki0007 reacted to a post in a topic:

SMM Metrics Time filter refined

loki0007 reacted to a post in a topic:

SMM Metrics Time filter refined

-

-

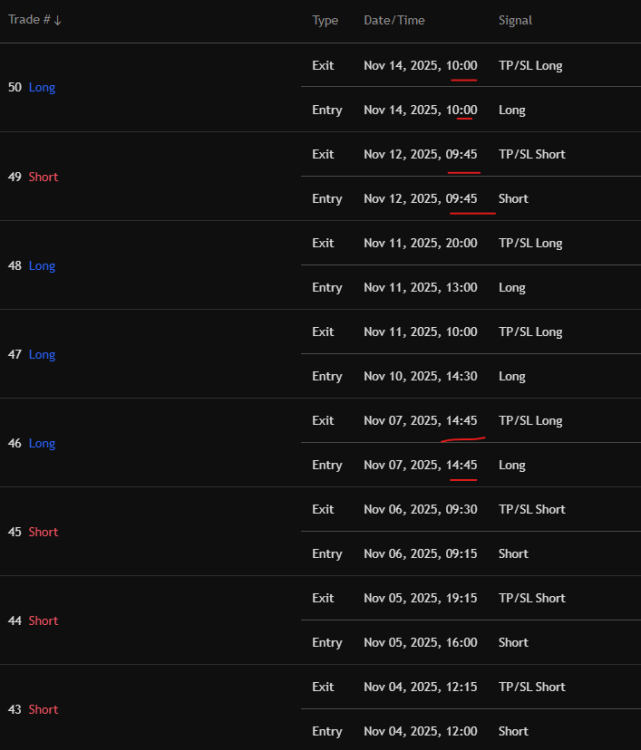

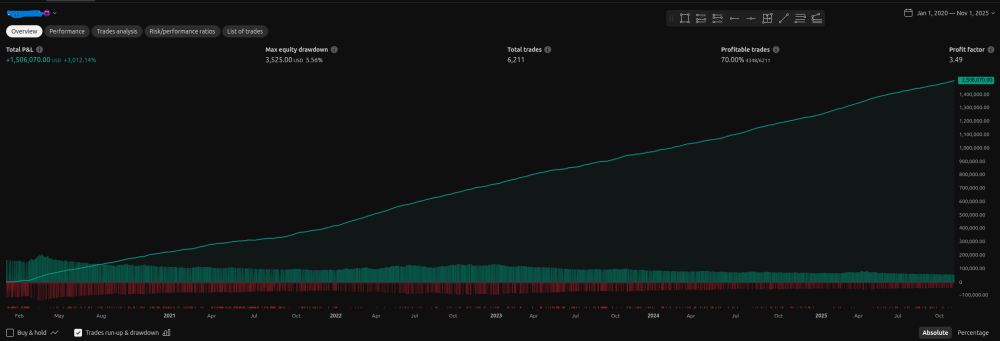

My guy check the trades Some trades duration is 0 seconds The absolute minimum trade duration is 1 bar (3 minutes), and in some cases effectively 0 minutes (entry and exit on the exact same 3-minute Heikin-Ashi bar) when the market gaps or sprints straight to the fixed 800-tick profit target or 500-tick stop-loss. With 800 ticks tp and 500 ticks sl still this mf has 0 min trade duration . I suggest this to test on Ninjatrader and please don't trust tradingview results Tradingview is absolute s*** when it comes to backtesting.

-

Normal Candle Fix.txt

-

-

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date: 19th November 2025. Wall Street Extends Declines as AI Jitters Intensify Ahead of Nvidia Earnings. Global markets shifted decisively into risk-off mode this week as Wall Street extended its decline for a fourth consecutive session. The sell-off reflects growing concerns over AI-driven valuations, a softening macro backdrop, and uncertainty ahead of Nvidia’s highly anticipated earnings report. Investor sentiment has deteriorated sharply since early November, with many questioning whether the extraordinary run in AI-linked equities can be sustained. The S&P 500 is now experiencing its worst losing streak since the early stages of this year’s AI bubble fears, as traders reposition cautiously ahead of Wednesday’s key event: Nvidia’s Q3 earnings. Wall Street Ends Lower but Off Intra-Day Lows All three major US indices finished Tuesday in the red, though losses were trimmed in afternoon trading: NASDAQ: –1.21% S&P 500: –0.82% Dow Jones: –1.07% The worst performance came from consumer discretionary and information technology, two sectors particularly sensitive to shifts in growth expectations. Adding pressure, Home Depot shares sank more than 6% after disappointing results, amplifying concerns over US consumer resilience heading into the holiday season. Bonds and Commodities React to Risk Aversion The drop in equities triggered a flight to safety, with Treasuries drawing renewed demand: 2-yr Treasury yield: 3.575% (–3.6 bps) 10-yr Treasury yield: 4.117% (–2.1 bps) Safe-haven flows also pushed gold up 0.62% to $4,070 per ounce, while oil rebounded 1.35% to $60.70 after briefly touching a multi-month low at $59.31. Dovish Waller Comments Revive Fed Rate Cut Bets Market expectations for a December Fed rate cut strengthened meaningfully following comments by Federal Reserve Governor Christopher Waller, who noted he ‘cannot envisage not cutting by 25 bps’ in December. Rate futures reacted immediately: December implied cut: –12.6 bps (up from –9.8 bps before Waller’s remarks) January implied cut: –23.1 bps Soft data from US jobless claims and the ADP employment report further bolstered rate-cut optimism, especially as signs of cooling in the labour market begin to align with the Fed’s objectives. Still, traders remain cautious, December’s outcome is far from guaranteed, and the market currently views the decision as a close call. Nvidia Earnings: A Pivot Point for the AI Trade The spotlight now shifts to Nvidia (NVDA), whose earnings report on Wednesday could set the tone for the entire AI complex. Nvidia’s results are often viewed as a barometer for AI demand, given the company’s dominant role in powering cloud-based artificial intelligence workloads. Market Nervousness Is Rising Nvidia shares closed 2.81% lower at $181.36 on Tuesday, extending a decline of roughly 12% from its record highs. According to analytics firm ORATS, this earnings event could trigger a market-cap swing of up to $320 billion, the largest potential post-earnings move in the company’s history. Investors are torn between two competing narratives: A beat-and-raise scenario may reinforce concerns about over-investment and inflated expectations. A modest beat might suggest AI demand is stabilising sooner than hoped, raising fears of slowing growth. Recent sales of Nvidia shares by major players, including Peter Thiel’s hedge fund and SoftBank, have also fuelled caution. What Wall Street Expects Q3 consensus forecasts (Bloomberg): EPS: $1.26 (vs. $0.81 a year ago) Revenue: $55.2B (vs. $35.1B a year ago) Data Center: $49.3B Gaming: $4.4B Gross Margin: 73.62% (vs. 75% last year) Nvidia continues to model zero revenue from China, with no progress reported on US-China AI chip export negotiations. Given the company’s influence, any surprise, positive or negative, could ripple across semiconductor stocks, cloud providers, and the broader market. Bitcoin Struggles as ‘Digital Gold’ Narrative Weakens Bitcoin’s performance continues to disappoint, with the world’s largest cryptocurrency falling nearly 30% from its 2025 peak. The decline has left Bitcoin lagging behind gold, long-term Treasuries, emerging market equities, and even traditionally low-growth sectors like utilities. On Tuesday, BTC briefly dipped below $90,000, near the average entry price of ETF inflows since launch, before recovering to trade around $93,241. Why BTC Is Underperforming Analysts point to several contributors: Lingering fallout from October’s crash, which liquidated ~$19B in leveraged positions. Weak risk sentiment stemming from sluggish Asian economic data and tech valuation corrections. Rising correlations between crypto and high-beta tech stocks ahead of Nvidia's results. Diminished confidence in Bitcoin as a hedge, diversifier, or store of value during recent market stress. Options markets now imply less than a 5% chance of Bitcoin revisiting its $126,000 peak by year-end, with strong demand for downside protection between $85K–$80K. Despite near-term pressure, Bitcoin remains well above pre-election levels, and historically, sharp drawdowns have often set the stage for sizeable rebounds. Conclusion Markets enter the midweek session on edge as investors brace for one of the most important earnings announcements of the quarter. With the Fed’s December meeting, AI valuation concerns, and crypto volatility all converging, sentiment may remain fragile until Nvidia provides clarity on the trajectory of AI-related demand. The next 48 hours are poised to play a crucial role in shaping market direction into year-end, and potentially redefining the narrative around the AI boom, risk appetite, and the role of digital assets in diversified portfolios. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Andria Pichidi HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

Anderson kunda joined the community

-

luludulu reacted to a post in a topic:

quantvue.io

luludulu reacted to a post in a topic:

quantvue.io

-

luludulu reacted to a post in a topic:

quantvue.io

luludulu reacted to a post in a topic:

quantvue.io

-

automated-trading ICT Concepts Indicator[Advanced] Ver 1.5.0.2

nanop replied to nanop's topic in Ninja Trader 8

@apmoo Boss please take a look when you get spare time. -

You're right, The last version is doing better 10 to 7 %. Forward testing is king. Let us find the best way to make them work.

-

@roddizon1978 Taylor's book is not easy to read. who or what material do you recommend to study from? Thx

-

I amnot using it but what i recall is that, it is a crack so , first diable your Antivirus, Install the software but dont run it. Place (overwrite) the crack in resepctive system folder and make that folder as exclusion in yourAV software. I believe few lines needs to be added to the host file to prevent access to vendor site, which somone could add here.

-

Not easy to fix