⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Past hour

-

Thank you for the clarification and the reupload.

-

techfo reacted to a post in a topic:

FIXED NT8 -NinjaTrader8 8.0.27.1 - 8.1.4.1

techfo reacted to a post in a topic:

FIXED NT8 -NinjaTrader8 8.0.27.1 - 8.1.4.1

-

thanks a lot for sharing- is there a website for this ?

-

Traderbeauty reacted to a post in a topic:

Delta scalper

Traderbeauty reacted to a post in a topic:

Delta scalper

-

Traderbeauty reacted to a post in a topic:

Delta scalper

Traderbeauty reacted to a post in a topic:

Delta scalper

-

TRADER reacted to a post in a topic:

Delta scalper

TRADER reacted to a post in a topic:

Delta scalper

- Today

-

⭐ htn4653 reacted to a post in a topic:

Delta scalper

⭐ htn4653 reacted to a post in a topic:

Delta scalper

-

Bene reacted to a post in a topic:

KISS OrderFlow 2123

Bene reacted to a post in a topic:

KISS OrderFlow 2123

-

Bene reacted to a post in a topic:

quantvue.io

Bene reacted to a post in a topic:

quantvue.io

-

Bene reacted to a post in a topic:

quantvue.io

Bene reacted to a post in a topic:

quantvue.io

-

N9T reacted to a post in a topic:

Delta scalper

N9T reacted to a post in a topic:

Delta scalper

-

⭐ osijek1289 reacted to a post in a topic:

Delta scalper

⭐ osijek1289 reacted to a post in a topic:

Delta scalper

-

Make sure you enable tick replay and have at least 3 days of data on your chart. Good use on the 2000 volume chart and 4 minute chart. scalping the next candle, or wait for the signal candle to be violated high or low of the signal and then reverse too. Also great for support and resistence, will leave here a 5 min chart with boxes show that. DeltaScalperNT8.zip

-

https://adtssystems.com/2026-releases need to educate

trader04 replied to TRADER's topic in Ninja Trader 8

Anyone can educate this indi please @N9T please -

Ti should be working! I tested my in system with the crack and its working.

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date:14th January 2026. Slight Drop in Inflation Fails to Boost the Stock Markets. The US released its inflation rate for December yesterday, confirming no significant rise in inflation. However, investors had previously set forecasts indicating a slight rise. Investors consider lower inflation rates to be positive for the stock market due to their impact on interest rates. Nonetheless, the stock market was not able to maintain its upward price momentum. The S&P500, Nasdaq, and Dow Jones initially saw a positive reaction to the Consumer Price Index (inflation) release. However, all ultimately ended the day lower with the Dow Jones witnessing the strongest decline (-0.76%). Why is the stock market witnessing a decline despite better-than-expected inflation figures? US Consumer Inflation The US inflation rate held at 2.7%, matching analysts’ expectations. Core inflation also remained unchanged at 2.6%, despite analysts expecting it to rise to 2.7%. Because inflation came in slightly better than expected, the stock market initially rose. The S&P 500 gained 0.39%, the Nasdaq rose 0.50%, and the Dow Jones increased 0.40%. The assets later declined as investors concluded that inflation was not low enough to convince the Federal Reserve to cut rates more frequently. According to reports, the chances of the Fed pausing this month rose from 95% to 97% and in March from 57% to 71%. As a result, the US Dollar rose in value while the stock market fell. In addition, investors are also monitoring the rise in Oil prices which have risen to a two-month high. The Federal Reserve, inflation, and interest rates will remain in the spotlight this afternoon. The US will make public its producer inflation rate, which will again impact both future CPI and interest rates. In addition, six members of the Fed’s voting committee will speak this afternoon. The Federal Open Market Committee members are likely to comment on the Fed’s independence, the investigation into the chairman, and interest rates. Those scheduled to give speeches include Mr Paulson, Mr Miran, Mr Kashkari, Mr Bostic, and Mr William. If the Fed maintains its hawkish tone and indicates no rate cuts in the first quarter, the stock market is likely to decline further. Trump’s Push to Lower Interest Rates & Boost the Property Market President Trump unveiled a plan to ban large institutional investors from buying family homes to curb rising housing prices. Critics argue the move is largely symbolic as investor strategies continue to evolve. Supporters believe the policy could help restore balance to the housing market. Possible consequences include legal challenges, increased market volatility, and only a modest effect on overall affordability. In addition, the US administration is also considering capping interest rates on Credit Cards. In response to both developments, certain stocks fell in value. For example, American Express stocks have fallen 7%, Visa 8%, and Mastercard almost 6%. JP Morgan Earnings Report Other stocks witnessing a significant decline are JP Morgan Stocks, which fell 4.00%. JP Morgan delivered a mixed but solid earnings report, supported by strong trading revenue, steady net interest income, and resilient asset and wealth management performance. However, headline results were weighed down by higher credit reserves tied to the Apple Card acquisition and weaker investment banking activity. The CEO was cautiously optimistic about the US economy while acknowledging regulatory and credit risks, leaving investor sentiment balanced between the bank’s underlying strength and near-term headwinds. S&P500 The S&P 500 is one of the indices that is most exposed to assets negatively affected by this move. Out of the most influential stocks for the S&P 500, only 50% rose in value on Tuesday, which is not high enough to obtain a buy signal. In addition, the VIX index is also continuing to rise, pointing towards a lower risk appetite amongst traders. Even with the recent decline, the price of the S&P 500 remains above the 75-Bar Exponential Moving Average. The RSI remains at a neutral level on the 2-hour chart and the price is trading below the VWAP. For this reason, the price is not obtaining an all-round signal pointing in one direction. However, after today’s Federal Reserve speeches and PPI release the index may form a stronger sense of direction. In the short term, if the price remains below $6,961.45, the asset is likely to maintain its current sell signal from Moving Averages. HFM - S&P 500 2-Hour Chart Key Takeaways: US inflation came in slightly better than expected for stocks, but not low enough to shift Federal Reserve rate-cut expectations. Stocks initially rose after the CPI release but closed lower as investors priced in a prolonged Fed pause. Rising oil prices and a stronger US Dollar added further pressure to equity markets. Trump’s proposals targeting housing investors and credit card rates weighed on financial and payment stocks. Market direction now hinges on upcoming PPI data and Federal Reserve speeches, with volatility increasing. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Michalis Efthymiou HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

Hello,Is it possible to make this work with the standard NinjaTrader setup as well? I’m currently having issues running it, so I wanted to ask if there is a basic or simplified version available.

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

EURUSD attempts to reverse upwards from support The EURUSD rate corrected downwards to the 1.1620 support level, where it met active buying interest and is attempting to reverse upwards. Find more details in our analysis for 14 January 2026. EURUSD technical analysis On the H1 chart, EURUSD quotes are attempting to reverse upwards after receiving support from buyers near the 1.1620 level. For further growth, the pair will need to overcome the 1.1700 resistance level, after which the upward move may continue. The EURUSD pair is attempting to reverse upwards after receiving buyer support at the 1.1620 level. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Pound at the start of a new rally: what lies ahead for GBPUSD on 14 January 2026 The GBPUSD forecast for today favours the GBP, with quotes likely to regain ground and test the 1.3510 level. Find out more in our analysis for 14 January 2026. GBPUSD forecast: key trading points US retail sales: previously at 0.4%, projected at 0.4% Speech by the Bank of England Deputy Governor for Markets and Banking Dave Ramsden GBPUSD forecast for 14 January 2026: 1.3510 and 1.3400 Fundamental analysis The GBPUSD forecast for today, 14 January 2026, is favourable for the pound, with quotes having every chance for further growth after a minor correction. Today, a speech by Dave Ramsden, Deputy Governor of the Bank of England for Markets and Banking, will take place. In his remarks, he may make statements or provide hints regarding the Bank of England’s next steps in monetary policy. In the event of an interest rate hike or the maintenance of a hawkish monetary policy stance, the British pound may strengthen RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 396 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

https://workupload.com/file/LDtb5GUBwKZ This file comes from Val only, however at first he set a one-month date limitation, which has now been removed by a kind person.

-

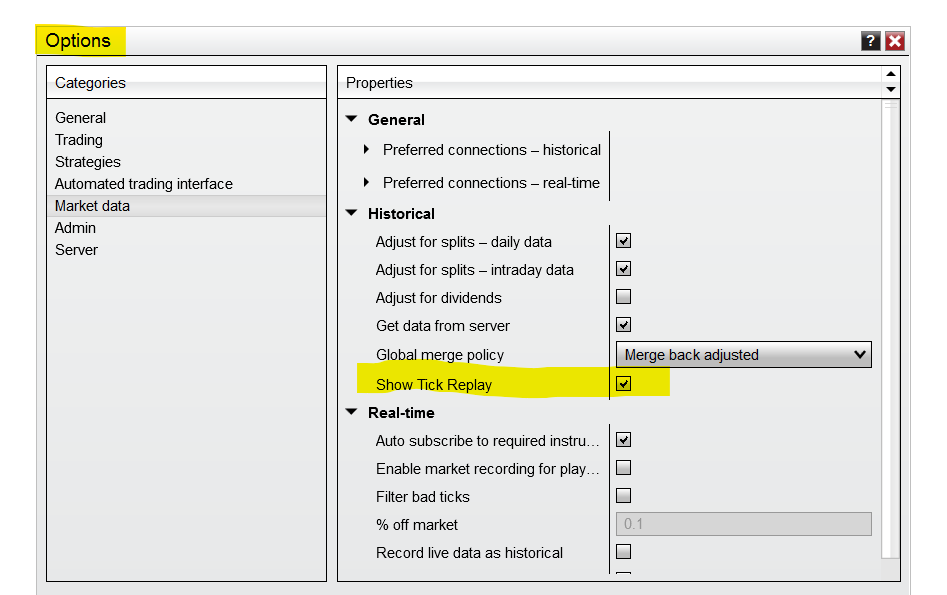

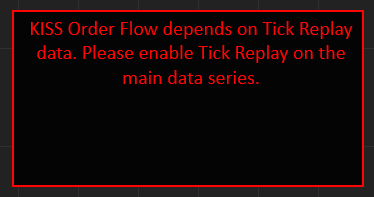

Hi, I’m new to using this and not very familiar with the settings yet. I’m not sure what this error means. Could you please explain it briefly and let me know how to fix it in NinjaTrader 8?

-

Larry Williams Market Forecast 2026

suanna replied to taxfreelt's topic in General Discussions and Lounge

That would be a very bold prediction. I think the probability of an increase starting in April is more like 72%. Anyway, I'm staying long. -

Sì, lo venderò. Questo è basato su MBO sintetico; voglio costruire anche la versione Real, ma richiede molto più lavoro e ha diversi "requisiti tecnici" che sono sicuro tu conosci già.

-

I recommend Hw.site, where you can learn from scratch. There, you can choose a cent account to start with, but it would be better to use a standard account and a Pro account once you have mastered it. As long as I've been using it, everything has been great and profitable.

-

Thanks very much Kesk,everything seems to work except TI(locked).

-

could you upload this again please. says file removed. as this one you mentioned it is 'treated' , do you mean val's stuff is removed from this version? thanks

-

Cool. If anyone can share some good settings with this new version.

-

Its perfectly working, Tried to run it on MNQ 1 Min Playback 8:30 to 11:30 from Jan 5th to 13th,.. here is the screen, now we need to find template/settings for it.

-

Wow. You were fast. I just read that it got released. Thank you very much.

-

https://mega.nz/file/6IxmVKzB#1aavH4uEm5-O1Jm3EKcKdrH82DVRRB6OktR6KD8X50o Terra 9 Jan 2026 version. If the old cracks work, fine use it as it is. If not leave a msg. The modules which require online access will not work !