⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Past hour

-

fxtrader99 reacted to a post in a topic:

NinZa LIQ Sweep Hunter

fxtrader99 reacted to a post in a topic:

NinZa LIQ Sweep Hunter

-

Can anyone please share "Back to the Future" their - TachEON Optimus Bot Educated or not. https://backtothefuturetrading.com/store/tacheon-optimus/ Thank you all traderbeauty-Jane

-

Traderbeauty reacted to a post in a topic:

NinZa LIQ Sweep Hunter

Traderbeauty reacted to a post in a topic:

NinZa LIQ Sweep Hunter

- Today

-

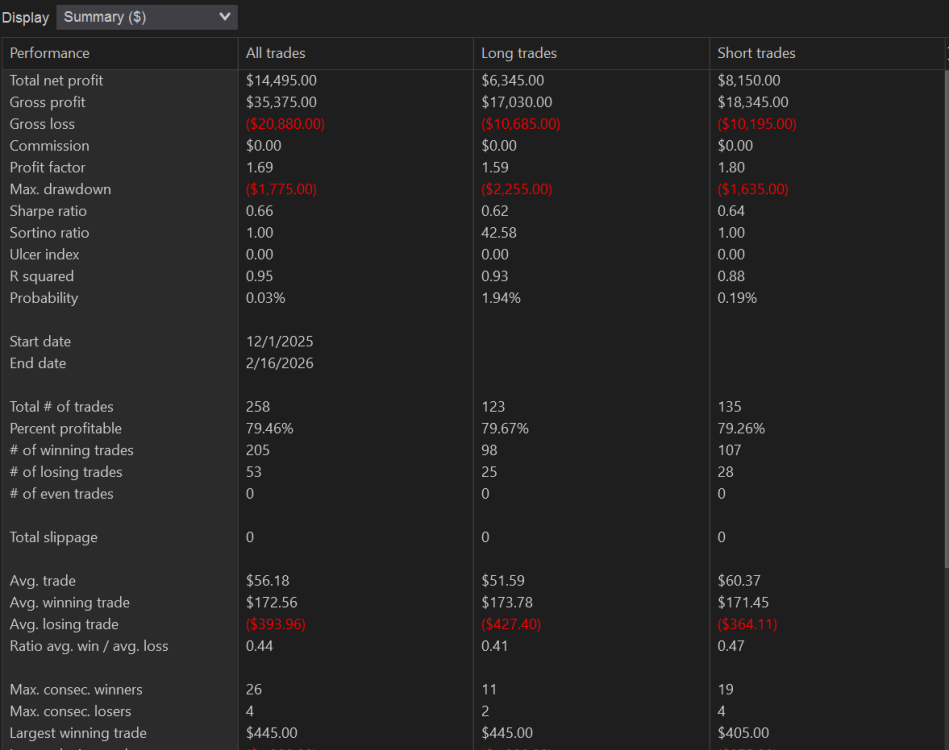

Currently working on this with GPT. still a long way to go. its Orderflow based with martingale incorporated. its the Deltascalper thing but my own version converted into a strategy and some orderflow touch.

-

⭐ SignalTime reacted to a post in a topic:

buysideglobal.com

⭐ SignalTime reacted to a post in a topic:

buysideglobal.com

-

⭐ SignalTime reacted to a post in a topic:

buysideglobal.com

⭐ SignalTime reacted to a post in a topic:

buysideglobal.com

-

⭐ SignalTime reacted to a post in a topic:

buysideglobal.com

⭐ SignalTime reacted to a post in a topic:

buysideglobal.com

-

⭐ SignalTime reacted to a post in a topic:

buysideglobal.com

⭐ SignalTime reacted to a post in a topic:

buysideglobal.com

-

⭐ SignalTime reacted to a post in a topic:

Ninza Flex VWAP

⭐ SignalTime reacted to a post in a topic:

Ninza Flex VWAP

-

⭐ SignalTime reacted to a post in a topic:

NinZa LIQ Sweep Hunter

⭐ SignalTime reacted to a post in a topic:

NinZa LIQ Sweep Hunter

-

⭐ SignalTime reacted to a post in a topic:

TradeTerminator

⭐ SignalTime reacted to a post in a topic:

TradeTerminator

-

⭐ SignalTime reacted to a post in a topic:

TradeTerminator

⭐ SignalTime reacted to a post in a topic:

TradeTerminator

-

Hello i was trying to make my workflow but i think to have more information for how the price gonna move and where i need to use the dom or tape. anyone have some good and clean template of that ?

-

I use the defaults because I tried I trade ES. I was looking at there site and it looks like it is made for ES. If you trade NQ they might be different it also depends on the timeframe you trade and if you use Renko or not.

-

The BLZ you also using default?

-

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

dotx replied to Ninja_On_The_Roof's topic in Ninja Trader 8

+1 Thanks @Ninja_On_The_Roof -

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

ampf replied to Ninja_On_The_Roof's topic in Ninja Trader 8

@Ninja_On_The_Roof Please, could you reupload? Thank you. -

Please share Fibonacci Galactic Trader if you have a working version.Thanks!

-

@Ninja_On_The_Roof @apmoo @kimsam @redux @N9T Please assist. Thanks Brothers 🙏

-

Not EDU but working with the unlockers that are found around here https://workupload.com/file/MCxMweTLPKk

-

Indicators to trade like Fabio Valentini ,Carmine Rosato ,etc.

⭐ kapitansb replied to ⭐ kapitansb's topic in Ninja Trader 8

delta profile : https://ninjatraderecosystem.com/user-app-share-download/legtolegdeltaprofile-rotation-based-delta-volume-profile/ created by : Fahmy aka Swoosh https://x.com/fahmyeu -

thanks it seemed to be working for me. I will continue to check it when time permits.

-

It's a new indicator. I think you're referring to VWAP Flux

-

Its already EDU on here @Eva Grey

-

Not EDU https://workupload.com/file/EB43Sb73Bjz

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date: 16th February 2026. Gold Pulls Back, Asia Trades Lightly, and AI Volatility Lingers: Markets Recalibrate Ahead of Key US Data. Global markets opened the week in a restrained mood, with Lunar New Year holidays draining liquidity from Asia, precious metals retreating from recent highs, and investors continuing to digest last week’s AI-driven volatility. While price moves were modest on the surface, underlying themes remain significant: inflation expectations, Federal Reserve policy direction, emerging market resilience, and the structural impact of artificial intelligence. US markets will also be closed on Monday for the Presidents’ Day holiday. Lunar New Year Drains Liquidity Across Asia Trading activity across Asia was heavily influenced by Lunar New Year celebrations, creating thin market conditions and mixed equity performance. Major regional exchanges in mainland China, South Korea, and Taiwan were closed entirely. Hong Kong’s Hang Seng Index operated for only a half-day session, rising 0.5%. Elsewhere: Australia’s S&P/ASX 200 gained 0.2% India’s BSE Sensex added 0.3% Japan’s Nikkei 225 slipped 0.2% Japan’s decline was less about holiday effects and more about disappointing economic data. The country’s GDP expanded at just 0.2% annualized in the final quarter of the year, below expectations. The weaker growth print increases the likelihood that Prime Minister Sanae Takaichi may pursue further fiscal stimulus to revive momentum. The Lunar New Year period once again highlights how regional cultural events can materially affect liquidity, volatility, and short-term price discovery in Asian markets. Gold and Silver Retreat After Extreme Volatility Precious metals moved lower on Monday as traders locked in profits amid thin trading conditions. Gold fell 0.6% to $5,015 per ounce Silver dropped 1.9% to $76.50 per ounce The pullback follows a period of dramatic swings. Gold had previously surged to record highs before suffering a sharp 9% one-day drop following news related to Federal Reserve leadership developments. Silver has been even more volatile, sliding more than 25% from recent peaks. Despite the latest decline, the broader trend remains powerful: Gold is still up approximately 70% over the past 12 months Silver has surged roughly 140% year-over-year Recent price action reflects consolidation rather than structural weakness. Friday’s US inflation data, which showed moderating price pressures, briefly reignited bullish momentum by strengthening expectations of potential Federal Reserve rate cuts. However, the lack of fresh catalysts combined with reduced Asian liquidity triggered profit-taking. The market appears to be transitioning from aggressive momentum buying to a phase of reassessment and balance between bullish structural drivers and short-term positioning pressures. Wall Street Stabilises After AI-Driven Turbulence Last week’s dominant theme was artificial intelligence disruption. Fears that AI could significantly reshape software, financial services, logistics, and real estate sectors triggered sharp moves beneath the surface of headline indices. By Friday: The Nasdaq Composite ended the week down 2.1% The S&P 500 posted a weekly loss of 1.4% The Dow Jones Industrial Average declined 1.2% on the week Semiconductor heavyweight Nvidia fell 2.2% on Friday, reflecting ongoing sensitivity to AI expectations. Meanwhile, AppLovin rebounded sharply after steep prior losses, illustrating how quickly sentiment can shift in high-beta technology names. Markets found some stability after softer US inflation readings reinforced the possibility of further Federal Reserve easing this year. With US markets closed Monday for Presidents’ Day, attention now shifts to Friday’s Personal Consumption Expenditures (PCE) report — the Fed’s preferred inflation gauge. Emerging Market Currencies Quietly Outperform One of the more underappreciated developments in global markets is the unusual stability of emerging-market currencies. Volatility measures suggest EM currencies have fluctuated less than their G7 counterparts for nearly 200 consecutive trading days; a rare stretch of calm. Several factors are contributing: A softer US dollar Expectations of gradual Fed rate cuts Strong commodity prices Robust capital inflows The carry trade dynamic remains supportive, as investors borrow in low-yielding currencies and allocate capital to higher-yielding emerging-market assets. So far this year, a basket of developing-market currencies has gained roughly 3%, extending last year’s strong performance. Controlled volatility continues to attract inflows, though such conditions tend to be fragile if global risk sentiment deteriorates. Oil and FX: Stability for Now Oil prices were largely unchanged, reflecting balanced supply-demand conditions. In foreign exchange: The US dollar strengthened modestly against the Japanese yen The euro eased slightly versus the dollar Movements were relatively contained, consistent with reduced liquidity and a broader wait-and-see tone ahead of key US data releases. The Bigger Picture: Repricing, Not Panic Markets are not in panic mode; they are in recalibration mode. Precious metals are consolidating after extreme swings. Equities are digesting AI disruption narratives. Emerging markets are benefiting from controlled volatility. Central bank expectations remain the anchor of sentiment. With Lunar New Year disruptions fading and US inflation data ahead, liquidity will return, and with it, potentially stronger directional moves. For now, the environment is defined by balance: optimism about easing inflation and resilient asset performance, tempered by structural uncertainty around AI, policy credibility, and global growth. The next decisive catalyst is likely to come from inflation data and how it reshapes expectations for the Federal Reserve’s next move. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Michalis Efthymiou HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

Rimuru started following order flow analysis

-

Any templates available?

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Easing US inflation expectations fuel EURUSD growth The EURUSD rate is strengthening amid slower US inflation, which has reinforced expectations of Federal Reserve policy easing. The current quote is 1.1865. Discover more in our analysis for 16 February 2026. EURUSD technical analysis EURUSD quotes are rebounding from the lower boundary of the ascending channel. Buyers are holding the price above the key 1.1845 support level. The pair continues to trade within a range, with the upper boundary near 1.1890. Technical analysis of EURUSD indicates potential growth towards 1.1985 if the price firmly consolidates above 1.1895. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDCAD in neutral: statistics will determine everything The USDCAD pair stands at 1.3616 on Monday. The focus is on fresh inflation data from Canada. Find out more in our analysis for 16 February 2026. USDCAD forecast: key takeaways The USDCAD pair stabilised after last week’s volatility Investors are focused on Canadian inflation data due on Tuesday USDCAD forecast for 16 February 2026: 1.3490 or 1.3725 Fundamental analysis The USDCAD pair starts the week at 1.3616. Previously, the Canadian dollar declined moderately but managed to retain most of its weekly gains thanks to signals of slowing inflation in the US. The focus is on Canada’s January CPI, scheduled for release on Tuesday. Annual inflation is expected to remain at 2.4%. This could influence expectations regarding the Bank of Canada’s future policy. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 419 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Thanks @kimsam. Its not opening. Can you reshare it please. In edge browser, it says unconfirmed cr download. tried to recover but no use.

-

Thank you. What are the optimal settings and timeframe for scalping MNQ/NQ?

-

Letho started following TradeTerminator

-

Hello Guy, you use TT Strategy or TT Strategy AI?

-

My guess is that you only added the indicators to chart but you didnt go into strategies tab to enable it.

-

Anyone else here has the same issue?