⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Past hour

-

⭐ trader65 reacted to a post in a topic:

[GET] ELWAVE 10.0e + Patch - Working Method ( Not tested by me... Only spreading it..

⭐ trader65 reacted to a post in a topic:

[GET] ELWAVE 10.0e + Patch - Working Method ( Not tested by me... Only spreading it..

-

⭐ trader65 reacted to a post in a topic:

ELWAVE 10.0e | 98.2 MB (cracked)

⭐ trader65 reacted to a post in a topic:

ELWAVE 10.0e | 98.2 MB (cracked)

-

Thank you kesk and banker2882 🙏

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date:16th January 2026. USDJPY: Intervention On The Table With US Support. Japan's finance minister tells journalists that the Japanese government is considering currency intervention to support the Japanese Yen. The Japanese Yen Index has already fallen more than 1.00% in the first 2 weeks of 2026. Though, the main concern for the Japanese Federal Government is the decline against the US Dollar, which at one point was almost at a 2% decline. The Japanese Yen is currently the second best performing currency during this morning’s Asian session, after the New Zealand Dollar. Will the Japanese Government Boost the Currency? Analysts cannot advise that a currency intervention is certain without any doubt. However, over the past week, the Japanese government has told journalists that they will support the currency. When asked about direct currency intervention, the finance minister said the option remains on the table. For this reason, many traders do believe the government will boost the currency with an intervention, or if they opt not to intervene directly, they will explore other options. It is important to note that the Bank of Japan is not likely to adjust interest rates without the snap elections ending first: the BOJ is due to announce their decision on Japan’s monetary policy next Friday, however, the snap election will most likely not take place until mid-February. Previously the government's interventions have not been successful other than a short-lived spike. However, according to Japan’s finance minister, on this occasion the move would be supported by the US. Will the Bank of Japan Increase Interest Rates? Some economists argue that with Japan’s new expansionary fiscal policy vision, the BOJ is more easily able to increase rates. Although, with the BOJ it's never that simple and they are traditionally known to move slowly. Market participants are reviewing December’s wholesale inflation data. Monthly inflation slowed from 0.3% to 0.1%, while annual inflation eased from 2.7% to 2.4%, mainly due to lower fuel prices. However, inflation remains above the Bank of Japan’s 2.0% target, which supports the case for maintaining a hawkish policy stance. According to a Reuters survey of leading economists, most expect the Bank of Japan to pause until July before raising interest rates again. Whereas, other economists believe the cut could come as early as April. The Bank of Japan will most likely raise rates by 0.25% and at most rise to 1.25% by the end of the year. If the Bank of Japan does not raise rates, the government will struggle to support the Japanese Yen in 2026. The Fed and Economic Data Support the US Dollar The US Dollar is trading lower this morning, but has been one of the best performing currencies of the week. The US Dollar Index has risen to its highest price since December 9th. Inflation has read more or less as per expectations, but economic data has been significantly higher. The Weekly Unemployment Claims fell to 198,000, the lowest in 6 weeks and lower than expectations. The US Retail Sales, Empire State Manufacturing Index and Philly Index have also all risen above expectations. Due to this, the market is expecting the Federal Reserve to pause in January and March unless data deteriorates. According to the Chicago Exchange, there is a 78% chance of no rate cuts in the first quarter of 2026. By the end of the year there is a 32% chance of 2 rate cuts, a 27% chance of 1 rate cut and a 21% chance of 3 rate cuts this year. However, the Federal Reserve’s hawkishness for the first quarter is supporting the US Dollar. USDJPY - Technical Analysis HFM - USDJPY 15-Minute Chart When it comes to government interventions, spreads tend to widen during the sudden spike in volatility and the price movement happens relatively quickly. Therefore, traders may consider an earlier entry with a medium-term view. On a 2-hour chart, the USDJPY has retraced back to the 75-bar Exponential Moving Average which can act as a support level. However, if this level is broken, sell signals may materialise on this timeframe. The MACD and RSI on the 2-hour chart are indicating downward price movement. On the 5-Minute timeframe the 200-bar Simple Moving Average and VWAP are indicating a bearish bias. According to the 200-bar EMA, sell signals are likely to remain as long as the price remains below 158.400. The main support level can be seen at 157.760. Key Takeaways: Japan’s finance minister says currency intervention remains an option as the Yen weakens against the US Dollar. Traders expect government support, but the Bank of Japan is unlikely to change interest rates until after the snap election. Economists see limited rate hikes in 2026, with policy rates likely peaking near 1.25%. Strong US economic data and a hawkish Federal Reserve continue to support the US Dollar. Technical indicators suggest downside risk for USDJPY unless prices move back above key resistance levels. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Michalis Efthymiou HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. - Today

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

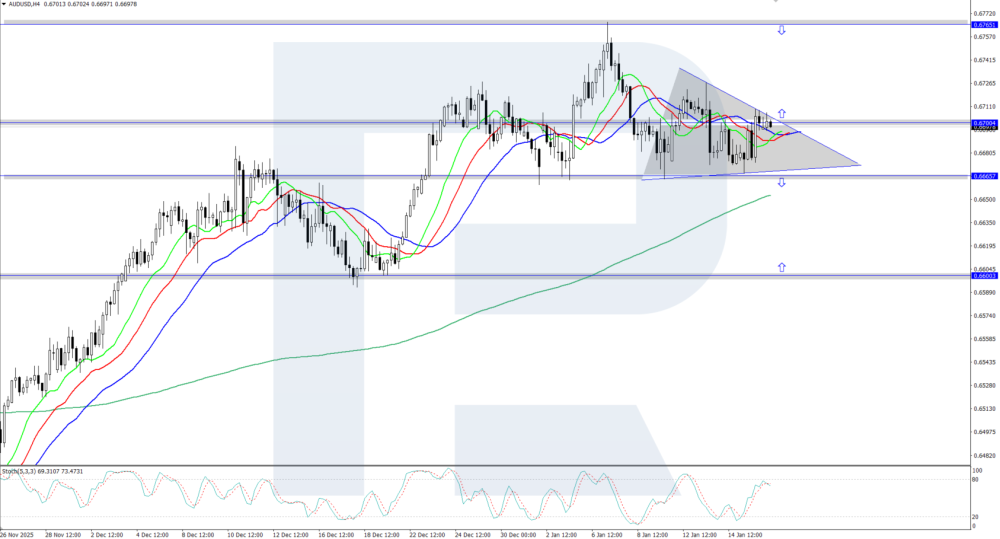

AUDUSD retreated from the all-time high The AUDUSD rate is undergoing a moderate correction after reaching an annual high of 0.6765 amid rising geopolitical tensions. Find out more in our analysis for 16 January 2026. AUDUSD technical analysis The AUDUSD pair is showing a downward correction following the recent strong rally. The Alligator indicator has turned downwards and continues to decline, so the correction may continue. The key support level is currently located at 0.6665. AUDUSD quotes are moderately correcting after reaching an annual high of 0.6765. Read more - AUDUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

EURUSD at a crossroads: decline or growth ahead The euro is once again attempting to recover positions against the USD, with EURUSD quotes trading near the 1.1600 level. Discover more in our analysis for 16 January 2026. EURUSD forecast: key trading points Germany Consumer Price Index (CPI): previously at -0.2%, projected at 0.0% The ECB may raise the interest rate this month EURUSD forecast for 16 January 2026: 1.1635 and 1.1565 Fundamental analysis The EURUSD forecast takes into account that today the euro is forming a corrective wave and is trading near the 1.1660 level. The ECB shows interest in strengthening the European currency and may continue tightening monetary policy this month to support the euro. The situation with the dollar currently remains uncertain due to expectations surrounding the Federal Reserve’s interest rate decision. Unlike the ECB, the Federal Reserve may decide to ease monetary policy and cut rates, which could weaken the dollar and provide an impulse for EURUSD growth. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 398 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

⭐ ajeet reacted to a post in a topic:

@@RenkoKings ImTREX

⭐ ajeet reacted to a post in a topic:

@@RenkoKings ImTREX

-

Thank you very much!!

-

kimsam reacted to a post in a topic:

Windows Server 2025 In VMWare Series

kimsam reacted to a post in a topic:

Windows Server 2025 In VMWare Series

-

⭐ RichardGere reacted to a post in a topic:

Timingsolution & Nifty Updates - 3

⭐ RichardGere reacted to a post in a topic:

Timingsolution & Nifty Updates - 3

-

⭐ RichardGere reacted to a post in a topic:

Timingsolution & Nifty Updates - 3

⭐ RichardGere reacted to a post in a topic:

Timingsolution & Nifty Updates - 3

-

2026.01.09 version https://workupload.com/file/xSkVnPU29u5

-

Can anyone please upload this course? Thanks in advance

-

2025.12.21 version; The new version will have to wait. hxxps://workupload.com/file/9UwQCmQbBqG

-

roddizon1978 reacted to a post in a topic:

ARC AI

roddizon1978 reacted to a post in a topic:

ARC AI

-

MagicMyke reacted to a post in a topic:

TradeTerminator

MagicMyke reacted to a post in a topic:

TradeTerminator

-

Can I get the password to download the indicator. Thanks

- Yesterday

-

Ac423 reacted to a post in a topic:

Windows Server 2025 In VMWare Series

Ac423 reacted to a post in a topic:

Windows Server 2025 In VMWare Series

-

Geostrading started following TradePilot AI BreakoutBOT

-

The free activation also work for Windows 10 IoT LTSC (extended till 2032) to bypass all Windows 11 crapware

-

Shortened from this source

-

To safely test programs before installing on main OS (and also to bypass Win 11 crapware) https://workupload.com/file/NjRUjSEeZVA Text.txt

-

"Hi everyone, I am looking for MZpack footprint templates and footprint action strategy templates. Could anyone who is satisfied with their current setup share their templates with me? I would appreciate it if you could provide the configuration files or settings that you find most effective. Thanks in advance!"

-

Ama1k started following [REQ] SMB Tape Reading Course

-

Does anyone have a functional link for SMB Reading The Tape? It seems like none of the links in this forum are active

-

Ama1k joined the community

-

Hey everyone! I saw on YouTube that he's already released the new version! Does anyone have it and could share it? Thanks!

-

I have been crypto enthusiast as well holding some of the altbags lately and still waiting for the bull run which was supposed to be in the late 2025. I am quite confident that this will be in 2026 for sure so can you predict how far this token can grow!

-

Agreed since that school of pipsology have served for a long time in this trading industry however the brokers like hfm, xm, lmfx, etc also have demo learn & earn or demo to real trading contests which can be used to earn money while learning how to trade through demo accounts.

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

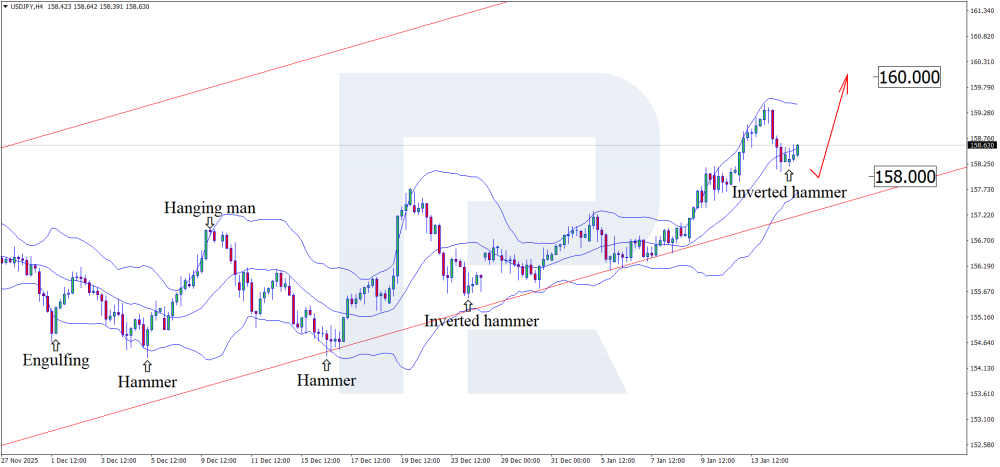

The dollar at a crossroads: how unemployment data and the Fed may affect USDJPY The yen attempts to regain ground, with the USDJPY rate trading near the 158.45 level. Discover more in our analysis for 15 January 2026. USDJPY technical analysis On the H4 chart, the USDJPY pair has formed an Inverted Hammer reversal pattern near the lower Bollinger Band and is trading around 158.45. At this stage, it may continue an upward wave following the pattern signal, with the 160.00 level acting as an upside target in this scenario. US fundamental factors work against the USD, while USDJPY technical analysis suggests growth towards the 160.00 level. Read more - USDJPY Forecast Attention Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team