⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Past hour

-

Ac423 reacted to a post in a topic:

Windows Server 2025 In VMWare Series

Ac423 reacted to a post in a topic:

Windows Server 2025 In VMWare Series

-

Geostrading started following TradePilot AI BreakoutBOT

- Today

-

The free activation also work for Windows 10 IoT LTSC (extended till 2032) to bypass all Windows 11 crapware

-

Shortened from this source

-

To safely test programs before installing on main OS (and also to bypass Win 11 crapware) https://workupload.com/file/NjRUjSEeZVA Text.txt

-

"Hi everyone, I am looking for MZpack footprint templates and footprint action strategy templates. Could anyone who is satisfied with their current setup share their templates with me? I would appreciate it if you could provide the configuration files or settings that you find most effective. Thanks in advance!"

-

Ama1k started following [REQ] SMB Tape Reading Course

-

Does anyone have a functional link for SMB Reading The Tape? It seems like none of the links in this forum are active

-

Ama1k joined the community

-

Harrys reacted to a post in a topic:

All User Apps Share Scripts Scraped up to 2024

Harrys reacted to a post in a topic:

All User Apps Share Scripts Scraped up to 2024

-

⭐ osijek1289 reacted to a post in a topic:

All User Apps Share Scripts Scraped up to 2024

⭐ osijek1289 reacted to a post in a topic:

All User Apps Share Scripts Scraped up to 2024

-

⭐ QuBit reacted to a post in a topic:

Delta scalper

⭐ QuBit reacted to a post in a topic:

Delta scalper

-

Hey everyone! I saw on YouTube that he's already released the new version! Does anyone have it and could share it? Thanks!

-

kimsam reacted to a post in a topic:

All User Apps Share Scripts Scraped up to 2024

kimsam reacted to a post in a topic:

All User Apps Share Scripts Scraped up to 2024

-

I have been crypto enthusiast as well holding some of the altbags lately and still waiting for the bull run which was supposed to be in the late 2025. I am quite confident that this will be in 2026 for sure so can you predict how far this token can grow!

-

Agreed since that school of pipsology have served for a long time in this trading industry however the brokers like hfm, xm, lmfx, etc also have demo learn & earn or demo to real trading contests which can be used to earn money while learning how to trade through demo accounts.

-

⭐ RichardGere reacted to a post in a topic:

Jhon Snow- Educator and contact

⭐ RichardGere reacted to a post in a topic:

Jhon Snow- Educator and contact

-

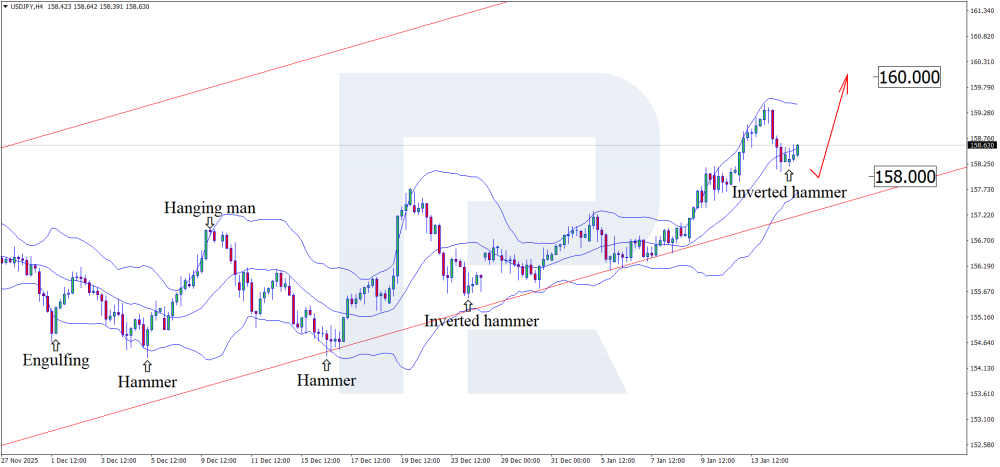

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

The dollar at a crossroads: how unemployment data and the Fed may affect USDJPY The yen attempts to regain ground, with the USDJPY rate trading near the 158.45 level. Discover more in our analysis for 15 January 2026. USDJPY technical analysis On the H4 chart, the USDJPY pair has formed an Inverted Hammer reversal pattern near the lower Bollinger Band and is trading around 158.45. At this stage, it may continue an upward wave following the pattern signal, with the 160.00 level acting as an upside target in this scenario. US fundamental factors work against the USD, while USDJPY technical analysis suggests growth towards the 160.00 level. Read more - USDJPY Forecast Attention Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

JP 225 forecast: the index has updated its all-time high The JP 225 stock index has continued its upward momentum. The JP 225 forecast for today is negative. JP 225 forecast: key trading points Recent data: Japan’s current account reached 3.67 trillion JPY Market impact: the effect for the Japanese equity market is moderately positive Fundamental analysis Japan’s current account balance exceeded expectations, posting a surplus of 3.674 trillion JPY, above the forecast of 3.594 trillion JPY and the previous reading of 2.834 trillion JPY. For the equity market, this primarily signals a stronger external position and higher net income inflows from abroad, which fundamentally supports economic resilience and reduces sensitivity to external shocks. For Japanese equities, the impact of a potentially stronger yen is mixed. A stronger yen reduces the value of overseas revenues when converted into yen and may pressure the profits of export-oriented companies, while also weakening their price competitiveness in global markets. At the same time, yen appreciation lowers the cost of imported energy and raw materials. RoboForex Market Analysis & Forex Forecasts Attention Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 397 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Playr101 reacted to a post in a topic:

quantvue.io

Playr101 reacted to a post in a topic:

quantvue.io

-

wertamido reacted to a post in a topic:

https://adtssystems.com/2026-releases need to educate

wertamido reacted to a post in a topic:

https://adtssystems.com/2026-releases need to educate

-

wertamido reacted to a post in a topic:

FIXED NT8 -NinjaTrader8 8.0.27.1 - 8.1.4.1

wertamido reacted to a post in a topic:

FIXED NT8 -NinjaTrader8 8.0.27.1 - 8.1.4.1

-

anyone can share this indi please pack Scalping agresivo

wertamido replied to TRADER's topic in Ninja Trader 8

up -

https://www.bilibili.tv/en/video/4791141966938624 User Apps Share Scripts.7z

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date:15th January 2026. From ETFs to Technicals: What’s Fuelling Silver’s 2026 Rally. The best-performing asset in 2026 so far is Silver. Silver paused during the Asian session this morning after rising for four consecutive days. However, technical analysis is not yet indicating a prolonged downturn. So, why is Silver the best-performing asset of 2026, and what are analysts predicting for 2026? Factors driving Silver’s Bullish Momentum The increase that Silver is experiencing is largely due to demand from institutional investors rather than physical demand. According to the latest reports and projections, demand for physical Silver is likely to slightly decrease over the next 12 months. Institutions are buying Silver for similar reasons to Gold, however, Silver is much more volatile and cheaper to purchase. The slightly lower inflation readings from this week, projections for more frequent interest rate cuts, and questions over Fed independence are increasing demand. Economists are not expecting the Federal Reserve to cut interest rates this month, nor in March 2026. For this reason, the US Dollar has slightly risen while stocks have fallen. However, economists do believe that in the second and third quarters of the year, the Fed will need to make frequent rate cuts. On average, economists believe the Fed will need to cut by 0.75% by the end of the year. This would take the Federal Fund Rate to 3.00%, the lowest since the summer of 2022. For this reason, investors expect the Federal Reserve to delay cuts in the first quarter but eventually cut rates later in the year. At the same time, investors are incorporating political risks into their strategy, which is resulting in a need for Gold and Silver. These include the Federal Reserve’s independence and US global intentions such as within Greenland. In addition, investors are also treading cautiously as the US Midterms will take place later in the year. Investors Buying Silver ETFs Market participants are reviewing the Silver Institute’s early 2025 outlook, which expects global industrial silver demand to fall 2% to 665 million ounces. The decline reflects trade policy uncertainty and reduced use in electronics and photochemical applications. Demand for physical bars and coins is also expected to drop to a seven-year low, down 4% from 2024. However, strong investment inflows into Silver ETFs rose 18%, with net inflows of 187 million ounces. This is likely to offset weaker physical demand and help support prices, particularly as investors seek protection from inflation and currency volatility. On the CME, Silver trading activity spiked on 7 January, with volumes reaching 195,000 contracts, well above the early-month average. XAGUSD - Technical Analysis HFM - 15-Minute Chart Due to the bullish price movement, indicators and price action are understandably pointing towards Silver’s trend continuing. Even with the current retracement, the price fell to the previous low and did not necessarily form significant breakouts. When looking at the 2-hour timeframe, the price of the metal remains above the key Moving Average, above the neutral area of the RSI, and the MACD. For this reason, indicators continue to point towards buyers maintaining control. Fundamental analysis also indicates this, with inflation reading slightly lower. The main risk for Silver and Gold is the rise in the US Dollar. If the US Dollar declines, Silver can potentially strengthen further. The only indicators currently pointing towards a downward price movement are the 200-bar Moving Average on the 5-minute timeframe. The price currently remains below this level, giving a bearish bias. However, the price is currently rising and trading close to this level. If the price forms a bullish breakout at $90.185, the bearish bias is likely to fade. Key Takeaways: Silver leads 2026 performance. It’s the top-performing asset so far, despite a brief pause after four consecutive days of gains. Institutional demand drives momentum. Growth is fuelled by ETFs and institutional buying rather than physical silver demand. Fed rate expectations influence buying. Investors anticipate rate cuts later in 2026, boosting silver and gold as hedges. Physical demand is declining. Industrial use and coins/bars are projected to drop, but ETF inflows (up 18%) support prices. Technical indicators remain bullish. Silver’s price is holding above key moving averages and RSI/MACD signals, suggesting buyers remain in control. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Michalis Efthymiou HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

anyone can share this indi please pack Scalping agresivo

Letho replied to TRADER's topic in Ninja Trader 8

up please -

Geostrading started following S M M - NT8

-

What is the Best Course for Begginer

CRYPTOHUSTLER replied to momo10's topic in General Forex Discussions

One of the best beginner forex courses is BabyPips School of Pipsology. It offers clear lessons on market basics, terminology, chart reading, and risk management. The content is beginner friendly and focuses on building understanding step by step before attempting real trades. -

Is this the best time to get into cryptocurrency?

CRYPTOHUSTLER replied to sakura's topic in General Forex Discussions

There is no universally perfect moment to enter cryptocurrency. Markets are influenced by cycles, technology progress, regulation, and global events. What matters most is your own financial situation, knowledge, and risk tolerance. Taking time to learn, starting gradually, and focusing on long-term understanding can be more effective than reacting to short-term price movements or hype. -

Digital assets derive worth from rarity, usefulness, credibility, and collective participation. Finite issuance, meaningful applications, reliable infrastructure, and engaged users fuel interest. Confidence and real-world adoption strengthen pricing. The LMGX token seeks to establish worth through functional purpose, open building practices, and community-led expansion, prioritizing long-term relevance over speculation by emphasizing steady delivery and balanced economic structure.

-

NQ Ultra - Futures Trading Bot // https://tradegreater.com/

N9T replied to luludulu's topic in Ninja Trader 8

I apply the same as with Gold (HA 500 ticks) -

NQ Ultra - Futures Trading Bot // https://tradegreater.com/

henryspencer66 replied to luludulu's topic in Ninja Trader 8

anyone have the settings for silver pls? -

LoneBladeRGC started following ⭐ fryguy1

-

LoneBladeRGC started following roddizon1978