⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Past hour

-

https://workupload.com/archive/4b4CGpVUMv Copy the resources file to bin/custom, then import RenkoKings_SpaceGPSSatellite_NT8 Credit to Ampoo, this is all his contribution Enjoy

-

not edu. needs to be activated to use.

-

⭐ osijek1289 reacted to a post in a topic:

FIXED NT8 -NinjaTrader8 8.0.27.1 - 8.1.4.1

⭐ osijek1289 reacted to a post in a topic:

FIXED NT8 -NinjaTrader8 8.0.27.1 - 8.1.4.1

- Today

-

Puzzle reacted to a post in a topic:

Please, I want Amibroker 6,43 64bit

Puzzle reacted to a post in a topic:

Please, I want Amibroker 6,43 64bit

-

⭐ Mestor reacted to a post in a topic:

SuperDOM Series

⭐ Mestor reacted to a post in a topic:

SuperDOM Series

-

@kimsam @apmoo please and thank you 🙂

-

Sadly I do not... lets see if someone can re up.

-

FIXED NT8 -NinjaTrader8 8.0.27.1 - 8.1.4.1

⭐ laser1000it replied to ngatho254's topic in Ninja Trader 8

I don't use any Rithmic patch , but if you want to contribute to other users it would be better to provide the psw.....thk in advance -

⭐ mangrad reacted to a post in a topic:

A11 overnight strategy

⭐ mangrad reacted to a post in a topic:

A11 overnight strategy

-

charlipro joined the community

-

yes this Val1312q tool can reset rithmic with nt 8.028

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Gold (XAUUSD) at a new peak: higher levels ahead Gold (XAUUSD) prices have tested 4,600 USD, with the market relying on a pool of political risks. Find more details in our analysis for 12 January 2026. XAUUSD forecast: key trading points Gold (XAUUSD) prices surged to a new high A broad spectrum of geopolitical risks supports demand for safe-haven assets US statistics are also bolstering gold Fundamental analysis Gold (XAUUSD) prices rose by more than 1% on Monday and exceeded 4,601 USD per ounce, reaching a new all-time high once again. The rally was driven by rising geopolitical risks and expectations of further interest rate cuts in the US. On Sunday, Iran’s parliamentary speaker warned the US and Israel about the consequences of possible intervention following threats of military strikes by President Donald Trump. The statements came amid mass protests in Iran, which reportedly resulted in hundreds of deaths. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 394 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

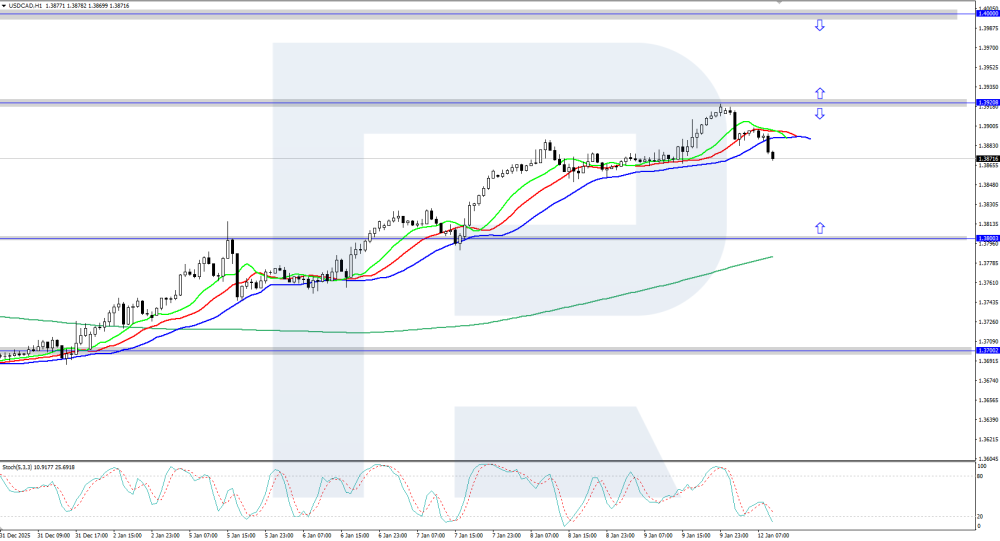

USDCAD rose to the 1.3900 area The USDCAD rate is on the rise, climbing into the area around 1.3900 amid an increase in unemployment in Canada. Discover more in our analysis for 12 January 2026. USDCAD technical analysis On the H1 chart, USDCAD quotes are showing upward momentum, reaching the 1.3900 area. The Alligator indicator is also pointing higher, confirming the current bullish dynamics. After a brief correction, the upward movement may continue. The USDCAD pair is showing upward dynamics, rising to the 1.3900 area. Read more - USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date:12th January 2026. Gold Hits All-Time Highs as the Fed Faces Political Pressure. Gold rises to new all-time highs as US prosecutors opened a criminal investigation into Jerome Powell over the weekend. In addition, the latest NFP figures continue to support more interest rate cuts in 2026, also supporting Gold prices. Analysts continue to point towards multiple reasons why institutions and investors are increasing Gold’s exposure levels. These include the threat to the Federal Reserve’s independence, employment data, and even US-EU tensions over Greenland. However, at what point is Gold too expensive? HFM - Gold Daily Chart Why Is the Federal Reserve Prompting Higher Gold Demand? The tensions between the Federal Reserve and the Trump administration have been well documented. The US government believes the Federal Reserve is not cutting interest rates at the pace it should be. The Federal Funds Rate currently stands at 3.75%, which is 1.75% lower than the highs from 2024. That said, interest rates are still considerably higher than those seen over the past decade. According to the Federal Reserve, they have been unable to cut at a faster pace due to tariffs creating uncertainties. More specifically, members of the Federal Open Market Committee had previously projected inflation would rise considerably due to tariffs. These projections have yet to materialise, providing Trump with additional grounds to criticize the Federal Reserve. Tensions have been on the rise over the past few days as US prosecutors started a criminal investigation into the head of the Federal Reserve, Jerome Powell. The investigation is looking at whether Mr Powell misled Congress about the scope and cost of a major $2.5 billion renovation of the Federal Reserve’s Washington office. President Trump and members of the administration have advised the cost is significantly higher than what the Chairman had disclosed. Particularly, Trump accused the Fed of adding ‘luxurious’ features to the renovation. However, Fed officials told journalists that these were later removed. The question is whether Powell gave misleading or false testimony to Congress about the renovation. According to Jerome Powell, the investigation is political pressure to force the Federal Reserve to cut rates. He said it is also meant as personal retaliation for not cutting rates so far. Powell told journalists the move raises concerns about the Fed’s independence. The risk to Federal Reserve independence is largely the development pushing Gold higher. NFP - Mixed Employment Data The NFP data from Friday had both positive and negative factors in the release. The Unemployment Rate fell back to 4.4%, lower than previous projections. However, the NFP Employment Change was only 50,000, lower than expectations. The employment data for December indicates the sector remains resilient, but risks do remain. According to analysts, the figures indicate the need for interest rate cuts but are not weak enough to significantly pressure the Federal Reserve. The chances of a Federal Reserve rate cut still remain low, a 5% possibility. However, investors will monitor if this changes after tomorrow's CPI figures. Gold (XAUUSD) - Technical Analysis As Gold has been increasing for six consecutive months, most indicators, particularly momentum indicators, point towards the bullish trend continuing. The question is whether the price is trading at an overpriced level. Certain timeframes do point towards the price potentially being overbought. For example, on the 4-hour timeframe, the price is trading at an overbought level on the RSI. In addition to this, on the daily timeframe, the price is forming a divergence pattern, which also signals a potential pullback. Momentum and trend-based indicators continue to point upward, and the price stays close to its average, suggesting investors do not overvalue it. In addition, fundamental factors continue to support Gold’s price. HFM - Gold 5-Minute Chart Certain Wall Street banks are also supporting the bullish trend maintaining momentum this year. Goldman Sachs has given a target price of $4,900. Bank of America and JP Morgan have given a target of $5,000. However, in the short-term, for bullish signals to be valid, the price must remain above $4,542.75, according to the 200-bar MA. Key Takeaways: Gold hit new all-time highs as US prosecutors launched a criminal investigation into Jerome Powell. Mixed NFP employment data supports the possibility of more Federal Reserve rate cuts in 2026. Investors increase Gold exposure due to Fed independence risks, employment trends, and US-EU geopolitical tensions. Technical indicators show Gold’s bullish momentum continues, though some timeframes signal potential overbought conditions. Major banks forecast Gold at $4,900-$5,000, with key support at $4,542.75 maintaining short-term bullish signals. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Michalis Efthymiou HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

anyone can share this indi please pack Scalping agresivo

Letho replied to TRADER's topic in Ninja Trader 8

up please -

Thank You very much

-

Letho reacted to a post in a topic:

Camarilla pivots and ovn bots

Letho reacted to a post in a topic:

Camarilla pivots and ovn bots

-

This is not a course from Dr Ernest Chan ! In fact the person speaking doesnt even mention his name. Moreover, this seems to be a 2nd part of some series if we understand correctly from the overview. Starts directly with Backtesting and then goes on to describe how to use Python. A lot of hours to go!

-

⭐ ajeet reacted to a post in a topic:

Camarilla pivots and ovn bots

⭐ ajeet reacted to a post in a topic:

Camarilla pivots and ovn bots

-

There's one more rithmic patcher (Rext 3) that I used on NT 8.0.22 It's from Val1312q and worked very fine for me. It's date locked to 13 Mar 2023, so run with date setter. It works both on Win10 and win11 Note: It may give positve warning on Antivirus like many other files from same author . https://workupload.com/file/B9XGWDgEnHL

-

thanks

-

⭐ aniketp007 reacted to a post in a topic:

Futures.i0 indicators requests

⭐ aniketp007 reacted to a post in a topic:

Futures.i0 indicators requests

-

Is ".exe" failing to open or patch NT? Have you attempted to use it in compatibility mode? Up until I switched to NT 28, everything was functioning properly for me, however, I am unable to test at this time.

-

It needs to be cracked https://www.sendspace.com/file/666hdt

-

Would it be possible to unlock the latest version 4.0.12? https://www.sendspace.com/file/g4kjhn

-

Sharing my templates and backtest for TPv4. Results are very good. Fully backtestable since using regular candlestick. 1m chart https://workupload.com/archive/R2tcKebqZs

-

AkramKhan joined the community

-

yes, with lots of improvement & efficiency and now with AI support one can quickly write custom code, fix the errors etc Highlights of version 7.00 This cycle of releases introduces a groundbreaking AI-powered feature, significant enhancements to the user interface including a dark mode expansion, and a host of new capabilities for AFL scripting and analysis. This release cycle demonstrates a focus on both innovative features with the AI Code Assistant and continuous improvement in user experience, scripting power, and data handling flexibility. Major New Features & Enhancements: Brand-new AFL Code Assistant integrated in AFL Editor powered by Artificial Intelligence LLM Remember our 2007 AFL Code Wizard? Cute, right? Get ready for the real deal. Now AmiBroker 7 features a brand-new, complete AI-driven AFL Code Assistant! It's a developer, an analyst, and a debugger, all in one. > Writes code from your English description. > Explains any formula you give it. > Analyzes your code's strengths & weaknesses. > Fixes bugs and errors instantly. > Suggests improvements. THE BEST PART? YOU CHOOSE THE AI BRAIN! Plug in OpenAI, Google Gemini, or even a 100% PRIVATE local AI running on your own PC. Your strategies stay YOURS. Symbol Tagging for Organization Users can now assign color-coded tags to symbols for easier identification and filtering. These tags are visible in the symbol list and can be managed programmatically via AFL. Integrated Software Updater A new built-in software updater allows for checking and installing new AmiBroker versions directly from the Help menu. Plot Opacity and Alpha Blending Introducing the SetOpacity function, allowing for transparency effects on various plot styles including lines, bars, candles, histograms, and areas when using QuickGFX. Dark Mode Expansion The dark mode introduced in earlier versions has been extended to more interface elements in version 6.92, including the Charts (formula) tree, Interpretation window, Symbol list, and more, for a consistent viewing experience. AFL (AmiBroker Formula Language) Advancements: New Analysis and Summary Capabilities The AddSummaryRows function can now be used in all analysis modes, not just explorations, to add summary statistics. New constants like asrTotal and asrAverage have been added for this purpose. Enhanced Category Management AFL now provides more robust control over symbol categories and tags, with new functions to add, remove, and retrieve symbols based on their assigned tags. File Handling A new thread-safe function, fappend, allows for safely appending text to a file from multiple threads simultaneously. Date and Time StrToDateTime now supports years up to 2037. Additionally, AddColumn supports new formats to display only the date or only the time portion of a DateTime value. Analysis Control A new SetOption("MaxEntryRank", N) allows users to limit the number of entry signals tracked per bar in backtests. User Interface and Usability Improvements: Flexible N-Second Intervals: N-second intervals no longer need to be aligned to a full minute, and time compression now supports second intervals that are not divisors of 60. AFL Editor Enhancements A new keyboard shortcut, Ctrl+/, has been added for line commenting. Users can also now move selected lines of code up or down using Alt+UP/DOWN arrow keys. Copying an entire line without selection is now possible. Improved Analysis Workflow Selecting a trade in the New Analysis result list can now automatically synchronize the chart, display trade arrows, and mark the trade range for a more intuitive analysis process. Batch Processing The ExecuteAndWait command in batch operations now allows for defining a current working directory. UI Polish Numerous smaller improvements have been made, such as using the default text tool font for new text objects on charts, better number display in the Account window to avoid scientific notation, and improved list view copy functionality. Data Handling

-

9 hours ago, fchot33 said: SuperDOM Series - Expert Columns for NinjaTrader® SuperDOM F8AcmkSu8H Install: 1. Close NT8, 2. Install exe, 3. Copy DLL file into doc/bin/custom, 4. Restart NT8 and look for SuperDOM Dynamic, then look for templates by right-clicking on DOM and selecting those available. Enjoy 🙂 THANK YOU FOR YOUR SHARE. ALSO, DO YOU HAVE PERHAPS https://tradingorderflow.com/product/limit-order-visualizer/ ?

- Yesterday