All Activity

- Past hour

-

setare started following Bar or Candle numbers indicator for MT4 , SQUARING THE CIRCLE BY George Bayer , AstroTrader +AstroTrader Movie and 2 others

- Today

-

Hello Does anyone know an indicator that selects candles based on the numbers we give by selecting a candle Suppose I select a candle and then enter a series of numbers, for example, the numbers 4, 8, and 10. This indicator selects candle 4 from the first candle (3 candles after the first candle), then candle 8, and then the tenth candle.

-

I have heard that the winners of these contests receive trading credits instead of real cash, what is the reason behind?

-

I can say better to check the repute since there are many bad examples of the past where even the regulated brokers turned into scam and never paid back to their traders.

-

Elliott Wave International’s Educational Video Series

Harishkc01 replied to fdd2k2's topic in Forex Clips & Movies

Thanks. I did not expect that on this old post I will get response. Have a good day. Thanks. -

Harishkc01 reacted to a post in a topic:

Elliott Wave International’s Educational Video Series

Harishkc01 reacted to a post in a topic:

Elliott Wave International’s Educational Video Series

-

Because you need to copy and paste the files into your document/nt8/bin/custom folder instead of importing them as normal.

-

⭐ FFRT reacted to a post in a topic:

Sentient Trader 4.04.17

⭐ FFRT reacted to a post in a topic:

Sentient Trader 4.04.17

-

4.0.4.17 is fully working or has any limitation?

-

yes

-

This thread about NT8 platform has become active again thanks to Ampoo, who started cracking the various DLLs, and then new reversal engineering joined in. What I don’t understand is why there still isn’t a cracked version of NT8. From my side, I think it would be better to have the core first and then the additions

-

I'm talking about the courses that the author of the Sentient Trader program sells and that explain how to work with the program.

-

i got an error saying the script you trying to import is not compatible with current NT version i have NT 8.1.5.2, please help here

- Yesterday

-

dahood joined the community

-

raj1301 reacted to a post in a topic:

metaswing.com

raj1301 reacted to a post in a topic:

metaswing.com

-

raj1301 reacted to a post in a topic:

metaswing.com

raj1301 reacted to a post in a topic:

metaswing.com

-

Playr101 reacted to a post in a topic:

metaswing.com

Playr101 reacted to a post in a topic:

metaswing.com

-

Playr101 reacted to a post in a topic:

metaswing.com

Playr101 reacted to a post in a topic:

metaswing.com

-

Playr101 reacted to a post in a topic:

tradingacademi.com

Playr101 reacted to a post in a topic:

tradingacademi.com

-

Spellbound21 reacted to a post in a topic:

quantvue.io

Spellbound21 reacted to a post in a topic:

quantvue.io

-

https://www.amazon.com/This-My-Story-Giuseppe-Torreggiani/dp/8888029532''' Is that?

-

looking at the chart it reminds me of the old GnosTICK levels from riosquant

-

@raj1301 Hope this helps. https://workupload.com/file/zzZ9FvLQpqB

-

Hello ampoo, The file was deleted. Can you please reupload it?

-

Any luck finding a NinjaTrader version of it? The white paper on the method is definitely a good start, but it doesn't explain exactly how he came up with those levels. I want to code it for TradingView

-

Xman joined the community

-

the only courses for cyclical analysis are those of Giuseppe Torreggiani, but only in Italian language and hard to find, everything else is just nonsense

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

US 500 forecast: the index set a new all-time high and began a correction The US 500 index approached the 6,500.0 level, and with each new all-time high, the likelihood of a downward correction increases. Today’s US 500 forecast is positive. US 500 forecast: key trading points Recent data: US JOLTS job openings for June came in at 7.43 million Market impact: the effect on the US stock market may be mixed, depending on the Federal Reserve’s interpretation of this data Fundamental analysis The JOLTS job openings figure reflects the number of available positions in the US and serves as a key indicator of labour market health. The current reading is 7.437 million, below both the forecast of 7.510 million and the previous figure of 7.712 million. This suggests weakening demand for labour and a gradual cooling of the economy. For equities, this may have a twofold impact. On the one hand, fewer job openings ease wage pressure and inflation risks, which increases the likelihood that the Federal Reserve will refrain from raising rates and could eventually resume rate cuts. On the other hand, it points to slowing economic activity, which raises investor caution. For the US 500 index, the impact varies by sector. The technology and real estate sectors benefit as a more accommodative Fed stance makes funding more accessible and supports growth stocks. Meanwhile, the financial sector may see reduced profitability due to lower interest rates. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 288 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

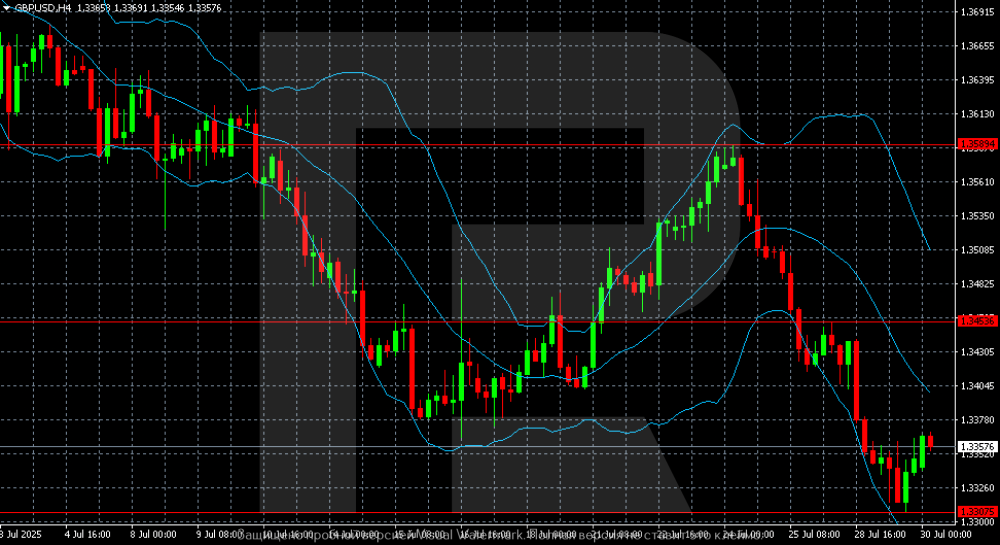

RBFX Support replied to RBFX Support's topic in Technical Analysis

GBPUSD at 20 May low: no support from economic data The GBPUSD pair dipped to 1.3357 on Wednesday as weak PMI data and a strong US dollar pressured the pound. Discover more in our analysis for 30 July 2025. GBPUSD technical analysis On the H4 chart, the GBPUSD pair remains under pressure, trading in a downtrend. After failing to consolidate above 1.3589, the pair reversed and reached a local low around 1.3300 by 30 July – its lowest level since the start of the month. The GBPUSD pair has fallen to its lowest since 20 May and appears weak. Read more - GBPUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

We present to your attention the penultimate version of the Sentient Trader cycle analysis program, version 4.04.17. Completely free of charge. Download link https://limewire.com/d/KzrLt#t1Y70GjzSU Password for archive "indo-investasi" We also have the new version 4.04.42 available for those who need it, priced at 50 USDT TRC20. Please send us a private message if you are interested in purchasing it. It does not include the additional "Click to Trade" and "FLD strategy" modules. These modules are only distributed with the purchase of particular courses. If anyone has them available, please send us a private message. Regards

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

[b]Date: 30th July 2025.[/b] [b]Global Markets Mixed as US-China Trade Talks Stall, Fed Holds Rates, and Euro Retreats.[/b] US-China Trade Tensions Weigh on Investor Sentiment Financial markets opened the midweek session on a cautious note as the latest round of US-China trade talks concluded in Stockholm without a definitive agreement. Both countries indicated willingness to extend the current tariff truce set to expire on August 12, but no final decision has been reached. China’s Vice Premier He Lifeng described the discussions as “constructive,” noting that both sides agreed to continue working toward an extension. Meanwhile, US Trade Representative Jamieson Greer confirmed the topic was discussed but emphasised that any extension still requires approval from President Donald Trump. US Treasury Secretary Scott Bessent added that although the dialogue was ‘fulsome,’ the Chinese may have ‘jumped the gun’ in announcing a pause. Strategic concerns such as China’s purchase of Iranian oil and export of dual-use technology to Russia were also raised. Asian and US Markets React to Trade and Earnings Headwinds Asian equities responded with mixed movements. Hong Kong’s Hang Seng Index slipped 1.2%, while the Shanghai Composite gained 0.2%. Japan’s Nikkei 225 declined marginally as losses in automakers like Toyota and Honda offset gains in tech stocks. Meanwhile, Australia’s ASX 200 and South Korea’s Kospi posted solid gains, while Taiwan’s Taiex and India’s Sensex advanced modestly. On Wall Street, US stock indices edged lower as traders digested corporate earnings and growing global uncertainty. The S&P 500 fell 0.3%, the Dow Jones Industrial Average dropped 0.5%, and the Nasdaq Composite lost 0.4%. High-profile movers included SoFi Technologies, which surged 7.4%, and UPS, which plunged 9.2% on weaker-than-expected results. Health care giant UnitedHealth Group dropped 5.8% after disappointing earnings, while Novo Nordisk shed over 21% on lowered 2025 guidance for its Wegovy weight-loss drug. Federal Reserve Maintains Rates Amid Inflation and Tariff Uncertainty The Federal Reserve began its much-anticipated policy meeting with expectations firmly anchored in a decision to keep interest rates steady. Despite renewed pressure from President Trump for cuts to stimulate the economy, policymakers are expected to wait for further data on inflation and the economic impact of tariffs. Treasury yields slipped as investors adopted a risk-off approach. A report showing a decline in US job openings added to concerns over a potential economic slowdown, though consumer confidence data remained relatively stable. Traders now await official signals from the Fed’s statement and Chair Jerome Powell’s comments. Euro Rally Stalls After EU-US Tariff Deal The euro, once one of the strongest-performing currencies of 2025, has started to lose momentum. After hitting a four-year high of $1.1830, it fell sharply this week following the EU's decision to impose a 15% tariff on US imports. Though less severe than President Trump’s initial threats, the new rate is a sharp increase from pre-2025 levels. Currently trading around $1.1554, the euro is on track for its first monthly loss this year, down nearly 2% in July. Analysts note that the rally had been driven by optimism over German fiscal stimulus and weakness in the US dollar. However, with a US-EU trade agreement reducing uncertainty and strong US earnings supporting the greenback, that trend has reversed. Bruno Schneller of Erlen Capital Management commented that the euro is facing a “reality check,” as speculative positions near record highs are now being unwound. CFTC data shows euro bullish bets have reached $18.4 billion, the highest since December 2023. Commodities: Copper and Oil Slide as China Stimulus Lacks Detail Commodities markets were also under pressure. Copper prices dropped 0.2% to $9,782 per ton on the London Metal Exchange, while iron ore declined by 0.9% in Singapore. Early gains were erased after a policy update from China’s Politburo failed to provide clear fiscal or monetary stimulus plans, disappointing traders who had anticipated stronger support. The global copper market has also been rattled by the Trump administration’s plan to impose a 50% tariff on copper imports starting August 1. With few details available, investors are bracing for widespread disruptions. Chile, the largest supplier of copper to the US, has requested exemptions, but US trade officials signalled that the measures would apply globally. Meanwhile, oil prices remained relatively flat. US crude hovered at $69.20 per barrel, while Brent crude edged up to $71.70. The broader energy market remains range-bound as traders await further developments in both monetary policy and international trade. Economic Data and Earnings to Drive Market Direction With the Fed expected to keep rates on hold, attention is shifting to upcoming economic reports and earnings data. The US is scheduled to release the latest Non-Farm Payrolls (NFP) report, along with inflation readings that will offer deeper insight into the strength of the recovery. In Europe, economic growth figures will help shape expectations for further fiscal intervention. Investors are also awaiting any update on whether the US and China will officially extend their tariff truce, a development that could ease trade tensions and support global risk sentiment. What Traders Should Watch This Week As market volatility picks up, traders should monitor several key themes: The Federal Reserve’s rate decision and Powell’s press conference US jobs and inflation data Confirmation or collapse of the US-China tariff pause More Q2 earnings reports from major US corporations Reactions to the EU-US trade agreement Signals of additional stimulus from China With global macro conditions in flux and central bank policies on pause, the coming days could define the next phase of market momentum in stocks, commodities, and currencies. [b]Always trade with strict risk management. Your capital is the single most important aspect of your trading business.[/b] [b]Please note that times displayed based on local time zone and are from time of writing this report.[/b] Click [url=https://www.hfm.com/hf/en/trading-tools/economic-calendar.html][b]HERE[/b][/url] to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click [url=https://www.hfm.com/en/trading-tools/trading-webinars.html][b]HERE[/b][/url] to register for FREE! [url=https://analysis.hfm.com/][b]Click HERE to READ more Market news.[/b][/url] [b]Andria Pichidi HFMarkets[/b] [b]Disclaimer:[/b] This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

Sorry Its working perfectly by overwriting in folder Thanks Kesk.