⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Today

-

This is what i have it still works. I would run the installers then go in custom folder to delete the .dll VWAP, Super Dom, Limit Order Visualizer, Order flow Speed that installer installed. Add the ANY dll and you should be set . Oh make sure you have NET framework 4.8 or better. The newer version I'll try to fix when i have some spare time. https://workupload.com/file/hkc7d4apVmL Thanks

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Gold (XAUUSD) rises to the 3,400 USD area XAUUSD prices continue to strengthen, climbing to the 3,400 USD area amid dollar weakness driven by US President Trump’s pressure on the Fed. Discover more in our analysis for 27 August 2025. XAUUSD technical analysis XAUUSD prices are on the rise after rebounding from the 3,300 USD area. The Alligator indicator has turned upwards, confirming potential continuation of the uptrend after a minor correction. Gold confidently rose to the 3,400 USD area amid ongoing dollar weakness. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

GBPUSD under pressure: market full of doubts The GBPUSD pair retreated to 1.3461 midweek. Market focus is on Fed independence concerns and the Bank of England’s strategy. Discover more in our analysis for 27 August 2025. GBPUSD forecast: key trading points The GBPUSD pair corrected after its rally in early August as doubts over US monetary policy resurfaced The market is watching the foundations for potential BoE rate decisions GBPUSD forecast for 27 August 2025: 1.3432 Fundamental analysis On Wednesday, the GBPUSD rate fell to 1.3461. Pressure on US short-term yields and threats to Fed independence created a negative backdrop for the US dollar, supporting the outlook for its weakening over the coming year. The decisive risk factor will be who Donald Trump nominates to replace the vacant Fed Governor seat, which will determine the extent of political influence over monetary policy. Investors are also closely watching developments in France, where the minority government faces a possible dismissal next month. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 306 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date: 27th August 2025. Stocks Remain Steady Despite India Tariffs, NVIDIA Earnings in Focus. Some investors may argue that the most important day for the NASDAQ is here with the release of NVIDIA’s Quarterly Earnings Report. NVIDIA is due to release the company’s quarterly report after the close of the day’s US Session. NVIDIA stocks are the most influential stocks for the NASDAQ and can have a ripple effect on all tech stocks. NVIDIA Stocks and Quarterly Earnings Report NVIDIA stocks have risen 1% each day over the past week and are already trading 0.32% higher during this morning’s after-hours trading. The bullish price movement ahead of the report indicates that shareholders are confident in the upcoming report. According to analysts’ projections, the company will see growth within all of its sectors. Analysts expect revenue to increase to $41.3 billion, which is a 57% increase year over year. In addition to this, the company’s Gaming Sector is also expected to have increased by 33%. In 2025 so far, NVIDIA stocks have risen 31% but the upcoming price movements will depend on whether the company can beat the current projections. NVIDIA’s quarterly earnings report is not solely important to the market because it's the world’s most valuable company. During August, the market has struggled to determine the intrinsic value of AI-related companies. The NASDAQ declined this month after a pessimistic report from the Massachusetts Institute of Technology and remarks by OpenAI CEO Sam Altman fueled doubts about the sector’s prolonged rally. Therefore, NVIDIA’s earnings report can either fuel these fears further or reinstate confidence in technology stocks. NASDAQ - Tariffs a Concern For Investors, But Not Yet Triggering A Decline The NASDAQ is being positively influenced by the upcoming NVIDIA report and has fully corrected the decline seen on Monday. However, the performance of the NASDAQ continues to remain under pressure from tariffs and Fed independence threats. The US has raised tariffs on Indian exports to as high as 50%, twice the previous rate, in retaliation for India’s ongoing purchases of Russian oil. However, traders need to note that many products are exempt from the tax. Nonetheless, in turn, New Delhi is deepening diplomatic engagement with China and Russia and advancing domestic reforms. It is also drawing on its foreign exchange reserves to steady financial markets. Currently, global stock markets remain unchanged and are not witnessing any significant declines due to the tariffs imposed on India. The VIX index is currently trading slightly lower, which is positive for the stock market. However, the Put and Call Ratios are increasing upwards towards the 0.70 level, which indicates stocks may potentially decline again. This would depend on NVIDIA’s earnings report as well as the upcoming US data. This includes tomorrow’s US Gross Domestic Product and Friday’s Core PCE Price Index. Analysts expect the US Gross Domestic Product to rise to 3.1% and for the Core PCE Price Index to rise 0.3%. A 0.3% increase in the index would be considered too high for the Federal Reserve and could apply some pressure on the NASDAQ. NASDAQ (USA100) - Technical Analysis When analysing the NASDAQ’s price movement on a daily timeframe, the price does not indicate a change of trend. The bias remains towards the upside, but there are clear indications that investors are becoming cautious of the extremely high price and the asset’s intrinsic value. NASDAQ 15-Minute Chart On the 2-hour chart, the price is trading above the 75-bar EMA, indicating buyers are attempting to gain control. However, it would be vital to break through the resistance level, which can be seen at 23,585.70. On smaller timeframes, the price on Wednesday is so far trading within a sideways price movement, but remains above the main trendlines and Moving Averages. If the price breaks above the $23,573.30, bullish signals will strengthen. Whereas if the price falls below $23,530.00, sell signals will materialise. Key Takeaways: NVIDIA’s earnings report is pivotal as its results could set the tone for all tech stocks. NVIDIA remains the NASDAQ’s most influential stock. Analysts project strong growth with a revenue of $41.3B (up 57% YoY) and notable gaming sector growth (+33%). US tariffs on India and Fed independence concerns weigh on sentiment, though markets remain stable for now. The NASDAQ’s bias stays bullish but faces key resistance near 23,585. A breakout or breakdown around current levels could signal the next move. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Michalis Efthymiou HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

CuanersID changed their profile photo

-

Pernah nggak sih Cuaners merasa trading itu gampang banget? Tinggal klik buy atau sell, lalu tunggu profit masuk. Banyak trader pemula di Indonesia yang berpikir begitu, padahal kenyataannya tidak sesederhana itu. Trading bukan cuma soal grafik atau angka, tapi juga soal bagaimana Cuaners mengatur modal, strategi, dan emosi. Nah, di sinilah filosofi 3M = Money, Method, Mind hadir sebagai fondasi penting. Tanpa 3M, trading bisa berakhir dengan kehilangan modal dan rasa frustrasi. Tapi kalau Cuaners memahami 3M, trading justru bisa jadi perjalanan yang lebih santuy, penuh kontrol diri, dan tentu saja tetap cuan. Money: Mengelola Modal adalah Kunci Awal Dulu, saya sempat berpikir bahwa modal besar adalah segalanya. Kenyataannya, banyak trader dengan modal besar justru bangkrut lebih cepat karena tidak bisa mengelolanya. Sebaliknya, ada banyak Cuaners dengan modal terbatas yang justru bisa bertahan lebih lama karena memiliki disiplin dalam mengatur risiko. Hal ini membuat saya semakin sadar bahwa yang terpenting bukan seberapa besar modal yang dimiliki, tetapi bagaimana cara mengelolanya dengan benar. Money management menjadi penyelamat utama. Saya belajar untuk tidak memaksakan diri masuk dengan lot besar hanya karena ingin cepat kaya. Jauh lebih aman mengatur risiko di kisaran kecil, sekitar satu hingga dua persen dari modal, dan selalu melengkapi transaksi dengan stop loss agar tidak tenggelam dalam kerugian. Selain uang, saya juga menyadari bahwa waktu adalah modal penting. Ada banyak Cuaners yang mampu tetap trading santuy sambil menjalankan aktivitas lain seperti bekerja, kuliah, atau bahkan liburan. Mereka membuktikan bahwa mengatur waktu dengan cerdas sama berharganya dengan mengatur dana. Method: Strategi yang Konsisten Lebih Penting daripada Strategi yang Hebat Saya pernah mengalami masa-masa bingung gonta-ganti strategi. Hari ini mencoba scalping, besok beralih ke swing trading, lalu lusa ikut-ikutan sinyal orang lain. Hasilnya justru membuat saya semakin bingung dan tidak mendapatkan hasil yang maksimal. Dari pengalaman itu, saya belajar bahwa strategi terbaik bukanlah yang terdengar paling hebat atau rumit, melainkan strategi yang bisa dijalankan dengan konsisten sesuai karakter pribadi. Ada Cuaners yang lebih nyaman dengan gaya trading cepat, sementara ada pula yang memilih menunggu peluang lebih lama dengan sabar. Keduanya bisa sama-sama berhasil asalkan dijalankan dengan disiplin. Sebelum diterapkan secara serius, strategi perlu diuji coba terlebih dahulu di akun demo, kemudian dievaluasi lewat catatan trading. Dengan cara itu, kita tahu kapan strategi bekerja dengan baik dan kapan harus berhati-hati. Saya sendiri sering membagikan cerita tentang strategi sederhana yang ternyata bisa sangat efektif. Misalnya, hanya dengan menggunakan candlestick dan Moving Average. Kesederhanaan justru menjadi kekuatan, karena mudah dipahami, mudah dipraktikkan, dan lebih sedikit membuat bingung. Mind: Mental Adalah Penentu Hasil Akhir Banyak trader yang jatuh bukan karena modal atau strategi, melainkan karena mental yang tidak siap. Saya pun pernah mengalaminya. Ada kalanya posisi trading saya floating minus, lalu saya panik dan buru-buru cut loss. Tidak lama setelah itu, harga malah berbalik arah ke posisi yang saya harapkan. Ada juga saat di mana saya terlalu serakah. Profit sudah terbuka, tapi saya tidak mengamankannya, hingga akhirnya pasar berbalik dan keuntungan itu hilang begitu saja. Dari pengalaman-pengalaman itu, saya sadar bahwa trading adalah maraton, bukan sprint. Tujuannya bukan mengejar keuntungan besar sekali jalan, melainkan membangun keuntungan kecil namun konsisten. Filosofi santuy tapi tetap cuan sangat relevan di sini. Dengan mental yang kuat, Cuaners bisa lebih tenang. Kita sudah memiliki rencana sebelum masuk pasar, sehingga apa pun hasilnya, kita tidak mudah goyah. Mengapa Filosofi 3M Cocok untuk Trader Indonesia? Bagi trader Indonesia, filosofi 3M menjadi fondasi yang sangat penting. Banyak trader pemula di Indonesia sering terjebak pada pola yang sama: terlalu cepat masuk pasar karena tergoda sinyal instan, melakukan overtrading tanpa perhitungan, atau panik saat posisi floating loss lalu buru-buru cut loss. Semua kebiasaan ini biasanya muncul karena tidak ada disiplin dalam mengelola modal, strategi yang tidak teruji, dan kontrol emosi yang lemah. Padahal, pasar finansial penuh risiko yang bisa menguras modal dalam hitungan menit. Inilah sebabnya 3M Money, Method, dan Mind harus dipahami sejak awal agar perjalanan trading tidak hanya soal profit sesaat, tetapi juga keberlangsungan jangka panjang. Filosofi ini ibarat pondasi rumah: jika kokoh, trader bisa menghadapi badai pasar dengan lebih tenang dan terarah. Agar perjalanan ini semakin jelas arahnya, saya ingin berbagi sedikit tips sederhana. Mulailah setiap transaksi dengan menghitung risiko yang masuk akal, jangan sampai mengorbankan lebih dari dua persen modal. Lalu pilihlah satu strategi yang sesuai dengan karakter Cuaners, jalankan secara konsisten tanpa mudah tergoda mencoba strategi baru setiap hari. Dan yang terakhir, latihlah mental agar tetap tenang, jangan terbawa emosi. Trading bukan sprint, melainkan perjalanan panjang. Profit kecil yang konsisten jauh lebih sehat daripada keuntungan besar sekali lalu hilang dalam sekejap. Trading memang penuh tantangan, tapi juga bisa menyenangkan jika dijalani dengan filosofi yang tepat. Bagi saya, 3M = Money, Method, Mind adalah fondasi yang menjaga keseimbangan antara modal, strategi, dan mental. Dengan dukungan aplikasi Dupoin, saya merasakan betul bagaimana filosofi ini bisa diterapkan. Ada akun demo untuk belajar, ada edukasi trading, ada analisa harian, dan ada live trading yang semuanya membantu saya mengelola modal, memperkuat strategi, dan menjaga kestabilan mental. Semua itu membuat saya yakin bahwa Dupoin bukan sekadar aplikasi, melainkan bagian dari gaya hidup trader yang modern dan sehat. Untuk semua Cuaners, ingatlah bahwa profit hanyalah hasil. Proseslah yang menentukan. Selama kita menjaga keseimbangan 3M, trading tidak lagi menjadi beban, melainkan bagian dari perjalanan santuy menuju cuan yang konsisten. Selamat mencoba Cuaners!

-

I would really like to see these two courses, if anyone has it please upload it. I would be so grateful; we have to help each other learn the best we can. 1- Matt Caruso – The Active Growth Investor 2- IBD IPO Home Study course I have over 400 audio and pdf books in my collection for trading and investing, you help me to get this course I will l help you get some the books you want in helping me. Thank you.

-

fxtrader99 reacted to a post in a topic:

ai.thealgotrader.live

fxtrader99 reacted to a post in a topic:

ai.thealgotrader.live

-

The E-Mini S&P Liquidity Sweep System - Ninjacators

roddizon1978 replied to ⭐ sean2003's topic in Tradestation Forum

we discuss and posted this already here -

fxzero.dark reacted to a post in a topic:

TradeSaber Predator X 3.0.1.1 LT

fxzero.dark reacted to a post in a topic:

TradeSaber Predator X 3.0.1.1 LT

-

⭐ shawnh started following Advanced GET with real-time data feed?

-

Has anybody out there had any success putting together an Advanced GET platform (any version), with a working real-time datafeed (such as MetaTrader)? I've been feeding AGet v9.1 EOD with exported intraday csv data files from MetaTrader, but I am getting pretty tired of closing/reopening AGet everytime to refresh the charts. If so, are the necessary pieces available here on the forum to cobble it all together? Thanks!

-

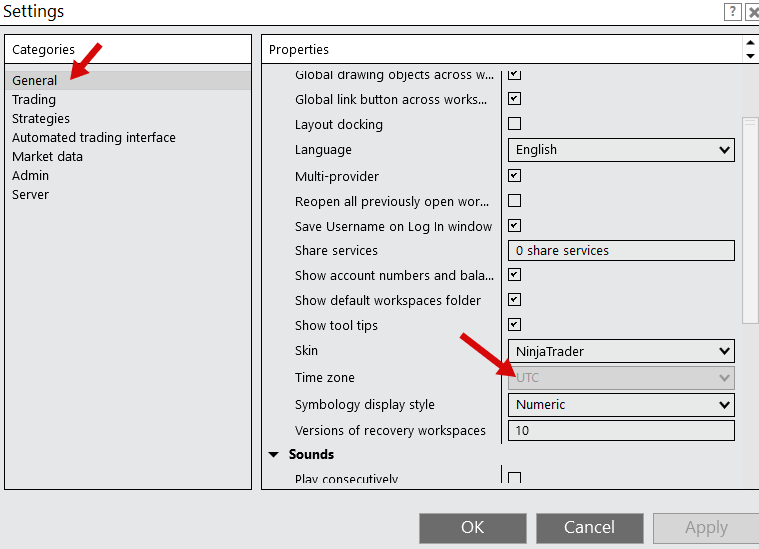

8.1.5.2 64-bit unable to change timezone it is grayed out

⭐ rcarlos1947 replied to ⭐ rcarlos1947's topic in Ninja Trader 8

@mmicro I have another computer on the same feed running NT8 8.1.4.1 and works fine, no issues. Thank you for your input. @aotegaoteg I have several templates that I created and have used, but the problem remains. Thank you for taking the time to respond. @roddizon1978 Yes, that is the Ninjatrader support recommended procedure, but also no resolution. I also thank you for responding. @Gretta You may have given me some insight as the computers I upgraded are all educated NT8, by two distinct educators. Even though the educated products I purchased from them work, there were several shared on this forum that were not educated but shared with @apmoo to fix, but worked as is on NT8 8.1.4.1, but no longer work on NT8 8.1.5.2. This leads me to believe that changes have been made to the licensing method. @fryguy1 may have been on to something about something in a folder in documents/Ninjatrader 8. In the Config.xml file there is a line: NT8 8.1.5.2 "<TimeZoneInfoSerializable>UTC</TimeZoneInfoSerializable>" If I edit using Notepad to the line in: NT8 8.1.4.1 "<TimeZoneInfoSerializable> />" The charts display the correct hours/minutes for my timezone. The Settings remain with TimeZone UTC grayed out, but I can choose any timezone on the chart and it will display correctly. The only glitch I have found so far is with one educator's fix, everything works correctly. With another educator's fix, I lose all my sim accounts and am not able to add any sim accounts. Again, thank you all for responding and keep throwing out ideas, maybe WE can find a work around, or be stuck with NT8 8.1.4.1 forever.👏 -

8.1.5.2 64-bit unable to change timezone it is grayed out

Gretta replied to ⭐ rcarlos1947's topic in Ninja Trader 8

This happened to me using a cracked version of NT by a certain "educator." When I removed his crack, the terminal was restored to normal. His crack froze the time zone adjustment for some reason and there was nothing he could do about it. -

8.1.5.2 64-bit unable to change timezone it is grayed out

roddizon1978 replied to ⭐ rcarlos1947's topic in Ninja Trader 8

Please use the steps below to synch your PC clock and delete your historical data: Please use the steps provided below to sync the PC clock: Close NinjaTrader Right click on your time->Adjust Date/Time Click "Sync Now" Once successfully synched open Documents->NinjaTrader 8 Open the db folder Delete the cache, day, minute and tick folders Restart NinjaTrader Let me know if I may be of further assistance. - Yesterday

-

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

Darryl 2030 joined the community

-

Please upload new fixed version thanks mate.

-

Does anyone have any experience with this? Looks like an ES 1-minute scalping system, claiming to make 11 points/day. They are asking $ 5,000, which is way overpriced, in my opinion. https://ninjacators.com/shop/premier-programs/the-e-mini-sp-liquidity-sweep-system-founding-member-edition/?srsltid=AfmBOormdsBG17Z3de-o3wKRcOZtFiN-21c7YH-0p3ELu9HJeU2Y9Gkr

-

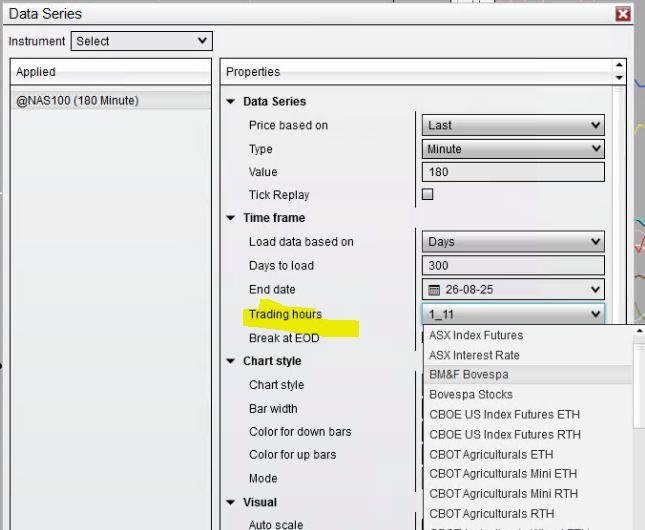

8.1.5.2 64-bit unable to change timezone it is grayed out

⭐ aotegaoteg replied to ⭐ rcarlos1947's topic in Ninja Trader 8

timezone are determine in the data Series of the chart you will first need to create it using the template -

MrAdmin reacted to a post in a topic:

Should we join forces with TGF Community? [Answer please]

MrAdmin reacted to a post in a topic:

Should we join forces with TGF Community? [Answer please]

-

8.1.5.2 64-bit unable to change timezone it is grayed out

mmicro replied to ⭐ rcarlos1947's topic in Ninja Trader 8

It may not be ninja, but maybe your computer location services. I heard it can cause issues! -

Trader809 joined the community

-

please share again brother i need this course

-

japne66 joined the community

-

nikunj joined the community

-

raj1301 reacted to a post in a topic:

ai.thealgotrader.live

raj1301 reacted to a post in a topic:

ai.thealgotrader.live

-

Playr101 reacted to a post in a topic:

ai.thealgotrader.live

Playr101 reacted to a post in a topic:

ai.thealgotrader.live

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Double Top pattern increases downside risk for USDJPY The USDJPY rate shows moderate growth, but ongoing expectations of BoJ tightening may intensify pressure on the US dollar. The current quote is 147.73. Discover more in our analysis for 26 August 2025. USDJPY technical analysis The USDJPY rate is retreating from a strong resistance level at 148.00 while staying within the ascending channel. The current dynamics point to a high probability of a correction towards the channel’s lower boundary at 146.70. The current USDJPY fundamentals reflect continued pressure on the US dollar and short-term downside risks. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

US 500 forecast: after rebounding from support, the index aims to hit its new all-time high The US 500 remains in an uptrend, with quotes poised to break above the resistance level. The US 500 forecast for today is positive. US 500 forecast: key trading points Recent data: US initial jobless claims came in at 235 thousand last week Market impact: this has a dual effect on the US stock market Fundamental analysis US initial jobless claims stood at 235 thousand last week, above the forecast of 226 thousand and the previous reading of 224 thousand. The rise in claims indicates some weakening of the labour market. Higher applications may signal a slowdown in economic activity. Signs of labour market cooling can ease pressure on the Federal Reserve to tighten monetary policy further, supporting expectations of stable or even lower interest rates. For the US 500, this data may trigger a mixed reaction in the short term. The technology and growth sectors may benefit, as they gain from prospects of looser monetary policy, while consumer-focused sectors may come under pressure due to expectations of weaker purchasing power. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 306 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

⭐ RichardGere reacted to a post in a topic:

ai.thealgotrader.live

⭐ RichardGere reacted to a post in a topic:

ai.thealgotrader.live

-

⭐ RichardGere reacted to a post in a topic:

ai.thealgotrader.live

⭐ RichardGere reacted to a post in a topic:

ai.thealgotrader.live

-

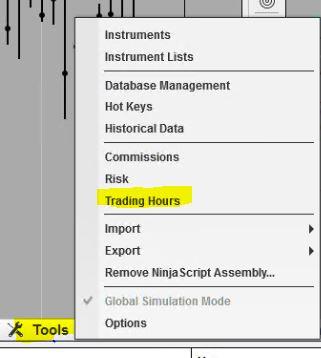

8.1.5.2 64-bit unable to change timezone it is grayed out

⭐ rcarlos1947 replied to ⭐ rcarlos1947's topic in Ninja Trader 8

@roddizon1978@fryguy1 Thank you both for responding. This is what it looks like in settings/tools: I looked in program files/ninjatrader and did not find any ini file. I'm surprised this is not a common problem cause it happened in 3 different computers. I may have to back out of 8.1.5.2 64-bit and fall back to 8.1.4.1-64 bit.