⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Past hour

-

Anyone has TDU VIDYA educated its the only TDU indicator I cant find educated thanks. https://workupload.com/file/xHWwUZmznT9 TDUVIDYa.zip

- Today

-

Can someone please share some knowledge about how to educate/crack/Unlock Indicators and software For knowledge purposes

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date: 4th December 2025. Global Markets Update: US Data Fuels Rate-Cut Hopes as Japan Edges Toward Tightening. US markets continued to react positively to signs of a cooling labour market on Wednesday, as a surprisingly weak ADP employment report reinforced expectations that the Federal Reserve could deliver another 25 bp rate cut at its 10 December meeting. ADP private payrolls fell by 32,000, far below forecasts, adding to speculation that policymakers may feel comfortable easing again. The data helped extend the rally in Treasuries. Yields erased their overnight gains and moved lower across the curve, with the 2-year declining to 3.483%, back below the 3.50% threshold, while the 10-year slipped to 4.058%. The drop in yields provided a tailwind for equities: Dow Jones: +0.86%, approaching its record high from mid-November S&P 500: +0.30% Nasdaq: +0.17%, held back by early weakness in big tech Microsoft was a notable drag after reports suggested the company had reduced AI-related sales targets, though later denials helped the stock stabilise. Meanwhile, the latest ISM Services PMI painted a mixed picture but did little to change expectations for policy easing next week. Asia: Markets Mixed as Bank of Japan Prepares to Shift Gears Asian equities delivered a mixed performance on Thursday, even as US markets hovered near record highs. The focus in the region centred squarely on Japan, where Bank of Japan Governor Kazuo Ueda has been quietly preparing political leaders for the country’s first rate hike in years. Ueda reportedly stressed the risks of a persistently weak yen and rising inflation during discussions with Prime Minister Sanae Takaichi, who just last year referred to rate hikes as ‘stupid.’ The diplomatic effort appears to have worked, markets now view a December hike to 0.75% as almost certain and believe political resistance to tightening is diminishing. However, the bigger uncertainty lies in the BOJ’s long-term rate trajectory, particularly as there is little clarity around where Japan’s neutral interest rate sits. The uneasy balance between political expectations and monetary policy will likely keep Japan’s bond market volatile. Japanese Bond Yields Hit 17-Year Highs The shift in expectations has pushed the 10-year JGB yield to 1.92%, its highest level since 2007. Analysts warn that yields near these levels may prompt Japanese banks to revisit their long-term bond strategies. The move comes amid broader global bond-market jitters and ahead of the BOJ’s key meeting on 18-19 December. 30-year JGB yield briefly touched 3.44%, a record high, before easing after a well-received government auction. Strong demand came from pension funds and foreign investors, even as domestic insurers remained cautious. Asia-Pacific Market Snapshot Nikkei 225: +2.3% to 51,028.42, approaching its all-time high. Gains were supported both by expectations of a Fed rate cut and speculation about BOJ tightening. SoftBank Group: +9.2% after its founder reiterated plans to prioritise AI investments following the exit from Nvidia. Despite the jump, shares remain down nearly 28% over the past month. Hang Seng: +0.5%, reversing earlier losses on strength in tech and consumer stocks. Shanghai Composite: −0.1% Kospi: −0.2%, as tech and autos weighed on the index ASX 200: +0.3%, recovering mid-session Taiex: flat India Sensex: +0.2% US futures were slightly higher in early Thursday trading. US Market Recap: Stocks Edge Closer to Records The broader US market continued edging towards new highs: S&P 500: +0.30%, now within 0.6% of its record Dow Jones: +0.9% Nasdaq: +0.2% Semiconductor names led the charge, Microchip Technology surged 12.2% after forecasting stronger-than-expected profit and sales, and Marvell Technology rose nearly 8% on solid earnings. Treasury yields continued to ease: the 10-year slipped to 4.06%, extending the move lower sparked by the weak ADP report. Bitcoin also rebounded strongly, climbing back above $93,000 after last month’s slide below $81,000. Oil prices firmed modestly early Thursday: WTI crude: $59.40 (+$0.45) Brent: $63.07 (+$0.40) The US dollar softened slightly, slipping against major currencies except the yen. FX Market Spotlight: Sterling Surges on Strong UK Data The British pound delivered its strongest one-day rally since April, jumping 1.1% against the US dollar on Wednesday. Sterling held those gains early Thursday, trading near $1.335, its highest level in over a month. The move came as UK business activity surprised to the upside: UK Composite PMI (Nov): 51.2 (forecast: 50.5) The upbeat data supported the view that economic momentum is stabilising, easing concerns surrounding last week’s Budget. Strategists at Bank of America and MUFG highlighted that the rally reflected both stronger data and the unwinding of negative positions built up ahead of the Budget announcement. The dollar’s softness was amplified by the weak US payrolls data and renewed speculation around the Federal Reserve leadership, after President Trump signalled that Kevin Hassett may be nominated as the next Fed Chair, fuelling expectations of faster rate cuts. The DXY fell 0.5% on the day. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Andria Pichidi HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Brent prices stuck in a sideways range Brent quotes show moderate growth, rising to the 63.00 USD area despite an increase in US crude oil inventories according to EIA data. Discover more in our analysis for 4 December 2025. Brent forecast: key trading points Market focus: US crude oil inventories rose by 0.57 million barrels last week Current trend: moving within a sideways range Brent forecast for 4 December 2025: 65.00 or 61.00 Fundamental analysis Brent prices climbed to 63.00 USD per barrel on Thursday, extending gains from the previous session. The move was supported by Ukrainian attacks on Russian oil infrastructure and stalled peace negotiations, which reduced expectations of a recovery in Russian supply. The US has also increased threats against Venezuela’s oil sector, adding to the geopolitical risk premium. However, crude prices remain capped by weak demand and potential oversupply. This is confirmed by EIA data showing a 0.57 million barrel increase in US crude inventories last week, along with rising gasoline and distillate stocks. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 376 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

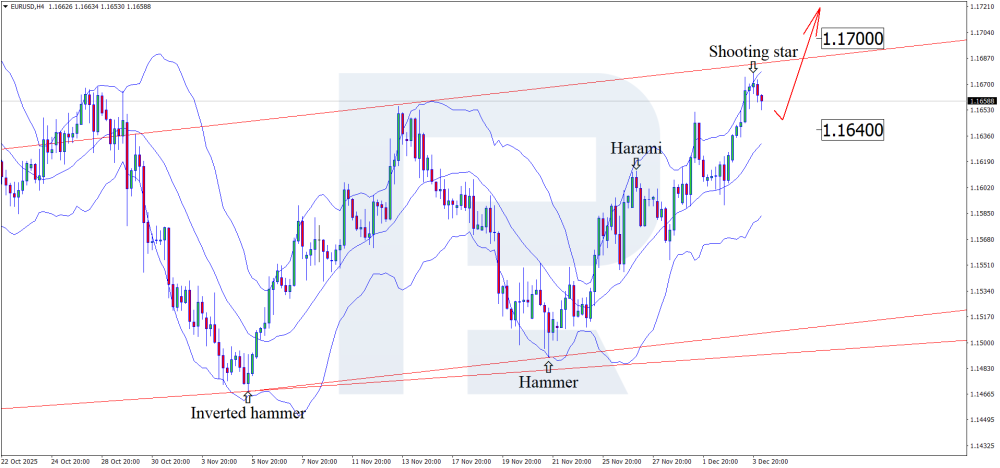

EURUSD poised for new highs Rising unemployment in the US supports the strengthening of the euro, with the EURUSD pair moving towards 1.1700. Discover more in our analysis for 4 December 2025. EURUSD technical analysis On the H4 chart, the EURUSD pair formed a Shooting Star reversal pattern near the upper Bollinger Band. At this stage, the price may extend a downward wave following the signal. The EURUSD outlook favours the euro. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Ninja448 reacted to a post in a topic:

NQ Ultra - Futures Trading Bot // https://tradegreater.com/

Ninja448 reacted to a post in a topic:

NQ Ultra - Futures Trading Bot // https://tradegreater.com/

-

some important Forex Advice

CryptoFluxor replied to Money Morkel's topic in General Forex Discussions

Successful forex trading depends on disciplined risk management, consistent position sizing, and avoiding overleveraging. Focus on one or two currency pairs, follow economic calendars, and rely on a tested strategy. Keep emotions controlled, use stop-loss orders, and review trades regularly to refine your approach and maintain long-term stability in markets. -

The Stock Trader’s Almanac 2026 offers historical market patterns, seasonal trends, monthly tendencies, and key calendar indicators. It highlights election-cycle effects, sector behavior, and statistical studies that help traders plan. Its data-driven insights support disciplined strategies and improve awareness of recurring market tendencies, useful for both new and experienced investors.

-

Centralized exchanges (CEXs) are run by companies that hold user assets and match trades internally. Decentralized exchanges (DEXs) use smart contracts, letting users keep control of their keys. CEXs offer convenience; DEXs offer autonomy. LMGX, like any token, may appear on either type depending on listings and available liquidity.

-

To convert files from epub to pdf, you can use these free websites: https://convertio.co/it/epub-pdf/ https://www.freepdfconvert.com/it/epub-in-pdf https://www.pdf2go.com/it/epub-in-pdf https://www.freeconvert.com/it/epub-to-pdf

-

There is no new update, and new Indo user with only 1 or 3 post should really stop asking here. Crack is unlikely since update and software now requires live logon account each use. Suggest you use old version.

-

⭐ traderwin started following SMM Metrics Time filter refined

-

techfo reacted to a post in a topic:

QuantVue QkronosEVO

techfo reacted to a post in a topic:

QuantVue QkronosEVO

-

Sedurajan joined the community

-

Cho mình hỏi chưa có file cài đặt MT20 hả các bạn?

-

can you post it here

-

Ninza Williams Fractal Pro & Ninza DWIN Reversal

sudheer4066 replied to ngatho254's topic in Ninja Trader 8

Is there any way for both old and new indicators working by any chance I have both new and old resources files -

raj1301 reacted to a post in a topic:

livewireindicators.com

raj1301 reacted to a post in a topic:

livewireindicators.com

-

raj1301 reacted to a post in a topic:

TradingSecretsAIChannels_NT8_1008b needs to fix

raj1301 reacted to a post in a topic:

TradingSecretsAIChannels_NT8_1008b needs to fix

-

It's an Epub , convert it to PDF calibre - Download calibre

-

⭐ ne0t reacted to a post in a topic:

Stock Traders Almanac 2026

⭐ ne0t reacted to a post in a topic:

Stock Traders Almanac 2026

-

Pls which vasion is working fine ? Pls

-

alexstar3224 reacted to a post in a topic:

Praedox 2.0 - Trader's Assistant

alexstar3224 reacted to a post in a topic:

Praedox 2.0 - Trader's Assistant

-

⭐ FredUrble reacted to a post in a topic:

Stock Traders Almanac 2026

⭐ FredUrble reacted to a post in a topic:

Stock Traders Almanac 2026

-

Bene reacted to a post in a topic:

Can someone please unlock the indicator?

Bene reacted to a post in a topic:

Can someone please unlock the indicator?

- Yesterday

-

edwills joined the community

-

TradingSecretsAIChannels_NT8_1008b needs to fix

⭐ rcarlos1947 replied to TRADER's topic in Ninja Trader 8

Surprisingly, the indicator chose to expose the 4 type of signals used to manually enter a trade using its trade panel. On the surface, there are many false signals which result in losses. But they also added 2 additional signals (Up/Down) which are exposed but not painted on the chart (Transparent). Theoretically these can be used to filter out many of the false signals. Knowing that these signals are available should allow us to automate the trades using StrategyBuilder, Predator, Wizdough, Shark Indicators, or whatever tickles your fancy. Enjoy !! -

AllIn reacted to a post in a topic:

livewireindicators.com

AllIn reacted to a post in a topic:

livewireindicators.com

-

Same, works

-

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

⭐ laser1000it reacted to a post in a topic:

Metastock 18 end of day c*****d.

⭐ laser1000it reacted to a post in a topic:

Metastock 18 end of day c*****d.

-

stickyfingaz joined the community

-

The link is still working. Do not click the link. Just copy link and paste. Then change the characters hxxp to http and medi@fire to mediafire.

-

@vinpipercan you post it again

-

bump

-

TradingSecretsAIChannels_NT8_1008b needs to fix

ngatho254 replied to TRADER's topic in Ninja Trader 8

bump -

I think we can get a lot of good resources on the youtube as well because internet has fundamentally changed everything.