⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Past hour

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

[B]Date: 30th September 2025.[/B] [B]US Stock Futures Flat as Shutdown Looms; Gold Prices Hit Record High.[/B] US stock futures held near unchanged levels on Tuesday, with investors bracing for the possibility of a US government shutdown as early as Wednesday. Futures tied to the Dow Jones Industrial Average, the S&P 500, and the Nasdaq 100 were little changed. A Monday meeting between PresidentDonald Trump and Democratic leaders ended without progress on a funding deal, leaving Congress until 12:01 a.m. ET on Wednesday to avert a shutdown. Vice President JD Vance warned after the talks: ‘I think we’re headed to a shutdown.’ If the government closes, the Bureau of Labour Statistics (BLS) will cease operations, delaying critical data releases on jobs and inflation. This comes at a sensitive time for the Federal Reserve, which is weighing further interest rate cuts. Only one of the agency’s 2,055 employees would remain active during the shutdown. The immediate focus is whether the September jobs report, due Friday, will be released. With the Fed having already delivered its first rate cut of the year, investors are counting on this report to guide expectations for more cuts. However, divisions among policymakers and mixed data have already cast doubt on a clear path forward. Despite political deadlock and new tariffs announced Monday, Wall Street managed modest gains to start the week. Investors are also watching for Nike’s earnings after Tuesday’s close, along with the latest job openings data from the BLS. Asian Markets Trade Cautiously Asian equities were mostly flat on Tuesday as markets prepared for the potential impact of a US shutdown. Japan’s Nikkei 225 edged down less than 0.1% to 45,023.48. Hong Kong’s Hang Seng Index was steady at 26,624.16. China’s factory activity data disappointed, signalling persistent weakness as trade tensions with the US weigh on exports. Shanghai Composite Index rose 0.4% to 3,878.88. Australia’s ASX 200 gained 0.1%, while South Korea’s Kospi rose 0.2%. While past shutdowns had minimal market impact, analysts warn that this one could delay critical economic data, adding fresh uncertainty. Some also note that the administration may pursue large-scale federal layoffs, amplifying risks. Stephen Innes of SPI Asset Management commented: ‘It feels as though traders have picked apart every angle of the shutdown story, but with less than a day before Washington shuts down, the theme refuses to die.”’ Wall Street Recap: Tech Stocks Lead Gains On Monday, Wall Street closed higher as technology stocks rebounded. S&P 500 rose 0.3% to 6,661.21. Dow Jones Industrial Average added 0.1% to 46,316.07. Nasdaq Composite climbed 0.5% to 22,591.15. Amazon gained 1.1% after sharp losses last week, while Microsoft rose 0.6%, helping lift the broader market. The focus now turns to Friday’s nonfarm payrolls report, which could sway the Fed’s rate-cut path. Strong job numbers may reduce the likelihood of further cuts, while weak data could heighten recession fears. Separately, Electronic Arts (EA) surged 4.5% after confirming a $55 billion all-cash buyout, the largest deal of its kind to take a company private. Gold Prices Hit Another Record High Gold prices continued their record-breaking rally on Tuesday, extending Monday’s surge as the looming US government shutdown added to economic uncertainty. Spot gold jumped as much as 0.9% to $3,867.25 per ounce, surpassing the previous session’s record close. The lack of progress in Washington has fueled fears that a shutdown could block the release of crucial data, complicating the Fed’s monetary policy decisions ahead of its next meeting. Meanwhile, industry news added to gold market focus: Newmont Corp. confirmed the departure of CEO Tom Palmer at year-end, while Barrick Mining Corp. announced the surprise exit of Mark Bristow. Both companies are the world’s largest gold producers. Gold has surged 47% year-to-date, on pace for its biggest annual gain since 1979, driven by central-bank buying and Fed rate cuts. Analysts at Goldman Sachs and Deutsche Bank expect the rally to extend further. US Treasuries gained on Monday, while the US dollar weakened, supporting bullion. Lower bond yields make non-yielding assets like gold more attractive, and a softer dollar reduces costs for global buyers. Silver, Platinum, and Palladium in Focus Other precious metals saw mixed trading on Tuesday: Silver and platinum paused after multi-year highs but remain up 63% and 76% year-to-date. Palladium held firm, supported by supply shortages. Tight markets have driven lease rates for silver, platinum, and palladium sharply higher, signaling dwindling inventories in London. Inflows into ETFs backed by these metals have added to the supply crunch. Oil and Currency Markets In energy trading, crude oil prices slipped: WTI crude fell 45 cents to $63.00 per barrel. Brent crude declined 51 cents to $66.58 per barrel. In currency markets: The US dollar eased to 148.54 yen from 148.60. The euro slipped to $1.1725 from $1.1727. Markets remain on edge as the US shutdown deadline approaches, with gold prices surging to record highs, US stock futures flat, and global markets cautious. Investors now await Friday’s jobs report, which could shape the Fed’s path on interest rate cuts and set the tone for the weeks ahead. [B]Always trade with strict risk management. Your capital is the single most important aspect of your trading business.[/B] [B]Please note that times displayed based on local time zone and are from time of writing this report.[/B] Click [URL='https://www.hfm.com/hf/en/trading-tools/economic-calendar.html'][B]HERE[/B][/URL] to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click [URL='https://www.hfm.com/en/trading-tools/trading-webinars.html'][B]HERE[/B][/URL] to register for FREE! [URL='https://analysis.hfm.com/'][B]Click HERE to READ more Market news.[/B][/URL] [B]Andria Pichidi HFMarkets[/B] [B]Disclaimer:[/B] This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Brent falls into the hands of the bears: rising supply signals nothing good Brent slipped to 66.42 USD per barrel. The market is filled with negativity ahead of additional supply entering the market. Discover more in our analysis for 30 September 2025. Brent forecast: key trading points Brent crude declines under pressure from geopolitics and OPEC+ rhetoric Additional supply on the global market will push prices down even faster Brent forecast for 30 September 2025: 65.40 Fundamental analysis Brent crude fell to 66.42 USD per barrel on Tuesday, extending the decline of the previous session. Prices are under pressure from expectations of increased global supply and discussions of a possible ceasefire in Gaza. Media reports suggest that at Sunday’s meeting, OPEC+ may approve an additional output increase of at least 137,000 barrels per day starting in November. Another factor was the resumption of oil exports from Iraqi Kurdistan. Flows through the Iraq–Turkey pipeline were restored on Saturday after a US-brokered agreement between regional authorities, Baghdad, Turkey, and foreign companies. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 330 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Head and Shoulders pattern formation threatens EURUSD bulls The EURUSD rate continues to strengthen amid pressure on the US dollar and growing expectations of further Fed easing. The rate currently stands at 1.1741. Find out more in our analysis for 30 September 2025. EURUSD technical analysis While the EURUSD rate remains within an upward channel, the current strengthening is capped by the resistance zone near 1.1745. The chart shows the formation of a Head and Shoulders reversal pattern. Additional pressure on the pair comes from the Stochastic Oscillator signal, where the indicator lines have approached overbought territory and are showing readiness to turn downwards. Fundamental factors support euro growth; however, technical analysis of EURUSD points to a high risk of a bearish scenario with a breakout below the support level and a decline towards 1.1645. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team - Today

-

(Req) Crush Topstep’s Trading Combine PREMIUM

Robin replied to Robin's topic in Forex Clips & Movie Request

$10 here, please share - https://cheapcourseszone.com/product/simpler-trading-crush-topsteps-trading-combine-premium -

Bambang Sugiarto reacted to a post in a topic:

Is Broker X faster at executing orders than Broker Y?

Bambang Sugiarto reacted to a post in a topic:

Is Broker X faster at executing orders than Broker Y?

-

⭐ laser1000it reacted to a post in a topic:

Metastock 18 end of day c*****d.

⭐ laser1000it reacted to a post in a topic:

Metastock 18 end of day c*****d.

-

-

Puzzle reacted to a post in a topic:

Metastock 18 end of day c*****d.

Puzzle reacted to a post in a topic:

Metastock 18 end of day c*****d.

-

Puzzle reacted to a post in a topic:

Metastock 18 end of day c*****d.

Puzzle reacted to a post in a topic:

Metastock 18 end of day c*****d.

-

A better chart of S&P500: https://workupload.com/file/uS2DFBXvVp2

-

(Req) Crush Topstep’s Trading Combine PREMIUM

roddizon1978 replied to Robin's topic in Forex Clips & Movie Request

Cost $34 , Willing to buy and share for $10 -

FredUrble you can convert Metastock legacy data in the new format MSLocal with the Downloader 18.

-

Image of S&P500 Metastock 18 chart: https://workupload.com/file/QzWx3MGTRwe Please upload Metastock 19 Real Time!

-

I already have some legacy data but it has a limited description field of 18 characters. I'm told the MSLocal format has been enhanced and updated and assume it will capture longer descriptions as well as possibly other new features. I was trying to find a copy of data in MSLocal format to analyze the files.

-

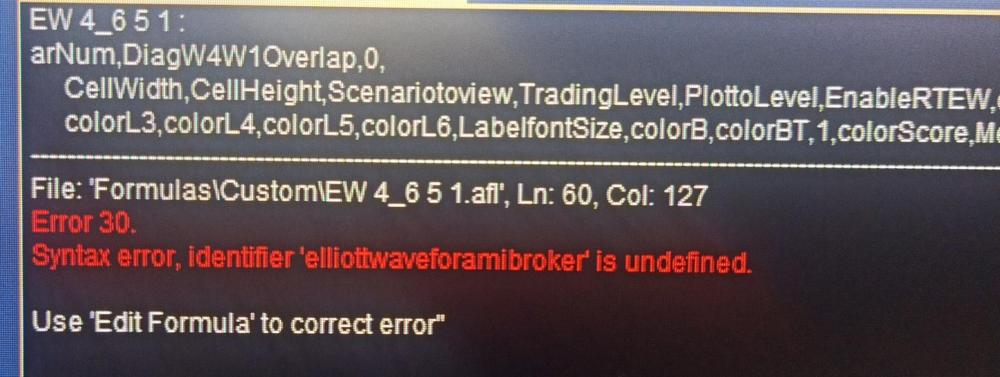

elliottwaveforamibroker.com indicator - require decompile

⭐ Atomo12345 replied to omrangassan's topic in Amibroker

Please if you are intersted in Metastock 18 EOD c*****d, go to this link: https://indo-investasi.com/topic/96972-metastock-18-end-of-day-cd/ -

You can use the Downloader of Metastock 11 to update the data of Metastock 18.

-

One's Text File format to import data via Downloader should be <TICKER>,<PER>,<DTYYYYMMDD>,<TIME>,<OPEN>,<HIGH>,<LOW>,<CLOSE>,<VOL>,<OPENINT> TEST,D,20050601,000000,60.0000,61.8000,59.6600,60.7700,34442,0 or <TICKER>,<NAME>,<DATE>,<OPEN>,<HIGH>,<LOW>,<CLOSE>,<VOLUME>,<OI> Also check

-

It works very well. FredUrble you can use the legacy Metastock data in Metastock 18. It works also with the same data of Metastock 11. Please I repeat. If someone have Metastock 18 or 19 Real Time trial post it in this forum and the emulator ,I think, works also for them. Thank you very mutch.

-

elliottwaveforamibroker.com indicator - require decompile

⭐ Atomo12345 replied to omrangassan's topic in Amibroker

I simulated to put the EWcount.dll 64 bit in the folder Plugins and I have your same error. haohaonguyen have reason you put the wrong EWcount.dll. Please put the exact file EWcount.dll 32 bit below in the link. https://workupload.com/file/ZVVUZSERBQM -

If this works, splendid. I had have been using MS11 for years.

-

Is there anyone who has data files in the new Metastock MSLocal format and can share some small sample?

-

Hi 😊 Anyone please share the course, Simpler Trading – Crush Topstep’s Trading Combine PREMIUM - https://fttuts.com/simpler-trading-crush-topsteps-trading-combine-premium Thanks!

-

elliottwaveforamibroker.com indicator - require decompile

haohaonguyen replied to omrangassan's topic in Amibroker