All Activity

- Past hour

-

appreciate it!!

-

⭐ laser1000it reacted to a post in a topic:

bd-corp-trading.com

⭐ laser1000it reacted to a post in a topic:

bd-corp-trading.com

-

Kermit 1981 reacted to a post in a topic:

Discretionary Trading - Random Thoughts

Kermit 1981 reacted to a post in a topic:

Discretionary Trading - Random Thoughts

-

does not work.

-

Kermit 1981 reacted to a post in a topic:

ninjacators E-mini Predictive Trader

Kermit 1981 reacted to a post in a topic:

ninjacators E-mini Predictive Trader

- Today

-

I respect the fact that you would want to be safe, but I am the business development manager at Quaderr. You can have a look at our website here: https://quaderr.com/ and navigate to free indicators and download the file from there if you do not trust this link.

-

it seems legit but this member just joined so check this file for viruses before you run it- just to be safe.

-

TRADER reacted to a post in a topic:

ninza.co Be$tAlligator

TRADER reacted to a post in a topic:

ninza.co Be$tAlligator

-

The real profitable traders have two things in common, one is they have focus and the second is discipline which means sticking to their plan.

-

https://whop.com/sbs-autotrader/?pass=prod_sGe2O1yKQ5kCH I was wondering if anyone has the latest version of the SBS Autotrader available. If so, I’d really appreciate it if you could share

-

There are also some digital tokens like $lmgx which can be collected at cheaper prices and can hold for future to sell it on higher prices. The point is simple that the earning money is not limited to mining only. We can trade assets on forex brokers, buy or sell the spot cypto and can buy some digital assets directly from their ico phase beside the mining operations.

-

IF you go here https://discord.gg/BRfvbd9N Our group have all the indicators you r looking for - including all the ninzas. Happy Trading!

-

Discretionary Trading - Random Thoughts

⭐ rcarlos1947 replied to ⭐ rcarlos1947's topic in Ninja Trader 8

@iamhtkr, Thank you for pointing that out. -

Kermit 1981 reacted to a post in a topic:

APMO please ADTS

Kermit 1981 reacted to a post in a topic:

APMO please ADTS

-

Quaderr started following Free NinjaTrader 8 Indicators

-

Greetings to all members. To gain access to amazing free indicators for NinjaTrader 8 simply visit: https://quaderr.com/free-indicators/ Choose from 13 Free indicators and once downloaded you will also receive an email with a $50 store credit to redeem on any lifetime license of any product. To get you started, find below the file for Quaderr VWAP, a free indicator from Quaderr. QuaderrVWAP.zip

-

Quaderr changed their profile photo

-

Quaderr joined the community

-

Hello, Can you resend please?

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDJPY crashes amid Japan’s export boom The USDJPY pair continues to move within a strong bearish impulse, with the price currently at 143.57. Find more details in our analysis for 21 May 2025. USDJPY forecast: key trading points Japan’s exports rose 2% year-on-year in April Japan’s trade balance for April showed a deficit of 115.85 billion yen Markets are watching for a possible meeting between the Japanese and US finance ministers USDJPY forecast for 21 May 2025: 141.45 Fundamental analysis The USDJPY rate is falling for the seventh consecutive trading session, supported by strong Japanese trade data. In April, exports rose by 2% year-on-year to 9.157 trillion yen, marking the seventh straight month of export growth, although at the slowest pace in that period. The yen also gained support from a narrowing trade deficit. In April 2025, Japan’s trade balance recorded a shortfall of 115.85 billion yen, significantly better than the 504.69 billion yen deficit a year earlier. However, the result still fell short of market expectations for a surplus. Market participants are closely watching for a potential meeting between Japan’s Finance Minister Katsunobu Kato and US Treasury Secretary Scott Bessent. The talks are expected to address currency market developments, particularly the yen’s sharp appreciation. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 243 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

GBPUSD storms highs, rising prices boost bullish sentiment The British pound continues to strengthen, with the GBPUSD rate soon likely to reach the 1.3500 level. Discover more in our analysis for 21 May 2025. GBPUSD technical analysis Having tested the lower Bollinger Band, the GBPUSD pair formed a Hammer reversal pattern on the H4 chart. The pair is now developing an upward wave in response to this signal. Since the GBPUSD pair remains within an ascending channel and given fundamental data from the UK and the US, the bullish wave is expected to continue. Positive forecasts for the British pound, together with GBPUSD technical analysis, suggest growth towards the 1.3500 resistance area. Read more - GBPUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

[b]Date: 21st May 2025.[/b] [b]Dollar Weakens Ahead of G-7 as Traders Watch for US Policy Shifts.[/b] The US dollar slipped to its lowest level in two weeks on Wednesday, as market participants turned their attention to the upcoming Group-of-Seven summit for clues on whether the Trump administration is favouring a weaker greenback. The Bloomberg Dollar Spot Index fell for a third straight session, losing 0.4% on the day. Speculation has grown after Japan’s Finance Minister, Katsunobu Kato, expressed his intent to hold currency discussions with US Treasury Secretary Scott Bessent during the G-7 meeting. South Korean officials have already confirmed that exchange rates were addressed during recent bilateral talks with the US, fueling expectations of a coordinated policy shift. Fiscal concerns are adding to the dollar’s woes. Lawmakers in Washington are working on a proposed tax cut plan that aims to keep the revenue impact within $4.5 trillion over a decade, currently estimated at $3.8 trillion. This comes on the heels of a credit downgrade by Moody’s, which cited persistent and unaddressed budget deficits as a key reason for lowering the US government's credit rating. ‘The dollar is declining in tandem with rising long-term US yields, as investors grow uneasy about financing America's twin deficits,’ said Moh Siong Sim, FX strategist at Bank of Singapore. ‘We’re likely witnessing the early stages of a broader reallocation away from overweight US positions by global investors.’ Geopolitical Tensions Lift Oil, Equities Mixed in Asia Oil prices spiked following a CNN report that suggested Israel may be preparing for a military strike on Iran’s nuclear facilities. US benchmark West Texas Intermediate crude rose $1.21 to $63.24 per barrel, while Brent crude added $1.20 to reach $66.58. The report, citing unnamed intelligence sources, said no final decision had been made by Israeli leaders, but any strike could derail ongoing nuclear negotiations and heighten instability in the Middle East—a region responsible for roughly a third of global oil supply. Asian equity markets were mixed. The Hang Seng gained 0.4%, Shanghai’s Composite edged up 0.2%, and Australia’s ASX 200 advanced 0.8%. South Korea’s Kospi rose by the same margin, and Taiwan’s Taiex climbed 0.6%. Tokyo’s Nikkei 225, however, dipped 0.1% amid ongoing trade tensions with the US Japan reported weaker trade data, with April exports to the US falling nearly 2% year-on-year. Total global export growth slowed to 2% from 4% in March, while imports from the US plunged over 11%. The country recorded a trade deficit of 115.8 billion yen ($804 million), and the yen's recent strength has further dampened export competitiveness. Vehicle exports, a core component of Japan’s trade, dropped nearly 6%. The Japanese government continues to urge Washington to remove the tariffs introduced under President Trump, particularly the 25% levy on autos and duties on steel and aluminium. Economic Revitalisation Minister Ryosei Akazawa is expected to meet with US officials this weekend in a third round of negotiations. Adding to domestic political pressures, Agriculture Minister Taku Eto resigned following controversial remarks about receiving free rice, triggering public backlash amid rising staple food prices. Wall Street Dips as Travel Stocks Lag; Quantum Firm Soars US stocks ended lower on Tuesday. The S&P 500 fell 0.4% to 5,940.46, its first decline in seven sessions. The Dow dropped 0.3%, and the Nasdaq lost 0.4%. Travel-related shares dragged the market lower, with Norwegian Cruise Line falling 3.9%, United Airlines off 2.9%, and Airbnb down 3.3%. Viking Holdings, despite better-than-expected earnings, slumped 5%. Home Depot shares slid 0.6% after quarterly earnings missed estimates, though revenue came in ahead. The company maintained its full-year guidance, contrasting with other corporations that have cited tariff uncertainty and economic headwinds as reasons to withhold forecasts. In contrast, D-Wave Quantum surged nearly 26% after launching a next-generation quantum computing platform, claiming it can tackle problems traditional computers cannot handle. Investors are watching for earnings from Lowe’s and Target today. Bonds and Currency Moves Treasury yields were little changed. The 10-year yield inched up to 4.47%, while the 2-year yield dipped slightly to 3.96%, reflecting expectations around future Federal Reserve policy. The dollar softened, trading at 144.10 yen from 144.51, while the euro climbed to $1.1307. UK & Canadian Inflation Reports Raise Stakes for June Rate Decision This morning UK inflation jumped to 3.5% y/y in the headline rate, from 2.6% y/y in the previous month, with prices rising a whopping 1.2% m/m. The later timing of Easter and the start of the new fiscal year clearly impacted the higher-than-expected number. Core inflation accelerated to 3.8% y/y from 3.4% y/y, with services price inflation hitting 5.4% y/y, up 0.7% points over the month. The wider CPIH rate accelerated to 4.1% y/y from 3.4% y/y. The higher-than-expected number backs warnings from Chief Economist Pill that inflation risks have not disappeared and is prompting traders to trim rate cut bets. Also, Canada’s April inflation data delivered a mixed picture. Headline CPI slowed to 1.7% year-over-year, the weakest since September, due to lower energy prices and the carbon tax repeal. However, core inflation surprised to the upside: the median rate climbed to 3.2% (from 2.9%), the trim rose to 3.1%, and the average core measure accelerated to 3.15%. The three-month moving average of core inflation jumped to 3.4% from 2.9%. These stronger core figures complicate the Bank of Canada’s upcoming rate decision on June 4. The central bank held rates steady at its April 16 meeting but may now face pressure to act amid persistent underlying inflation. [b]Always trade with strict risk management. Your capital is the single most important aspect of your trading business.[/b] [b]Please note that times displayed based on local time zone and are from time of writing this report.[/b] Click [url=https://www.hfm.com/hf/en/trading-tools/economic-calendar.html][b]HERE[/b][/url] to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click [url=https://www.hfm.com/en/trading-tools/trading-webinars.html][b]HERE[/b][/url] to register for FREE! [url=https://analysis.hfm.com/][b]Click HERE to READ more Market news.[/b][/url] [b]Andria Pichidi HFMarkets[/b] [b]Disclaimer:[/b] This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

⭐ epictetus reacted to a post in a topic:

eminifuturesdaytrader.com

⭐ epictetus reacted to a post in a topic:

eminifuturesdaytrader.com

-

⭐ epictetus reacted to a post in a topic:

nCatTrendLineTrader

⭐ epictetus reacted to a post in a topic:

nCatTrendLineTrader

-

⭐ epictetus reacted to a post in a topic:

snowflaketrader.com

⭐ epictetus reacted to a post in a topic:

snowflaketrader.com

-

thanks will try when have Ninja

-

@Ninja_On_The_Roof @ampfcan u plz check if this works on ur ninjatrader? @the_evil https://www.adts-trading-school.com/product/18460561/super-heikin-ashi-indicator SuperHeikinAshi.zip

-

thank for sharing and definitely like that approach you talk about. Is the link correct?

-

iamhktr reacted to a post in a topic:

Discretionary Trading - Random Thoughts

iamhktr reacted to a post in a topic:

Discretionary Trading - Random Thoughts

-

Even though it’s a demo, the competitive aspect forces you to follow your plan more strictly. That kind of mindset pays off in real trading too.

- Yesterday

-

⭐ mangrad reacted to a post in a topic:

snowflaketrader.com

⭐ mangrad reacted to a post in a topic:

snowflaketrader.com

-

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

bd_ joined the community

-

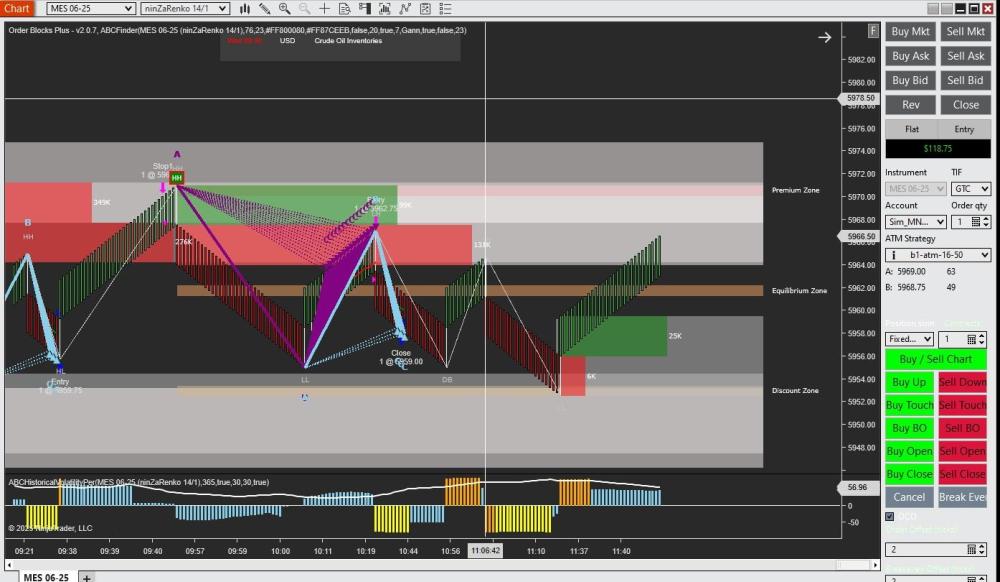

I've seen many Bots being shared and have tested a bunch using Strategy Analyzer, Playback, and Sim-real-time,but I've yet to find one that I feel I can throw real many at. Most of them have drawdowns that I can't survive, or the win/loss ratio is less than 1:1, or consecutive winners/losers is upside down. With today's volatility, any BOT or Indicator that depends on ATR, momentum, or volatility is quickly thrown into "your guess is as good as mine" mode. Volume, Delta, Buyers/Sellers, Bid/Ask etc We all know can/are be(ing) manipulated so that WE, the retail trader is usually late to the party. So with that in mind, the only recourse is to learn discretionary trading. Not an easy task since there hundreds of thousands of indicators of any flavor you want. So the challenge is decide what financial you wish to trade, start with a simple price chart or Renko chart and start adding one indicator that you feel may add clarity. Here comes the hard part, take the time required to study the behavior of the Price/indicator while in Sim mode. Keep it simple, do not add more indicators until you feel that the first one adds value after watching it for at least a week. Document what you see, where it adds value and where it fails. If it speaks to you, than go for a 2nd week but this time take Sim trades where you feel it adds value. At the end of the week, assess the metrics that are important to you. Repeat by adding another indicator until you feel that it is something you can trade. To make it more challenging for myself, I set the SIM accounts to $500, and use MES/MNQ futures. My theory is that if I can't steadily grow a small account than I revise my entry/Stops and try again until I'm convinced that the method works for Me or if not, its back to the drawing board. So now you know that I am not a successful trader and will not raise my SIM account money, because its too easy to overtrade, jump in on FOMO, trade by the seat of my pants instead of sticking to the plan. You probably guessed that I do not trade any funded accounts for the same reasons. I appreciate the tips, apps, and insights provide by the more experienced traders on this forum, but also those that have provided Bots/indicators to be educated, since many work on cracked NT8 without any tweaking. Especially to our friend @apmoo who has constantly provided packages to expand my arsenal. Thank you all for indulging my ramblings. So, to add some clarity to my ramblings, here is one example of putting together something that speaks to you. But please don't ask me for settings, templates, or whatever, because this is just one of several methods that I've looked at. The package provide by @apmoo here: https://indo-investasi.com/topic/93625-snowflaketradercom/?_rid=66590

-

bounty_hunt3r joined the community

-

It needs live and required data feed.

-

expirechicken started following ⭐ apmoo

-

expirechicken started following HFT SPECTRE AND RENKOPNF

-

For Apmoo. It uses email verification to unlock the indicator. i heard its agile.net locked. if you can, will appreciate a lot @apmoo HFT_RENKO_PNF_Import.zip HFT_SPECTRE_LITE_Import.zip