⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Past hour

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

[B]Date: 10th February 2026.[/B] [B]S&P 500 Rebounds as AI Stocks Lead Gains Ahead of Key US Economic Data.[/B] The US stock market witnesses a second consecutive day of significant gains as market sentiment improves. The S&P 500 earlier in the month fell by more than 4%, but has been regaining bullish momentum. The index has now formed a 90% correction. The upward price movement is largely due to sentiment towards technology companies and AI improvements. AI-related companies are mainly driving the bullish momentum. NVIDIA, Microsoft and Broadcom are the main drivers of the trend. Today, the US will release its latest Retail Sales figure, which will trigger some volatility for the stock market. However, the price in the medium-term will largely depend on the upcoming NFP data and US Inflation. US Jobs and Inflation Data The S&P 500 bullish trend is strongly connected to the upcoming US data, as it is likely to indicate how the Federal Reserve will set its path for interest rates. Buyers will ideally be looking for the inflation rate to decline and for employment to remain somewhat stable. Stronger employment data would allow more leeway for the Federal Reserve to make no adjustments to interest rates. Analysts are expecting the Non-Farm Employment Change to add 66,000, similar to the previous months. The US Unemployment Rateis also likely to remain at 4.4%. Analysts project the Consumer Price Index (inflation rate) to fall from 2.7% to 2.5%, the lowest in 8-months. Currently, there is only a 17% chance of an interest rate cut in March according to the Fedwatch Tool. However, the decline in inflation can prompt this statistic to move in favour of the stock market. If indeed the statistics do read as per expectations, the S&P 500 may see further bullish momentum. Another key release will also come from company earnings. Cisco and McDonald’s are due to announce their quarterly earnings report tomorrow. In 2026, Cisco stocks have risen 14% while McDonald's has risen 7%. The two companies make up almost 1% of the total S&P 500. Risks To The Stock Market Goldman Sachs’ closely watched “Panic Index” has surged to near so-called “max fear” levels, underscoring a sharp rise in investor anxiety across US equity markets. The spike reflects growing concern that the recent bout of volatility may not be over, and that a deeper sell-off could be triggered if key technical thresholds give way. According to Goldman’s analysis, positioning and sentiment indicators suggest that as much as $33 billion in equity selling could be unleashed if the S&P 500 breaks below critical support levels that many systematic and momentum-based strategies rely on. However, other indicators related to risk do not support this outlook. The VIX Index, another fear index, is trading slightly higher this morning; however, its weekly performance indicates a positive stock market. For 2026, the VIX Index has traded higher, which is concerning, but if the index continues to fall like the past week, the fear factor will decline. S&P 500 - Technical Analysis HFM - S&P 500 30-Minute Chart The price action and waves within the S&P 500 are following the traditional bullish trend pattern. Price swings continue to form higher highs and higher lows on smaller timeframes, such as the 15-Minute chart. On the 2-hour timeframe, the price is trading above the 75-Bar EMA and 100-Bar SMA, which indicates a bullish sentiment. The price also remains on the positive side of the MACD, but not above the signal line. However, if the price rises above $6,971, the bars within the MACD are likely to cross above the signal line. As a result, bullish signals are likely to strengthen. If bearish momentum gains and the price falls below $6955, bullish sentiment and technical indicators will likely fade. Key Takeaways: S&P 500 rebounds after a 4% pullback, regaining bullish momentum. AI and big tech lead gains, driven by NVIDIA, Microsoft, and Broadcom. Key US data ahead (Retail Sales, NFP, Inflation) will steer market direction. Rate-cut odds remain low, but falling inflation could boost equities. Risk signals are mixed, with panic indicators elevated but technicals still bullish. [B]Always trade with strict risk management. Your capital is the single most important aspect of your trading business.[/B] [B]Please note that times displayed based on local time zone and are from time of writing this report.[/B] Click [URL='https://www.hfm.com/hf/en/trading-tools/economic-calendar.html'][B]HERE[/B][/URL] to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click [URL='https://www.hfm.com/en/trading-tools/trading-webinars.html'][B]HERE[/B][/URL] to register for FREE! [URL='https://analysis.hfm.com/'][B]Click HERE to READ more Market news.[/B][/URL] [B]Michalis Efthymiou HFMarkets[/B] [B]Disclaimer:[/B] This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

Dimdium reacted to a post in a topic:

Replikanto 1.6.1.2

Dimdium reacted to a post in a topic:

Replikanto 1.6.1.2

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

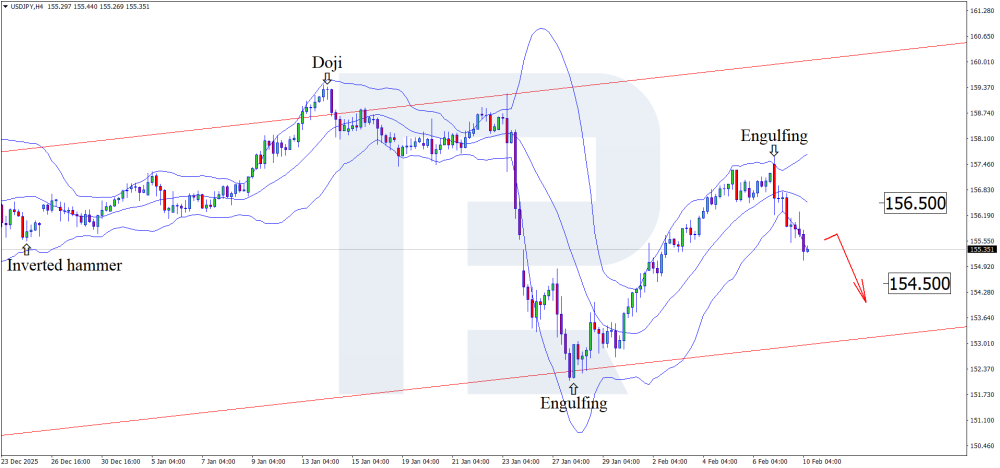

BoJ intervention rumours push USDJPY lower The USD continues to lose ground against the yen, with quotes testing the 156.70 level. Discover more in our analysis for 10 February 2026. USDJPY technical analysis On the H4 chart, the USDJPY pair formed an Engulfing reversal pattern near the upper Bollinger Band and is trading around the 155.40 level. At this stage, the price may continue its downward wave following the pattern’s signal, with the downside target at 154.50. The yen continues to strengthen against the USD, with technical analysis of USDJPY suggesting a decline towards the 154.50 support level. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

US 500 forecast: the index enters downtrend After reaching its all-time high, the US 500 has entered a downtrend. The US 500 forecast for today is positive. US 500 forecast: key takeaways Recent data: US initial jobless claims totalled 231 thousand last week Market impact: the data has a negative impact on the equity market Fundamental analysis The release of US initial jobless claims (231 thousand versus a forecast of 212 thousand and 209 thousand the previous week) provides a moderately negative short-term signal for the US 500 index, as it points to a more noticeable cooling of the labour market than the consensus expectation. At the same time, it is important to consider the scale: the level of claims remains below crisis levels and closer to the historically normal range. For the US 500 index, the key factor in such conditions is typically the reaction of expectations regarding the Fed’s interest rate. If the market interprets the increase in claims as a factor reducing the likelihood of further monetary tightening, some of the negative impact on stocks may be offset through lower bond yields and improved valuations of companies’ future cash flows. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 415 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

- Today

-

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

voodooalien joined the community

-

Very high leverage like 1:1000 can boost gains with limited capital, but it significantly increases the chance of rapid losses. Small market moves can erase an account without strict controls. It requires strong discipline, precise stop losses, and experience. For many traders, using lower leverage leads to steadier performance and better longevity than relying on extreme exposure.

-

Effective forex trading depends on structure and control. Protect capital by using stop losses, proper lot sizing, and sensible leverage. Stick to liquid major pairs for more reliable movement. Use both technical and fundamental insights, follow a defined strategy, and avoid emotional decisions. Long term success comes from patience, consistency, and ongoing learning rather than trying to win every trade.

-

ETH price analysis works best when technical and fundamental methods are used together. Review price charts to spot trends, key support and resistance zones, and volume changes. Examine on chain metrics such as network activity, staking levels, and protocol updates. Keep an eye on macro factors and sentiment, while ecosystem indicators, including assets like lmgx token, may hint at growing platform demand.

-

Chidiroglou reacted to a post in a topic:

ORS Fusion and Axios

Chidiroglou reacted to a post in a topic:

ORS Fusion and Axios

-

I’m not sure this is a good idea. We need to find another way to handle this, otherwise everyone will start sending files directly to you, me, or others. I think the best approach is to share the original files. Then, whether they should be shared or not can be decided by the EDU ...

-

⭐ ahmed ibrahim reacted to a post in a topic:

Elder Disk v2.0 for Metastock.

⭐ ahmed ibrahim reacted to a post in a topic:

Elder Disk v2.0 for Metastock.

-

From now on, I leave it to the person who shared with me the original file to share themselves the educated version I did for them. So, it's really up to them to decide. I personally just fix the files, try them a bit, and if I dont find them useful, I throw them away.

-

fxzero.dark reacted to a post in a topic:

monkeymantrades.com

fxzero.dark reacted to a post in a topic:

monkeymantrades.com

-

booster reacted to a post in a topic:

www.whaletrailtrading.com

booster reacted to a post in a topic:

www.whaletrailtrading.com

-

fxzero.dark reacted to a post in a topic:

https://thetradeengine.com/ needs to educate

fxzero.dark reacted to a post in a topic:

https://thetradeengine.com/ needs to educate

-

fxzero.dark reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

fxzero.dark reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

-

vvekbkup joined the community

-

fxzero.dark reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

fxzero.dark reacted to a post in a topic:

NINZA INDIES - FREE OF CONSUSION - FRUSTRATION - HEADACHES - TIME

- Yesterday

-

Anyone with a great template for Trade Terminator?

-

II VIP Membership - FREE upgrade for OLD and ACTIVE Members

vcee replied to MrAdmin's topic in Announcements

Thanks Traderbeauty! Looking forward to seeing this happen very soon! -

Did anyone ever try the free one from TWST Store?

-

@N9T Please share.. thxs

-

@N9T Yea, thats it. Please can you post the files? Thank you very much.

-

@N9T yes , it is , the same strategy

-

This? https://ibb.co/tp25Jwsb

-

I think sticking with the demo for a minimum of six months before jumping to the live trades or else we can burn our live funds which could be saved if choose to stay on a demo while learning.

-

Cryptocurrencies and gold: You need to take a position

bluemac replied to fahdforex's topic in General Forex Discussions

Looks like both of the commodities looking for a deep correction and then may go up again since for now it looks like blood bath making panic among those who bought it at the top. -

What software did Patrick Mikula use to draw?

⭐ RichardGere replied to setare's topic in Ask For Help

I can't post right now as I don't have my archives with me. Will do it when I return to work. -

II VIP Membership - FREE upgrade for OLD and ACTIVE Members

Traderbeauty replied to MrAdmin's topic in Announcements

The VIP is not active at all , there is nothing there for now. Once I get it started I will add all the members that have been around for a long time. -

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

Hello I am in Search of The Active Trader Program by Safety in The Market. https://safetyinthemarket.com.au/product/active-trader-program-online-training-coaching/ I am in dire need of this one, as my mentor has asked me to check this before moving ahead with Gann Trading. If Anyone has it please Share, I hold 3 Astro Books of Jenkins, I can share them with you if you help me out.