⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Past hour

-

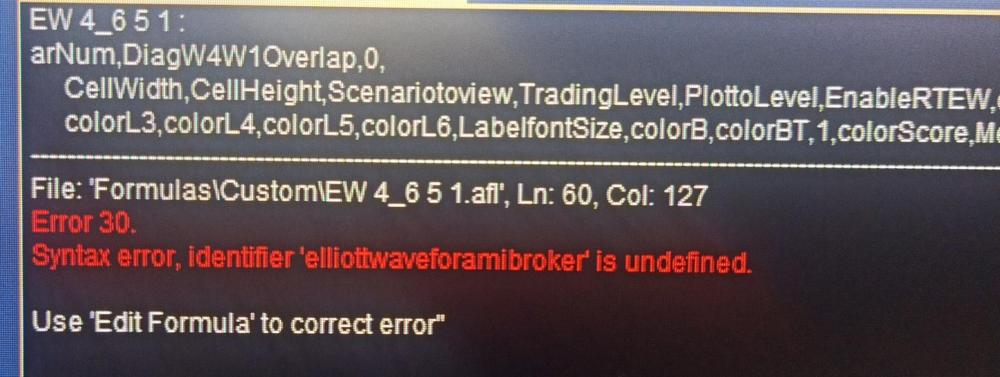

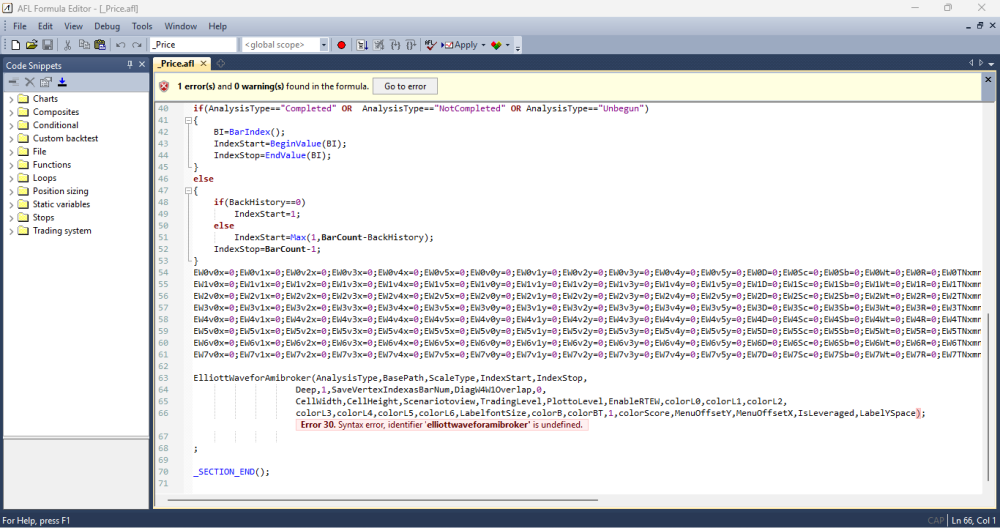

elliottwaveforamibroker.com indicator - require decompile

haohaonguyen replied to omrangassan's topic in Amibroker

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date: 29th September 2025. US Futures Advance as Shutdown Deadline Nears. US stock futures pushed higher on Monday morning as traders braced for a potential federal government shutdown later this week. Dow Jones Industrial Average futures and S&P 500 futures both gained about 0.4%, while contracts tied to the tech-heavy Nasdaq 100 rose 0.5%. With funding for the government set to expire as early as Wednesday, investors are unsure whether crucial data releases, especially Friday’s closely watched monthly employment report, will go ahead as planned. The figures feed directly into the Federal Reserve’s view of the economy and into expectations for interest-rate cuts that have helped power recent market gains. A meeting between President Trump and congressional leaders scheduled for Monday is widely seen as one of the last chances to avert a shutdown. Economic data released last week added to the uncertainty. Initial jobless claims came in lower than projected and GDP growth was revised higher, prompting debate over whether the Fed will slow policy as much as markets have priced in. Wall Street economists now see the September payroll report showing 43,000 new jobs with unemployment holding at 4.3%. Stocks Recover from a Losing Week Markets are also regrouping after a soft week marked by weakness in artificial-intelligence-linked shares and an unexpected round of tariff announcements from President Trump for October 1. All three major indices declined: the S&P 500 slipped 0.3% for its worst weekly performance since early August; the Nasdaq Composite fell 0.7%; and the Dow Jones Industrial Average dipped 0.2%, breaking a three-week winning streak. Even so, equities remain on track to finish September and the third quarter with gains. Month-to-date, the S&P 500 is ahead 2.8%, the Dow is up 1.5%, and the Nasdaq, buoyed by technology names, has climbed 2.9%. Corporate news is light this week. Nike reports on Wednesday in what’s expected to be the most significant earnings release, while Carnival posts results Monday. Big banks will launch the third-quarter earnings season in mid-October. Precious Metals Hit Fresh Highs Gold jumped as much as 1.4% to a record $3,812.05 an ounce, surpassing last Tuesday’s peak and extending its winning streak to six weeks. Silver rose 2.4%, while platinum and palladium also rallied, supported by tight supply and continued inflows into metal-backed exchange-traded funds. The dollar weakened ahead of Monday’s meeting between President Trump and congressional leaders, with government funding set to run out Tuesday if no temporary spending deal is struck. A weaker greenback typically boosts demand for precious metals priced in dollars. A shutdown could also delay the release of Friday’s jobs report. Subdued employment figures would strengthen the case for Fed rate cuts at the October policy meeting, a scenario that usually benefits non-interest-bearing assets like gold and silver. Still, policymakers remain divided on how quickly to ease, particularly after some recent economic surprises to the upside. Oil Slides on Supply Signals Oil prices retreated as signs of another OPEC+ production increase in November, coupled with the restart of a key Iraqi pipeline, revived concerns about a global supply glut. Brent crude slipped back below $70 a barrel after rallying more than 5% last week, while West Texas Intermediate traded near $65. According to people familiar with the talks, the Saudi-led alliance is weighing an output boost at least equal to the 137,000 barrels per day already scheduled for October. That increase is smaller than earlier monthly hikes, and several members have limited capacity to pump more. Iraq has resumed shipments through a pipeline from its northern fields to a Turkish terminal after more than two years of suspension, North Oil Co. Director General Amer Al-Mehairi said. Even with Monday’s pullback, crude remains on course for monthly and quarterly gains. OPEC+ has shifted toward reclaiming market share rather than strictly managing prices, while demand has been underpinned by Chinese stockpiling and geopolitical tensions, including Ukrainian strikes on Russian energy infrastructure. Analysts at RBC Capital Markets led by Helima Croft expect another incremental 137,000-barrel-a-day addition in November but note that traders are beginning to price in rising risks from conflicts involving Russia and Iran. Looking further ahead, the International Energy Agency projects a record supply surplus by 2026 as OPEC+ restores production and non-OPEC rivals increase output. Goldman Sachs forecasts Brent could fall to the mid-$50s a barrel next year despite China’s continued stockpiling. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Andria Pichidi HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. - Today

-

⭐ kutaradja reacted to a post in a topic:

Metastock 18 end of day c*****d.

⭐ kutaradja reacted to a post in a topic:

Metastock 18 end of day c*****d.

- Yesterday

-

bestorderflow requires level 2 data as this requires too. bestorderflow has a discord group where results ar posted and they are impressive, but it costs 1500usd. Regarding to comparison with other tools, I haven't done however the best test you can make with this kind of tool is to watch the levels with the most significant volume and see how the prices reacts to it. In my opinion any match with other tools is not relevant, if it gives me reliable info is what it matters.

-

Any idea how this even works when Ninja themselves say they don't support MBO data? A recent review on TrustPilot even called out BOF for the same thing... Just curious if anyone's tested BOF or the alternative mentioned in this post against Atas, MW, or QT to see if it actually matches up?

-

babeonidi reacted to a post in a topic:

elliottwaveforamibroker.com indicator - require decompile

babeonidi reacted to a post in a topic:

elliottwaveforamibroker.com indicator - require decompile

-

babeonidi reacted to a post in a topic:

Metastock 18 end of day c*****d.

babeonidi reacted to a post in a topic:

Metastock 18 end of day c*****d.

-

Looks interesting

-

techfo reacted to a post in a topic:

autofuturestrading.com

techfo reacted to a post in a topic:

autofuturestrading.com

-

⭐ RichardGere reacted to a post in a topic:

Metastock 18 end of day c*****d.

⭐ RichardGere reacted to a post in a topic:

Metastock 18 end of day c*****d.

-

elliottwaveforamibroker.com indicator - require decompile

⭐ Atomo12345 replied to omrangassan's topic in Amibroker

Hi Moh. Try this. Delete the entire your folder of Amibroker. Substitute it with my folder Amibroker in the rar file. Put the folder Indici in C:\Program Files (x86)\Equis\MetaStock\Charts This time it must works. https://workupload.com/file/aqDCHSUGanj -

Finally we have Metastock 18 EOD c*****d. Install Metastock.Use the emulator to load it.Follow the instructions on the emulator. For the data you must have Metastock local data and manipulate them with the Downloader. Please if you have Metastock trial 18 or 19 real time post it in the forum. I think that the emulator works also for them. Thank you to daddypenguin,author of the emulator. Good day! https://workupload.com/file/uadKARSDaZ4

-

Does anyone have a list of the names of the bots that are part of this portfolio?

-

⭐ goldeneagle1 reacted to a post in a topic:

az-invest.eu Ultimate Renko add-on

⭐ goldeneagle1 reacted to a post in a topic:

az-invest.eu Ultimate Renko add-on

-

⭐ goldeneagle1 reacted to a post in a topic:

N!njacators L!quidity Sweep

⭐ goldeneagle1 reacted to a post in a topic:

N!njacators L!quidity Sweep

-

elliottwaveforamibroker.com indicator - require decompile

Moh replied to omrangassan's topic in Amibroker

32 -

PK2 joined the community

-

Nice got it thanks

-

https://www.youtube.com/watch?v=iImOk0QEvzE

-

https://www.ninjastrategyloader.com/nsl-market-depth-order-flow-for-ninjatrader-8/

-

ampf started following az-invest.eu Ultimate Renko add-on and Bestorderflow MBO Alternative

-

This is a great alternative to bestorderflow MBO. https://www.ninjastrategyloader.com/wp-content/uploads/2025/08/NSL_Market_Depth_Order_Flow.zip needs to be educated

-

elliottwaveforamibroker.com indicator - require decompile

haohaonguyen replied to omrangassan's topic in Amibroker

Check if it is 64 or 32 -

Forex.com I don't think has CFD data. You would have to use FXCM and connect NT8 to that. https://www.fxcm.com/markets/indices/

-

These renko from https://www.az-invest.eu/ninja-trader-7-custom-charts look interesting https://limewire.com/d/ATEFB#ruvq44bkms need to be educated

-

marshal joined the community

-

Connecting cTrader Demo Account to Ninjatrader https://ctrader.com/download https://help.ctrader.com/ctrader/trading-accounts/ https://support.ninjatrader.com/s/article/Connecting-To-Your-cTrader-Account?language=en_US https://forum.ninjatrader.com/forum/ninjatrader-8/platform-technical-support-aa/1174972-connecting-ctrader-account-to-ninjatrader Hope this may help

-

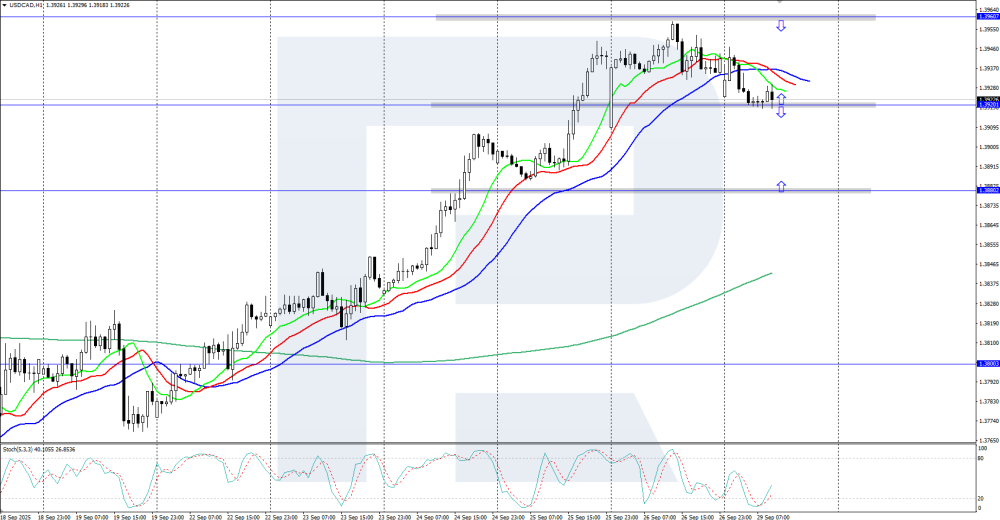

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

USDCAD corrected towards support at 1.3920 The USDCAD rate fell to the area around 1.3900 amid a possible US government shutdown this week due to suspended funding. Discover more in our analysis for 29 September 2025. USDCAD technical analysis On the H4 chart, the USDCAD pair is declining within the current downward correction. The daily trend is still bullish, so the pair may resume growth after the correction is complete. The USDCAD rate is falling, having reached the 1.3920 support level. Read more - USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

DE 40 forecast: the index breaks out of the sideways channel and continues to decline The DE 40 index approached a resistance level, but the downtrend continues. The DE 40 forecast for today is negative. DE 40 forecast: key trading points Recent data: Germany’s ifo Business Climate Index for September 2025 came in at 87.7 points Market impact: the figures create a restrictive backdrop for the German equity market Fundamental analysis Germany’s ifo Business Climate Index for September 2025 stood at 87.7 points, below the forecast of 89.3 and lower than the previous figure of 88.9. This reflects weakening optimism among German companies, with cautious expectations regarding business activity, domestic demand, and external conditions. The decline highlights ongoing pressure from high costs, weak exports, and global economic uncertainty. For the German equity market, these figures form a restrictive backdrop. Declining business sentiment could reinforce investor caution, particularly in industry, machinery, and exports, which are traditionally sensitive to shifts in the business climate. Much will depend on the ECB’s next steps — any monetary easing could help support the German economy. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 329 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

elliottwaveforamibroker.com indicator - require decompile

Moh replied to omrangassan's topic in Amibroker

-

elliottwaveforamibroker.com indicator - require decompile

haohaonguyen replied to omrangassan's topic in Amibroker

Follow me. Click edit code to see if it reports an error. -

Hi 😊 Can someone please share this fttuts course? https://fttuts.com/ruben-villahermosa-advanced-wyckoff-course Thanks!