All Activity

- Past hour

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

[b]Date: 13th May 2025.[/b] [b]US-China Deal Eases Recession Fears, Goldman Raises 2025 Targets.[/b] Investors continue to focus on the weekend's trade deal between the US and China which continues to prompt vital trends. The agreement between the two largest economies changes the outlook for almost all assets. Although investors will also start to turn their focus to a pending trade agreement with the EU and this week’s inflation data. Global Stocks Rebound Aiming To Fully Regain Previous Losses The global stock market rose significantly after the announcement of a trade deal with China to lower tariffs. You can find the details of the agreement in yesterday’s article. The SNP500 rose 3.26% and has regained 79% of the stock market crash from March-April. Of the most influential components (stocks within the SNP500) 82% rose in value with mainly defensive stocks declining. Defensive stocks include Philip Morris, Johnson & Johnson and Coca-Cola. Due to the trade agreement most economies have lowered their projections for a recession in 2025. Previously economists were advising a 30-50% chance of a recession in the second half of the year. However, these projections have now significantly fallen and will do further if the US and EU also sign a trade agreement. In today’s early hours Goldman Sachs advised it is increasing its target within the stock market. Goldman Sachs strategists, such as David Kostin, now project the SNP500 to potentially rise to $6,500 within the next 12 months. Previously the estimate was between $6,100-6,200. However, analysts also note that the US-China agreement is still temporary and will expire in 89 days. In the short-term, investors will be laser focused on the Consumer Price Index (inflation). The CPI is due to be made public at 12:30 GMT. Analysts expect the US inflation rate to remain at 2.4%. If the rate reads as expected or lower, the stock market potentially can further rise as economists will expect a Federal Reserve rate cut. GBPUSD - The Pound Struggles Despite Positive Employment Data The US Dollar has been the best performing currency of the week as investors return to the Greenback. This is largely due to the trade agreement with China and investors correcting previous market pricings. However, the USD is retracing lower on Tuesday giving back some od this week’s gains. The Great British Pound on the other hand is also supported by the latest employment data from this morning. Although this has not been mirrored on the price. The UK Claimant Count Change fell to +5,200 and the Average Earnings Index read 5.5%. Both announcements were better than previous expectations. However, the GBP still remains the worst performing currency of the day so far after the USD. Yesterday, Bank of England Monetary Policy Director Megan Green stated that while wage and consumer price growth continues to slow, the figures remain meaningful. However, she also noted a rise in medium-term inflation expectations among the public. Gold Forms a Retracement Pattern and Obtains A Divergence Indication The price of Gold rose 0.88% on Tuesday almost fully correcting the bearish price action from Monday, bar the bearish price gap. Currently, the metal is finding support at the $3,201.00 support level from April 12th and May 1st. However, the upward price movement of the day is forming a similar pattern to previous retracements. Therefore, it is vital for Gold traders to note that the price movement could either be a retracement or change in trend. Currently, in terms of fundamentals, the data is indicating a bearish bias, although some positive factors remain. For example, if the Federal Reserve starts to take a more dovish tone due to the trade deal, Gold may continue to be used as a hedge against inflation. However, if countries continue signing trade deals and Ukraine and Russia reach an agreement in Thursday’s negotiations, renewed bearish momentum might hit Gold. According to the White House, President Trump may possibly attend the negotiations on Thursday between Ukraine and Russia. Key Takeaway Points: The weekend trade agreement between the US and China has boosted investor confidence and shifted the outlook across global assets, reducing recession fears for 2025. Global stock markets surged, with the S&P 500 up 3.26%. Defensive stocks underperformed, while 82% of components posted gains. Investor attention now turns to today’s US CPI data and the potential US-EU trade agreement. A softer inflation reading could trigger Fed rate cut expectations. The US Dollar leads among currencies but is slightly retracing. The Pound is supported by strong UK jobs data but remains one of the day’s weaker performers. Gold rose 0.88% Tuesday but remains at risk of renewed bearish pressure if global trade deals continue and Ukraine-Russia negotiations succeed. [b]Always trade with strict risk management. Your capital is the single most important aspect of your trading business.[/b] [b]Please note that times displayed based on local time zone and are from time of writing this report.[/b] Click [url=https://www.hfm.com/hf/en/trading-tools/economic-calendar.html][b]HERE[/b][/url] to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click [url=https://www.hfm.com/en/trading-tools/trading-webinars.html][b]HERE[/b][/url] to register for FREE! [url=https://analysis.hfm.com/][b]Click HERE to READ more Market news.[/b][/url] [b]Michalis Efthymiou HFMarkets[/b] [b]Disclaimer:[/b] This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. - Today

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

EURUSD tumbles to the 1.1100 area; will the decline continue? The EURUSD pair plunged to 1.1100 following the US-China agreement on reducing reciprocal tariffs. Today's spotlight is on the US inflation report. Find more details in our analysis for 13 May 2025. EURUSD forecast: key trading points Market focus: today’s highlight is the US April inflation statistics, with the Consumer Price Index (CPI) scheduled for release Current trend: a downtrend prevails EURUSD forecast for 13 May 2025: 1.1200 and 1.1000 Fundamental analysis The EURUSD pair continues to decline as the US dollar gains strength amid optimism over a de-escalation in the US-China trade dispute. The two countries agreed to a 90-day reduction in tariffs after talks in Geneva, signalling a meaningful thaw in trade tensions that had intensified last month. Today, all eyes are on the US CPI data for April. The consensus forecasts suggest an increase of 0.3% month-on-month and 2.4% year-on-year. Any substantial deviation from these expectations could fuel heightened volatility in the EURUSD pair. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 237 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

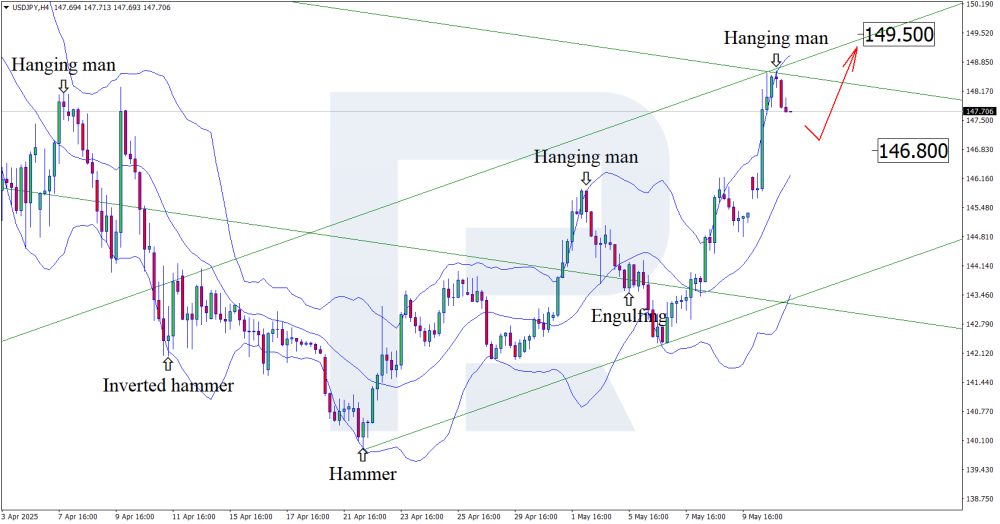

Japan’s economy under pressure, USDJPY poised to surge The downward revision of Japan’s GDP forecast may propel the USDJPY pair towards the 149.50 level. Discover more in our analysis for 13 May 2025. USDJPY technical analysis On the H4 chart, the USDJPY price tested the upper Bollinger Band and formed a Hanging Man reversal pattern, hovering around 147.60. It may now form a corrective wave following the signal from the pattern. Since the price remains within an ascending channel, it could reach 146.80. Coupled with the USDJPY technical analysis, the decline in Japan’s economic data suggests a correction towards 146.80 before growth. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

-

luvlibeauty reacted to a post in a topic:

Sniper Auto Trader

luvlibeauty reacted to a post in a topic:

Sniper Auto Trader

-

luvlibeauty reacted to a post in a topic:

Sniper Auto Trader

luvlibeauty reacted to a post in a topic:

Sniper Auto Trader

-

bwt presicion trading nt8 please give

Ninja_On_The_Roof replied to xplodvicky's topic in Ninja Trader 8

A full one was already posted and it works just fine. -

If you’re looking for a place to learn and trade without feeling overwhelmed, HFM is worth a look. Especially for new traders who prefer things in their own language.

-

tnthco reacted to a post in a topic:

Timingsolution & Nifty Updates - 3

tnthco reacted to a post in a topic:

Timingsolution & Nifty Updates - 3

-

thanks ad thanks ad

- Yesterday

-

Can you explain this more it’s interesting

-

II VIP Membership - FREE upgrade for OLD and ACTIVE Members

roddizon1978 replied to MrAdmin's topic in Announcements

Sir: I I am not a long time member but I am a good contributing member, I help by contributing a lot of item. Can you make me a VIP member , instead of those who have no contribution . -

-

⭐ QuBit reacted to a post in a topic:

Hawk Bot Plus ATM

⭐ QuBit reacted to a post in a topic:

Hawk Bot Plus ATM

-

Check this out think its the same bot. He will demonstrate the bot and maybe share settings over the coming weeks.

-

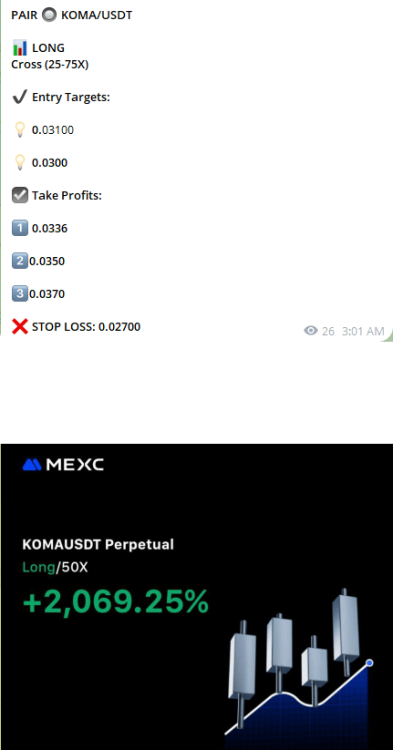

Guys I have ask ClubbingBuy to open a funded account for Crypto call on one server live. I have been doing trial from this server , and i got 5 and 5 win already on their call. I want to see all their call everyday and you could see it too ,if you participate. I will inforned you if it breaks throught, the faster the better. We have open before in the past a server calls and, the Nifty traders benefitted in gold trade and Forex trade. So participate so we could make the contribution less.

-

By the way, the best way to make money in the market is to find weakness or vulnerabilities in the thousands of asset class that is available to us, retail traders and trade the price action, NOT your strategy. A good pair is USDTRY, you just need to buy the strongest currencies and sell the weakest currency with high inflation and high interest rate and you make money, no stress

-

A telegram group already exists, Traderbeauty, is the admin feel free to reach her by the way what is this poweremini?

-

you need this ? h**ps://www.sendspace.com/file/zm4nzm (rar psw= Indo)

-

To fix the problem where Download "Yahoo Finance Workaround" is not found: download amiquote 4.17 free version copy folder DataSources from free version

-

I'm new to trading and I'm eager to learn from experience traders and be in a trading community such as this.

-

⭐ Aurel88 reacted to a post in a topic:

nCatPivotPointSuite

⭐ Aurel88 reacted to a post in a topic:

nCatPivotPointSuite

-

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

anotatta joined the community

-

Have you tried anything like that? It is actually great in terms of enriching your trading experience because competition adds motivation to think and invent something smarter and better

-

hamedqholamy joined the community

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

[b]Date: 12th May 2025.[/b] [b]NASDAQ Gains Nearly 4% as US-China Agree to Lower Tariffs.[/b] The NASDAQ soars higher as the US and China finally get on the way and show signs of ‘substantial progress’. Thanks to the positive tone and recent agreements with other partners, the market is clearly leaning toward a risk-on sentiment. The NASDAQ rises to a 2-month high, but can the index rise to previous highs? US-China Trade Negotiations - What We Know So Far! Currently, the level of tariffs on Chinese goods is 145%, which, in other words, will bring imports to the US to a halt. In Trump’s recent press conference, he said he believes tariffs should be lowered to 80%. However, most economists believe the US will aim to bring them down to 55-60%. On Sunday night, trade negotiations in Geneva made ‘substantial progress;’ toward easing tariffs, according to both parties. At that time, the ‘details’ remained scarce, but purely on the positive sentiment, the NASDAQ is quickly reacting. Though this morning the Treasury Secretary and chief negotiator outlined what has been agreed. As part of a 90-day deal, China will lower the tariffs on US imports from 125% to 10% and the US on China from 145% to 30%. On the positive side, the tariffs are significantly lower than previous expectations, but a slight negative is that the agreement is solely for 90 days. Newly imposed tariffs drove the 6-week stock market crash in March–April, during which the NASDAQ dropped by 27%. Economists say that if the US, the EU and China sign a trade agreement, the economy will avoid a recession. At the moment, the price of the NASDAQ and most indices have positively reacted to the news. Before the announcement was made, the NASDAQ was trading 2.10% higher than Friday’s closing price. This was purely due to the positive tone from Sunday. The NASDAQ rose a further 1.50% in the minutes after Scott Bessent’s trade announcement. NASDAQ - Inflation and Earnings Report The price movement of the NASDAQ will also depend on the upcoming economic releases and earnings data. In terms of Quarterly Earnings Reports, Applied Materials and Cisco Systems are due to announce their reports on Wednesday and Thursday. The two companies hold a weight of 2.42% and are known to create moderate volatility. Both companies have beaten their earnings expectations over the past 12 months, and both stocks have risen in the past week. However, it's also important to note that Cisco Systems is the most influential of the two. Nevertheless, traders should note that the Consumer Price Index (inflation) report can overshadow the earnings reports. The consumer inflation is due tomorrow afternoon, and the producer inflation on Thursday. Analysts expect the consumer inflation to remain at 2.4%, which remains relatively close to the Fed’s target of 2.00%. If inflation reads as per expectations, the NASDAQ may potentially react positively. A lower inflation reading will also support the NASDAQ, however, if inflation rises above 2.4%, the reading may trigger inflation concerns related to tariffs. NASDAQ - Technical Analysis On the 2-Hour timeframe, the NASDAQ continues to honour the trend-line and in the short-term the index shows significant bullish momentum. Currently, the price movement is not showing any indications of downward price movement or divergence patterns. However, the only concern for short-term traders is a retracement due to the price being overbought on most oscillators. Currently, bullish price action holds strong. Key Takeaway Points: US-China Trade: Positive developments in tariff talks have pushed the NASDAQ to a 2-month high, signaling strong risk-on sentiment. Trade Deal Reached: Both countries agreed to lower tariffs significantly for 90 days, sparking a strong market reaction. The NASDAQ trades almost 4% higher. Inflation and Earnings: Upcoming CPI data and earnings reports from Applied Materials and Cisco may drive further NASDAQ movement. Technical Outlook Remains Bullish: NASDAQ shows strong upward momentum with no immediate bearish signals, though overbought conditions could prompt a short-term pullback. [b]Always trade with strict risk management. Your capital is the single most important aspect of your trading business.[/b] [b]Please note that times displayed based on local time zone and are from time of writing this report.[/b] Click [url=https://www.hfm.com/hf/en/trading-tools/economic-calendar.html][b]HERE[/b][/url] to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click [url=https://www.hfm.com/en/trading-tools/trading-webinars.html][b]HERE[/b][/url] to register for FREE! [url=https://analysis.hfm.com/][b]Click HERE to READ more Market news.[/b][/url] [b]Andria Pichidi HFMarkets[/b] [b]Disclaimer:[/b] This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

I always tell people to go to babypips and check out pipsology, its free with the best jump start to forex trading. straight forward and everything will flow like water after that.. demo are a must for anyone starting, all brokers offer demo, if traders wanna have a crypto and forex in one you can check out lmfx as well, a unique integration of both markets. its quiet exciting.

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

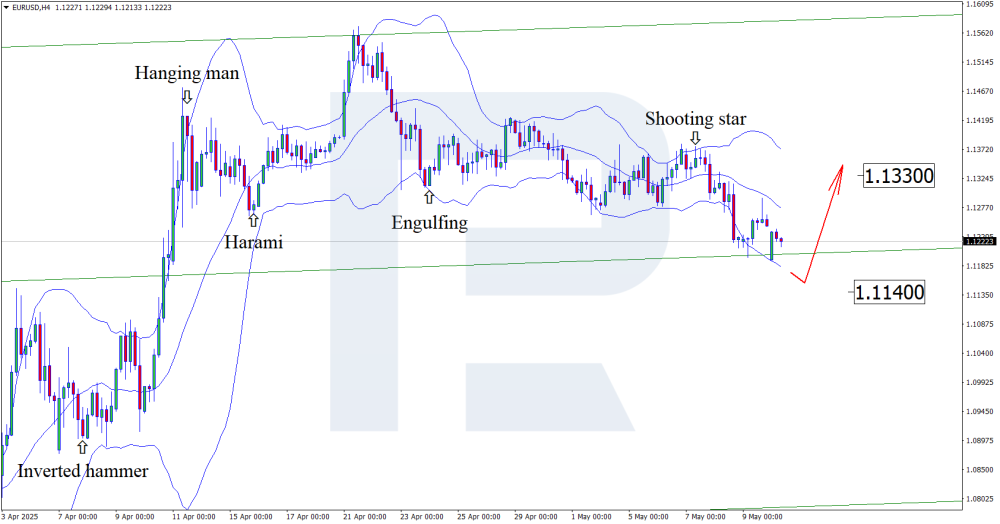

EURUSD poised for reversal: outcome depends on meeting in Brussels Ahead of the Eurogroup meeting, the EURUSD pair may complete its correction and head towards the 1.1330 resistance level. Discover more in our analysis for 12 May 2025. EURUSD technical analysis On the H4 chart, the EURUSD price has formed a Shooting Star reversal pattern near the upper Bollinger Band. The pair is currently undergoing a downward wave in response to this signal. However, since quotes remain within the ascending channel, they could climb to the nearest resistance level at 1.1330 after the correction. With the Eurogroup meeting as today's main market driver, the outlook for EURUSD appears optimistic. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Gold (XAUUSD) at weekly low as market bets on good news Gold (XAUUSD) has dropped to 3,275 USD as demand for safe-haven assets fades. The market is awaiting the announcement of a potential deal between China and the US. Find out more in our analysis for 12 May 2025. XAUUSD forecast: key trading points Gold (XAUUSD) prices decline amid expectations of progress in China-US trade talks The market anticipates official statements on the issue as early as Monday XAUUSD forecast for 12 May 2025: 3,258 and 3,223 Fundamental analysis Gold (XAUUSD) prices fell to 3,275 USD on Monday, marking their lowest level in a week, a roughly 1% drop from Friday. The decline is driven by expectations, with the market awaiting an official announcement on progress in China-US trade negotiations early this week. Rumours suggest that productive developments are underway, and confirmation could arrive today. Against this backdrop, investor appetite for safe-haven assets has diminished. Market participants are clearly pricing in a favourable outcome. Although little concrete information has been released, Chinese officials have indicated readiness for formal talks, and Washington has suggested that conditions for progress are in place. In any case, this will be known today. Gold also came under pressure last week following comments from the US Federal Reserve. Speaking after the recent meeting, Fed Chairman Jerome Powell noted that there are no current plans for pre-emptive interest rate cuts. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 237 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

tumlack started following GxT Garret Course

-

Hello kindly share GxT course or pdf from Market lens