⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Past hour

-

can you share the settings which is working for you.. thxs

-

⭐ QuBit reacted to a post in a topic:

quantvue.io

⭐ QuBit reacted to a post in a topic:

quantvue.io

- Today

-

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

Does anyone have a cracked version of MotiveWave v7 for Mac OS?

-

hybrid76 reacted to a post in a topic:

Ninza unlocker need to edu

hybrid76 reacted to a post in a topic:

Ninza unlocker need to edu

-

Trader - thank u very much.... much appreciated 🙂

-

hybrid76 reacted to a post in a topic:

Ninza unlocker need to edu

hybrid76 reacted to a post in a topic:

Ninza unlocker need to edu

-

minika8575 joined the community

-

holol reacted to a post in a topic:

Bots NoCode for MT4-MT5

holol reacted to a post in a topic:

Bots NoCode for MT4-MT5

-

Playr101 reacted to a post in a topic:

Simple Market Metrics

Playr101 reacted to a post in a topic:

Simple Market Metrics

-

Playr101 reacted to a post in a topic:

Simple Market Metrics

Playr101 reacted to a post in a topic:

Simple Market Metrics

-

Does anyone have the Evo settings they use overnight etc?

-

Does anyone have the overnight Zeus settings or the QKronos Evo recommended settings? zeus has been really good last couple weeks.

-

AllIn reacted to a post in a topic:

Ninza unlocker need to edu

AllIn reacted to a post in a topic:

Ninza unlocker need to edu

-

jetstrade reacted to a post in a topic:

Ninza unlocker need to edu

jetstrade reacted to a post in a topic:

Ninza unlocker need to edu

-

jetstrade reacted to a post in a topic:

Ninza unlocker need to edu

jetstrade reacted to a post in a topic:

Ninza unlocker need to edu

-

Servan started following Bots NoCode for MT4-MT5

-

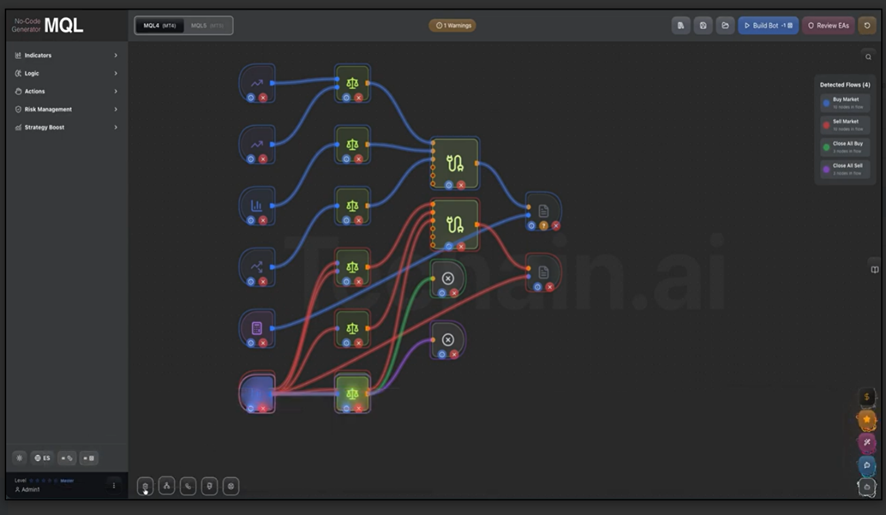

I’ve been trying to become profitable for a long time. I used to trade manually, but seeing the rise of automation, I decided to try my luck with bots. Since I don’t know how to program and can’t afford a programmer, I’ve tried absolutely everything: I’ve used several Expert Advisors with no results; either they simply don’t work, or within a few days they completely destroy your account. I searched all over the internet without finding anything truly good and worth it. I’ve spent a lot of money on bots, and none of them delivered what they promised. When I was already on the verge of giving up, I finally found a platform that is truly worth it. Even though I was very skeptical at first, after falling into the “trap” so many times, I decided to give it a try anyway. After all, I had nothing to lose, and for the price of the subscription, it was worth trying. The platform is Techain.ai, and it allows you to automatically create no-code bots for whatever you want to trade and however you want to trade it. It works with nodes that connect like a puzzle: you choose what you want to do, how you want to do it, and the system builds it for you. In addition, they have pre-designed bots in case you don’t want to build one from scratch; you just need to adjust a few parameters according to your investment style (scalping, swing trading, or day trading). I’m sharing this information because I understand that there may be more people in the same situation I was in, and it can be really tough. So if I can help in any way, I will. I’m also sharing an image of one of the bots I created a couple of days ago for EURUSD, which has been working great for me.

-

⭐ RichardGere reacted to a post in a topic:

Ninza unlocker need to edu

⭐ RichardGere reacted to a post in a topic:

Ninza unlocker need to edu

-

Read one more time my post here : If you still dont get it then you dont deserve it.

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Pound poised for growth: what awaits GBPUSD after the Fed meeting The British pound continues to strengthen against the US dollar, and amid expectations of the Fed’s interest rate decision, the GBPUSD rate may rise towards the 1.3920 level. Discover more in our analysis for 28 January 2026. GBPUSD forecast: key trading points US Federal Reserve interest rate decision: previous value – 3.75%, projected at 3.75% Current trend: moving upwards GBPUSD forecast for 28 January 2026: 1.3920 Fundamental analysis The GBPUSD forecast for today, 28 January 2026, remains favourable for the pound, as prices still have strong potential for further growth after a minor correction. Today, the Federal Reserve will hold its meeting and announce its interest rate decision. The current rate stands at 3.75%. Considering recent comments from Fed officials, US economic data, and prevailing market sentiment, there is a high probability that the rate will remain unchanged. This, in turn, could slightly weaken the US dollar, which aligns with the preferences of the US president. A weaker dollar is beneficial for President Donald Trump, as it supports stronger competitiveness against Chinese manufacturers. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 406 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

USDJPY loses ground amid US dollar weakness The USDJPY pair is correcting after a sharp decline amid the strengthening of the Japanese yen, driven by fundamental factors. The rate currently stands at 152.65. Find out more in our analysis for 28 January 2026. USDJPY technical analysis USDJPY quotes are undergoing a moderate correction within a formed descending channel. Sellers are confidently holding the price below the EMA-65, indicating lingering medium-term bearish pressure. The current USDJPY correction reflects a combination of strengthening fundamental support. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date: 28th January 2026. Trump Embraces a Weaker US Dollar. The US Dollar continues to decline as the market awaits the Federal Reserve’s interest rate decision. A decision not to adjust interest rates is almost certain, but investors will be hoping for more guidance on March’s decision. However, the hawkish Federal Reserve is not supporting the US Dollar in any way. The US Dollar Index is trading at its lowest price since early 2022 and the President’s recent comments are fuelling poor sentiment towards the currency. The decline in the US Dollar is consequently supporting Gold and Metal prices, while institutions increase exposure to the Swiss Franc, Australian Dollar and New Zealand Dollar. USDCHF - Swiss Franc Approaches 15-Year High Against US Dollar The US is experiencing particularly strong economic data and a resilient employment sector. Inflation on the other hand remains above the Federal Reserve’s target but below most economists’ projections. Nonetheless, even with inflation remaining lower than expectations, the Federal Reserve is under no pressure to cut interest rates in the economy. The Federal Reserve is likely to keep interest rates unchanged for the first quarter of 2026 in order to ensure inflation does not rise. The Fed is likely to cut on one occasion in the second quarter and another in the third quarter. However, the hawkishness of the Federal Reserve is not supporting the US Dollar. The decline in the US Dollar is driven by questions over the independence of the Federal Reserve. Additional pressure comes from the upcoming appointment of a new chairman in May and the president’s embracing a weaker Dollar. Markets expect the new chairman to be more in line with the administration’s dovish stance. Overnight, the US President, Donald Trump, told investors that ‘I think the value of the Dollar is great’ and he would not be worried about the decline continuing. Reports suggest the Trump administration could favour a gradual decline in the US Dollar to support manufacturing. At the same time, institutions and countries are working to reduce exposure to US volatility. HFM - USDCHF Weekly Chart The Swiss Franc is one of the best performing currencies of the day and is the third best of the year so far. Investors are increasing their exposure to the Swiss Franc due to its safe haven status. In addition, the Swiss Franc is less at risk of any backlashes from geopolitical issues. This is also supporting the price of the Australian and New Zealand Dollars. Australian Inflation Continues to Rise The Australian Dollar continues to find support from positive economic data fuelling speculation of no interest rate cuts in 2026. This morning, the monthly Consumer Price Index rose from 0.0% to 1.0% and the inflation rate rose from 3.4% to 3.8%. As a result, the inflation rate remains unstable and may indicate the country’s monetary policy is not adequately restrictive. Previously economists were placing the probability of a rate hike at 50%. Economists are yet to confirm their new projection after the latest inflation data. However, the chances of an interest rate hike have likely risen. Gold - A Weaker Dollar Continues to Fuel HFM - XAUUSD Weekly Chart Gold’s price continues to increase for a seventh consecutive day and has already risen more than 20% this month. However, technical analysts are becoming increasingly cautious about an overbought price. The Federal Reserve is not likely to cut interest rates in this quarter, and the stock market continues to rise while the economy performs well. The price of the US Dollar Index is retracing slightly higher after the recent dip. If the price continues to rise above 96.00, the chances of Gold retracing will also grow. In addition, the VIX index has fallen more than 1.50% this morning, indicating a risk-on appetite. This can also slightly pressure Gold in the short term. Key Takeaways: The US Dollar weakens as markets await Fed guidance despite rates likely remaining unchanged. Dollar sentiment is hurt by political pressure and doubts over Fed independence. A weaker Dollar boosts gold and metals; investors rotate into CHF, AUD and NZD. Swiss franc outperforms on safe-haven demand amid global volatility concerns. Rising Australian inflation strengthens AUD and raises interest rate hike expectations. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Michalis Efthymiou HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

A lot of forex brokers actually offer 1:1000 leverage these days, especially on standard or micro accounts. You’ll see this at brokers like HFM, XM, Octa,... Usually it depends on the account type, balance size, and which regulation you’re under - higher leverage is more common outside EU/UK rules. Obviously 1:1000 isn’t for everyone but it’s there if you know how to manage risk.

-

@N9TI already tried testing but it crashes my Ninja,I cant get Ninza Romantic pulse and Apex flow working on edu Ninja 8.0.22 ,I just needed to know how other people got it working what version of Ninja? and the correct resource file Thanks

-

Hi @kimsam, as discussed, this is not the original file. I have analyzed further the NinzaResource from dec 2025 versus Jan 2026. The latest one has new classes, like NinzaListView, that are used by new indicators like HelloWin infinity engine. Therefore, such indicators are not compatible with 2025 version of Ninza resource. Ofc, we cannot have 2 version of resouce files either as they will conflict. So, bottom line is I just need the latest original resouce file to unlock latest indicators. For all the guys who are DMing me to provide this or that Ninza indicator, I will simply ignore such request. I am not a ninza indicator provider. Be grateful that I am spending time educating files for free already.

-

Yes, I agree with you, but that's just a standard feature. Can we know for sure whether a broker is ECN or not? Actually, we sometimes don't care what type of broker it is because what matters is that our money is safe, trading runs smoothly, and our withdrawals are paid. The most important thing, in my opinion, is that we know who is behind the broker so that when there is a problem, we can ask for clarification and find out their track record.

-

This being said, did you even bother testing or just waiting to be spoon fed?

-

Rimuru started following Order Flow Courses [Big Share]

-

non edu ninja, 8.1.5.2 ... check the Ninza Unlocker thread for his resource file

- Yesterday

-

@kimsam @apmoo any update on this my friends? Thx

-

Can someone please re-upload the latest version they have? All links done work in this thread. Thanks

-

https://tpte.de/ Sidi Indicators, super indicator

ngatho254 replied to TRADER's topic in Ninja Trader 8

@TRADER Kindly re upload the files