Date: 27th October 2025.

The Nikkei225 Soars as Takaichi’s Policies and Trade Truce Boost Investor Optimism.

On Monday, the Nikkei225 rose above 50,000 for the first time in its history driven by investor optimism. The Nikkei225 is the best-performing index of 2025 so far, having risen 28.65%. The Nikkei225 is currently trading with gains 9% higher than the DAX, the second best-performing index of 2025. However, the Japanese Yen is showing the opposite trend, so what is driving these key market movements?

Japan and Prime Minister Sanae Takaichi

Sanae Takaichi officially became Prime Minister on 21 October. Mrs Takaichi is a firm believer in expansionary fiscal policy despite being a conservative. A key issue for Japan is its gross domestic product (GDP) growth rate which is only 0.1%. The growth rate has been on a downward trajectory since the 1970s and continues to pose a challenge for Japan. However, many investors believe Takaichi has the boldness needed to reverse these trends.

She plans to roll out targeted fiscal stimulus, supporting key industries such as artificial intelligence (AI) and semiconductors, removing the provisional gasoline tax, and offering winter utility subsidies. In addition to this, the new Prime Minister is looking to strengthen ties with China and regional economies, as well as expand Japan’s Self-Defence Forces for the first time since the Second World War.

Many economists believe these measures are likely to stimulate economic growth and boost Japanese companies. These moves are also likely to weaken the negative impact of the Bank of Japan’s interest rate increases. For this reason, demand for the Nikkei225 is significantly increasing and is on track to record its strongest year-on-year performance since 2013.

NIKKEI225: 20-Year Performance (YoY)

Inflation, Trade And Investor Sentiment

The US and China have agreed to pause plans to impose 100% tariffs on Chinese goods. At the same time, China will delay implementing stricter export controls on rare earths bound for the US. Another element of the agreement is that China will resume purchases of US soybeans and other agricultural products. Previously, this trade had almost come to a standstill.

The trade agreements made between President Trump and Xi had a positive impact not only on the Nikkei225 but also across the global equity markets. All indices are trading higher, while the VIX has fallen by 4%. The decline in the VIX highlights the market’s renewed “risk-on” sentiment.

Lastly, global Purchasing Managers’ Index (PMI) readings released on Friday, alongside lower US inflation data, supported global demand. Germany, the UK and the US all saw their PMI figures rise above expectations. In addition to this, the US Consumer Price Index (CPI) rose from 2.9% to 3.00% (the forecast has been for 3.1%). As inflation came in lower than expected, investors now anticipate more frequent rate cuts by the Federal Reserve.

Bank of Japan and The Japanese Yen

The Japanese Yen remains the worst-performing currency. This is primarily due to expectations that the Bank of Japan will not raise interest rates as much as previously anticipated. In addition to this, Japan’s expansionary fiscal policy is fuelling concerns over the country’s high debt-to-GDP ratio. However, the weaker Japanese Yen is making the Nikkei225 more attractive to foreign investors.

Current expectations are that the Bank of Japan will keep interest rates unchanged on Thursday. A pause would likely support the Nikkei225, but traders will continue to monitor price action for signals of potential trends ahead.

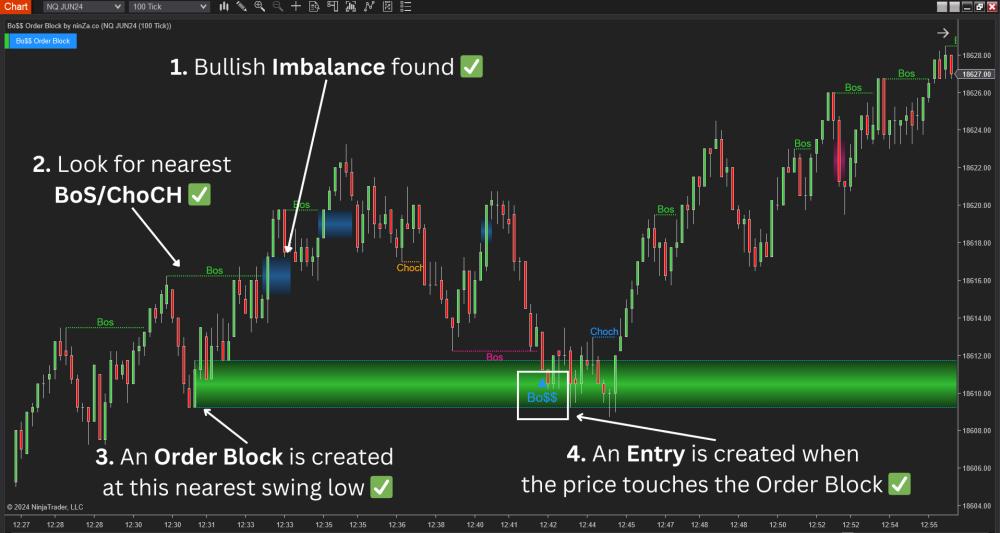

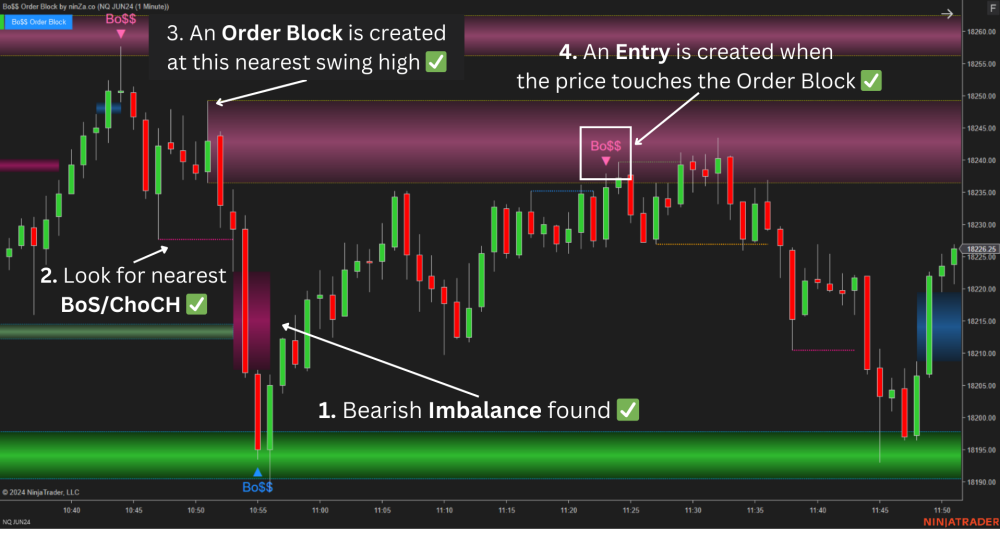

Nikkei225 Daily Chart

The index is currently trading above the 75-Period Moving Average and 100-Period moving averages. In addition to this, the price is showing a buy signal on the RSI, while swings continue to form higher highs above previous key levels. As a result, the Nikkei225 (JPN225) maintains a bullish bias. However, traders should note that this could shift in the short-term if the price falls below 49,693.50.

Key Takeaways:

The Nikkei225 hit 50,000 for the first time, making it 2025’s best-performing global index.

Prime Minister Sanae Takaichi’s pro-growth fiscal policies have boosted investor confidence and market optimism.

The US–China trade truce lifted global markets, supporting bullish trends and strengthening risk appetite.

A weaker yen continues to support Japanese stocks but raises concerns over Japan’s rising debt levels.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Michalis Efthymiou

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.