All Activity

- Past hour

-

⭐ goldeneagle1 reacted to a post in a topic:

Anyone can educate with Viper Trading Indicator?

⭐ goldeneagle1 reacted to a post in a topic:

Anyone can educate with Viper Trading Indicator?

-

@atljam you just copied and pasted all the five files in the zip into your bin/custom folder? Thanks

- Today

-

non educated NT, i manually added, the Kadi version on post 2

-

Anyone can educate with Viper Trading Indicator?

roddizon1978 replied to Tasfy's topic in Ninja Trader 8

Yes it was educated already , find it. Even you educate it and have the manual, You need some lessons to learn it; it is not that easy. So you need a least a month to 2 month of membership , to master it , $149 a month membership . I need Orderflow Labs educated, I need to test it. E -

⭐ trader65 reacted to a post in a topic:

jenacie.com

⭐ trader65 reacted to a post in a topic:

jenacie.com

-

⭐ trader65 reacted to a post in a topic:

markttechniktrading.de

⭐ trader65 reacted to a post in a topic:

markttechniktrading.de

-

@roddizon1978 I've had it on 1 minute chart all day, no issues. Running live Sim account on edu NT8, may make a difference.

-

Anyone can educate with Viper Trading Indicator?

Ninja_On_The_Roof replied to Tasfy's topic in Ninja Trader 8

Viper was educated long ago. -

⭐ goldeneagle1 reacted to a post in a topic:

Multi-Timeframe Fu$ion

⭐ goldeneagle1 reacted to a post in a topic:

Multi-Timeframe Fu$ion

-

⭐ goldeneagle1 reacted to a post in a topic:

jenacie.com

⭐ goldeneagle1 reacted to a post in a topic:

jenacie.com

-

⭐ goldeneagle1 reacted to a post in a topic:

apexinsights.llc

⭐ goldeneagle1 reacted to a post in a topic:

apexinsights.llc

-

I tried using it, and it kind of freeze my chart.

-

@atljam How did you import it? or did you just copy and paste into your bin/custom folder? Also, is your NinjaTrader Educated? Thanks

-

i tried to tell you i read the dll, there is no "trial" code in it. ive had it way past 7 days and its working

-

⭐ fryguy1 reacted to a post in a topic:

apexinsights.llc

⭐ fryguy1 reacted to a post in a topic:

apexinsights.llc

-

⭐ mangrad reacted to a post in a topic:

jenacie.com

⭐ mangrad reacted to a post in a topic:

jenacie.com

-

J W reacted to a post in a topic:

markttechniktrading.de

J W reacted to a post in a topic:

markttechniktrading.de

-

@kadi Thank you very much!! That was everything to do, now it show up in my indicators and its working 🙂 best regards

-

⭐ fryguy1 reacted to a post in a topic:

jenacie.com

⭐ fryguy1 reacted to a post in a topic:

jenacie.com

-

1. Create a strategy with dozens of parameters 2. Optimize it to find a good cherry picked backtest 3. Create a website and sell. 4. $$$

-

@J W Unzip the file and copy the contents to "documents -> ninjatrader 8 -> Bin -> custom" folder

-

J W joined the community

-

Hi rcarlos, I have just one question, i have downloaded the .zip file from @apmoo and i dont get it to run in Ninjatrader, when i try to import it via Import/Ninjatrader Script it will not work. In the .zip file is the .cs inidicator file missing and only .xml files are in the .zip are shown, i dont know, maybe someone can help me would be very nice Thanks! best regards

-

Tried all possible ways. If you're trying it for the first time, you'll have to wait for 7 days to know.

-

@atljam Can you list the steps? because after the 7 days trial, its still asking for lifetime License

-

dll is totally converted to C# no license code in it. you failed a step, you must remove the PredatorOrderEntry dll file in the documents-NinjaTrader-Bin- Custom folder and put the Km one in its place

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

[b]Date: 7th July 2025.[/b] [b]Oil Prices Drop But Bullish Potential Remains![/b] OPEC members confirm they will increase oil production and output in July and August. As a result, the price of Oil fell 1.40% on Monday, but almost regains its previous losses. According to reports, the higher output is an attempt by OPEC members to regain market share. Oil has largely been trading sideways since June 24th after the 16% decline. What’s next for Crude Oil prices? US Oil / Crude Oil Chart OPEC and New Oil Output! Members of OPEC have seen tensions rise as certain members have been producing more oil than others. As a result, the main topic for discussion during yesterday’s meeting was an increase across all members. This development was the main reason for the day’s bearish price gap. As Bloomberg reports, Riyadh is trying to win back lost market share by asking to continue the production quota adjustment of 411,000 barrels per day in August, and possibly in the months thereafter. Saudi Aramco has already lowered the price of Arab Light crude for Asian buyers by $0.20 in July. At the same time, eight OPEC+ countries, including Russia, Saudi Arabia, Algeria, Iraq, Kuwait, the UAE, Kazakhstan, and Oman, are slowly lifting their voluntary production cuts, raising output by another 386,000 barrels per day. Morgan Stanley analysts expect Brent Crude to fall to around $60.20 and Crude Oil to $58.80, with a supply surplus of 1.3 million barrels per day in 2026. Potential For Regained Bullish Momentum Regardless of the bearish price gap, traders should note that bullish momentum is being regained. According to many economists, the potential for higher oil prices continues to linger at the back of traders’ minds despite the US actively looking to bring prices lower. This includes stronger-than-expected economic data, particularly from the employment sector. The US latest employment report came as a shock to investors, and the country’s unemployment rate fell to 4.1%, the lowest since March and significantly lower than the market’s projections. In addition to this, the NFP Employment Change read 35,000 higher than expectations. Higher economic and employment data can justify a higher oil output and keep prices high. On the other hand, the economy and its outlook will significantly depend on global trade policy. Currently, investors look for confirmation on which countries will see higher tariffs imposed. The current deadline is July 9th. If the policy change triggers a bearish market, the price of Oil is likely to fall. Lastly, another factor which investors are contemplating is the ability of Iran to enrich and produce nuclear weapons. According to the Pentagon, the recent attacks on Iran set back the nuclear program by 6-12 months. Also, most experts believe the US, Israel and Iran will not be able to make an agreement on the country’s nuclear policy. As a result, is the conflict simply going to resume at a later point? If so, the geo-political tensions could push prices higher as they did in June 2025. Key Takeaway Points: OPEC+ is increasing oil output in July and August to regain market share, leading to an initial dip in prices. Despite the output increase, a potential for bullish momentum remains due to stronger-than-expected data, especially in the US employment sector. Upcoming global trade policy changes (July 9th deadline) could trigger a bearish market and cause oil prices to fall if new tariffs are imposed. Ongoing geopolitical tensions surrounding Iran's nuclear program could push oil prices higher again if conflict resumes. [b]Always trade with strict risk management. Your capital is the single most important aspect of your trading business.[/b] [b]Please note that times displayed based on local time zone and are from time of writing this report.[/b] Click [url=https://www.hfm.com/hf/en/trading-tools/economic-calendar.html][b]HERE[/b][/url] to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click [url=https://www.hfm.com/en/trading-tools/trading-webinars.html][b]HERE[/b][/url] to register for FREE! [url=https://analysis.hfm.com/][b]Click HERE to READ more Market news.[/b][/url] [b]Michalis Efthymiou HFMarkets[/b] [b]Disclaimer:[/b] This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. [b]Date: 7th July 2025.[/b] [b]Oil Prices Drop But Bullish Potential Remains![/b] OPEC members confirm they will increase oil production and output in July and August. As a result, the price of Oil fell 1.40% on Monday, but almost regains its previous losses. According to reports, the higher output is an attempt by OPEC members to regain market share. Oil has largely been trading sideways since June 24th after the 16% decline. What’s next for Crude Oil prices? US Oil / Crude Oil Chart OPEC and New Oil Output! Members of OPEC have seen tensions rise as certain members have been producing more oil than others. As a result, the main topic for discussion during yesterday’s meeting was an increase across all members. This development was the main reason for the day’s bearish price gap. As Bloomberg reports, Riyadh is trying to win back lost market share by asking to continue the production quota adjustment of 411,000 barrels per day in August, and possibly in the months thereafter. Saudi Aramco has already lowered the price of Arab Light crude for Asian buyers by $0.20 in July. At the same time, eight OPEC+ countries, including Russia, Saudi Arabia, Algeria, Iraq, Kuwait, the UAE, Kazakhstan, and Oman, are slowly lifting their voluntary production cuts, raising output by another 386,000 barrels per day. Morgan Stanley analysts expect Brent Crude to fall to around $60.20 and Crude Oil to $58.80, with a supply surplus of 1.3 million barrels per day in 2026. Potential For Regained Bullish Momentum Regardless of the bearish price gap, traders should note that bullish momentum is being regained. According to many economists, the potential for higher oil prices continues to linger at the back of traders’ minds despite the US actively looking to bring prices lower. This includes stronger-than-expected economic data, particularly from the employment sector. The US latest employment report came as a shock to investors, and the country’s unemployment rate fell to 4.1%, the lowest since March and significantly lower than the market’s projections. In addition to this, the NFP Employment Change read 35,000 higher than expectations. Higher economic and employment data can justify a higher oil output and keep prices high. On the other hand, the economy and its outlook will significantly depend on global trade policy. Currently, investors look for confirmation on which countries will see higher tariffs imposed. The current deadline is July 9th. If the policy change triggers a bearish market, the price of Oil is likely to fall. Lastly, another factor which investors are contemplating is the ability of Iran to enrich and produce nuclear weapons. According to the Pentagon, the recent attacks on Iran set back the nuclear program by 6-12 months. Also, most experts believe the US, Israel and Iran will not be able to make an agreement on the country’s nuclear policy. As a result, is the conflict simply going to resume at a later point? If so, the geo-political tensions could push prices higher as they did in June 2025. Key Takeaway Points: OPEC+ is increasing oil output in July and August to regain market share, leading to an initial dip in prices. Despite the output increase, a potential for bullish momentum remains due to stronger-than-expected data, especially in the US employment sector. Upcoming global trade policy changes (July 9th deadline) could trigger a bearish market and cause oil prices to fall if new tariffs are imposed. Ongoing geopolitical tensions surrounding Iran's nuclear program could push oil prices higher again if conflict resumes. [b]Always trade with strict risk management. Your capital is the single most important aspect of your trading business.[/b] [b]Please note that times displayed based on local time zone and are from time of writing this report.[/b] Click [url=https://www.hfm.com/hf/en/trading-tools/economic-calendar.html][b]HERE[/b][/url] to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click [url=https://www.hfm.com/en/trading-tools/trading-webinars.html][b]HERE[/b][/url] to register for FREE! [url=https://analysis.hfm.com/][b]Click HERE to READ more Market news.[/b][/url] [b]Michalis Efthymiou HFMarkets[/b] [b]Disclaimer:[/b] This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. [b]Date: 7th July 2025.[/b] [b]Oil Prices Drop But Bullish Potential Remains![/b] OPEC members confirm they will increase oil production and output in July and August. As a result, the price of Oil fell 1.40% on Monday, but almost regains its previous losses. According to reports, the higher output is an attempt by OPEC members to regain market share. Oil has largely been trading sideways since June 24th after the 16% decline. What’s next for Crude Oil prices? US Oil / Crude Oil Chart OPEC and New Oil Output! Members of OPEC have seen tensions rise as certain members have been producing more oil than others. As a result, the main topic for discussion during yesterday’s meeting was an increase across all members. This development was the main reason for the day’s bearish price gap. As Bloomberg reports, Riyadh is trying to win back lost market share by asking to continue the production quota adjustment of 411,000 barrels per day in August, and possibly in the months thereafter. Saudi Aramco has already lowered the price of Arab Light crude for Asian buyers by $0.20 in July. At the same time, eight OPEC+ countries, including Russia, Saudi Arabia, Algeria, Iraq, Kuwait, the UAE, Kazakhstan, and Oman, are slowly lifting their voluntary production cuts, raising output by another 386,000 barrels per day. Morgan Stanley analysts expect Brent Crude to fall to around $60.20 and Crude Oil to $58.80, with a supply surplus of 1.3 million barrels per day in 2026. Potential For Regained Bullish Momentum Regardless of the bearish price gap, traders should note that bullish momentum is being regained. According to many economists, the potential for higher oil prices continues to linger at the back of traders’ minds despite the US actively looking to bring prices lower. This includes stronger-than-expected economic data, particularly from the employment sector. The US latest employment report came as a shock to investors, and the country’s unemployment rate fell to 4.1%, the lowest since March and significantly lower than the market’s projections. In addition to this, the NFP Employment Change read 35,000 higher than expectations. Higher economic and employment data can justify a higher oil output and keep prices high. On the other hand, the economy and its outlook will significantly depend on global trade policy. Currently, investors look for confirmation on which countries will see higher tariffs imposed. The current deadline is July 9th. If the policy change triggers a bearish market, the price of Oil is likely to fall. Lastly, another factor which investors are contemplating is the ability of Iran to enrich and produce nuclear weapons. According to the Pentagon, the recent attacks on Iran set back the nuclear program by 6-12 months. Also, most experts believe the US, Israel and Iran will not be able to make an agreement on the country’s nuclear policy. As a result, is the conflict simply going to resume at a later point? If so, the geo-political tensions could push prices higher as they did in June 2025. Key Takeaway Points: OPEC+ is increasing oil output in July and August to regain market share, leading to an initial dip in prices. Despite the output increase, a potential for bullish momentum remains due to stronger-than-expected data, especially in the US employment sector. Upcoming global trade policy changes (July 9th deadline) could trigger a bearish market and cause oil prices to fall if new tariffs are imposed. Ongoing geopolitical tensions surrounding Iran's nuclear program could push oil prices higher again if conflict resumes. [b]Always trade with strict risk management. Your capital is the single most important aspect of your trading business.[/b] [b]Please note that times displayed based on local time zone and are from time of writing this report.[/b] Click [url=https://www.hfm.com/hf/en/trading-tools/economic-calendar.html][b]HERE[/b][/url] to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click [url=https://www.hfm.com/en/trading-tools/trading-webinars.html][b]HERE[/b][/url] to register for FREE! [url=https://analysis.hfm.com/][b]Click HERE to READ more Market news.[/b][/url] [b]Michalis Efthymiou HFMarkets[/b] [b]Disclaimer:[/b] This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. [b]Date: 7th July 2025.[/b] [b]Oil Prices Drop But Bullish Potential Remains![/b] OPEC members confirm they will increase oil production and output in July and August. As a result, the price of Oil fell 1.40% on Monday, but almost regains its previous losses. According to reports, the higher output is an attempt by OPEC members to regain market share. Oil has largely been trading sideways since June 24th after the 16% decline. What’s next for Crude Oil prices? US Oil / Crude Oil Chart OPEC and New Oil Output! Members of OPEC have seen tensions rise as certain members have been producing more oil than others. As a result, the main topic for discussion during yesterday’s meeting was an increase across all members. This development was the main reason for the day’s bearish price gap. As Bloomberg reports, Riyadh is trying to win back lost market share by asking to continue the production quota adjustment of 411,000 barrels per day in August, and possibly in the months thereafter. Saudi Aramco has already lowered the price of Arab Light crude for Asian buyers by $0.20 in July. At the same time, eight OPEC+ countries, including Russia, Saudi Arabia, Algeria, Iraq, Kuwait, the UAE, Kazakhstan, and Oman, are slowly lifting their voluntary production cuts, raising output by another 386,000 barrels per day. Morgan Stanley analysts expect Brent Crude to fall to around $60.20 and Crude Oil to $58.80, with a supply surplus of 1.3 million barrels per day in 2026. Potential For Regained Bullish Momentum Regardless of the bearish price gap, traders should note that bullish momentum is being regained. According to many economists, the potential for higher oil prices continues to linger at the back of traders’ minds despite the US actively looking to bring prices lower. This includes stronger-than-expected economic data, particularly from the employment sector. The US latest employment report came as a shock to investors, and the country’s unemployment rate fell to 4.1%, the lowest since March and significantly lower than the market’s projections. In addition to this, the NFP Employment Change read 35,000 higher than expectations. Higher economic and employment data can justify a higher oil output and keep prices high. On the other hand, the economy and its outlook will significantly depend on global trade policy. Currently, investors look for confirmation on which countries will see higher tariffs imposed. The current deadline is July 9th. If the policy change triggers a bearish market, the price of Oil is likely to fall. Lastly, another factor which investors are contemplating is the ability of Iran to enrich and produce nuclear weapons. According to the Pentagon, the recent attacks on Iran set back the nuclear program by 6-12 months. Also, most experts believe the US, Israel and Iran will not be able to make an agreement on the country’s nuclear policy. As a result, is the conflict simply going to resume at a later point? If so, the geo-political tensions could push prices higher as they did in June 2025. Key Takeaway Points: OPEC+ is increasing oil output in July and August to regain market share, leading to an initial dip in prices. Despite the output increase, a potential for bullish momentum remains due to stronger-than-expected data, especially in the US employment sector. Upcoming global trade policy changes (July 9th deadline) could trigger a bearish market and cause oil prices to fall if new tariffs are imposed. Ongoing geopolitical tensions surrounding Iran's nuclear program could push oil prices higher again if conflict resumes. [b]Always trade with strict risk management. Your capital is the single most important aspect of your trading business.[/b] [b]Please note that times displayed based on local time zone and are from time of writing this report.[/b] Click [url=https://www.hfm.com/hf/en/trading-tools/economic-calendar.html][b]HERE[/b][/url] to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click [url=https://www.hfm.com/en/trading-tools/trading-webinars.html][b]HERE[/b][/url] to register for FREE! [url=https://analysis.hfm.com/][b]Click HERE to READ more Market news.[/b][/url] [b]Michalis Efthymiou HFMarkets[/b] [b]Disclaimer:[/b] This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. [b]Date: 7th July 2025.[/b] [b]Oil Prices Drop But Bullish Potential Remains![/b] OPEC members confirm they will increase oil production and output in July and August. As a result, the price of Oil fell 1.40% on Monday, but almost regains its previous losses. According to reports, the higher output is an attempt by OPEC members to regain market share. Oil has largely been trading sideways since June 24th after the 16% decline. What’s next for Crude Oil prices? US Oil / Crude Oil Chart OPEC and New Oil Output! Members of OPEC have seen tensions rise as certain members have been producing more oil than others. As a result, the main topic for discussion during yesterday’s meeting was an increase across all members. This development was the main reason for the day’s bearish price gap. As Bloomberg reports, Riyadh is trying to win back lost market share by asking to continue the production quota adjustment of 411,000 barrels per day in August, and possibly in the months thereafter. Saudi Aramco has already lowered the price of Arab Light crude for Asian buyers by $0.20 in July. At the same time, eight OPEC+ countries, including Russia, Saudi Arabia, Algeria, Iraq, Kuwait, the UAE, Kazakhstan, and Oman, are slowly lifting their voluntary production cuts, raising output by another 386,000 barrels per day. Morgan Stanley analysts expect Brent Crude to fall to around $60.20 and Crude Oil to $58.80, with a supply surplus of 1.3 million barrels per day in 2026. Potential For Regained Bullish Momentum Regardless of the bearish price gap, traders should note that bullish momentum is being regained. According to many economists, the potential for higher oil prices continues to linger at the back of traders’ minds despite the US actively looking to bring prices lower. This includes stronger-than-expected economic data, particularly from the employment sector. The US latest employment report came as a shock to investors, and the country’s unemployment rate fell to 4.1%, the lowest since March and significantly lower than the market’s projections. In addition to this, the NFP Employment Change read 35,000 higher than expectations. Higher economic and employment data can justify a higher oil output and keep prices high. On the other hand, the economy and its outlook will significantly depend on global trade policy. Currently, investors look for confirmation on which countries will see higher tariffs imposed. The current deadline is July 9th. If the policy change triggers a bearish market, the price of Oil is likely to fall. Lastly, another factor which investors are contemplating is the ability of Iran to enrich and produce nuclear weapons. According to the Pentagon, the recent attacks on Iran set back the nuclear program by 6-12 months. Also, most experts believe the US, Israel and Iran will not be able to make an agreement on the country’s nuclear policy. As a result, is the conflict simply going to resume at a later point? If so, the geo-political tensions could push prices higher as they did in June 2025. Key Takeaway Points: OPEC+ is increasing oil output in July and August to regain market share, leading to an initial dip in prices. Despite the output increase, a potential for bullish momentum remains due to stronger-than-expected data, especially in the US employment sector. Upcoming global trade policy changes (July 9th deadline) could trigger a bearish market and cause oil prices to fall if new tariffs are imposed. Ongoing geopolitical tensions surrounding Iran's nuclear program could push oil prices higher again if conflict resumes. [b]Always trade with strict risk management. Your capital is the single most important aspect of your trading business.[/b] [b]Please note that times displayed based on local time zone and are from time of writing this report.[/b] Click [url=https://www.hfm.com/hf/en/trading-tools/economic-calendar.html][b]HERE[/b][/url] to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click [url=https://www.hfm.com/en/trading-tools/trading-webinars.html][b]HERE[/b][/url] to register for FREE! [url=https://analysis.hfm.com/][b]Click HERE to READ more Market news.[/b][/url] [b]Michalis Efthymiou HFMarkets[/b] [b]Disclaimer:[/b] This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. [b]Date: 7th July 2025.[/b] [b]Oil Prices Drop But Bullish Potential Remains![/b] OPEC members confirm they will increase oil production and output in July and August. As a result, the price of Oil fell 1.40% on Monday, but almost regains its previous losses. According to reports, the higher output is an attempt by OPEC members to regain market share. Oil has largely been trading sideways since June 24th after the 16% decline. What’s next for Crude Oil prices? US Oil / Crude Oil Chart OPEC and New Oil Output! Members of OPEC have seen tensions rise as certain members have been producing more oil than others. As a result, the main topic for discussion during yesterday’s meeting was an increase across all members. This development was the main reason for the day’s bearish price gap. As Bloomberg reports, Riyadh is trying to win back lost market share by asking to continue the production quota adjustment of 411,000 barrels per day in August, and possibly in the months thereafter. Saudi Aramco has already lowered the price of Arab Light crude for Asian buyers by $0.20 in July. At the same time, eight OPEC+ countries, including Russia, Saudi Arabia, Algeria, Iraq, Kuwait, the UAE, Kazakhstan, and Oman, are slowly lifting their voluntary production cuts, raising output by another 386,000 barrels per day. Morgan Stanley analysts expect Brent Crude to fall to around $60.20 and Crude Oil to $58.80, with a supply surplus of 1.3 million barrels per day in 2026. Potential For Regained Bullish Momentum Regardless of the bearish price gap, traders should note that bullish momentum is being regained. According to many economists, the potential for higher oil prices continues to linger at the back of traders’ minds despite the US actively looking to bring prices lower. This includes stronger-than-expected economic data, particularly from the employment sector. The US latest employment report came as a shock to investors, and the country’s unemployment rate fell to 4.1%, the lowest since March and significantly lower than the market’s projections. In addition to this, the NFP Employment Change read 35,000 higher than expectations. Higher economic and employment data can justify a higher oil output and keep prices high. On the other hand, the economy and its outlook will significantly depend on global trade policy. Currently, investors look for confirmation on which countries will see higher tariffs imposed. The current deadline is July 9th. If the policy change triggers a bearish market, the price of Oil is likely to fall. Lastly, another factor which investors are contemplating is the ability of Iran to enrich and produce nuclear weapons. According to the Pentagon, the recent attacks on Iran set back the nuclear program by 6-12 months. Also, most experts believe the US, Israel and Iran will not be able to make an agreement on the country’s nuclear policy. As a result, is the conflict simply going to resume at a later point? If so, the geo-political tensions could push prices higher as they did in June 2025. Key Takeaway Points: OPEC+ is increasing oil output in July and August to regain market share, leading to an initial dip in prices. Despite the output increase, a potential for bullish momentum remains due to stronger-than-expected data, especially in the US employment sector. Upcoming global trade policy changes (July 9th deadline) could trigger a bearish market and cause oil prices to fall if new tariffs are imposed. Ongoing geopolitical tensions surrounding Iran's nuclear program could push oil prices higher again if conflict resumes. [b]Always trade with strict risk management. Your capital is the single most important aspect of your trading business.[/b] [b]Please note that times displayed based on local time zone and are from time of writing this report.[/b] Click [url=https://www.hfm.com/hf/en/trading-tools/economic-calendar.html][b]HERE[/b][/url] to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click [url=https://www.hfm.com/en/trading-tools/trading-webinars.html][b]HERE[/b][/url] to register for FREE! [url=https://analysis.hfm.com/][b]Click HERE to READ more Market news.[/b][/url] [b]Michalis Efthymiou HFMarkets[/b] [b]Disclaimer:[/b] This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

Market Technical Analysis by RoboForex

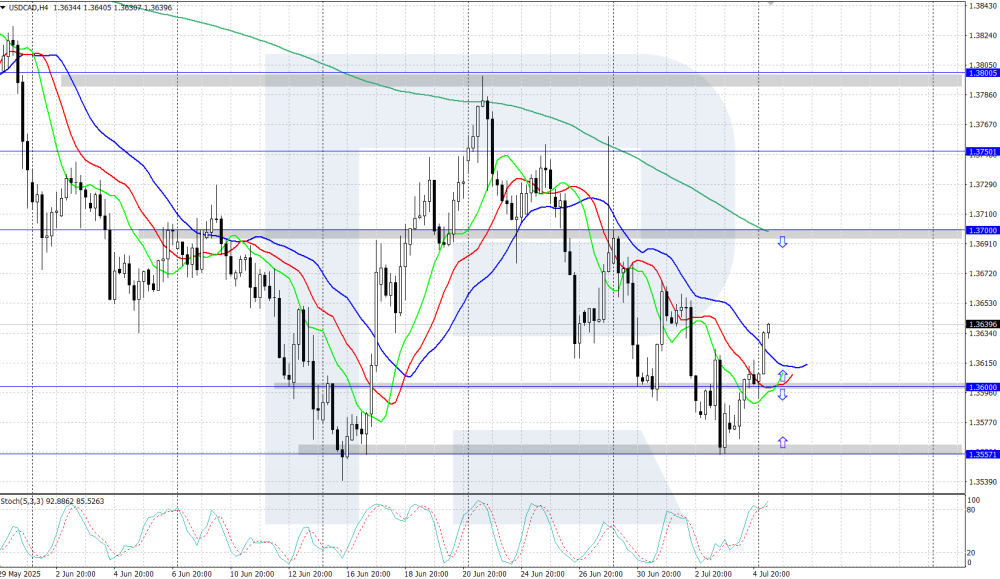

RBFX Support replied to RBFX Support's topic in Technical Analysis

USDCAD: the pair reversed upwards, will growth continue? USDCAD reversed upwards and consolidated above 1.3600 amid weak Canadian economic data published last week. Details – in our analysis for 7 July 2025. USDCAD technical analysis On the H4 chart, USDCAD quotes show an upward correction within a downtrend. Quotes rebounded from daily support at 1.3557 and formed a reversal upwards. In the near term, there is a high probability of the upward correction continuing. USDCAD quotes reversed upwards and rose to an area above 1.3600. Read more - USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

EURUSD weekly forecast: US budget deficit and trade wars in focus Last week the euro reached new peaks but EURUSD corrected by week’s end, stabilising amid the US holiday and market readiness to react swiftly to changing conditions. This weekly EURUSD forecast analyses factors that could drive the pair to fresh 2025 highs. EURUSD forecast: key trading points Market focus: Donald Trump signs measures set to push the US budget deficit to its limits. On 9 July maximum trade tariffs come into effect. Current trend: The medium-term uptrend remains intact; short-term consolidation is near 1.1780. EURUSD forecast for 7-11 July 2025: Growth target – retest of the 1.1836 high; support levels – 1.1680 and 1.1439. Fundamental analysis EURUSD fundamentals remain mixed and contradictory. The dollar strengthened after the US jobs report showed 147,000 new jobs created in June – above forecasts and May’s reading. Unemployment fell to 4.1 % despite expectations of a rise. These figures lowered the chance of a near-term Fed rate cut and briefly restored dollar demand as a relatively stable currency. In the UK and eurozone, attention turns to central bank policy. The Bank of England signals readiness to cut rates in August amid fears of overheating and a sharp economic slowdown. The ECB remains more reserved: President Christine Lagarde stated that further steps depend on data and that current rates are near neutral. This gives EUR local stability while the dollar weakens overall. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 271 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

This looks interesting,.. need to find right template . anyone has templates for this?

-

Can anyone please share this course https://fttuts.com/the-forex-scalpers-the-indices-orderflow-masterclass/

-

Look forward for magician !

- 1 reply

-

- profit mahcine

- aminbroker

-

(and 2 more)

Tagged with:

-

@kimsam Please take a look at it again. Showing Free Trial License has Expired after using it for 7 days