⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Past hour

-

Found it. Sorry for the duplicated thread.

- Today

-

⭐ chullankallan reacted to a post in a topic:

Sentient Trader 4.04.17

⭐ chullankallan reacted to a post in a topic:

Sentient Trader 4.04.17

-

apmoo already has a thread of the same title

-

ampf started following maverickindicators.com , algotradingsystems.net , wealthtechnical.com and 1 other

-

Needs to be educated https://account.algotradingsystems.net/Secure/Downloads

-

Needs to be educated https://www.wealthtechnical.com/indicators.html Files can be downloaded here https://account.algotradingsystems.net/Secure/Downloads

-

Needs to be educated https://www.youtube.com/@TheAlgoTraderLLC https://limewire.com/d/H9WO6#vmaaILkg0u

-

Need to be educated MaverickMultiX.zip is triggering virus alert https://www.maverickindicators.com/ https://www.youtube.com/@MaverickIndicators/videos https://limewire.com/d/5m9wi#WGjv5EC5hS

-

Do emotions determine profits more than analysis?

arabitech replied to Bambang Sugiarto's topic in General Forex Discussions

Emotions may lead to second opinion and that creates trouble in the middle of the trading, so better to back test any strategy on a demo account and write a proper trade management plan in order to curb emotions. -

Managing the risks and money is just another skill associated with making profits in the trading which come with experience and spending time in the market.

-

Did not work for me. Even though i managed to successfully "make" the serial with your installer file but TI remained locked for any version upgrade that has the online check. Only bro Kesk installer version works. :(((((. Hope someone can find a breakthrough.

-

Might I ask you, why are you doing a strategy as an indicator? Would it not be easier to make an indicator and call it from a strategy?

-

kkreg reacted to a post in a topic:

chompsky.net

kkreg reacted to a post in a topic:

chompsky.net

-

kkreg reacted to a post in a topic:

tradinghabitually.com

kkreg reacted to a post in a topic:

tradinghabitually.com

-

thanks bros...

-

kkreg reacted to a post in a topic:

advancedsoftwarefeatures.com

kkreg reacted to a post in a topic:

advancedsoftwarefeatures.com

-

Both money management and risk management are crucial for traders, since they help protect capital and ensure long-term growth. Just like in investing, where diversification in Mining Stocks can balance potential risks with rewards, applying the same mindset to trading allows you to stay disciplined and consistent.

-

Do emotions have a greater impact on profits than analysis? Many traders fail not because of poor strategies, but because they cannot control their emotions. Let's discuss! Share your opinions and experiences about the role of emotions in trading or investing. Which is more dominant: logic or feelings?

-

hybrid76 reacted to a post in a topic:

chompsky.net

hybrid76 reacted to a post in a topic:

chompsky.net

-

The exact string to search in x64dbg: Search for Current module pattern in Hex: write 8B95E8FDFFFF8D85ECFDFFFFB900

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date: 3rd September 2025. Global Market Turmoil: Bond Yields Surge, Gold Hits Record High. Global financial markets came under pressure on Tuesday as rising bond yields, inflation concerns, and political uncertainty shook investor confidence. The result was a sharp selloff in equities, soaring government borrowing costs, and a flight to safe-haven assets such as gold and silver. Bond Yields Surge to Multi-Decade Highs US markets reopened after the Labor Day holiday to heavy selling, as an avalanche of new corporate bond issuance amplified pressure on Treasuries. Longer-dated maturities bore the brunt, with the UK’s 30-year gilt yield climbing 6 basis points to 5.692% — its highest level since 1998. The surge in yields reflected deep investor unease, leaving equity markets awash in red. The trend extended globally: Japan’s 30-year government bond (JGB) yield climbed to a record 3.255%. The US 30-year Treasury yield approached the key 5% level. European government bonds also faced selling pressure, reflecting mounting fiscal and debt sustainability concerns. In Asia, Japan’s Nikkei fell 0.69% on worries about the country’s fiscal health, while the MSCI Asia-Pacific index slipped 0.4%. European equity futures pointed to a cautious open, with traders weighing risks from bond market volatility and ongoing political uncertainty in France and the UK. Ben Bennett, Asia Head of Investment Strategy at Legal & General, noted: "It’s a perfect storm for long-dated bonds. Fiscal deficits are huge, issuance is heavy, and Japan is no longer exporting capital to buy foreign bonds. This is becoming a major headache for governments." Gold Soars to Fresh Record Against this backdrop of fiscal anxiety and political uncertainty, gold surged to a historic high. The benchmark bullion price jumped beyond $3,526 per troy ounce — surpassing April’s record and marking a 34% gain since the start of the year. The rally has been supported by a weaker dollar, expectations of a US interest rate cut, and concerns over the Federal Reserve’s independence after President Trump’s political interventions. Trump has openly pressured Fed Chair Jay Powell and moved to dismiss Governor Lisa Cook, heightening fears that monetary policy could be compromised. Investor demand has also been reinforced by large inflows into gold exchange-traded funds (ETFs) and central bank purchases. Analysts at Goldman Sachs now forecast gold to reach $4,000 per troy ounce by mid-2026. Silver joined the rally, climbing to $40.8 a troy ounce — its highest in 14 years — as investors broadened their search for safe-haven assets. Sterling Slumps as UK Debt Costs Climb The British pound posted its sharpest one-day drop since April, falling as much as 1.5% against the US dollar before stabilizing. The slide came as the UK’s 30-year gilt yield touched 5.72%, reflecting deep concerns over the country’s public finances. Market Outlook: Jobs Data and CPI in Focus Investors now await a series of key US economic releases: Job openings and private payrolls data this week. The August US nonfarm payrolls report on Friday. CPI inflation data on September 11, which could be decisive for the Fed. Markets are currently pricing in an 89% chance of a 25-basis-point Fed rate cut this month. With global bond yields at multi-decade highs, gold at record prices, and currencies under pressure, markets are entering a highly volatile phase. Fiscal deficits, political risks, and central bank credibility are now the dominant forces shaping investor behavior. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Andria Pichidi HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

⭐ laser1000it reacted to a post in a topic:

A free very good complete and praticse program for time series predictions.

⭐ laser1000it reacted to a post in a topic:

A free very good complete and praticse program for time series predictions.

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDJPY rally: yen avoids risk The USDJPY pair surged to 148.80, with political imbalance weighing on the yen outlook. Find out more in our analysis for 3 September 2025. USDJPY forecast: key trading points The USDJPY pair is rising rapidly The market is monitoring political issues and pricing in these risks USDJPY forecast for 3 September 2025: 148.90 Fundamental analysis The USDJPY rate climbed to 148.80 midweek. The yen reached a one-month low amid political uncertainty in Japan. Hiroshi Moriyama, secretary of the ruling party and close ally of Prime Minister Shigeru Ishiba, announced his resignation. This fueled speculation about Ishiba’s potential departure, with pressure mounting after his election defeat. Among possible successors is Sanae Takaichi, known for her support of low interest rates. Meanwhile, Bank of Japan Deputy Governor Ryozo Himino emphasised on Tuesday that the central bank will continue to raise rates gradually but noted the persistence of elevated global risks. This signals no urgency in tightening policy. Investors now await fresh wage data, which should provide additional signals on the future course of monetary policy. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 311 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

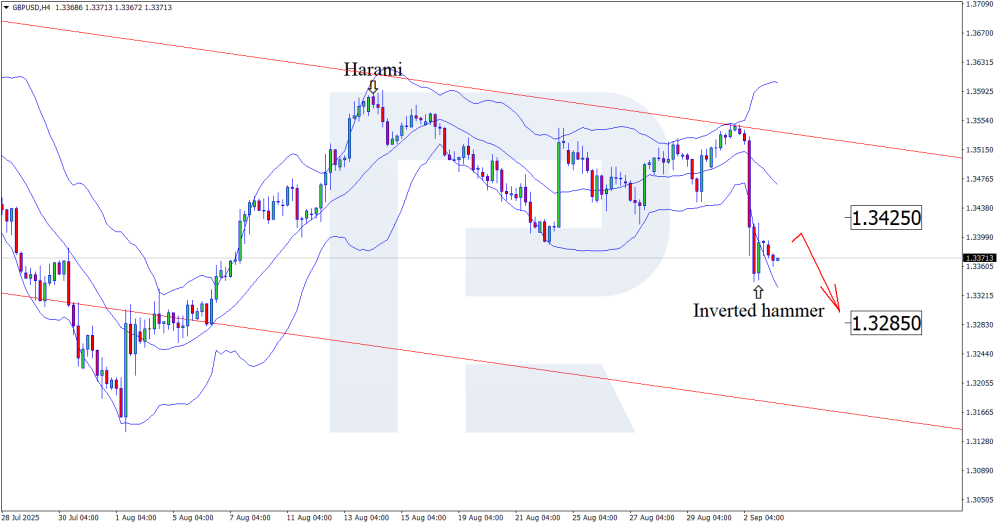

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

GBPUSD in turbulence zone – what will the Bank of England say The British pound came under pressure again, but ahead of key fundamental data, there is a small chance of a GBPUSD correction towards 1.3425. Discover more in our analysis for 3 September 2025. GBPUSD technical analysis On the H4 chart, the GBPUSD pair tested the lower Bollinger Band and formed an Inverted Hammer reversal pattern. At this stage, the pair may develop a corrective wave following this signal. Given that the price is within a descending channel after a sharp drop, a corrective rebound is likely. The market is waiting for the Bank of England MPC hearings. Read more - GBPUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Optuma 1.6 (Market Analyst by old name)

⭐ laser1000it replied to ⭐ kesk's topic in Trading Platforms

waste time...you won't find 2.2 working in those links -

🥲 these were the files delivered to me, if anyone can get them would great. But thank you K 🙏

-

these are the files I use to get a key file I use a version of timing solution from 2016 just works best for me and the video that shows how to do it and also olly debug https://www.sendspace.com/file/om8tn0

-

setare reacted to a post in a topic:

A free very good complete and praticse program for time series predictions.

setare reacted to a post in a topic:

A free very good complete and praticse program for time series predictions.

-

Harrys reacted to a post in a topic:

chompsky.net

Harrys reacted to a post in a topic:

chompsky.net

-

as i know the Advanced GET only work with EOD data

-

fdeuf reacted to a post in a topic:

chompsky.net

fdeuf reacted to a post in a topic:

chompsky.net

-

Need the original files

-

setare started following ATCH FVG strategie

-

Is there no one here who is an NT programmer?