All Activity

- Today

-

II VIP Membership - FREE upgrade for OLD and ACTIVE Members

ESVepara replied to MrAdmin's topic in Announcements

Hello. Long time member and contributor. Please upgrade to the VIP. Thanks -

II VIP Membership - FREE upgrade for OLD and ACTIVE Members

emity replied to MrAdmin's topic in Announcements

hi received a email about free VIP Membership. Will be honored for such a opportunity . -

⭐ iatin reacted to a post in a topic:

0 DTE on spy

⭐ iatin reacted to a post in a topic:

0 DTE on spy

-

The course below looks interesting and low cost. Maybe some others can join in. Thanks https://clubbingbuy.com/threads/prime-defi.13342/

-

The course below looks interesting and low cost. Maybe some others can join in. Thanks https://clubbingbuy.com/threads/defi-profits-made-simple.15489/

-

⭐ laser1000it reacted to a post in a topic:

Sometime Amibroker turn to unregistered.

⭐ laser1000it reacted to a post in a topic:

Sometime Amibroker turn to unregistered.

-

⭐ laser1000it reacted to a post in a topic:

Sometime Amibroker turn to unregistered.

⭐ laser1000it reacted to a post in a topic:

Sometime Amibroker turn to unregistered.

-

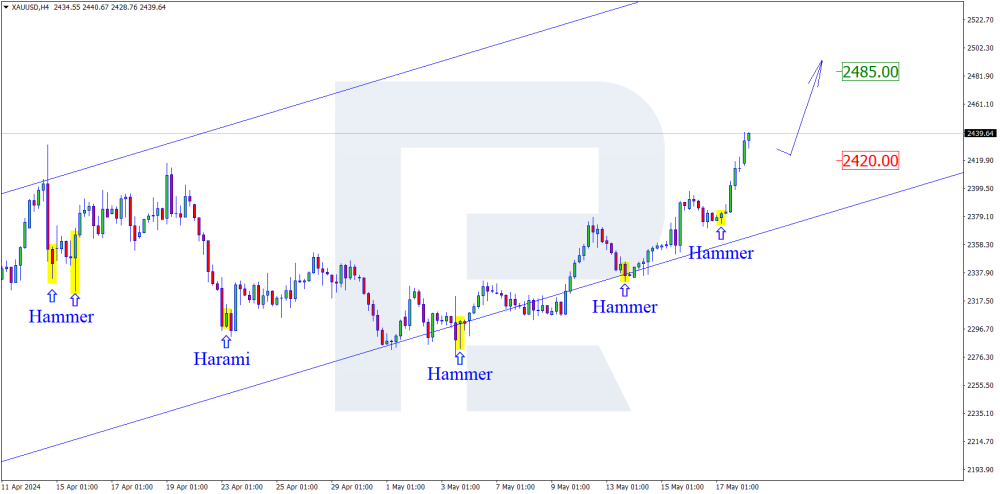

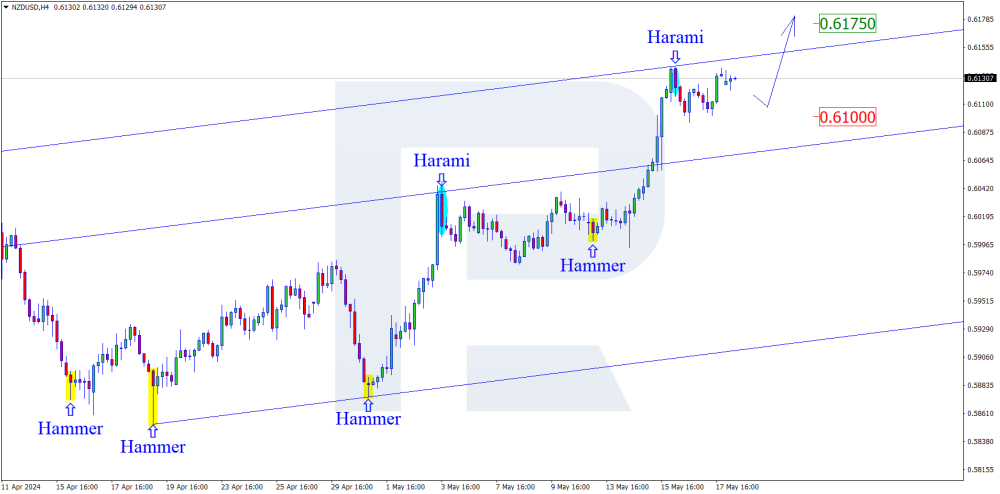

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Japanese Candlesticks Analysis 20.05.2024 (XAUUSD, NZDUSD, GBPUSD) XAUUSD, “Gold vs US Dollar” Gold has formed a Hammer pattern. Currently, the instrument is going by the reversal signal in an ascending wave. The growth target might be 2485.00. After testing the resistance level, the price could break above it and continue its upward momentum. However, the quotes could correct to 2420.00 before rising. NZDUSD, “New Zealand Dollar vs US Dollar” NZDUSD has formed a Harami reversal pattern on H4. Currently, the instrument might continue to go by the reversal signal in a corrective wave. The pullback target might be 0.6100. After rebounding from the support level, the quotes might continue their upward trajectory. However, the price could rise to 0.6175 without testing the support. GBPUSD, “Great Britain Pound vs US Dollar” GBPUSD has formed a Shooting Star reversal pattern on H4. Currently, the instrument could go by the reversal signal in a descending wave. The correction target might be 1.2665. However, the price could rise to 1.2765 and continue the uptrend without testing the support level. Read more - Japanese Candlesticks Analysis (XAUUSD, NZDUSD, GBPUSD) Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

EURUSD is slightly higher. Overview for 20.05.2024 The primary currency pair looks lively on Monday. The current EURUSD exchange rate stands at 1.0880. This morning, the exchange rate touched 1.0895, marking a two-month peak tested last week. The market will soon mainly focus on the core PCE data, a key inflation indicator used by the Federal Reserve to gauge price pressure. This data will be released on 31 May. The market believes that the Fed will not have all the necessary statistics for its next meeting and will, therefore, not make crucial decisions in June or July. Federal Reserve Chair Jerome Powell might use his speech at the Jackson Hole Economic Symposium in August to present his stance regarding the September meeting. Investors will focus this week on the publication of the Federal Reserve’s latest meeting minutes and the eurozone's current PMI data. Fundamental analysis for other instruments can be found in the section "Forex Forecasts and Analysis" on our website. Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 14 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

This is the complete file hosts to solve the problem. I have forgotten the last two lines. # Amibroker Blocker Key Verificator 127.0.0.1 www.amibroker.com 127.0.0.1 amibroker.com 127.0.0.1 www.amibroker.pl 127.0.0.1 amibroker.pl 127.0.0.1 www.amibroker.net 127.0.0.1 amibroker.net 127.0.0.1 updates.connectify.me 127.0.0.1 ns1.amibroker.com 127.0.0.1 NEO.PL 127.0.0.1 www.enom.com

-

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date: 16th May 2024. Market News – Stagflationary Risk for Japan; Bonds & Stocks Higher. Economic Indicators & Central Banks: Stocks and bonds gave a big sigh of relief after CPI and retail sales came in below expectations, supporting beliefs the FOMC will be able to cut rates by September. The markets had positioned for upside surprises. Wall Street surged with all three major indexes climbing to fresh record highs. Technical buying in Treasuries was also supportive after key rate levels were breached, sending yields to the lows since early April. Fed policy outlook: there is increasing optimism for a September rate cut, according to Fed funds futures, BUT most officials say they want several months of data to be confident in their actions. Plus, while price pressures are receding, rates are still well above the 2% target, keeping policy on hold. But the market is now showing about 22 bps in cuts by the end of Q3, with some 48 bps priced in for the end of 2024. Stagflationary Risk for Japan: GDP contracted much sharper than anticipated, for a 3rd quarter in a row. This is mainly due to consumer spending. The GDP deflator though came in higher than expected but still down from the previous quarter. The sharper than anticipated contraction in activity will complicate the outlook for the BoJ, and dent rate hike bets. Financial Markets Performance: The USDIndex slumped to 103.95, the first time below the 104 level since April 9. Yen benefitted significantly, with USDJPY currently at 154.35 as easing US inflation boosted bets on the Fed easing monetary policy this year, weakening USD, boosting the Yen. Gold benefited from a weaker Dollar and a rally in bonds and the precious metal is trading at $2389 per ounce. At the same time, the precarious geopolitical situation in the Middle East is underpinning haven demand. Oil prices rebounded slightly after the shinking of US stockpiles and the risk-on mood due to declined US Inflation. However USOil is still at the lowest level in 2 months, at 78.57. Market Trends: The NASDAQ popped 1.4% to 16,742. The S&P500 advanced 1.17% to 5308, marking a new handle. And the Dow rose 0.88% to 39,908. Treasury yields tumbled sharply too on the increasingly dovish Fed outlook. Additionally, the break of key technical levels extended the gains to the lowest levels since early April before the shocking CPI data on April 10 boosted rates. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Andria Pichidi Market Analyst HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

Peter adams reacted to a post in a topic:

[Please Vote] What markets do you trade now?

Peter adams reacted to a post in a topic:

[Please Vote] What markets do you trade now?

-

Start from Post #1, read the instructions over there, install them. Find the latest Terra update which you can see and use that.

-

Sometime Amibroker turn to unregistered.Please delete the keys below in Regedit. Someone knows the way to solve definitly this little problem? "HKEYCURRENT USER\Software\Microsoft\Windows\CurrentVersion\ Explorer\CLSID\{949ECF34-5756-4b9c-9692-2decAA8b91a2}" (it contains a key value named 'Specialfolder'). 2. Delete the corresponding AmiBroker directory 3. Run "regedit" and delete the below registry: Value "ModernViewStatePersist" in "HKEY_CURRENT_USER\Software\Microsoft\Windows\Curr entVersion\Explorer\Advanced" Value "ModernViewStatePersistent" in "HKEY_CURRENT_USER\Software\Microsoft\Windows\Curr entVersion\Explorer\Advanced"

-

Please upload Amiquote 4.15 cracked.

⭐ Atomo12345 replied to ⭐ Atomo12345's topic in Trading Platforms

Sometime Amibroker turn to unregistered.Please delete the keys below in Regedit. Someone know the way to solve definitly this little problem? "HKEYCURRENT USER\Software\Microsoft\Windows\CurrentVersion\ Explorer\CLSID\{949ECF34-5756-4b9c-9692-2decAA8b91a2}" (it contains a key value named 'Specialfolder'). 2. Delete the corresponding AmiBroker directory 3. Run "regedit" and delete the below registry: Value "ModernViewStatePersist" in "HKEY_CURRENT_USER\Software\Microsoft\Windows\Curr entVersion\Explorer\Advanced" Value "ModernViewStatePersistent" in "HKEY_CURRENT_USER\Software\Microsoft\Windows\Curr entVersion\Explorer\Advanced" -

II VIP Membership - FREE upgrade for OLD and ACTIVE Members

PS Doddy replied to MrAdmin's topic in Announcements

Yes count me in. - Yesterday

-

-

[GET] Minervini Private Access 2022

⭐ ahmed ibrahim replied to ⭐ ahmed ibrahim's topic in Forex Clips & Movies

Unfortunately, no, I searched for it long enough, perhaps minervini held it for 2 months to make his "MTP" course -

II VIP Membership - FREE upgrade for OLD and ACTIVE Members

rmassip replied to MrAdmin's topic in Announcements

Hi there, long time member since 2019, only just saw the email and found my password...if there is any chance of the VIP membership I'd greatly appreciate it thanks ☺️ -

⭐ mesagio reacted to a post in a topic:

[GET] Minervini Private Access 2022

⭐ mesagio reacted to a post in a topic:

[GET] Minervini Private Access 2022

-

[GET] Minervini Private Access 2022

⭐ mesagio replied to ⭐ ahmed ibrahim's topic in Forex Clips & Movies

thx. Do you have July and August also ? -

Traderbeauty reacted to a post in a topic:

REQ: Ultimate Scalper

Traderbeauty reacted to a post in a topic:

REQ: Ultimate Scalper

-

II VIP Membership - FREE upgrade for OLD and ACTIVE Members

ralph kabota replied to MrAdmin's topic in Announcements

have been a member since 2008 and I posted more than 20. can you please upgrade my membership -

Bill A reacted to a post in a topic:

TDU - Latest

Bill A reacted to a post in a topic:

TDU - Latest

-

II VIP Membership - FREE upgrade for OLD and ACTIVE Members

⭐ fxknight replied to MrAdmin's topic in Announcements

Please upgrade me for VIP. Been with you for over 10 years. Thanks! -

Thank you.

-

nytrader1 joined the community

-

Thank you 👍

-

h**ps://[email protected]/file/bo1i4x