⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Past hour

-

- Today

-

NinZa Multi-Instrument Synergy (Fusion)

Ninja_On_The_Roof replied to ⭐ rcarlos1947's topic in Ninja Trader 8

https://workupload.com/archive/22cXUVn8aa -

NASDAQ reacted to a post in a topic:

fixed .. ORS Fusion and Axios

NASDAQ reacted to a post in a topic:

fixed .. ORS Fusion and Axios

-

⭐ laser1000it reacted to a post in a topic:

DTTW - Atlas Line

⭐ laser1000it reacted to a post in a topic:

DTTW - Atlas Line

-

⭐ laser1000it reacted to a post in a topic:

AI Prop Firm Prompt

⭐ laser1000it reacted to a post in a topic:

AI Prop Firm Prompt

-

⭐ laser1000it reacted to a post in a topic:

fixed .. ORS Fusion and Axios

⭐ laser1000it reacted to a post in a topic:

fixed .. ORS Fusion and Axios

-

Ninja_On_The_Roof reacted to a post in a topic:

marketxero.com

Ninja_On_The_Roof reacted to a post in a topic:

marketxero.com

-

Ninja_On_The_Roof reacted to a post in a topic:

marketxero.com

Ninja_On_The_Roof reacted to a post in a topic:

marketxero.com

-

Ninja_On_The_Roof reacted to a post in a topic:

marketxero.com

Ninja_On_The_Roof reacted to a post in a topic:

marketxero.com

-

Ninja_On_The_Roof reacted to a post in a topic:

DTTW - Atlas Line

Ninja_On_The_Roof reacted to a post in a topic:

DTTW - Atlas Line

-

Could you put the QQE indicator from NinzaCo on your charts, with same settings, and see if they match with your Axios? Thanks.

-

And finally, sorry I do not have the 3 game plans you asked for.🤗😂🤪

-

So, the question is...Which prop firm are you going to use? And so, does it have daily loss limit rule or it has EOD rule? This, might make you have or change to a different strategy to trade effectively. Does it have consistency rule for testing phase or it has none? 30%? 50%? This, will determine if you would have to continue to trade more, if and if you make profits more than 30% or 50% of their target goal. In your case, 50K. So yes, more days for your completion. Instead of $3000 target, now you would have to make more and more than this amount.

-

anyone got a2 mercantile mentorship course video link . i found old posts but the link there are not working .

-

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

Estimated amount of days to complete depends on many factors. You could make $100 today and you stop for the day. That might just be your daily goal target for profit. But the next day, you could happen to have a runner to run wild and you end up with a huge profit. This, moves up your days closer to the finish line. But then, the next day, you could end up losing all that profit back, plus more.

-

The bottom line is, just take it easy and slow. If you place a trade and you feel un-easy and stressed out with sweaty hands, then that is an indicator for which, you have probably oversized your trade.

-

Kermit 1981 reacted to a post in a topic:

marketxero.com

Kermit 1981 reacted to a post in a topic:

marketxero.com

-

The drawdown is $2500. But some folks think this is a solid number. Not realizing that there are also fees to add with each opening and closing trade. They keep going and going to some almost $2000. Then wondering why they have blown their accounts. Hey, I have $2500 for drawdown, why did you fail me, they ask. I only lost $2000. But yeah, they do not realize they have been opening and closing at least 50 trades and the fees kept adding and piling up.

-

This, we are not even talking about what instrument you are choosing to trade. This makes a big difference as well. ES is one story but NQ is another. It is a beast. So the risk and reward or your stoploss and target might need to be adjusted for each. Stoploss for NQ might need to be bigger to give it some breathing rooms, since it moves up and down like a nutcase on weeds.

-

The truth is, just because someone passes in 1 day, that does not mean at all, that this trader is going to be successful trading his or her funded account with the same way. It might just be pure luck he or she hit on the very first day, with a big win from a big drop or push. Yes, it is possible. I have done that myself and I know many traders have as well. But I blew my funded accounts as quickly as I passed. Gone with the wind. Thinking, with the same mentality and actions when I passed that I could again use with funded accounts. I was a fool. I was dumb. That is, the honest truth on my part.

-

the secret sauce as the creator of Axios calls it, the green and red arrows is a simple QQE indicator with 8,2,1.3 settings , see this https://ninjatraderecosystem.com/user-app-share-download/xtrends-qqe-indicator-for-nt8/

-

If you know that your strategy is to risk 20 points and a reward ratio of 40 points, then you already know how many trades you could throw out in a day, your max trades. Only imagine, with that ratio you have, if you come in right at the start and you hit 3 losses back to back. Then, should that be an indication for you to just now stop trading for the day? If you hit 3 winners straight. Then should that also be an indication for you to now stop for the day? Not even to mention that, there are prop firms with daily capped amount, whether it is 30% or 50% based off your your given target goal.

-

With a 50K account, I suggest to go slow with micros. Yes, it will take longer to pass but this aint a marathon. You have 30 days to complete. Why do it in such a hurry, only to blow your accounts left and right. Screw that psychology trap of "pass in 1 day". Screw that 7 max contracts. You have it there to know that you still have the ability to add on contracts, when in deed, you really need to do so...But never, ever come in straight with max contracts. That is a disaster waiting to happen.

-

Trading, to some degree, is a gamble. Yes, true so but then it is a type of gamble with knowledge, sheer concentration and with educated thinking, analyzing and actions. Unlike a type of gamble when we hit Las Vegas, put $10 bucks in a slot machine and pull. That is just pure luck, if we do actually win. But again, everything in life, really is a gamble. We win. We lose. We are down. We are up. We fight with life to survive, left and right with every single decision that we make.

-

To me at least, in my view, the "max contract size" and the "one day pass" are purely psychological traps. Folks, especially the "desperates" and newbies, think they can just come in with maximum contracts allowed, in order to pass in just 1 day. That is insane. Only to blow them all in 1 trade or two, or in a single day.

-

They cant answer you because, for once, they do not know your choice of prop firm. Everyone of them has slightly different rules. Some have intraday drawdown. Some do not. Some have EOD drawdown. Some have daily loss limit and the others, dont. It does make a huge difference when it comes to this and that is just, on the surface.

-

oussamaosm joined the community

-

Ze_Pequeno reacted to a post in a topic:

RObos specialist in MGC, needs to educate

Ze_Pequeno reacted to a post in a topic:

RObos specialist in MGC, needs to educate

-

anyone with ORS Fusion working strayegy analyzer template?

-

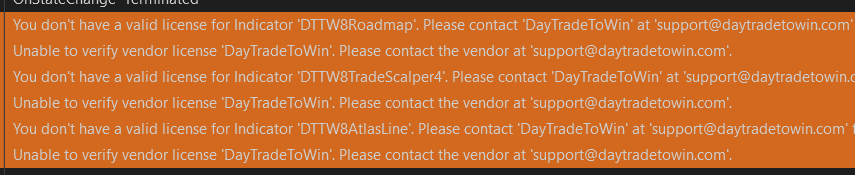

The Roadmap, Scalper4, News, Atlas have been educated and posted.

-

Someone has the indicator updated and the whole bundle? Footprint, VP, and levels? https://marketxero.com/

-

sorry i was not aware, this is the same file that was uploaded to indo, what about other versions that was uploaded to indo are they also infected? i can test it in a VM or sandbox and check if does have a virus, also i still do not know how to get it working, the instructions are confusing?

-

used trader432 template with secondary turned off started an eval to test , we'll see where it goes from here, i turned it off for this account after this profit:, but shifted to Sim account for rest of day10am-12pm window

-

THEY NEED TO BE EDU @apmoo@kimsam@N9T@redux DTTW8AtlasLine.cs DTTW8AtlasLine.dll DTTW8ATO2.cs DTTW8ATO2.dll DTTW8Multilines.cs DTTW8Multilines.dll DTTW8News4.cs DTTW8News4.dll DTTW8Roadmap.cs DTTW8Roadmap.dll DTTW8TradeScalper4.cs DTTW8TradeScalper4.dll

-

Just to be safe.......che with this action: try it in a virtual machine and once you reset the trial you'll see that you don't have any viruses