AllForexnews

-

Posts

739 -

Joined

-

Last visited

Content Type

Profiles

Forums

Articles

Posts posted by AllForexnews

-

-

Date: 11th June 2024.

Market News – Inflation reports dominates!

Economic Indicators & Central Banks:

- The selloff in Treasuries continued ahead of the FOMC decision tomorrow, though losses were moderate. Disappointment that the continued strength in the labor market will push back any easing until at least September at the earliest continued to weigh.

- Chinese stocks dropped after traders returned from a long weekend, weighed down by weak travel spending and renewed concerns over the property sector, raising doubts about the sustainability of China’s economic recovery.

- Developer Dexin China Holdings gets liquidation order from a Hong Kong court adding to a growing number of legal victories for creditors involving overdue debt.

- Geopolitical risks also affected shares of electric vehicle makers as traders awaited the European Commission’s decision on provisional duties expected this week.

- Australian business confidence turned negative in May, and conditions slipped to below-average levels, indicating that elevated interest rates and a worsening consumer outlook are weighing on the corporate sector.

- Markets are also closely monitoring potential fallout from political upheavals in Europe.

- All three major indexes closed higher on Monday, with the S&P500 and Nasdaq both hitting new records. The Dow ended the day up about 0.2%, following a modest finish to a winning week.

- The CSI 300 Index of mainland shares fell up to 1.4% after reopening from the Dragon Boat Festival holiday, while Hong Kong-listed Chinese shares were among Asia’s biggest decliners, dropping as much as 2%.

- Apple Inc. sank despite unveiling new artificial intelligence features. The company’s suppliers also dropped after Apple’s latest AI platform was seen as disappointing.

- Billionaire Elon Musk stated he would ban Apple devices from his companies if OpenAI’s software is integrated at the operating system level, calling it a security risk.

Financial Markets Performance:- The USDIndex has caught a bid with the push back to rate cut expectations. It closed at 105.150, back with a 105 handle for the first time since May 14.

- The EURUSD stalled at 1.0770, while GBPUSD declined slightly today after the tight labor data.

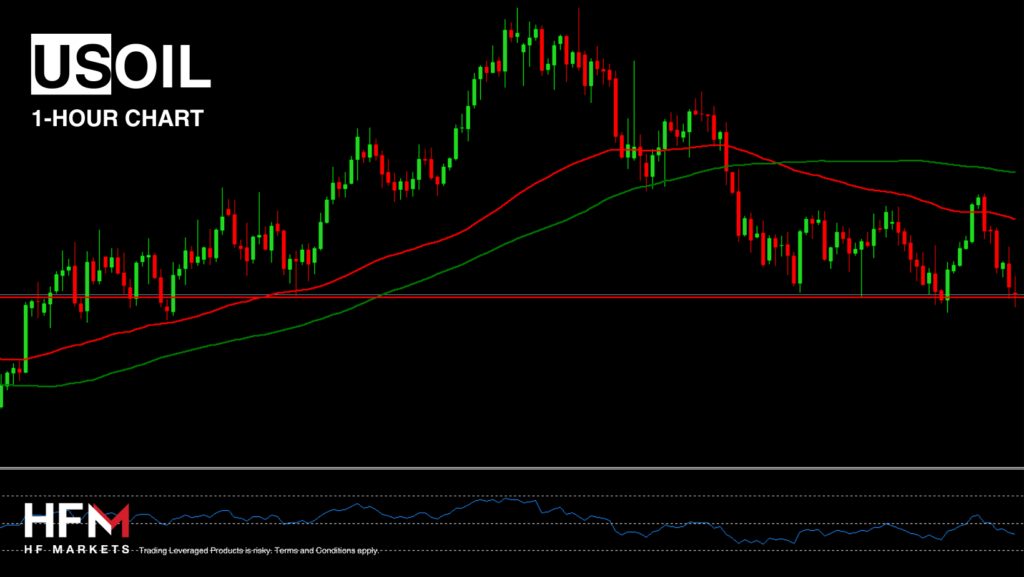

- USOIL held the biggest jump since March ahead of an OPEC report that will provide a snapshot on the market outlook.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Andria Pichidi

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

Date: 7th June 2024.

ECB closer look: All options open for the second half of the year!

ECB officials continue to dampen rate cut speculation, following on from Lagarde’s hawkish comments yesterday. Officials have been out in force this morning to continue stressing that the inflation outlook remains uncertain and that the central bank is not committing to a particular rate path for the rest of the year.

The ECB cut rates by 25 basis points, but as we expected it was a “hawkish” cut that left all options open for the second half of the year. Lagarde repeatedly stressed that future decisions will be data dependent, and even refused to confirm that yesterday’s move was the first step of an easing cycle. Rate cuts in September and December are still a possibility, but not cast in stone.

Simkus admitted that there may be more than one rate cut this year, but on the whole, the comments were designed to keep a lid on speculation that the central bank kicked off a rate cut cycle yesterday. Austria’s central bank head Holzmann went on record yesterday to confirm that he was the sole dissenter objecting to a cut yesterday, and so far the doves have been quiet, which is helping to affirm Lagarde’s hawkish message yesterday.

Details of the Rate Cut

The ECB delivered the first rate cut in five years and lowered key rates by 25 basis points. The deposit rate is now at 3.75% and the main refinancing rate at 4.25%. It was a “hawkish cut,” as near term inflation forecasts were revised higher, and Lagarde flagged that domestic inflation remains high. The statement stressed that the ECB is not pre-committing to a particular rate path, and the comments leave all options on the table for the second half of the year.

Economic Activity and Forecasts

The ECB noted the improvement in economic activity through the first quarter of the year. Lagarde also highlighted that manufacturing is showing signs of stabilization, with stronger exports expected to support growth in coming quarters. At the same time, monetary policy should be less of a drag on demand over time, according to the ECB. The new set of forecasts show GDP rising 0.9% this year, which is more than the 0.6% expected back in March. The forecast for 2025 has been revised slightly down to 1.4% from 1.5% previously, and the ECB still expects a slight acceleration to 1.6% for 2026.

The inflation forecast for this year was raised to 2.5% from 2.3%, and the projection for 2025 was hiked to 2.2% from 2.0%. As such, inflation will fall toward the target later than previously anticipated, though the forecast for 2026 was left unchanged at 1.9%. This means the headline rate is still expected to fall below the target at the end of the forecast horizon.

Upside Risks to Inflation

The statement noted upside risks to the inflation outlook from wages and profits, which could be higher than currently anticipated. Geopolitical tensions and extreme weather events could also push up prices once again, according to the ECB. At the same time, the ECB acknowledged that inflation could come in lower than anticipated if monetary restrictions have more of a dampening effect than currently anticipated, or if global growth weakens more than projected.

http://www.actioneconomics.com/upload/Europe-Econ/EMU17_400x250.gif

The press conference was mainly dedicated to driving home the point that future decisions will depend on data available at the time of the respective meeting. Lagarde even refused to confirm that the central bank has effectively kicked off an easing cycle, and said in response to a question that she wouldn’t necessarily say that the ECB started a “dialing-back process”. She suggested it is likely, but refused to confirm it, which in theory means rates could actually go up again.

This seems unlikely, given that this move was a near unanimous decision, but its makes clear that the ECB will not cut rates at every meeting and that the outlook for the rest of the year is still very much open. The ECB still thinks that monetary policy needs to remain restrictive for the foreseeable future against the backdrop of high domestic inflation. However, as chief economist Lane suggested recently, officials will have to debate at every meeting whether the data allows the central bank to dial back the degree of restrictiveness.

Employment and Inflation Dynamics

http://www.actioneconomics.com/upload/Europe-Econ/EMU12_400x250.gif

Wage growth, profits, and services price inflation will remain the key numbers to watch through the rest of the year. Lagarde pointed to data on the compensation of employees, due to be released tomorrow, but also flagged that current wage agreements are often still backward looking, as they reflect attempts to compensate for the sharp rise in prices since the start of the Ukraine war. As we flagged previously, the multi-year wage agreements in Germany are a prime example of that. However, as Lagarde highlighted, the deals on the table so far show sharp increases for this year, but also imply a slowdown in wage growth in coming years.

However, unemployment is at a record low and the number of vacancies has dropped only slightly. At the same time, service price inflation remains stubbornly high, which suggests that companies have sufficient room to pass on higher labor costs. With real disposable income rising, thanks to lower inflation and higher wages, companies could find it even easier to hike prices in the second half of the year, and yesterday’s rate cut is also likely to boost demand. In the current situation, this could add to domestic price pressures.

Looking ahead, the only thing that is clear is that Lagarde did her best to keep expectations of back-to-back cuts under control. The chances still are that the ECB will deliver two more 25 basis point cuts in September and December, but at this point, nothing is cast in stone.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Andria Pichidi

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

Date: 6th June 2024.

Ideal Economic Conditions Push The NASDAQ To New Highs!

- Economists expect the European Central Bank to cut interest rates this afternoon. However, investors will be keen to hear how many cuts are likely in 2024 after strong wage growth.

- The NASDAQ climbs to a new all-time high while economic data indicates an earlier rate adjustment but not a recession.

- The NASDAQ rises more than 2.00% on Wednesday. 88% of the most influential components within the NASDAQ rose.

- The US employment sector continues to witness signs of a slowdown, but investor sentiment rises while the ISM Services PMI rises to a 9-month high.

The NASDAQ rose again to an all-time-high after obtaining the ideal economic data to signal a sooner rate adjustment but not a harsh landing. The ADP Non-Farm Employment Change fell to 152,000 and the JOLTS Job Openings to 8,060,000. The data indicates the US employment sector is now at a higher risk of declining, but not yet necessarily on the downturn. Simultaneously the ISM Services PMI rose to a 9-month high which points to potential economic growth in the services sector.

As mentioned during yesterday’s market analysis, in order for the stock market to witness a stronger bullish impulse wave, investors will be looking for two elements. Economic data to pressure the Fed to adjust interest rates, but also some positive data to lower the risk of a recession. This was the primary reason for the strong trend observed during yesterday’s US session, marking one of the rare occasions when the asset increased without any pullbacks.

The 11 stocks with the highest “weight” all rose in value and only 12% of the most influential stocks declined. The best performing stocks were Broadcom (+6.18%), Applied Material (+5.25%) and NVIDIA (+5.16%). The only stocks which did not witness an increase were PepsiCo which fell 0.23% and Cisco Systems which fell 2.95%.

The NASDAQ is obtaining clear indications of upward price movement on all indicators (2-Hour & 4-Hour Chart). However, the price is trading slightly lower this morning which may prompt short term traders to hold off buy signals. In order to obtain a further buy signal, technical analysts point to 3 potential entry points. Based on the 100-Bar SMA the 5-Minute chart indicates a buy signal above $19,077.09, Fibonacci indicates a buy signal at $19,082.50 and the breakout level is at $19,095.00.

EURCHF – Investors Focus On The ECB’s Rate Decisions!

The day’s best performing currencies during this morning’s Asian session are the Swiss Franc, Canadian Dollar and the Australian Dollar. Therefore, if investors wish to speculate downward price movement due to rate cuts, these pairs potentially can be beneficial. From these exchanges the lowest spread is the EURAUD. During this morning the EURCHF is trading 0.09% lower and is forming a symmetrical triangle. Therefore, there is not yet a clear indication of buy or sell indications.

However, volatility is likely to rise after the European Cash Open and after the European Central Bank’s rate decision. Most economists believe the European Central Bank will cut interest rates 0.25%, and according to Bloomberg, this has almost been fully priced within the market. However, economists advise a key factor will be how many rate cuts are likely. Over the past two weeks, the Eurozone witnessed higher wage growth, economic growth and sticky inflation. Therefore, the main question will be how many interest rate cuts will come in the rest of 2024.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Michalis Efthymiou

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

Date: 5th June 2024.

US Job Vacancies Fall to Their Lowest Level In 3 Years.

- US Job Vacancies fell to their lowest level in more than 3 years adding to fears of economic contraction.

- This week US PMI data falls and there are now lower job vacancies. Has the US economy passed its peak and is now in a downfall?

- Analysts advise if bond yields drop below 4.300%, yields can fall as low as 4.00% in the near term.

- Stocks rise to a weekly high as investors predict earlier rate hikes. A pause in September has fallen to a 35.00% possibility (5.00% lower) according to the Chicago Exchange.

The SNP500 on Tuesday struggled due to poor investor sentiment and fear of economic slowdown. However, the price rose due to the latest US JOLTS Job Openings which shows less job vacancies within the US economy. This is due to investors changing their view on future interest rate cuts. Investors are evaluating whether the poorer economic data will tempt the Federal Reserve to lower rates, which supports the economy and makes stocks more attractive.

However, analysts advise a strong stock market needs a balance between the economy and monetary policy. If investors fear a recession, shareholders may opt to lower exposure to the stock market regardless of lower interest rates. In order to monitor investor sentiment, the market will continue to monitor the VIX which has risen over the past week. In addition to this, investors will also monitor if the High Low Index falls from recent highs.

The JOLTS Job Openings has fallen from 8.49 million to 8.06 million and is 700,000 lower than the 6-month average. Investors will now give more importance to today’s ADP Employment Change and tomorrow’s Weekly Unemployment Claims. If both also significantly fall, stocks can gain upward momentum due to potentially lower rates or can collapse on recession fears. This will also depend on today’s ISM Services PMI. Analysts advise investors will ideally want to see lower employment data and a positive PMI or visa versa. We can see here there is a thin line between lower rates and a harsh landing.

Over the past week bond yields have significantly fallen which is positive for the stock market. However, the 10-Year Treasuries are 0.013% lower now. If bond yields fall below 4.300%, the yields can fall as low as 4.000% which is known to be positive for stocks in general. Oil prices have fallen almost 9% in 5-days which could also improve sentiment and weaken inflation over the next 2-months.

European stocks open higher as we approach the European Cash Open. However, investors will monitor the price movement after the US news releases. The SNP500’s price is currently trading above the main sentiment lines and Moving Averages which is a positive indication. Now the price is slightly lower but if it rises above $5,306.83 without forming a lower low beforehand, buy signals will become stronger.

USDJPY – The Japanese Yen Witnesses The Largest Currency Decline!

The day’s worst performing currency is the Japanese Yen while the best performing is the US Dollar. Even though the US Dollar is being pressured by a higher chance of lower rates, the Fed’s policy is still more competitive than most Central Banks. In addition to this, the Dollar’s safe haven element may also play a part. The exchange rate is witnessing buy signals on most indicators, but technical analysts are cautious after already seeing a 0.72% climb this morning.

Bank of Japan (BoJ) Deputy Governor Ryozo Himino stated today that officials should closely monitor yen movements due to their potential significant impact on the national economy. Consequently, currency weakness will be a crucial factor in deciding the timing and extent of the next increase in borrowing costs. BoJ Governor Kazuo Ueda also emphasized that the regulator’s primary objective is to allow the market to set long-term interest rates while retaining the capability to scale back large-scale bond purchases in the short term.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Michalis Efthymiou

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

Date: 4th June 2024.

The Euro Declines As The ECB’s Rate Decision Approaches!

- The EURUSD retreats from recent highs and gains strong indications from momentum indicators. The Euro also declines against the Japanese Yen.

- Stocks decline in Tuesday’s pre-trading session, but will lower oil prices soon prompt a new surge of buyers?

- The US economy shows signs of slowing, but analysts advise no recession while employment remains strong.

- Chip-makers save the NASDAQ from witnessing a strong decline on Monday. NVIDIA rises 4.90% and Micron Technology 2.54%.

The NASDAQ saw prices increasing throughout the day but fell within the first 4 hours of the US session. However, like Friday, investors re-entered the market at the lower price in the second half of the session. As a result, the NASDAQ ended the day 0.47% higher, but this was largely due to good performance from NVIDIA stocks which rose more than 4.90%. According to Wall Street, without NVIDIA, the NASDAQ would most likely have ended lower. NVIDIA is currently the fourth most influential company amongst the NASDAQ’s components.

The latest news which is holding investor attention is the latest Purchasing Managers Index, which is one of the few leading indicators. Other economic data are known as laggings as they are based on past data rather than sentiment and future outlook. The ISM Manufacturing PMI and Manufacturing Prices both read lower than expectations and lower than the previous month. However, investors should not necessarily “overreact” as analysts advise this would not mean anything unless employment also contracts. Additionally, the Final Manufacturing PMI read 51.3 which still indicates economic expansion, and the lower oil prices can support stocks in the longer term.

A slight decline is not necessarily negative for the stock market as long as there is not a higher risk of a recession. The lower consumer demand and economic activity could prompt the Federal Reserve to consider more than 1 rate cut in 2024. 53.0% of large traders are betting on this, up from 49.0% before the publication of the statistics. Additionally, most experts predict that the regulators will cut the interest rate twice over the course of the year, totalling 0.50%.

Nonetheless, technical analysis indicates there is still the possibility of the price declining. The price was unable to remain above the main sentiment lines and did not form a higher high. At the moment, the RSI is currently priced at 50.30 which indicates the price may witness a reverting price condition.

If the price rises to a new high breaking above $18,638.50, the momentum could indicate upward price movement again. Otherwise, bearish crossovers on the 5-minute chart will continue to indicate valid downward momentum. Currently, European stocks are declining and if they keep falling, investors can use this as an indication of a risk-off sentiment.

EURUSD – The Euro Gives Up Gains As The ECB’s Rate Decision Approaches

The price of the EURUSD continues to form higher highs and higher lows but is currently trading within a downward price movement. If the price declines below 1.08576, the bullish trend pattern will be broken. Investors are currently contemplating the timing of the European Central Bank’s first interest rate cut.

The EU Manufacturing PMI rose from 45.7 points to 47.3 points, and the German PMI from 42.5 points to 45.4 points, justifying preliminary estimates. Experts believe that the European economy is gradually recovering but sustainable growth has not yet been achieved. On Thursday, the European Central Bank will make a decision on its policy: according to forecasts, regulator officials will reduce the interest rate from 4.50% to 4.25%, the deposit rate from 4.00% to 3.75%, and the marginal rate from 4.75% to 4.50%.

The EURUSD is seeing indications of upward price movement on the 2-hour timeframe, but so far is declining against most currencies. In addition to this, the price is witnessing strong bearish momentum and bearish indication on the 5-minute chart. Therefore, the current signals point towards a short-term bias. However, if the momentum continues investors may revisit this outlook and consider a full correction.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Michalis Efthymiou

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

Date: 3rd June 2024.

OPEC+ Announces Gradually Higher Supply and NVIDIA a New Accelerator.

- Oil declines as the European Cash Open edges closer. Oil prices have fallen for 4 consecutive days measuring almost 4.00%.

- OPEC+ members advise the group will have the option to not continue voluntary cuts from September onwards.

- All US and global indices start Monday’s trading higher after a poor end to May 2024. The bullish price gap illustrates a potential “risk-on” market.

- NVIDIA announces its next generation of accelerator chips and promises annual upgrades. NVIDIA stocks are already trading 0.55% higher in pre-trading hours.

The price of Crude Oil fell almost 4.00% in the last 3 days of last week due to the OPEC+ meeting. The meeting is now at an end and journalists are pointing out 2 key points. The first, is that the OPEC+ group will keep limitations on production as it has since COVID-19. The second, is that countries which have voluntarily added additional cuts will have the option to reduce these cuts from September onwards.

According to analysts, the market should not necessarily “overreact”, because if OPEC+ increases supply, it will only be gradual. Additionally, analysts also advise the group will only look to re-introduce production if the market conditions allow it to. Nonetheless, traditionally, additional supply is known by analysts to apply downward pressure on commodities. This is something which can also be seen over the past week, but investors will be keen to see the price drop below the support level.

The support level has been a key psychological level for investors throughout the month of May, specifically on 3 occasions. The price is currently trading below the 50.00 on the RSI and below most longer-term Moving Averages. If the price declines below the 65.00 Fibonacci level at $76.70 per Barrel, momentum will signal possible further decline.

USA100 – NVIDIA Announces a New Accelerator Chip!

The NASDAQ struggled within the previous week and at one point was down more than 3.00%. However, a large surge of buyers towards the end of Friday’s session saw a strong rebound and the index also trades higher during today’s Asian session. The NASDAQ is currently being influenced by 3 factors. However, investors will also give importance to the pricing of rate adjustments after the US employment data.

The first factor prompting investors to increase tech-stock exposure is NVIDIA. The CEO of the company has again advised the technology and AI market will continue to grow and become more aggressive. In addition to this, Mr Huang advised NVIDIA is releasing a new accelerator chip and promises more within the upcoming year.

A second positive factor for not only the NASDAQ, but global indices, is most analysts believe the European Central Bank will lower interest rates for the first time in the current cycle. If more global banks decide to reduce the restrictiveness of their monetary policy, stocks will become more attractive. However, only if the move is not a response to potential economic contraction.

Lastly investors are also taking advantage of the lower entry point and feel an improved sentiment as Oil prices are declining. Investors hope lower oil prices will apply less upward pressure on inflation.

If the price rises above $18,638.83 the price will form a bullish breakout pattern which indicates upward movement. However, for a stronger and longer-term bullish trend, investors will be keen for the price to increase above the 75-Bar EMA and 100-Bar SMA. These two moving averages are currently priced at $18,658.28 and $18,733.30.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Michalis Efthymiou

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

Date: 30th May 2024.

Market News – Yields jump; Stocks under pressure.

Economic Indicators & Central Banks:

- The FOMC’s high-for-longer stance, along with some increasing fears of a rate hike, continue to weigh on Treasuries. That’s taking a toll on Wall Street too with profit taking from recent record highs knocking stocks down further.

- There was weakness in EGBs after stronger German inflation and wage data.

- US Yields have risen since the market breathed a sigh of relief after cooler CPI and retail sales, and are back near the highs since November.

- Global equities are headed for their worst week since mid-April.

- In New Zealand, the new government delivered on its election promise to cut taxes in its first budget even as the Treasury forecast bigger deficits and a delayed return to surplus.

- Wall Street dropped, led by the Dow’s -1.06% decline. The S&P500 declined -0.74%, with the NASDAQ -0.58% lower. Several earnings reports have been less than stellar as well. Salesforce disappointed today, while HP beat. Meanwhile, retailers are coming into the spotlight and there are fears of weakness.

Financial Markets Performance:- The USDIndex has been benefiting from the hawkish outlooks. It has bounced back over 105.

- The USDJPY fell, with the Yen advancing after weakening to beyond 157.50 on Wednesday, falling through a level that had prompted the latest round of suspected action.

- The Rand extended losses as South Africa’s election vote count gathers pace.

- Gold and Oil steadied. USOIL is well below the week’s high however it has been ranging since yesterday afternoon as traders look to US stockpile data later today and an OPEC+ meeting at the weekend for more clarity on the supply and demand outlook.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Andria Pichidi

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

Date: 29th May 2024.

Market News – Stocks drop with bonds.

Economic Indicators & Central Banks:

- The NASDAQ was the star as the markets, of it rallied 0.59% to close at 17,019.88 for a fresh record high. And it is its first time over the 17,000 level. A 7% pop from Nvidia supported.

- Fed Kashkari said he wants to see “many more months” of positive inflation data before a rate cut.

- German GfK consumer confidence improves further. All signs are that consumption trends should improve with the rise in real-disposable income as falling inflation, rising wages and the prospect of rate cuts boost sentiment.

- US consumer confidence beat assumptions. Confidence has displayed only a slight updraft since mid-2022, after a prior deterioration from mid-2021 peaks.

Asian & European Open:

- European & US stocks slipped earlier today against a backdrop of rising government bond yields. DAX fell 0.2% and FTSE lost 0.06%. Traders are pricing in that the ECB will lower its deposit rate when policymakers meet next week.

- Asia stock market dipped as Chinese tech and property companies declined. The Hang Seng Tech index shed 2.3%.

Financial Markets Performance:- The USDIndex is steady and Treasury yields also held firm ahead of key inflation data, which could offer more clarity on the Fed rate trajectory.

- The USDJPY fell to 156.88 nearing levels that prompted suspected interventions by Tokyo in late April and early May. Currently rebounded again above 157. Japanese officials might issue verbal warnings again, but without tangible action, the USDJPY could march towards late April levels

- The EURUSD dipped to 1.0830 but still marked its first monthly gain in 2024. Meanwhile, the GBPUSD was last at 1.2760.

- Gold steadied at $2350 per ounce as markets wait for key US PCE numbers at the end of the week. Bullion hit a record high early last week, only to post the sharpest weekly correction this year as the Fed reiterated the “high-for-longer” message.

- Oil broke the $80 barrier as Middle East tensions have picked up again. Markets are now looking ahead to the release of key US inflation data and the OPEC+ meeting on June 2.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Andria Pichidi

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

Date: 28th May 2024.

Market News – Stocks Mixed, USD Down ahead of crucial inflation data later this week.

Economic Indicators & Central Banks:

- ECB officials continue to flag a June cut, but even ECB chief economist Lane, hardly one of the hawks, stressed that policy settings will likely have to remain restrictive for the rest of the year. ECB’s Schnabel wants to reserve QE for moments of crisis. Villeroy says ECB shouldn’t rule out July cut.

- Lagarde will have to perform a difficult balancing act next week, to convince markets that all options remain open for the second half of the year.

- FT reported: Chinese property developers saw their shares rally in recent weeks after Beijing announced a real estate support package, but have subsequently sold off amid concerns the measures will not be enough to help the stricken sector.

- Japan’s service prices rose 2.8% year-on-year, the fastest increase in over 30 years, indicating a broadening inflation trend. This jump, surpassing economists’ 2.3% forecast, supports the case for the Bank of Japan to raise interest rates. The BOJ sees service prices as crucial for gauging inflation spread. This data may prompt the BOJ to consider an earlier rate hike, with some forecasts suggesting a possible move by July.

- Chinese equities declined with real estate companies dragging down the country’s benchmark index.

- European & US futures arehigher as the Dollar slipped before a swath of inflation prints that’s expected to influence the direction of global monetary policy.

- All eyes this week are on fresh inflation data from Australia to Japan, the euro region and the US. The ECB is set to release its April CPI expectations later in the day.

Financial Markets Performance:- The USDIndex slipped for a 2nd day, retesting 6-month trendline. Currently set at 104.35.

- Gold prices remained steady as the Dollar eased, with investors eyeing key US inflation data for hints on potential Fed rate cuts. Spot gold held at $2,342 per ounce.

- Oil prices steadied after 2 days of gains, i.e. at $78.70, despite rising Middle East tensions following the death of an Egyptian soldier in a clash with Israeli troops. Overall, prices have dipped since early April due to weakening demand from Asia, leading Brent’s prompt spread close to a contango structure, signaling increasing supply relative to consumption.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Andria Pichidi

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

Date: 27th May 2024.

The New Zealand Dollar Tops All Currencies, Gold Lags Behind Silver!

- Silver and Gold increase in value during Monday’s Asian Session. Silver rises more than 2.00%, considerably more than Gold. Will Gold gain momentum during the US trading session?

- Citi Group advise the price of Gold can potentially rise to $3,000 in the next 12 months. The institution also advises commodity prices are likely to remain high.

- The New Zealand Dollar is the best performing currency on Monday followed by the Japanese Yen. The Yen loses momentum as the Asian Session comes to an end.

- Of the NASDAQ’s 20 most influential stocks, only 4 ended Friday’s session in the red. The index ended the session 1.10% high and 0.06% higher in today’s Asian Session.

The price of Gold fell significantly for 3 consecutive days and a total of more than 5.00%. However, investors want to determine how the price is likely to develop throughout the week. On the 2-hour chart the price is trading below the 50.00 on the RSI and below the 75-Bar EMA. Both these indicate a downward price movement. However, the price is trading at a previous support level and the RSI has risen above 40.00. So, at which point are investors likely to see buy or sell signals?

The strongest signals will be able to be seen if the price witnesses a downward price movement as this will also be in line with the 2-hour chart and not provide conflicting signals. If the price trades below $2,341.30, the price will see an ultra-short-term signal for some bearish price action. If the price trades below $2,338.95, a short-term signal will indicate a slightly larger decline. Bullish signals will be active above $2,345.00 or at the breakout at $2,347.50.

According to Citi group, the price of Gold still has the possibility of reaching as high as $3,000, but would require the Federal Reserve to start adjusting their policy. According to Citi Group, five rate hikes over the next 12 months will put Gold priced at $3,000. However, many economists believe the Federal Reserve will only cut on 1-2 occasion in 2024. Fed officials said the share of goods whose prices were growing by 3–5% or higher is now greater than it should be under normal conditions, and the employment sector remains resistant to the measures taken. However, according to Bostic, a transition to reducing borrowing costs is possible but not earlier than October.

NZDCHF – High Inflation Continues to Support The New Zealand Dollar

The best performing currency of the day is the New Zealand Dollar, while the worst performing is the Swiss Franc. However, due to the larger spread, which is traditional to this pair, investors hold on for larger price movements. On the 2-hour chart the price of the exchange has continuously traded above the 75-Bar EMA since the 13th May and is trading almost 3.50% higher over the past month.

The upward price movement is largely due to the high inflation in New Zealand and the central banks reluctancy to indicate a rate adjustment in the near future. In addition to this, the Swiss National Bank also is believed to be one of the most bearish central bank globally. New Zealand’s inflation rate is continuing to decline and is not witnessing a slowdown like the US. However, the inflation rate remains at 4.00% significantly higher than Switzerland’s 1.4% inflation rate.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Michalis Efthymiou

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

Date: 24th May 2024.

Market News – Erosion in Fed rate cut odds; Stocks, Oil & Gold under pressure

Economic Indicators & Central Banks:

Nvidia bigger than entire stock market – Market cap now greater than Australia, South Korea and Russia.- After the massive Nvidia beat, rallying over 9% on the day, failed to reinvigorate the rally at the close. It was unable to support the major indexes.

- Wall street: The profit takers ruined the party, taking advantage of recent record highs to take some chips off the table. Erosion in Fed rate cut expectations provided extra incentive to sell.

- Strong US economic activity: Strong PMI, tight jobless claims, slump in Home sales and high home prices pushed Fed rate cut expectations further back. US jobs data released showed initial applications for unemployment were slightly lower than expected, indicating the economy was holding up despite high rates. The data, Fedspeak and the FOMC minutes, have cast doubt over whether officials will have enough evidence of the disinflation trend to begin cutting rates by September.

- It is an early close in bonds today and that could accelerate activity as traders position ahead of the long Memorial Day weekend.

- Asian equities dropped today, following Wall Street lower.

- Chinese officials announced an Rmb300bn ($42bn) lending package to help buy back real estate from the nation’s indebted property developers.

- Japan: Inflation slowed for the 2nd straight month in April, making it difficult for BOJ to proceed with further tightening. Inflation could pick up due to weaker Yen and rising Oil.

- BOE UK consumer confidence recovered while retail sales slumped. For the BoE that means there is less risk of a wage-price spiral as companies will increasingly struggle to pass on higher labor costs. More arguments in favor of an early rate cut then, despite recent data showing that headline inflation is not coming down as fast as hoped.

Financial Markets Performance:- The USDIndex found its footing, extending against G10 for a 5th day.

- Pound dropped after the UK Retail Sales, with GBPUSD at 1.2670.

- Oil declined after hitting its 3-month low as the market flashed signs of weakness ahead of the US summer driving season. Elsewhere, Gold remains weak at $2337, for a 3rd day.

- The Dow lost -1.5% to 39,065 with Boeing down over -7%. Live Nation dove as the DoJ filed suit to divest Ticketmaster. The S&P500 slumped -0.74% to 5267. And the NASDAQ declined -0.39%.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Andria Pichidi

Market Analyst

HMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

Date: 23rd May 2024.

NVIDIA Surpasses Earnings Expectations, Fed Considers Another Rate Hike.

- FOMC Meeting Minutes confirms certain members believe the current monetary policy may not be “adequately restrictive”.

- The US stock market depreciated after the Meeting Minutes. However, investors quickly bought shares after NVIDIA’s Quarterly Earnings Report. The US Stock Market on average rose 0.50% after the Meeting Minutes.

- NVIDIA’s Earnings Per Share rose from $5.16 to $6.12 and Revenue rose 15% in the first quarter of 2024.

- Yesterday the US Dollar Index rose up to 0.32% and shot upwards 0.15% in the 30-minutes after the Fed release.

On Wednesday, the NASDAQ spent most of the day witnessing intraday declines which gained momentum after the Fed Minutes. After the Federal Reserve Meeting Minutes, the NASDAQ was trading 0.69% lower and the SNP500 0.74% lower. The decline was a result of the ultra-hawkish comments within the Federal Open Market Committee regarding monetary policy and inflation. However, as the price fell to $18,619.54, the price thereafter surged more than 1.50% within the next 8-hours.

The change in trend is a result of the positive Quarterly Earnings Report from NVIDIA. NVIDIA’s Earnings Per Share rose from $5.16 to $6.12 and Revenue rose 15% in the first quarter of 2024. Shareholders held onto their shares while buy orders rose triggering a much higher price. In addition to this, NVIDIA’s director’s speech expressed confidence in earnings and the upcoming quarters. NVIDIA’s management also compared their success to the industrial revolution.

As a result, NVIDIA’s stock rose more than 6.00% after market close and is now trading above $1,000. In addition to this, the comments and earnings data had a positive effect on investor sentiment in the broader stock market, but particularly for semiconductors and chipmaking companies. For example, AMD’s stocks rose almost 2.00% and Applied Material Stocks rose 1.75% after NVIDIA’s earnings report.

Due to the volatility the price of the index is obtaining primarily “buy” signals from indications and technical analysis in general. The price has also become “overbought” on the RSI on some timeframes but remains within a buy signal and not overbought on intraday timeframes. Though investors should note that the Fed’s Meeting Minutes does bear risk for the index. This will be expanded on below.

EURUSD – The US Dollar Rises As Fed Members Play With The Thought Of Another Rate Hike!

The EURUSD is trading within an upward facing corrective swing measuring 0.14%. The bullish price movement is currently only forming a retracement pattern as the EURUSD exchange rate has been trading within a bearish trend for 5 days but gained momentum yesterday due to the US Meeting Minutes.

According to the Meeting Minutes, certain officials believe the policy requires a 25-basis points hike to achieve the 2% target. In addition to this, even the members which are known to be more dovish were troubled by the rise in inflation. Economists continue to believe the Federal Reserve is unlikely to increase rates despite the recent comments. There is a 49% possibility of a rate cut in September according to the CME FedWatch Tool. However, 13.00% of the market believe there will be no cuts at all in 2024.

The hawkish comments regarding higher interest rates are positive for the US Dollar and have triggered various sell signals for the EURUSD. However, investors should also note that a hawkish Fed can also significantly pressure the stock market. Currently, economists are battling amongst each other over whether the higher earnings or the hawkish Fed will be the main price driver. Currently, the higher earnings data is winning, but this may not be the case if inflation does not decline this month.

In terms of the Euro, the latest price driver is the European PMI data for Germany and France. German PMI beat expectations while French data saw a mixed reaction. Investors will now turn their attention to the US data later in this afternoon.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Michalis Efthymiou

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

Date: 22nd May 2024.

UK Inflation Drop Boosts GBP, But Analysts See Correction Signals.

- The NASDAQ forms its 5th bullish wave resulting in the index trading 8% higher this month alone. Investors are waiting for NVIDIA’s earnings report.

- The market awaits the release of the latest FOMC Meeting Minutes for further indications on the potential rate adjustments.

- The US Dollar Index declines to a 7-week low, but can tonight’s Meeting Minutes change the trend? Read below what economists are predicting.

- UK inflation declines from 3.2% to 2.3% in its largest drop since December 2023. The Pound increases as the inflation rate did not decline to 2.1% as previously

The GBPUSD is trading 0.30% higher after the release of April’s UK inflation figures. The US Dollar and the Japanese Yen are the worst performing currencies of the day. Traders looking to speculate a rising Pound may benefit from these weakening currencies. The GBPJPY is trading 0.47% higher so far. However, investors should be cautious of any change in price action as the next session (European Market) opens.

The UK’s inflation figure fell from 3.2% to 2.3% which is the largest drop in 2024 so far and brings the Bank of England closer to its target. This would normally pressure the currency, but there are some factors which have triggered a bullish Pound. This includes the Core Consumer Price Index which fell from 4.2% to 3.9% instead of falling to 3.6% which were the previous expectations. Also, certain sectors did not see a decline in inflation in April, which is a continued concern. For these reasons, investors have increased their exposure to the Pound, supporting the currency. Also, economists are advising that the weakening inflation rate can increase investment demand which also further supports the country’s economy and subsequently the currency.

Furthermore, investors will also need to take into consideration the price condition of the US Dollar individually. Dollar traders will be focusing on tonight’s Federal Open Market Committee’s Meeting Minutes. The market will particularly be looking for clarity on how many adjustments are likely in 2024, if any at all. In addition to this, if an adjustment is likely in July, September or later in the year. If the report indicates less cuts and a delay, the US Dollar potentially can witness further demand and a change in trend. This is something which was particularly seen in April 2024.

The price action of the GBPUSD is forming a bullish trend and most trend-based indicators are signalling a higher price. However, there are signs that the price may correct back to the previous range. For example, on the 4-Hour chart the price is witnessing a divergence signal. in addition to this, the price is also trading at a significant resistance level from November, December and January. Though, for the resistance level to become active, the Dollar will likely require support from the upcoming Meeting Minutes. In the short term, sell signals are likely to materialize after crossing 1.27400 and 1.27268.

USA100 – Bullish Trend, But Investor Focus On Meeting Minutes & NVIDIA Earnings

The NASDAQ saw a decline in the price as the US Open was approaching, however, the price momentum quickly changed when US investors started trading. The index rose 0.30% by the end of day and was the best performing US index. During the US Session 62.5% of stocks holding a weight of more than 1.00% rose while 37.5% fell. The main price drivers which supported the upward price movement were Microsoft, Alphabet, Apple, NVIDIA and Netflix.

Investors will closely be monitoring the upcoming earnings report for NVIDIA, but also the FOMC’s Meeting Minutes. A more restrictive monetary policy can pressure the stock market, but the level of pressure and downward price movement will also depend on the results of NVIDIA’s earnings. Additionally, shareholders will also focus on Intuit’s Quarterly Earnings Report tomorrow evening, but this will have a lesser effect compared to NVIDIA.

A concern for intraday traders is the decline in indices around the world in markets which are currently open. For example, the DAX, FTSE100, CAC and Nikkei225 are all trading lower. In addition to this, the US 10-Year Bond Yields are trading 0.0027% higher which is additional pressure on equities. Nonetheless, technical analysis in the medium to longer term continue to point to a continued upward trend.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Michalis Efthymiou

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

Date: 21st May 2024.

NASDAQ Soars with AI and Semiconductor Stocks Leading the Charge, While AUD Struggles.

- The NASDAQ witnesses a large surge in buy orders at the opening of the US trading session, adding 0.80%. The index has added 13.74% in 2024 up to now.

- AI & Semiconductor stocks are mainly behind the upward surge in the market ahead of NVIDIA’s earnings report tomorrow evening.

- The Australian Dollar is again the worst performing currency for a second day with the AUD Index trading 0.22% lower.

- The RBA’s Meeting Minutes confirm the committee deem a “pause” the strongest case, but that a hike may be necessary if data is “overoptimistic”.

The NASDAQ saw a decline in the price before the US market opened, but quickly changed thereafter. At the opening of the US session, the NASDAQ rose for 3 straight hours adding 0.80% before losing momentum. Due to the bullish momentum, the index again rose to renew its all-time highs.

The best performing stocks with yesterday’s markets were largely AI driven companies as well as companies within the semiconductor sector. Some of the best performing stocks within these sectors were Applied Materials (+3.71%), Lam Research Corp (+3.29%) and Micron Technology (+2.96%). However, investors are of course mainly focusing on NVIDIA which is also likely to determine the investor sentiment towards the index in general. NVIDIA stocks rose 2.49% during yesterday’s session and is trading 0.27% higher during today’s pre-trading hours.

No major events are in the books for the day which may influence NASDAQ. However, investors will monitor the FOMC Member’s speech, Mr Christopher Weller, who is also likely to add to the rhetoric from the past week. However, investors have largely ignored comments from the Fed regarding less rate cuts than previously thought. Therefore, the speech is likely to have minimal effect unless extremely hawkish.

Technical analysis does continue to point towards an upward price movement in the medium – longer term. The price waves continue to form higher lows and higher highs. Simultaneously, the price of the index is trading above the Moving Averages and above 50.00 on the RSI. However, technical analysts advise the upward price movement may be lesser than yesterday’s due to the upcoming earnings data.

The US 10-year bond yields rose 0.05% during this morning’s Asian session. ideally investors would like to see yields remain no higher than their current point to support a further upward trend. During yesterday’s session 73% of stocks holding a weight of more than half a percent rose. For further upward price movement, investors would ideally like to again see more than 70% of the components rise further.

AUDUSD – A Break Of The Support Level Could Strengthen Sell Signals!

This morning the AUDUSD exchange rate fell 0.33% to retrace upwards when reaching the previous support level. The Australian Dollar Index is the worst performing currency trading 0.22% lower. However, the exchange rate is struggling to gain momentum below the 0.66471 support level. If the price declines below this level, sell signals are likely to strengthen.

For the exchange rate to gain momentum, the US Dollar Index will also need to support price action. The most recent support for the currency is the hawkish comments from members of the Federal Reserve Open Committee. Mrs. Loretta advises 3 rate cuts are no longer appropriate and more or less not possible, and also advises the market is no longer worried that the policy is too restrictive. Mr Bostic also added to the hawkish rhetoric.

The Reserve Bank of Australia’s Meeting Minutes confirm that the committee favor a pause and remain largely predictable. However, the Meeting Minutes also state the regulator would consider a hike if data became more optimistic. Nonetheless, this has not yet had a positive effect.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Michalis Efthymiou

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

Date: 16th May 2024.

Market News – Stagflationary Risk for Japan; Bonds & Stocks Higher.

Economic Indicators & Central Banks:

- Stocks and bonds gave a big sigh of relief after CPI and retail sales came in below expectations, supporting beliefs the FOMC will be able to cut rates by September.

- The markets had positioned for upside surprises. Wall Street surged with all three major indexes climbing to fresh record highs.

- Technical buying in Treasuries was also supportive after key rate levels were breached, sending yields to the lows since early April.

- Fed policy outlook: there is increasing optimism for a September rate cut, according to Fed funds futures, BUT most officials say they want several months of data to be confident in their actions. Plus, while price pressures are receding, rates are still well above the 2% target, keeping policy on hold. But the market is now showing about 22 bps in cuts by the end of Q3, with some 48 bps priced in for the end of 2024.

- Stagflationary Risk for Japan: GDP contracted much sharper than anticipated, for a 3rd quarter in a row. This is mainly due to consumer spending. The GDP deflator though came in higher than expected but still down from the previous quarter. The sharper than anticipated contraction in activity will complicate the outlook for the BoJ, and dent rate hike bets.

Financial Markets Performance:- The USDIndex slumped to 103.95, the first time below the 104 level since April 9.

- Yen benefitted significantly, with USDJPY currently at 154.35 as easing US inflation boosted bets on the Fed easing monetary policy this year, weakening USD, boosting the Yen.

- Gold benefited from a weaker Dollar and a rally in bonds and the precious metal is trading at $2389 per ounce. At the same time, the precarious geopolitical situation in the Middle East is underpinning haven demand.

- Oil prices rebounded slightly after the shinking of US stockpiles and the risk-on mood due to declined US Inflation. However USOil is still at the lowest level in 2 months, at 78.57.

Market Trends:

- The NASDAQ popped 1.4% to 16,742. The S&P500 advanced 1.17% to 5308, marking a new handle. And the Dow rose 0.88% to 39,908.

- Treasury yields tumbled sharply too on the increasingly dovish Fed outlook. Additionally, the break of key technical levels extended the gains to the lowest levels since early April before the shocking CPI data on April 10 boosted rates.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Andria Pichidi

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

Date: 17th May 2024.

Market News – Asian and European futures followed Wall Street lower.

Economic Indicators & Central Banks:

- The Dow topped 40,000 for the first time ever, but was unable to close with that historic handle. Concurrently, the S&P tried for its 24th record high this year but failed too.

- The rise in Treasury yields after stronger than expected import prices, and a drumbeat from Fed officials that rates need to remain high for longer, encouraged profit taking.

- Most Asian equity markets and European futures have followed Wall Street lower, after US data dented rate cut hikes.

- Chinese data showing slowed consumption and a drop in home sales, although industrial production numbers looked relatively robust.

- Japan’s core consumer inflation slowed for a 2nd month in a row in April from a year earlier, while the core consumer prices index (CPI) is expected to decelerate to 2.2% from 2.6% in March, the lowest level in 3 months, but still at or above the central bank’s 2% target for more than two years.

Financial Markets Performance:- The USDIndex firmed slightly to 104.518 and up from the day’s nadir of 104.080. But it held a 104 handle for a second straight day. It traded above the 105 level from April 10 until May 15.

- Silver has surged nearly 25% this year, outpacing Gold and becoming a top-performing commodity, though it remains relatively inexpensive compared to gold. Both metals have hit record highs due to central-bank buying and increased interest in China.

- USOil is 0.75% higher at $79.23.

- All three major US indexes closed slightly in the red after posting all-time highs on Wednesday.

- The NASDAQ closed with a -0.26% decline, while the S&P500 lost -0.21%, and the Dow was off -0.1% at 39,869. It was a corrective day for Treasuries too. Bonds unwound part of their recent rally that took rates down to the lows since early April.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Andria Pichidi

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

Date: 16th May 2024.

Market News – Stagflationary Risk for Japan; Bonds & Stocks Higher.

Economic Indicators & Central Banks:

- Stocks and bonds gave a big sigh of relief after CPI and retail sales came in below expectations, supporting beliefs the FOMC will be able to cut rates by September.

- The markets had positioned for upside surprises. Wall Street surged with all three major indexes climbing to fresh record highs.

- Technical buying in Treasuries was also supportive after key rate levels were breached, sending yields to the lows since early April.