-

Posts

980 -

Joined

-

Last visited

Content Type

Profiles

Forums

Articles

Posts posted by uncle gober

-

-

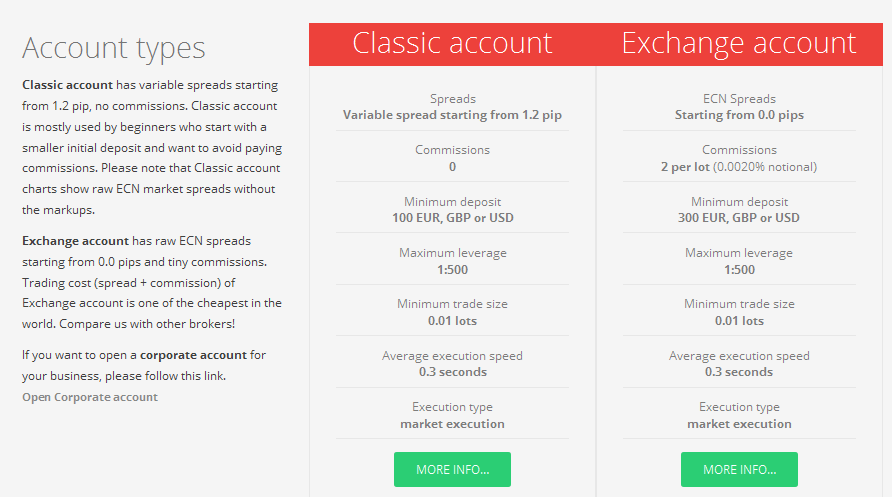

A good broker will provide benefits to the trader. I chose Armada Markets for the following reasons: Low spreads, Direct access, All strategies allowed, Your funds are safe, Start with low costs, Leverage up to 1:500, Trade with 62 currency pairs, spot gold and silver and Friendly multilingual client support

-

Your funds are safe

Segregated funds mean your money is held separately from our own capital. We cannot use your funds except for your trading purposes.

-

On the trading platform leverage is the important elements for the Forex traders,l everage mainly depended on your capital if have the little capital then you can be uses the high leverage and your capital is large then you can be uses the low leverage .Now i use leverage 1:500 with initially deposit 100$ in Armada Markets

-

With the development of forex trading, forex broker now we find easy by offering a variety of promotions and bonuses. for me, bonuses and promotions is not the main thing but the convenience of trading with the right environmental conditions for a trading system that I did. I often use scalping systems where the system takes the speed of execution and low spreads, now I use Armada Markets which gives very low spreads

-

I now feel safe to deposit my money in the Armada Markets, so far based on my experience, i comfort with this broker bercaue They provide me the exellent service especilaly on case of deposit and withdraw

-

Trading without spreads is fun, but with a large commission certainly would make it uncomfortable. I myself use an ECN broker that provide small commission with low spreads. my broker initially taking comission 2 per lot (0.0020% notional)

-

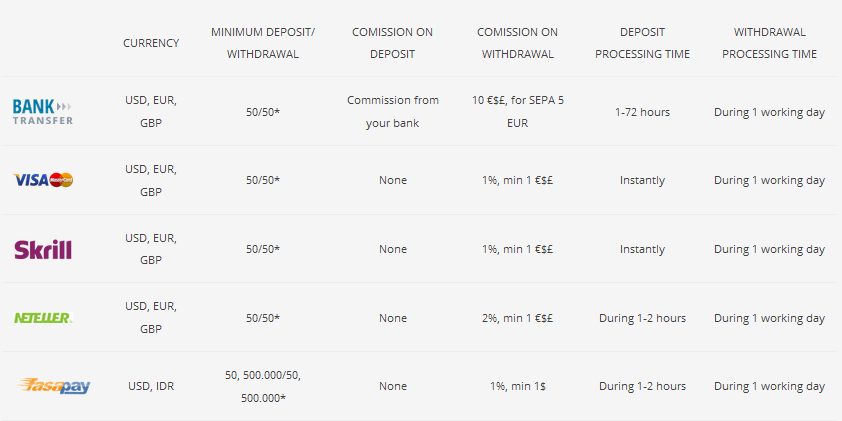

Deposit/Withdrawal Options

Armada Markets

* Please contact our client support in case you want to withdraw the amount smaller than 50 USD, EUR, GBP.

-

we can not get success in forex without analysis. analysis is the main key to understand the market then only we can earn from forex if you trade without analysis then no chance we can success in forex.

I would recommend you to experience trading on their demo account first before making any decision to open a live account. As you may know, every broker offers different type of platforms. Check on spreads, commissions, minimum deposit, term & conditions, etc. you can open in my broker now and trying a demo contest. Currently I am participating in Armada Markets demo contest and link

-

Where Will Ukraine Get Gas for Winter?

As European Union is introducing new sanctions against Russia which this time will target also oil and gas industry Russia's permanent representative to the EU Chizhov had this to say: "New EU sanctions against Russia leave Russia no other choice but to go for certain counter-measures.

We leave politics for the politicians but an interesting chart we came across today is the average monthly temperatures in Kyiv, Ukraine. As both sides announce or threaten with sanctions Ukraine is actually experiencing declining temperatures outside (and soon at home if the situation is going to get much worse). Where is Ukraine going to buy gas this Winter?

How this affects FX markets? First of all USD/RUB hit record highs today as Russian rubble is under pressure. Rubble is likely to continue weakening over the coming weeks as there is no resolution in sight. Also, while EUR/USD has found some support in recent days it has not been able to climb above the key 1.3000 and should we close this week below that level then we could be up for a further downside. Euro has currently key support level at 1.2750.

FX trading never stops at: www.armadamarkets.com

-

You can find good broker on web search their you will find their ranking as well as all detail what they offer . Now mostly brokers offer low spread , low deposit accounts , different types of accounts you have to choose what you need. You can use high spreads best client support any time.I am happy to work with Armada Markets they give me all what I need for trading.

-

I am now more prefer to use ECN brokers, ECN broker provides you direct access to the market. The broker earns only from commissions paid by the customer. Armada Markets is one of ECN broker, the broker has a speed of execution and low spreads are needed by traders to do scalping to Achieve maximum profit. this is usually the main thing when traders decide to choose the right broker for scalping. based on my experience, Armada Markets gives traders especially for scalpers with very good platforms.

-

Get started in 2 easy steps

Open account in Armada Markets

Existing Clients. If you are our existing client then please send e-mail to [email protected] and ask our account department to put account to Myfxbook autotrade group.

Link Your Account To Autotrade

The next stage is to visit the Myfxbook website and link your Armada Markets trading account to Myfxbook AutoTrade.

-

I feel satisfaction at Amada Trading Markets, as a sacalper I am very satisfied with the comfort provided by the broker. I feel satisfaction when doing so because of the low spreads and commissions as well as fast execution speed

-

making a good money management can help us making decision in trading. we can control our emotional decision by following our trading plan and money management. i think we also need to do analysis before trading when we can make decision before trading we can make order quickly and can avoid our emotions. I like a trader who win " Trader Of The Nonth Contest" in Armada Markets. They using a good money management and now they can get a huge profit

-

the contest is very helpful for traders, because the contest then we can get good trading skills. contest is a good event to hone our trading skills. for that we have to use the contest well

Demo contest is very useful to practice trading that we do in the real account. by using a demo contest with discipline applying strict money management will help us to more consistently make trades on real account. if it is consistently applied, it will produce a trading profit

-

September started on Forex markets with a big bang. We saw mini-crash in EUR/USD and GBP/USD. Dollar is back guys but for how long?

Trade volatile markets: www.armadamarkets.com

-

On this Saturday, September 6 we will trigger a live server update to the latest MT4 build 670 ensuring that you have the best possible trading solution with much more stable and secure functionality.

As this update will be done on our server, if your MT4 build version is higher than 600, your terminal will be automatically updated with no further action required on your side. In case that you are running an older MT4 build version (released prior to build 600), you will need to restart your MT4 terminal and afterwards be prompted to manually allow the update. It is strongly recommended to do so in order to take full advantage of the latest technology available. You can check the current build number of your MT4 by clicking on the Help menu and then the About submenu.

Due to the abovementioned updates of live servers, clients who are still using older versions of the MT4 (prior to the build 600) will not be able to connect.

You can always download the latest trading software from our website.

-

As far as I know forex trading has substantial risk, the size of the risk can be seen from the leverage used, the greater the leverage used, the greater the risk, but the greater the risk, the possibility of profit would be even greater. For myself, for my trading, I use the maximum leverage is 1: 500, and to further minimize the risk, I always use a stop loss and take profit as part of money management that I use.

-

The secure of money in forex business can not be assured because forex involve a lot of risk but it depends on the broker you are using and the ability to minmize the risk involve. I'm pretty sure that my money is save in forex business with my broker and there are different ways to minimize my risk via the platform offered to me by my broker.

-

ECB Hires Blackrock for Advice on ABS-Buying - Will it Work?

We learned today that the European Central Bank (ECB) hired the US-based BlackRock Inc., the world’s biggest money manager, to advise on developing a program to buy asset-backed securities or ABS in short. ECB thinks that this program will save eurozone from deflationary pressures and boost the economic activity.

What is ABS?

Asset-backed securities (ABS) are usually a pool of small and illiquid assets which are unable to be sold individually. The pools of underlying assets can include common payments from credit cards, auto loans, and mortgage loans. Why banks use ABS is to sell some of their more illiquid assets and thereby free up some of their capital to be able to offer more credit. So in a sense it is a normal cycle in banking.

What it this means for the Eurozone is that instead of previously focusing on supporting the government bond markets and especially avoiding the periphery (Greece, Italy, Spain, etc) bond yields going to levels unaffordable, the ECB is now planning to start buying corporate debt. The idea is to free up capital for the banks, liquify the corporate bond market and therefore improve the credit flow for companies and boost the economy.Where ECB sees problems?

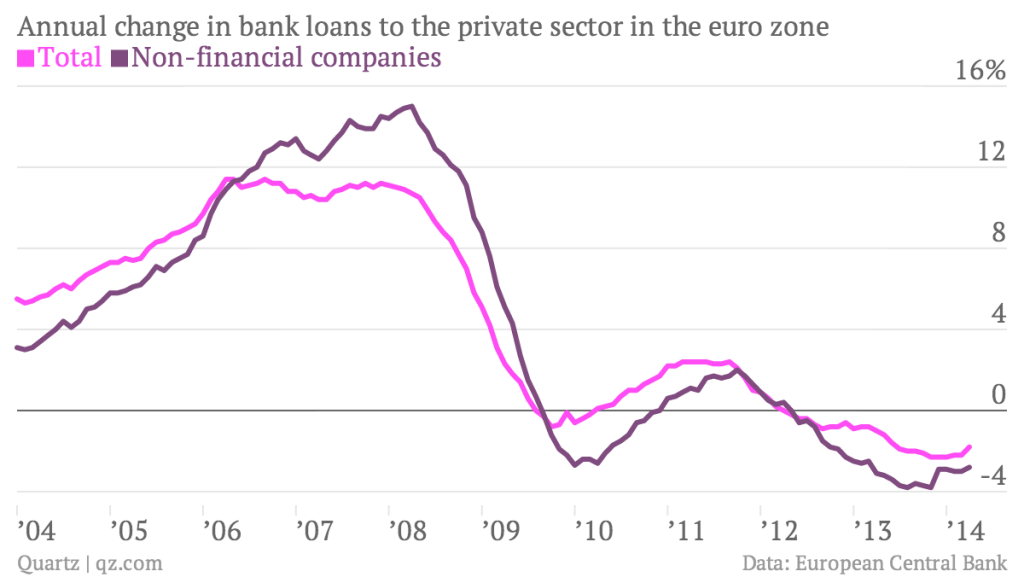

Let's have a look at bank loans in Eurozone. In the chart below you clearly see one problem - despite all of the (statistically unproven) hype about economic recovery in the Eurozone, bank lending to private sector has been on a gradual decline. It has not recovered post-2008 crisis. The decline in bank lending is the main reason why ECB likes to talk about deflationary risks.

When companies do not borrow, they don't make any investments into new capacity or products which in turn means they require less people to work. This is also the reason why we still see high unemployment rates across Eurozone except Germany. When talking about unemployment data we recommend our readers focus on labor force participation rates instead of official unemployment rates. You'd be surprised why!

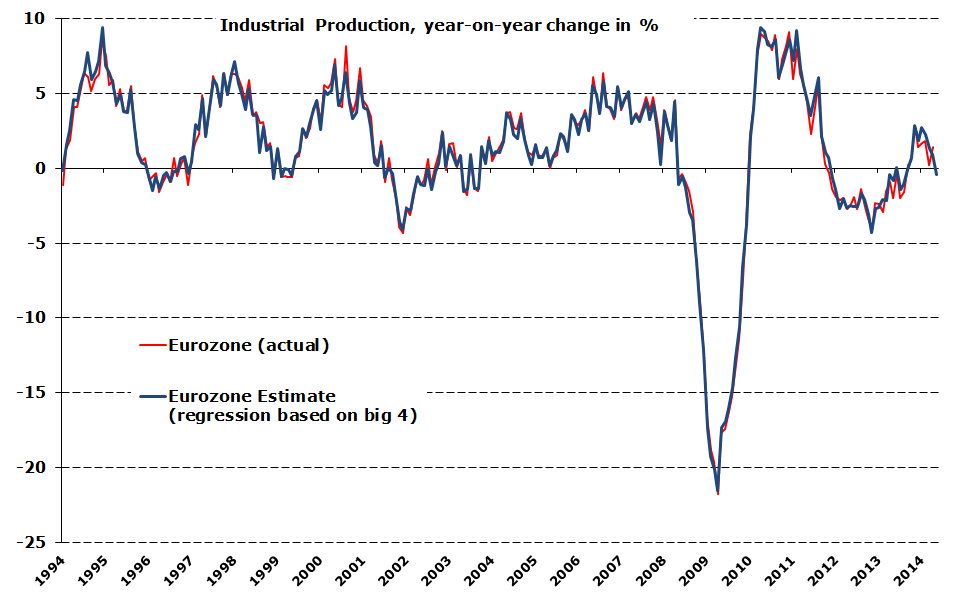

Do the companies really need more debt?

The strong growth we experienced in industrial production starting from 2009 has long ended. In fact the recent data indicates that we are currently on a decline. It is in decline because the consumers don't demand so many products. So why would companies need more financing if they already operate at below average capacity utilization rates and in light of the current turmoil around Ukraine (and the inconfidence it creates among consumers) it is very unlikely that consumers will suddenly want to buy another iPhone or a brand new car. Consumers are focused on pure necessities such as food and shelter.

What is wrong with the European consumers?

If you look at any unofficial inflation data then you will discover that inflation in Eurozone is much higher than you get to read from the official statistics. Add to this the negative real salary growth and you kind of get the feeling that consumers are not feeling very optimistic about the future. They know that prices will tend to move higher whereas their salaries have not been raised that much. So, consumers look to cut back on their spending. The want to save.

The reason why real inflation is high is due to the aggressive liquidity boosts coupled with ZIRP (NIRP in Eurozone) that most G7 central banks have engaged with since 2008. This liquidity has found its way to stock market, commodities market and in turn to products in our refrigirators. It has paralyzed the consumer as this liquidity boost has not boosted their real incomes.Will the purchasing of ABS work?

Unfortunately, we think that it will not work because the Eurozone companies do not require additional financing at circumstances which we have explained. The companies need the end demand to pick up. But for that we need a stable socio-economic and political situation in Eurozone and around.

Post 2008 crisis a lot of issues that needed to be resolved are still unsolved. Some of these issues are here:- Most Eurozone governments still run large budget deficits as limited efforts have been taken to improve government efficencies and budget structures

- Eurozone debt/GDP figures haven't improved - they have become worse which has worsened also future borrowing capacity of most countries

- Banks haven't been recapitalized and zombie banks still exist

Russian sanctions

Recent Russian sanctions to ban imports of certain agricultural products from European Union will have a severe impact on European agricultural industry. For the European consumers it will at first be quite pleasant - products unsold to Russia will oversupply the local market and will lower the food prices. It will generate a certain feeling of relief among working class members of the society which make up majority of the population.

The lower food prices and overcapacity will ultimately start bankrupting European agricultural and food processing industry and will drastically lower supply. Once the reduction in supply will take its course we will have a massive inflationary pressure which will at the same time lower the purchasing power of majority of Europeans. Lower purchasing power will ultimately start to affect other industries and Europe will fall into another severe economic crisis.

We hope that these scenarios will not take place although we admit that this would be a bit naive. What it all means for the FX markets is that volatility will pick up (we touched this topic in our recent post here: Alert: Record Low Volatility on Forex Markets About to End) over the coming months and higher volatility will mean more trading opportunities but also more risk.Forex trading for smart traders: www.armadamarkets.com

-

Become a trader. Armada Markets offers currency trading services. FX license, no requotes, deep liquidity and ECN spreads.

Calculators & FX Quoes

Classic and Exchange account trading benefits: speads as low as 0.0 pips; no re-quotes, delays nor interventions; scalping, EAs and news trading allowed; STP, DMA and NDD; Leverage up to 1:500; trade from 0.01 lot; minimum deposit 100 EUR/USD/GBP/PLN

-

Demo contest are great to learn trading and you will even get a prize if you are successful. Currently I am participating in Armada Markets demo contest and link

-

I just suggest the forex broker for smart clients and scalpers. why i say that, because Armada Markets give the trader spreads as low as 0. that spread are suitable for scalpers and for the long term trader give more advantages

-

I just use leverage 1:500 to trade in forex and it's maximal leverage from Armada Markets. But i can trade with low spread starting from 0.0 pips and it's really make me feel comfort when trading. The most important is we must be discipline when trading so we can get maximal result, regardless leverage we use

Why Deposit Bonuses Are Bad For You

in Forex Brokers

Posted

I don't think bonus from broker bad for us if we can manage our trading properly. I need a bonus. Bonuses of the broker is very helpful for traders but as traders we must have planning to use these bonuses so that all the terms of the bonus will be fulfilled. I now use Get 25€$£ Special Bonus