-

Posts

980 -

Joined

-

Last visited

Content Type

Profiles

Forums

Articles

Posts posted by uncle gober

-

-

Specific trading strategy should be used exactly for a chosen currency pair, for which it is created because it depends on the ratio of the certain currency pair. However, this does not mean that the other currency pair won’t benefit from the chosen strategy, but make sure you analyse the strategy more before applying it on different currency pairs.

The main task of any Forex trading strategy is to minimize the impact of external factors on the Forex trader and to organize trader’s activities. The development of a trading strategy can even be compared with the development of a business plan for a specific project.

When developing your own trading strategy or improving the old one, it is important to remember these rules:

- Any trading strategy has a share of subjectivity, it does not guarantee a success and can work also against you;

- Each Forex trading strategy should be compatible with a trader’s style;

- 95% of trading failures are caused by lack of the psychological stability – Forex trading strategy is designed to solve this problem.

Traders can combine different methods or develop even their own indicators and trading robots, because there is no limit in different variations. now I try to stay consistent to trade with some combination of several indicators that I try to apply in TICKMILL

-

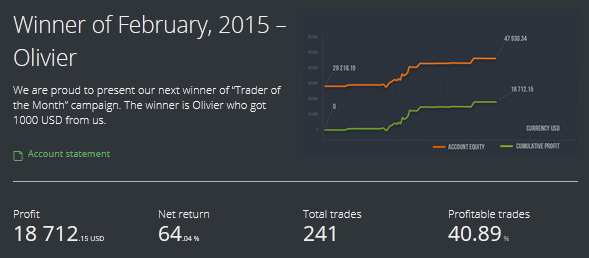

Experience of course and learning materials. I saw a few important notes given by the winners of the real account "Trader Of The Month" in Tickmill. I am now trying to be able to use the principles of their work to increase knowledge of trading.

What instruments do you prefer to trade and why?

My favorite instruments are EUR/USD and GBP/USD

What schedule (trading hours) do you have for your trading?

I always trade during Asian session.

Did you receive personal training from other traders or did you mainly educate yourself on your own?

I have read a lot of traders’ blogs. Most of my knowledge came from there. I have also watched a lots of videos what are teaching trading strategies. I copied some strategies and improved those.

Do you create your own strategies or use the ones that already exist? Can you briefly describe your strategy?

Yes, I have my own strategy which is very complicated to explain. I use mixed strategies combined with lots of different Indicators, Expert Advisor and manual trading.

What is the most important quality a trader should have?

There are few of them that are very important. Most important quality is patience.The second one is ability to learn different trading skills and understanding financial markets.

How do you deal with losses, does it have an emotional impact on you?

As a trader you have to be prepared to take risks and losses.

Are you satisfied with our service and is there anything we can improve?

I am extremely satisfied with you services. I tried many brokers for my long trading career and coul not find any better. I hope that you add some online trading platforms in the future.

-

Slippage is when an order is filled at a price that is different than the requested price.

Most conversations I hear regarding slippage tend to speak about it in a negative light, when in reality, this normal market occurrence can be a good thing for traders. when orders are sent out to be filled by a liquidity provider or bank, they are filled at the best available price whether the fill price is above or below the price requested.

To put this concept into a numerical example, let’s say we attempt to buy the EURUSD at the current market rate of 1.3650. When the order is filled, there are 3 potential outcomes.

Outcome #1 (No Slippage)

The order is submitted and the best available buy price being offered is 1.3650 (exactly what we requested), the order is then filled at 1.3650.

Outcome #2 (Positive Slippage)

The order is submitted and the best available buy price being offered suddenly changes to 1.3640 (10 pips below our requested price) while our order is executing, the order is then filled at this better price of 1.3640.

Outcome #3 (Negative Slippage)

The order is submitted and the best available buy price being offered suddenly changes to 1.3660 (10 pips above our requested price)while our order is executing, the order is then filled at this price of 1.3660.

Anytime we are filled at a different price, it is called slippage. I now get maximum profit with an average positive slippage in TICKMILL.

-

some friends ever complained to the broker server they use. they mean using an account with the type of outside ECN. I think the type of ECN accounts will benefit No re-quotes, delays nor interventions as of now I feel in trading I did in TICKMILL

how about you think ?

-

Easy start with Classic account

Classic account has variable spreads starting from 1.2 pip, no commissions. Classic account is mostly used by beginners who start with smaller initial deposit and want to avoid paying commissions. Please note that Classic account charts show raw market spreads without the markup.

Forex Trading Hours

Forex trading: available 24 hours a day, 5 days a week allowing traders access during all Forex market trading times. You can trade from Monday 00:00 (GMT+2) to Friday 24:00 (GMT+2).Please note that there is a trading break each day from 00:00 (GMT+2) until 00:05 (GMT+2). For Daylight Saving Time we use New York time zone.

Metals trading: starting from 01:00 (GMT+2) on Monday, close 24:00 (GMT+2) on Friday. There is a trading break each day from 00:00 (GMT+2) until 01:00 (GMT+2). For Daylight Saving Time we use New York time zone.

Margins on Metals

Margins on spot gold (XAUUSD) and spot silver (XAGUSD) depend on the account leverage. Gold leverage is 2 times lower than account leverage, silver leverage is 4 times lower than account leverage.

Example: Suppose your account has a leverage of 1:100. Your leverage for gold will be 1:50 (2 times lower) and for silver 1:25 (4 times lower).

-

I would recommend you to experience trading on their demo account first before making any decision to open a live account. As you may know, every broker offers different type of platforms. Check on spreads, commissions, minimum deposit, term & conditions, etc.

I have been trading with TICKMILL for quite sometimes. I'm satisfied with their friendly customer support and execution so far.

-

The key is keep learing new knowledge and learn lessons from practice, find right trading strategy and risk management method etc.

Yes, knowledge and experience are very important in forex trading, without the knowledge and experience it's hard to us to minimize the risk of forex and earn extra income from this business.

-

You can find a good forex broker recommendations from various sources, but before you invest your money, it helps us to find out more about the credibility of the broker is concerned, both regulations, customer service, security of our funds, servers, financial transactions and much more . It is better to try the performance of the server with demo account first

-

forex business is a global business where there is a very large transactions each day involving banking institutions, brokers and traders. every trader has his own criteria in selecting a broker and I now choose TICKMILL that have trading platform with the optimum conditions where I can get a small spreads and fast execution speed.

-

Account types

FX Leverage

Clients can choose the appropriate leverage when they open the account or at a later by contacting customer support. The default leverage is 1:500. Higher leverage means higher risks.

Order types

We set no limits on placing orders as you can even place orders at the spread. FX traders can execute a number of orders with Tickmill, including:

- Market execution

- Buy limit

- Sell limit

- Buy stop

- Sell stop

- Take profit

- Stop loss

- Good till cancelled

Trading conditions- Forex instruments: 62 currency pairs

- Precious metals: gold and silver

- Leverage available: 1:500

- Trading platform: MetaTrader 4

- Execution model: DMA, NDD , STP

- Base currencies: EUR, GBP or USD

- Min trade size: 0.01 lots

- Margin call / stop-out: 100% / 30%

- Primary trading server: London (backups in New York)

- Trading style on Exchange account: all trading styles are accepted including high-frequency and high volume trading with EA-s and algos, hedging allowed, FIFO rule is not applicable

-

Margin and leverage is very important for traders to make trades. Now I use the leverage of 1: 500 in TICKMILL using 0:05 lot every trading by using the pair EUR/USD. using the facilities Calculators & FX Quotes, I get a margin 10$ and pip value 0.45$. With the condition spreads as low as 0 makes me comfortable to gain profit in TICKMILL

-

forex business is a global business where there is a very large transactions each day involving banking institutions, brokers and traders. every trader has his own criteria in selecting a broker and I now choose TICKMILL that have trading platform with the optimum conditions where I can get a small spreads and fast execution speed.

-

Many brokers criteria that must be considered. I now choose a broker of the system as well as trading conditions that give the best benefit to me. I now use a scalping system to trade. to do scalping require server speed and accuracy of execution without requotes. I get this when trying to trade in Tickmill to open ECN account.

-

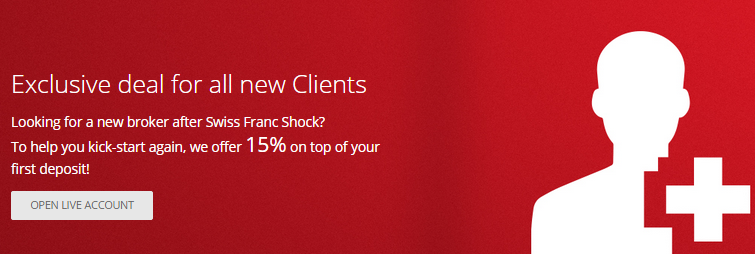

The brokers who are regulated and well known are trusted . You can make your dealings confidently with them. TICKMILL are also good broker they are regulated broker . Offer low spread on all major currency pairs. You can get 15% bonus on all type of accounts on deposits. I am satisfied with trading I am doing with TICKMILL.

-

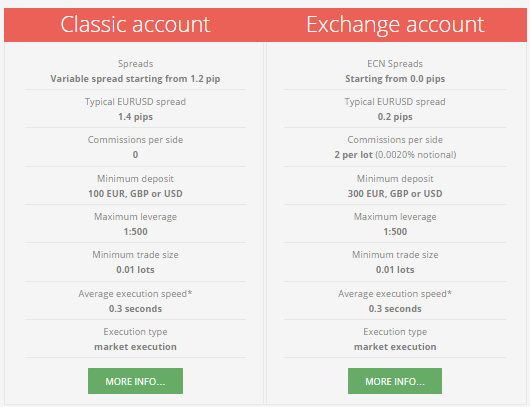

Account types

Classic account has variable spreads starting from 1.2 pips, no commissions. Classic account is mostly used by beginners who start with a smaller initial deposit and want to avoid paying commissions. Please note that Classic account charts show raw ECN market spreads without the markups.

Exchange account has raw ECN spreads starting from 0.0 pips and tiny commissions. Trading cost (spread + commission) of Exchange account is one of the cheapest in the world. Compare us with other brokers!

If you want to open a corporate account for your business, please follow this link. Open Corporate account

-

Forex is really challenging . Every day we have to face market with new energy . We do not know what will happen to market in next movement . So this is a challenge to analyze market, Manage account and trades accordingly. Our decision to enter and exit in market at accurate position is necessary to get profit . If we are not to compete this challenge we will face loss.

-

Now I began to find my confidence in the broker Tickmill. Now I am trying to discipline in trading and trying to maximize trading conditions given. my method to trade is scalping. this method is very suitable for me to apply in this broker because this broker perovide me the spreads as low as 0.0 pips; no re-quotes, delays nor interventions; scalping, EAs and news trading allowed; STP, DMA and NDD; Leverage up to 1:500; trade from 0.01 lot. This all provide me the comfort to trade with my style without worried

-

Most trading systems and strategies are highly dependent on the spread offered by the broker like scalping technique, and often a spread value that is too high may render a trading system useless. If the trading system requires you to open many positions in a short amount of time, then it is very important that you find a Forex broker that offers low spreads. This is why high frequency traders always pay close attention to the spread that each broker offers. I like scalping technique. I get a profit in the forex business using scalping techniques. I opened and closed the trading no more than 2 minutes. I need the speed of execution and low spreads to gain maximum profit. I am now comfortable trading with this system in the Tickmill

-

Introduction:

It was a challenging time during last few weeks for many traders. It all started by the record-high volatility on CHF pairs and ended up with the situation that many traders are now seeking for a broker whom they can trust.

With the combination of great risk management and best trading conditions, Tickmill is definitely the broker to consider! Tickmill welcomes all new clients who seek for safe heaven and wish to continue trading with minimal trading costs.

We hope that with this campaign you will be motivated to try out our trading conditions. We are sure you will be satisfied! See you trading with Tickmill!

Not fully convinced? Here are few facts to consider:

- We covered all negative balances created by EUR/CHF crash.

- We have not issued a single re-quote ever, including recent EUR/CHF event.

- We did not cancel any trades done with EUR/CHF and other CHF pairs.

- We keep trader’s expenses at the lowest possible level (Spreads from 0 pips and low commission).

- We always process withdrawals in 24 hours during business days.

- We provide 1:500 leverage even for the large accounts.

- We clear your orders only at large and well-capitalized banks and liquidity providers.

- We keep all client funds on segregated accounts.

- We love our Clients and provide excellent Client experience.

TRY OUR SERVICES

Terms and Conditions:

- Client may only claim 15% bonus on the first deposit, which is at least €$£ 100 and not covered by any other campaign or bonus. Maximum bonus amount is €$£ 5 000.

- In order to claim the bonus, please send an email to [email protected] with the code phrase “Welcome to Tickmill†after the deposit.

- Trade at least 1 lot for each €$£ 5 to withdraw the bonus.

- Tickmill reserves the right to disqualify any user if there is a suspicion of misuse or abuse.

- Tickmill reserves the right to change the Terms of the campaign or cancel it at any time.

-

Introduction:

It was a challenging time during last few weeks for many traders. It all started by the record-high volatility on CHF pairs and ended up with the situation that many traders are now seeking for a broker whom they can trust.

With the combination of great risk management and best trading conditions, Tickmill is definitely the broker to consider! Tickmill welcomes all new clients who seek for safe heaven and wish to continue trading with minimal trading costs.

We hope that with this campaign you will be motivated to try out our trading conditions. We are sure you will be satisfied! See you trading with Tickmill!

Not fully convinced? Here are few facts to consider:

- We covered all negative balances created by EUR/CHF crash.

- We have not issued a single re-quote ever, including recent EUR/CHF event.

- We did not cancel any trades done with EUR/CHF and other CHF pairs.

- We keep trader’s expenses at the lowest possible level (Spreads from 0 pips and low commission).

- We always process withdrawals in 24 hours during business days.

- We provide 1:500 leverage even for the large accounts.

- We clear your orders only at large and well-capitalized banks and liquidity providers.

- We keep all client funds on segregated accounts.

- We love our Clients and provide excellent Client experience.

TRY OUR SERVICES

Terms and Conditions:

- Client may only claim 15% bonus on the first deposit, which is at least €$£ 100 and not covered by any other campaign or bonus. Maximum bonus amount is €$£ 5 000.

- In order to claim the bonus, please send an email to [email protected] with the code phrase “Welcome to Tickmill†after the deposit.

- Trade at least 1 lot for each €$£ 5 to withdraw the bonus.

- Tickmill reserves the right to disqualify any user if there is a suspicion of misuse or abuse.

- Tickmill reserves the right to change the Terms of the campaign or cancel it at any time.

-

Trading with scalping method requires expertise and skill that good. novice traders should not be used to using this technique, but can use other analytical techniques which have a smaller risk. besides, if wrong in choosing a broker with a large spread and slow execution speed would be very dangerous. so now I use tickmill. this broker provide me EUR/USD pair with average raw spread 0.2-0.5 pips,No-requotes on my close to 1700 trades now and Positive slippage on news trading.

-

Leverage is one of the tools used by the broker to improve balance traders to trade in the forex market. each broker has its own policies regarding the maximum limit leverage. but I am very comfortable using the leverage of 1: 500 in Tickmill and teh other i can get sperads as low as 0.0 pips; no re-quotes, delays nor interventions; scalping, EAs and news trading allowed and STP, DMA and NDD execution

-

I won’t endorse one particular broker; it’s an individual choice and largely depends on your preferences. But, I will give you a broker choice that will help you jump start your trading career and choose the right broker you want. Tickmill are a good choices based on my trading experience in the broker.

I get a profit in the forex business using scalping techniques. I opened and closed the trading no more than 2 minutes. I need the speed of execution and low spreads to gain maximum profit. I am now comfortable trading with this system in my broker

-

Each broker certainly offers various facilities with various promotions in every campaign so that you are interested in trading with them. but for me, bonus or other promotion not being primary. I was more focused on low spreads and execution speed and also the smooth withdrawal. Now I trade forex in the Tickmill. Tickmill is authorised and regulated as a Securities Dealer by the Financial Services Authority (FSA) of Seychelles with a licence number SD008. We are a transparent and open company. Our accounting, internal procedures and systems are audited by third party auditors and the FSA. Funds are held with Barclays Bank, MCB Bank and other major banks. Tickmill is the new way of trading with extremely low market spreads, no-requotes, STP and DMA, absolute transparency and the latest trading technology.

Tickmill.com - Reliable, Secure and Transparent

in Forex Brokers

Posted

Tickmill Broadens its Customer Appeal as a Trader-Friendly Brokerage by Introducing Eight Key CFDs

Client-oriented global ECN broker Tickmill announced today the availability of CFDs in its diverse product line.

Keeping a key promise made to Tickmill’s discerning customer base of experienced traders, the brokerage has followed through on its commitment to launch CFDs in its very first quarter of operations.

Sudhanshu Agarwal, CEO of Tickmill explains, “This is a very important step forward for Tickmill as CFDs are popular and widely traded instruments. The availability of eight major CFDs covering key stock indices for Germany, Japan, Europe, the United Kingdom, the USA, as well as WTI Crude Oil, will cement the Tickmill’s reputation as a broker with truly global trading appeal.â€

A CFD, also known as ‘Contract for Difference’, is a derivative product that gives opportunity to make money from both falling and rising markets. And because there is no expiry date, a CFD therefore allows traders to hold their positions for as long as they wish.

The eight major CFDs introduced by Tickmill are based on the most liquid markets hence providing its traders the best opportunity to succeed. Overall the flexibility of CFDs provides an excellent hedge against losses. In fact, traders can easily use CFDs to protect themselves against unexpected market movements.

Our traders have requested CFD trading and we are proud to deliver these contracts which cover the most popular stock indices as well as the world’s most heavily traded commodity…

Tickmill continues to make every possible effort to ensure its position as a respected leader in the retail financial brokerage industry. The delivery of these instruments is one of the fundamental steps we are making towards our commitment.

A complete listing of the eight available CFDs and Tickmill’s other retail products can be found here at this link:

Amongst Tickmill’s attractions to retail brokerage clients are spreads from zero pips, a transparent ECN (full STP and DMA) platform permitting all strategies including scalping, and a wealth of diverse trading instruments including 64 currency pairs as well as CFDs, precious metals, and related commodities.