⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Past hour

-

I just tested it on fixed ninja and it didnt work for me

-

We going to need @apmoo for this bad boy!

-

hybrid76 reacted to a post in a topic:

Need help decompiling

hybrid76 reacted to a post in a topic:

Need help decompiling

-

And what do you think about .ex5 (MT5) EAs? How hard are they to crack?

-

LegendaryTrader Indicator - Newest Versions

sudheer4066 replied to Ricardo44's topic in Ninja Trader 8

It was not working for me also - Today

-

dex reacted to a post in a topic:

QuantVue QkronosEVO

dex reacted to a post in a topic:

QuantVue QkronosEVO

-

Got it from Rohit

-

raj1301 reacted to a post in a topic:

https://ninjabotai.pro/

raj1301 reacted to a post in a topic:

https://ninjabotai.pro/

-

fxtrader99 reacted to a post in a topic:

https://ninjabotai.pro/

fxtrader99 reacted to a post in a topic:

https://ninjabotai.pro/

-

Playr101 reacted to a post in a topic:

Replikanto

Playr101 reacted to a post in a topic:

Replikanto

-

1st link already dead

-

Playr101 reacted to a post in a topic:

QuantVue QkronosEVO

Playr101 reacted to a post in a topic:

QuantVue QkronosEVO

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Brent under sellers’ pressure: a new wave of decline may be near Brent crude slips to 62.38 USD on Tuesday. Negotiations involving the US continue. Discover more in our analysis for 25 November 2025. Brent forecast: key trading points Brent crude reacts to geopolitics There is a chance of further price decline due to potential supply growth Brent forecast for 25 November 2025: 61.30 Fundamental analysis Brent prices are falling towards 62.38 USD per barrel on Tuesday, partially correcting the previous session’s gains. The market continues to react to news of a potential peace agreement involving Russia. According to media reports, the 28-point settlement plan proposed by the US has been reduced to 19 points after discussions in Switzerland. It is not disclosed which provisions were removed. Nevertheless, the progress of negotiations fuels expectations that, if an agreement is reached, sanctions against the Russian oil sector could be eased. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 369 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

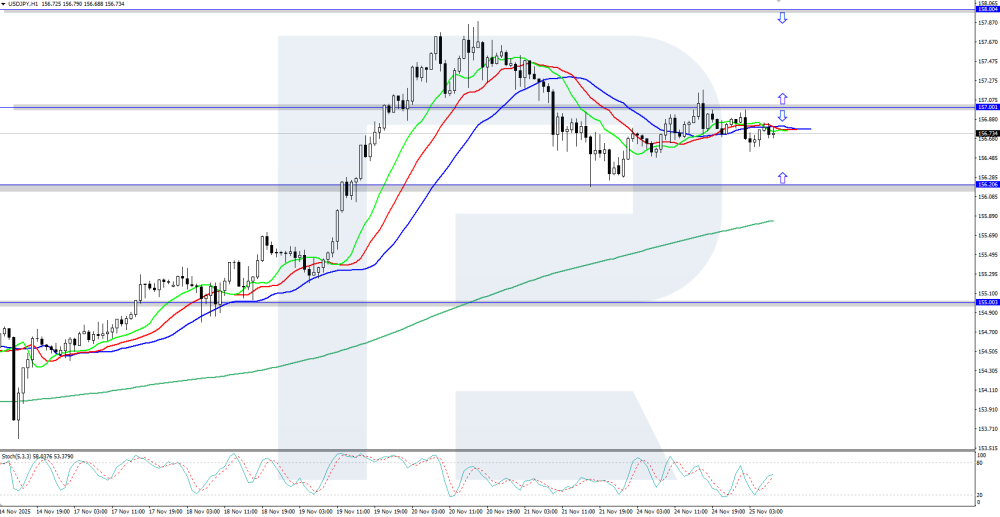

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

USDJPY corrects down from the highs The USDJPY rate is moderately declining, falling below 157.00 amid concerns about potential Bank of Japan interventions. Find out more in our analysis for 25 November 2025. USDJPY technical analysis The USDJPY rate is declining within the current downward correction. The Alligator indicator has turned downwards, confirming the prevailing bearish momentum. The nearest local support level is located at 156.20. The USDJPY pair dipped below 157.00 as market participants fear that the Bank of Japan may conduct currency interventions to support the yen. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Where can one find the fixed ninja?

-

Which one of them are you referring to? @mmicro

-

keeps loses small and runners long, nice!

-

Works on fixed ninja

-

@kimsam @apmoo Thanks 🙏

-

Does any one have some of Ron's live streams from simple market metrics, would be much appreciated.

-

Can these be educated pls https://workupload.com/archive/4HNqMvvBRh

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date: 25th November 2025. Asian Markets Rise as US Stock Rally Boosts Global Sentiment; Bitcoin Stabilises. Asian stocks traded mostly higher on Tuesday, supported by a strong rally on Wall Street as investors increased their bets that the Federal Reserve may cut interest rates soon. Meanwhile, US futures slipped, oil prices fell, and Bitcoin attempted to recover after weeks of heavy selling. Asian Stock Markets Mixed but Mostly Higher Japan’s Nikkei 225 was little changed at 48,628.85 as markets reopened from a holiday. The index was pressured by a sharp 10.3% drop in SoftBank after concerns emerged that Google’s new Gemini AI model could challenge returns from SoftBank’s major investment in OpenAI. In the rest of Asia: Kospi in South Korea rose 0.3% to 3,859.12. Taiwan’s Taiex jumped 1.5%, extending tech-sector strength. Hong Kong’s Hang Seng climbed 0.4% to 25,821.47. Shanghai Composite gained 0.9% to 3,872.45. Alibaba rose 1.6% ahead of its earnings release later in the day. Australia’s S&P/ASX 200 added 0.1%, closing at 8,537.00. US Stock Market Rallies Ahead of Thanksgiving Week US markets will pause on Thursday for the Thanksgiving holiday before Black Friday and Cyber Monday. Still, investors kicked off the shortened trading week with strong gains: S&P 500 jumped 1.5% to 6,705.12. Dow Jones added 0.4% to 46,448.27. Nasdaq Composite surged 2.7% to 22,872.01. The rally was fuelled by rising expectations of a potential Fed rate cut in December, which would help support the US economy and boost equity valuations. AI-related stocks also drove momentum: Alphabet surged 6.3% on optimism around its latest Gemini AI technology. Nvidia climbed 2.1%, extending its AI-driven leadership. Despite recent volatility, the S&P 500 remains within 2.7% of its all-time high, underscoring continued investor confidence in the US market outlook. Key Inflation Data in Focus This Week Markets are now awaiting the US Producer Price Index (PPI) for September, a major signal of inflation trends. Economists expect wholesale inflation to stay at 2.6% year-over-year. A hotter-than-expected reading could reduce the likelihood of a December Fed rate cut, especially with inflation still above the central bank’s 2% target. Even so, traders currently price in an 85% probability of a rate cut, up sharply from last week’s levels. Oil Prices Fall as Dollar and Euro Slip In early Tuesday trading: WTI crude dropped 25 cents to $58.59 per barrel. Brent crude fell 30 cents to $62.42. The US dollar eased to 156.70 yen. The euro slightly declined to $1.1517. Bitcoin Price Attempts to Recover After Heavy Selling Bitcoin, which has been under intense selling pressure in recent weeks, slipped 1.1% to $88,100, far below last month’s high near $125,000. The downturn erased over $1 trillion from the broader crypto market and drove Bitcoin to a seven-month low. However, market signals suggest that the sell-off may be stabilising: Bitcoin’s 14-day RSI is now around 32, near oversold territory. Implied volatility on Bitcoin options has dropped to levels last seen in April. Put-option premiums have fallen sharply, with the cost of downside protection dropping from 11% to 4.5%, according to Orbit Markets’ Caroline Mauron. ‘This indicates that stress has eased significantly and investors believe Bitcoin may have found a near-term bottom,’ Mauron said. Still, caution dominates the crypto space. Bitcoin remains on track for its worst month since 2022, and crypto ETFs appear set for their largest monthly outflows since launching. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Andria Pichidi HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

Victoire reacted to a post in a topic:

Pirate Trader's Markets And Mind

Victoire reacted to a post in a topic:

Pirate Trader's Markets And Mind

-

alexstar3224 started following Night

-

Using 1:1000 leverage can boost returns on small capital, but it also magnifies losses just as quickly. Even small market shifts can trigger a complete account wipeout. Skilled traders with strong discipline might handle it, but most beginners face high risk. More moderate leverage is usually the safer option.

-

Foreign brokers offering large bonuses can seem appealing, but they often come with strict terms or withdrawal limits that reduce their value. These incentives may help new traders, yet they can also be used as marketing tactics. It’s important to review regulations, conditions, and broker credibility before committing.

-

Bitcoin Can Probably Make It But 90% Of The Altcoins Won’t ⭐ epictetus reacted to a post in a topic:

MenthorQLevel version 6

⭐ epictetus reacted to a post in a topic:

MenthorQLevel version 6

-

Wethekings started following https://ninjabotai.pro/

-

where do we drop these?

-

⭐ laser1000it reacted to a post in a topic:

Need help decompiling

⭐ laser1000it reacted to a post in a topic:

Need help decompiling

-

⭐ traderwin started following automated-trading ICT Concepts Indicator[Advanced] Ver 1.5.0.2 , Replikanto and https://ninjabotai.pro/

-

⭐ traderwin reacted to a post in a topic:

Replikanto

⭐ traderwin reacted to a post in a topic:

Replikanto

-

MenthorQLevel Indicator but got problem need to take the problem, administrator rights and Norton problem,v and reposted https://drive.google.com/file/d/1CjjenXtLotPh1sKO9indUUGASmuphUmL/view?usp=sharing https://drive.google.com/file/d/12F9VymZ361t4o-dC_TdtYsRhI4UoclRW/view?usp=sharing

-

What setting did you use to get this result? Thanks!

-

MKTMAKR joined the community

-

automated-trading ICT Concepts Indicator[Advanced] Ver 1.5.0.2

TRADER replied to nanop's topic in Ninja Trader 8

can u share please @kimsam