All Activity

- Past hour

-

- Today

-

⭐ trader65 reacted to a post in a topic:

Wave59 2.33 cracked

⭐ trader65 reacted to a post in a topic:

Wave59 2.33 cracked

-

New link: https://e.pcloud.link/publink/show?code=XZbRKtZkB9sAqqPSiL07Ja8z43rXViFNX0V

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

The dollar falls – EURUSD rises: what’s next? The drop in Nonfarm Payrolls has hit the US dollar, with EURUSD continuing its upward move towards 1.1460. Discover more in our analysis for 9 June 2025. EURUSD forecast: key trading points Nonfarm Payrolls data weakened the US dollar The ECB may pause its rate adjustments EURUSD forecast for 9 June 2025: 1.1460 Fundamental analysis Today’s EURUSD forecast favours the European currency. After the release of the Nonfarm Payrolls report, the dollar keeps losing ground against the euro. The actual figure came in at 149K, down from 142K in the previous period. While the drop might seem marginal at first glance, combined with other weak US macro data, it exerted pressure on the dollar and triggered an upward move in EURUSD. Investors are growing cautious about the weakening US dollar and seeking safe havens for their assets. Meanwhile, after initiating a rate cut cycle, the ECB has signalled a possible pause in further rate moves, which has strengthened the euro and supported the current rally in EURUSD. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 256 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

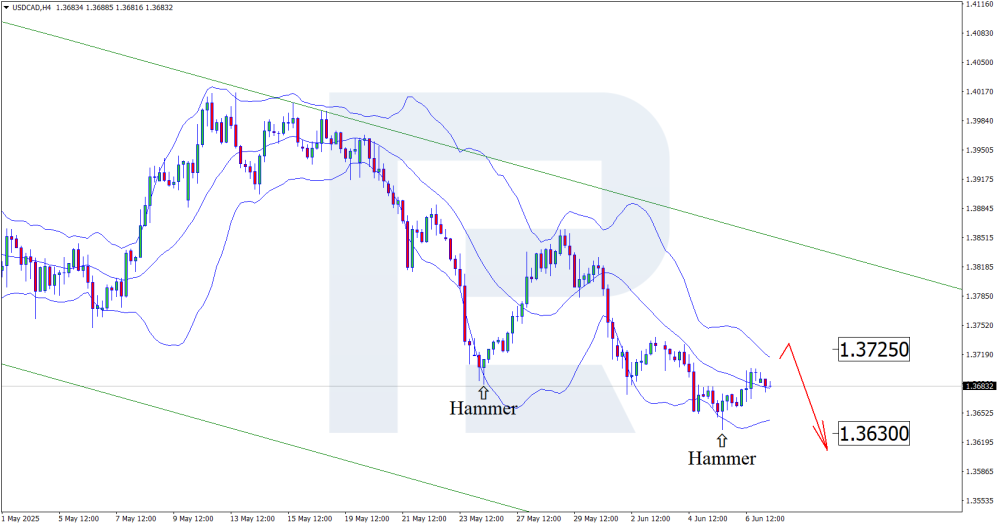

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

The dollar falls, the loonie celebrates: what’s next for USDCAD A stronger Canadian labour market supports the loonie and could push USDCAD down towards the support level at 1.3630. Discover more in our analysis for 9 June 2025. USDCAD technical analysis On the H4 chart, USDCAD formed a reversal pattern – Hammer – near the lower Bollinger Band. The pair is currently developing a correction from this signal. As prices remain within the descending channel, a move towards the nearest resistance at 1.3725 is possible. All macroeconomic factors currently favour the Canadian dollar. Read more - USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

fdeuf reacted to a post in a topic:

tradesaber.com

fdeuf reacted to a post in a topic:

tradesaber.com

-

ALE_00_ reacted to a post in a topic:

Ultimate Scalper Pro & Ultimate Backdoor Needs Unlocking

ALE_00_ reacted to a post in a topic:

Ultimate Scalper Pro & Ultimate Backdoor Needs Unlocking

-

what did you have to do to make it work? And what's your ninjatrader version?

-

II VIP Membership - FREE upgrade for OLD and ACTIVE Members

tradevelopers replied to MrAdmin's topic in Announcements

I HAD OTHER USER NAME I ALREDY SEND SEEVRAL TIME THE REQUEST TO ACTIATE MY OLD USER -

⭐ zhangw reacted to a post in a topic:

[Req] Traders handbook

⭐ zhangw reacted to a post in a topic:

[Req] Traders handbook

-

Try this: https://www.mediafire.com/file/wjqbhr4vauzrbep/59.zip/file

-

fxzero.dark started following All iGrid NT8 Indicators

- Yesterday

-

tell us , it s cracked o no ?

-

kimsam reacted to a post in a topic:

tradesaber.com

kimsam reacted to a post in a topic:

tradesaber.com

-

MavKol reacted to a post in a topic:

The Tunnel Thru the air Videos

MavKol reacted to a post in a topic:

The Tunnel Thru the air Videos

-

Thank you so much for taking your time to re-upload.

-

MavKol reacted to a post in a topic:

Any FTTUTS course

MavKol reacted to a post in a topic:

Any FTTUTS course

-

⭐ osijek1289 reacted to a post in a topic:

tradesaber.com

⭐ osijek1289 reacted to a post in a topic:

tradesaber.com

-

Sorry I don't have similar course. Actually I downloaded only two days ago from Telegram. So I thought I uploaded it for you since you can't access Telegram.

-

I think this is the vendor website https://www.coderfortraders.com/

-

-

Any chance you can extend the link? Thank you

-

@RichardGere This is a very good course by TraderLion. Thank you for sharing. Do you have any similar to this? Thank you

-

Thank you so much much, it worked.

-

Also, does anyone have Simpler Trading courses, such as New Multi Squeeze Pro System Elite, Monster Momo Method, Sandbox Strategy, Voodoo or any others by John Carter? Thank you. Also, does anyone have good options based courses? Thank you

-

Hi; Here is a workupload link https://workupload.com/file/gGXyFpWruMq

-

@MOF NET I do not have Telegram (no cellphone and this app wants an actual cell number to be working). Would you please suggest if it's possible to have a desktop app and somehow bypass the cell phone setup? Or could you please share the links in an alternative format? Thank you.

-

https://workupload.com/file/cRRVUFGQAKc cracked by @apmoo

-

Harrys started following tradesaber.com

-

Any chance of getting this latest version fixed? PredatorXOrderEntry_TRIAL_V3.0.0.0.zip

-

The latest version of Tradesaber which is just the order entry addon is available free on https://tradesaber.com/order-entry-buttons/

-

thanks