All Activity

- Past hour

-

Another trader that Jeff Bierman discussed is Sir John Templeton, here is a good book (.mobi) on his trading methods. Description: https://www.amazon.com/dp/B08BX4WYST Templeton's Way with Money.txt

-

techfo reacted to a post in a topic:

Affordable Indicators - Help Educate

techfo reacted to a post in a topic:

Affordable Indicators - Help Educate

-

-

techfo reacted to a post in a topic:

Nex Gen 3 Group Buy

techfo reacted to a post in a topic:

Nex Gen 3 Group Buy

- Today

-

Maybe we should ask the admins to create another Quantower related section on this forum. QT is becoming popular.

-

@laser1000it Please can you post the link to the edu igrid for NT8?

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

[b]Date: 23th June 2025.[/b] [b]The USD Benefits From Middle East Escalations[/b] UK and European Purchasing Managers’ Indexes have been made publicly available but so far are not supporting either currency. So far, the best-performing currency is the US Dollar. The US will release its own PMI report at 13:45 GMT+0. The price of the US Dollar continues to witness the impact of the hawkish Federal Reserve and new escalations within the Middle East. UK and EU PMI Data The European PMI reports were the first to be made public. Both French PMI reports fell below expectations and below the previous month’s release. Particularly investors were concerned with the Manufacturing PMI which fell from 49.8 to 47.8. The German Manufacturing PMI read as expected while the Services PMI rose to a 2-month high. A similar story for the UK, Manufacturing PMI data read higher than expectations while the Services PMI read as expected. However, the Great British Pound index still fell in value despite the report. In addition to this, the Pound also continues to remain under pressure from the Bank of England which held its interest rate at 4.25%, supported by six of the nine governing board members, in response to improved trading conditions following the agreement with the US. The Euro Index is currently trading at 0.56% lower and the Pound at 0.63%. The Bank of England Governor’s speech tomorrow afternoon, along with Thursday’s address, will play a major role in driving the British Pound. Meanwhile, the Euro will see limited releases, with the German IFO Business Climate standing out as the key focus. US Dollar And Middle East Escalation The best-performing currency of the day is the US Dollar which is currently trading 0.69% higher so far today. The first reaction of the US Dollar after the US bombing of Fordow, Natanz and Isfahan was a downward price movement, however, the market since then has significantly risen in value. The US Dollar is currently trading at its highest price on June 11th. The US Dollar strengthened as geopolitical tensions escalated after US strikes on Iranian nuclear sites triggering a lower risk appetite. However, traders will be closely monitoring the release of the US Manufacturing and Services PMI. Investors expect both PMI reports to be slightly weaker than the previous month, however, this cannot be certain until the release is made public. EURUSD - Technical Analysis EURUSD 2-Hour Chart The EURUSD is currently trading below the 75-period EMA and is currently forming a descending triangle pattern on the 2-hour chart. The descending triangle pattern is known to provide a bearish bias as it trades below the 75-period EMA. However, the price is also trading at the support level. On smaller timeframes, the price continues to trade below the 200-period SMA but is retracing higher. However, the retracement is unable to maintain momentum and is forming lower highs. Key Price Takeaways: USD leads as geopolitical tensions and Fed hawkishness boost demand; up 0.69% today. UK and EU PMIs failed to support GBP and EUR despite some stronger readings. BoE and ECB speeches/data remain key drivers; markets await US PMI release. EUR/USD shows bearish signals, trading below key EMAs in a descending triangle. [b]Always trade with strict risk management. Your capital is the single most important aspect of your trading business.[/b] [b]Please note that times displayed based on local time zone and are from time of writing this report.[/b] Click [url=https://www.hfm.com/hf/en/trading-tools/economic-calendar.html][b]HERE[/b][/url] to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click [url=https://www.hfm.com/en/trading-tools/trading-webinars.html][b]HERE[/b][/url] to register for FREE! [url=https://analysis.hfm.com/][b]Click HERE to READ more Market news.[/b][/url] [b]Michalis Efthymiou HFMarkets[/b] [b]Disclaimer:[/b] This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

fxzero.dark reacted to a post in a topic:

Ekitai & Seihai Need Unlocking

fxzero.dark reacted to a post in a topic:

Ekitai & Seihai Need Unlocking

-

fxzero.dark reacted to a post in a topic:

Predator X Order Entry V3.0.0.1

fxzero.dark reacted to a post in a topic:

Predator X Order Entry V3.0.0.1

-

fxzero.dark reacted to a post in a topic:

ninjastrategyloader.com

fxzero.dark reacted to a post in a topic:

ninjastrategyloader.com

-

fxzero.dark started following ninjastrategyloader.com

-

⭐ osijek1289 reacted to a post in a topic:

Affordable Indicators - Help Educate

⭐ osijek1289 reacted to a post in a topic:

Affordable Indicators - Help Educate

-

Jim Rogers is another trader that Professor Bierman profiled, his book on trading commodities is here: https://indo-investasi.com/topic/81527-hot-commodities-how-anyone-can-invest-profitably-in-the-worlds-best-market/?do=findComment&comment=726545&_rid=93128

-

Not everyone here has Quantower, and I think your request will die here. iGrid for NinjaTrader has been educated. I don’t know if it works because I don’t use NT.

-

Dragon- started following ALGO IQ (Quantower req)

-

First of apologies for posting about Quantower related in NT8 section. Does anyone have the latest update for Algo IQ they could possibly share? Would be greatly appreciated! If anyone here is in the iGrid Quantower programme and could share updates that would be fantastic! Many thanks! For reference, new super bands: https://www.youtube.com/watch?v=C2GZhR25bCY https://www.gridalgo.com/

-

Yeah, Rohit seems to do that. He does eventually get you what you want.

-

mulejuice joined the community

-

kimsam reacted to a post in a topic:

Nex Gen 3 Group Buy

kimsam reacted to a post in a topic:

Nex Gen 3 Group Buy

-

You right.. as i told ..they installing it in your PC after ..for license... . I saw that in the code .. i found a way to baybass it .. And they using updated version of ninjatrader .. It's working for me now .. but still some errors.. because the version.. need to fix .

-

fxtrader99 reacted to a post in a topic:

Affordable Indicators - Help Educate

fxtrader99 reacted to a post in a topic:

Affordable Indicators - Help Educate

-

My experience is not the same. Sorry. He is fast when you want to purchase and he does deliver proper working software. But my aftercare experience is bad. I used 2 e-mailadresses after encountering issues. When he wasn't responding to my request for a software update for a few days, I sent him another e-mail from a dummy account I used. There I expressed interest in buying a product. Response within 24 hours. Do with that what you will, but that is my experience.

-

Does this include the MZpack Indicators .exe installer. Look like it just install the strategy.

-

⭐ goldeneagle1 reacted to a post in a topic:

Nex Gen 3 Group Buy

⭐ goldeneagle1 reacted to a post in a topic:

Nex Gen 3 Group Buy

-

Historical Quotes Downloader cracked

⭐ laser1000it replied to ⭐ Atomo12345's topic in Trading Platforms

Unfortunaly -

Anyone who purchased or tried NextGen knew that after installation the initial batch of DLLs prompted you to log into your computer to modify certain settings. I was able to confirm that afterwards they would send you DLLs that overwrote certain files, as well as additional files placed in the /x86 directories—possibly including an x86 code section designed to prevent bypassing, especially since the locations where similar files were placed remained unknown. When Abblesys was cracked by John, several people provided information about this. The same goes for taskools—they contain x86 code sections (i.e., written in C++) intended to hinder deobfuscation.

-

rubadub joined the community

-

(Req) bill williams profitunity course

DeepSeekecske replied to wt501's topic in Forex Clips & Movies

Dear Gadfly, This is a truly valuable contribution to the system! Thank you very much for taking the time to share it with us! -

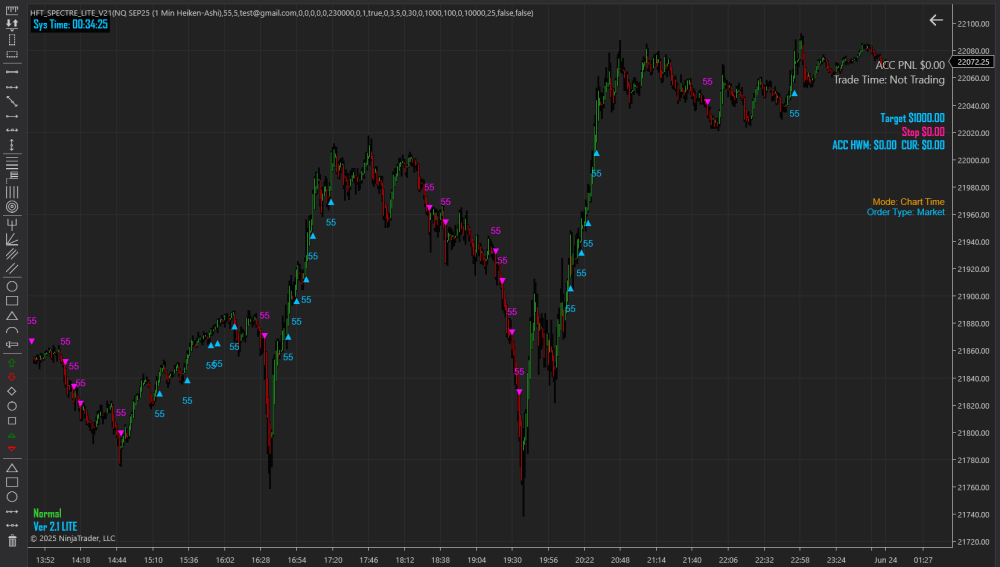

https://www.alphaautotrading.com/

Ninja_On_The_Roof replied to cyb3r_trader's topic in Ninja Trader 8

And, if you are into things that repaint, this might be just for you. -

Ohh geez wheeze! Must be making a ton of $$$ but then again, it is hard work educating stuff. It is a degree in itself, as a job.

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDJPY holds at monthly highs: too many risks in play The USDJPY pair has climbed to a five-week peak as the US dollar benefits from safe-haven demand. Find more details in our analysis for 23 June 2025. USDJPY forecast: key trading points The USDJPY pair reached a five-week high amid strong market demand for safe-haven assets Domestic signals from Japan appear solid USDJPY forecast for 23 June 2025: 146.78 Fundamental analysis The USDJPY rate rose to 146.70. Strong demand for the US dollar as a safe-haven asset followed a sharp escalation in the Middle East conflict. The United States struck three Iranian nuclear facilities, joining Israel in the confrontation with Tehran. Domestic Japanese data provided some positive signs, with the manufacturing sector returning to growth in June for the first time since May 2024. The services sector also expanded for the third consecutive month, indicating broad economic resilience. Last week, the Bank of Japan kept the benchmark interest rate at 0.5% per annum. The central bank commented that firms continued to pass rising wages onto prices, keeping core inflation high. BoJ Governor Kazuo Ueda reaffirmed a data-driven policy approach and left the door open for further rate hikes if inflationary pressure intensifies. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 264 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Middle East conflict and Canada’s economic weakness push USDCAD higher The USDCAD pair is strengthening amid signs of a weakening Canadian economy, with the price currently at 1.3757. Discover more in our analysis for 23 June 2025. USDCAD technical analysis The USDCAD rate continues to strengthen, with buyers retaining control over the market as prices remain within an ascending channel. Today’s USDCAD forecast anticipates a rebound from the EMA-65 and a climb towards 1.3845. Weak Canadian economic data and US dollar support driven by geopolitical instability continue to lift USDCAD. Read more - USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Yes, he is same one, he is having multiple websites.

-

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

Maybe you can help us with it. 😟