⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Past hour

-

can you share the link to their website

- Today

-

I'm not sure what to tell you, it probably depends on the platform and whether it's original or from a sketchy source from my side dll was cleaned well, but I don't see any follow-through it will depend by the settings..

-

hay una version pero no se como instalarlo, alguien por favor podria ayudarme, muchas gracias

-

HWX started following TradewithRaja

-

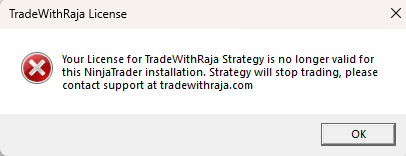

I'm getting this license error; I've already removed and re-imported it and restarted. My Ninja 8.1.5.2

-

Oana SSS reacted to a post in a topic:

quantvue.io

Oana SSS reacted to a post in a topic:

quantvue.io

-

⭐ osijek1289 reacted to a post in a topic:

mas capital m trader needs edu

⭐ osijek1289 reacted to a post in a topic:

mas capital m trader needs edu

-

TRADER reacted to a post in a topic:

mas capital m trader needs edu

TRADER reacted to a post in a topic:

mas capital m trader needs edu

-

-

Latest Templates: https://workupload.com/archive/hkhaXabUmz

-

Yes, I checked, they are not there. If someone has them, it would be truly appreciated

-

Por favor compartan el software con crack, ya no se puede descargar, y muchisimas gracias por ser tan amables.

-

A little searching goes a long way, thanks to @apmoo

-

The software looks detailed, however, cyclical lows do not occur exactly at the same time each cycle, since there are multiple cycles combining at any one time and how they phase and interplay determines when bottoms may occur.

-

Private Training Course by RTM founder Ifmyante

⭐ insaneike replied to ⭐ insaneike's topic in Forex Clips & Movies

Spoiler https://mega.nz/folder/isgQCbzQ#cuSBV2Gt5IXQEPufkSQxpA I've uploaded all I'd. Enjoy and Good Luck. -

this is a excellent software h**ps://www.investimentivincenti.it/default.asp?pag=Cycles Navigator

-

This is an excellent program. Is there a version available for sharing?

-

Mourya joined the community

-

TDU footprint v.2.0.14 zip + Big trades v1.0.0.9 - new features

fchot33 replied to sarutobi's topic in Ninja Trader 8

The BigTrades from MZpack aka mzbigtrades are decent too.. with their Iceberg trades and using Quantumdelta from Ninza that comes filtered already is good enough. The QuantumDelta from ninza places dots above or below candle. Not sure if there is a way to place the dot in th right section of the candle but I use both to filter out and works just fine. -

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date: 16th December 2025. US Stock Futures Down as Markets Brace for Delayed Jobs Report and Inflation Data. It’s finally here. US stock futures moved lower on Tuesday, extending recent losses as global markets prepared for a crucial wave of delayed US economic data that could shape interest rate expectations well into next year. Futures linked to the Dow Jones Industrial Average declined 0.3%, while S&P 500 futures fell 0.6%. Contracts tied to the Nasdaq 100 slid 0.9%, deepening losses from the start of the week. Technology stocks led Monday’s pullback, as lingering concerns around artificial intelligence investments continued to weigh on sentiment. While AI-related volatility has dominated recent sessions, market attention has firmly shifted towards macroeconomic developments, with investors closely watching the release of the November US nonfarm payrolls report, which arrives later than usual due to the recent government shutdown. Delayed US Jobs Report Takes Centre Stage Today’s employment figures will set the tone for another critical release later this week, as November US consumer inflation data is scheduled for publication on Thursday. Together, the jobs and CPI reports represent a substantial portion of the ‘great deal of data’ that Fed Chair Jerome Powell has emphasised policymakers will assess ahead of their next interest rate decision in January. The long-awaited November NFP report is expected to fill a data gap left by the shutdown and reignite debate over the future path of Federal Reserve interest rate policy in 2026. The figures are scheduled for release at 13:30 GMT alongside a partial update to October payrolls data. Economists forecast a modest increase of around 50,000 jobs for November, while the unemployment rate is expected to tick up to 4.4%, keeping it near its highest level since 2021. The softer outlook has reinforced expectations that the Fed may shift its focus more decisively toward supporting labour market conditions rather than battling persistent inflation. Currently, market pricing reflects two Federal Reserve rate cuts next year, assuming employment data continues to cool without triggering a sharp economic downturn. Regarding inflation, economists expect Thursday’s report to show that US consumer prices rose 3.1% year-on-year in November, reinforcing the view that inflation remains elevated but is no longer accelerating. Market participants are hoping for a scenario in which labour market conditions weaken just enough to justify further rate cuts, without tipping the economy into recession. Lower interest rates tend to support economic growth and asset prices but also carry the risk of reigniting inflation pressures. Markets Embrace the ‘Bad Is Good’ Narrative Analysts at Morgan Stanley described the current environment as a ‘bad is good’ regime, where weaker jobs data could actually be bullish for equities by increasing expectations for additional monetary easing. ‘This week’s jobs data could prove more important for equity market perceptions of interest rate policy than last week’s FOMC meeting,’ the bank noted, adding that moderate labour market weakness may be interpreted positively by stock investors. Asian Markets Retreat as Global Rate Risks Loom Overnight, Asian equity markets also declined sharply. Japan’s Nikkei 225 fell 1.6% to 49,383.29 after preliminary factory data indicated a slight slowdown in manufacturing activity. The S&P Global Flash PMI edged higher to 49.7 in November from 48.7 previously, remaining just below the 50 threshold that separates expansion from contraction. Investors are closely monitoring Japanese economic indicators ahead of the Bank of Japan’s policy meeting on Friday, where a widely anticipated interest rate hike could trigger volatility across global bond markets, currencies, and cryptocurrencies. China Data Signals Loss of Momentum Chinese markets also moved lower after weaker-than-expected November data. Retail sales rose just 1.3% year-on-year, marking the slowest pace of growth since the pandemic in 2022. Lending activity and fixed investment figures also came in softer, reinforcing concerns about slowing economic momentum into year-end. ‘Overall, the data confirms a loss of momentum heading into year-end and aligns with our growth forecasts moderating to around 4% in the final quarter,’ said Tan Boon Heng of Mizuho Bank. Hong Kong’s Hang Seng Index dropped 1.6% to 25,211.24, while mainland China’s Shanghai Composite fell 1.1% to 3,825.71. Oil Prices Edge Lower Ahead of Key Data In early trading on Tuesday, US benchmark crude oil (WTI) slipped 37 cents to $56.45 per barrel, while Brent crude fell 35 cents to $60.21 per barrel, as investors awaited fresh signals on economic growth and energy demand. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Andria Pichidi HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Brent: prices fall to support at 60.00 USD Brent prices have dropped toward the 60.00 USD area amid peace talks on Ukraine and concerns over excess oil supply in global markets. Details — in our analysis for 16 December 2025. Brent forecast: key trading points Market focus: today the market awaits US employment data for November Current trend: a downward move is observed Brent forecast for 16 December 2025: 58.50 or 64.00 Fundamental analysis Brent prices are declining, falling toward the psychologically important 60.00 USD level, supported by renewed negotiations over a potential peace agreement between Russia and Ukraine. On Monday, US officials signaled that an agreement between Russia and Ukraine is closer than ever, as Washington has agreed to provide security guarantees to Kyiv, although territorial issues remain unresolved. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 384 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

The dollar on thin ice: US labor market data could ignite EURUSD The euro continues to strengthen against the US dollar, with EURUSD quotes testing the 1.1750 level. Details — in our analysis for 16 December 2025. EURUSD technical analysis On the H4 chart, EURUSD has formed a Hammer reversal pattern near the lower Bollinger Band. At this stage, the pair may continue its upward wave as part of the pattern’s follow-through. Given that prices remain within an ascending channel, EURUSD may move toward the 1.1800 level. The euro continues to strengthen amid upcoming US labor market data. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

YUSEF joined the community

-

In forex, it is best to invest in major currency pairs such as EUR/USD, GBP/USD, and USD/JPY because they are highly liquid and more stable. Choose a regulated broker, use strong risk management, and begin with small trades while learning market analysis.