All Activity

- Past hour

-

I see they list their token LMGX on Bitmart and the price seems good. I may invest some soon.

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

[b]Date: 19th May 2025.[/b] [b]Global Markets Slide After US Credit Rating Downgrade, Weak Chinese Data Add to Investor Jitters.[/b] Asian markets fell today while US futures and the dollar weakened, as global investors digested Moody’s downgrade of the US sovereign credit rating. The move came in response to the US government's persistent struggle to control rising debt, currently sitting at $36 trillion. US Credit Rating Downgrade Sends Ripples Through Global Markets Moody’s cut the US sovereign credit score from its long-held AAA rating to Aa1 — the first downgrade since 1917. The rating agency cited worsening fiscal conditions, a widening deficit, and increasing concerns over the government's capacity to manage its debt obligations. It follows earlier warnings in 2023 and echoes similar concerns raised by Fitch and S&P in previous years. The downgrade hit global sentiment hard. The futures for the S&P 500 slid 0.9%, while those for the Dow Jones Industrial Average declined 0.6%. The US dollar weakened, dipping to 145.14 yen from 145.65 yen, while the euro remained flat at $1.1183. Asian Markets Under Pressure Amid Weak China Data Chinese equities slipped after fresh data revealed slower-than-expected economic growth. April retail sales in China rose just 5.1% year-on-year, missing forecasts, while industrial output growth eased to 6.1% from 7.7% in March. The slowdown raises concerns over excess inventories and reduced domestic demand, particularly in the wake of the ongoing US-China trade tensions. The Hang Seng in Hong Kong fell 0.7% to 23,184.74, and Shanghai’s Composite Index edged down 0.2% to 3,361.72. Japan’s Nikkei 225 dropped 0.4%, Korea’s Kospi lost 1%, and Taiwan’s Taiex shed 0.8%. Australia’s ASX 200 declined 0.1%. Adding to the pessimism, China’s property market showed no signs of recovery, with new home prices unchanged in April, marking nearly two years of stagnant growth despite government support efforts. Trade War Uncertainty Looms Over Markets Tensions between the US and its trading partners continue to add volatility. Treasury Secretary Scott Bessent warned that President Donald Trump would impose tariffs on countries not negotiating in ‘good faith.’ Although Bessent did not clarify what qualifies as ‘good faith,’ he stated that letters outlining tariff rates would be sent to non-compliant nations. Trump has already shifted tariff rates multiple times this year. In April, he reduced most tariffs to 10% for 90 days to encourage negotiations, while tariffs on Chinese imports were adjusted to 30%. Despite last week’s 90-day standstill agreement between the US and China, investor sentiment remains fragile amid concerns over Trump’s unpredictable trade policies. Wall Street Rallies but Risks Remain Despite the looming economic headwinds, Wall Street closed higher last week. The S&P 500 gained 0.7% to 5,958.38, bringing it within 3% of its February all-time high. The Dow climbed 0.8% to 42,654.74, while the Nasdaq rose 0.5% to 19,211.10. Optimism over potential tariff rollbacks helped fuel the rally, but fears of a recession and stubborn inflation still weigh heavily. Moody’s downgrade also underscores long-term structural challenges for the US economy, as successive administrations have failed to rein in government spending. Consumer Sentiment, Inflation Expectations Worsen The University of Michigan’s latest consumer sentiment index showed another decline in May, though the pace of deterioration slowed. More troubling, Americans now expect inflation to reach 7.3% over the next year, up from 6.5% the month before, further complicating the Federal Reserve’s path toward rate cuts. Hope remains that softer inflation readings and slowing economic activity could eventually prompt the Fed to ease monetary policy,a key support for markets facing trade shocks and fiscal uncertainty. Gold Gains on Safe-Haven Demand Gold prices edged higher as investors turned to safe-haven assets amid mounting US fiscal concerns. Spot gold rose 0.5% to $3,218.30 an ounce in Singapore after briefly surging as much as 1.4% earlier in the session. The Bloomberg Dollar Spot Index slipped 0.2%. Moody’s downgrade of the US credit rating supported gold’s appeal. The precious metal, which hit record highs above $3,500 an ounce last month, remains up over 20% this year despite recent pullbacks driven by easing geopolitical tensions. Oil Prices Dip on Weak Data and Credit Worries Oil prices fell Monday following the US credit rating downgrade and underwhelming Chinese economic data. Brent crude slipped 0.5% to $65.06 a barrel, while US West Texas Intermediate (WTI) dropped 0.4% to $62.23. The more actively traded July WTI contract also fell 0.5% to $61.66. While the recent truce between the US and China initially lifted crude prices, concerns over the durability of the agreement and China’s faltering recovery have kept investors cautious. Corporate Highlights: Mergers and Market Moves In corporate news, Charter Communications rose 1.8% after announcing a merger with Cox Communications. The combined entity will retain the Cox name and be headquartered in Stamford, Connecticut. Nvidia-backed CoreWeave jumped 22.1% after the tech giant increased its stake in the AI cloud computing firm from just under 6% to 7%. Meanwhile, US-listed shares of Novo Nordisk fell 2.7% after the company announced CEO Lars Fruergaard Jørgensen will step down amid recent market challenges, despite the popularity of its Wegovy weight-loss drug. Outlook: Uncertainty Ahead With the US credit rating downgrade, wavering trade relationships, and mixed economic signals from China, financial markets are likely to remain volatile. While some positive inflation data could support a dovish Fed pivot later in the year, uncertainty over global trade policies and fiscal stability will continue to dominate investor sentiment. [b]Always trade with strict risk management. Your capital is the single most important aspect of your trading business.[/b] [b]Please note that times displayed based on local time zone and are from time of writing this report.[/b] Click [url=https://www.hfm.com/hf/en/trading-tools/economic-calendar.html][b]HERE[/b][/url] to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click [url=https://www.hfm.com/en/trading-tools/trading-webinars.html][b]HERE[/b][/url] to register for FREE! [url=https://analysis.hfm.com/][b]Click HERE to READ more Market news.[/b][/url] [b]Andria Pichidi HFMarkets[/b] [b]Disclaimer:[/b] This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

jquiroz75 reacted to a post in a topic:

quantvue.io

jquiroz75 reacted to a post in a topic:

quantvue.io

-

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

jquiroz75 joined the community

- Today

-

SpartanGR77 joined the community

-

We can expect anything in this trading world especially when it comes to digital assets since the new era being revolutionized by the digital currencies and everyone now is able to transfer millions of funds from one place to another within minutes using the digital currencies in a simple manner without involving banks of other intermediaries. So in short, i guess that this might change or replace the gold too in future.

-

It is actually better than trading a simple demo account because it at least give you an option to win prize money beside back testing or trading the real market conditions using a demo.

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

EURUSD reversed upwards – will the rally continue? The EURUSD pair has formed a local upward reversal after bouncing off the daily support level at 1.1065, with further growth possible. Discover more in our analysis for 19 May 2025. EURUSD forecast: key trading points Market focus: today, the market awaits eurozone inflation data for April, with the Consumer Price Index (CPI) scheduled for release Current trend: upward movement is in progress EURUSD forecast for 19 May 2025: 1.1130 and 1.1265 Fundamental analysis Investor attention is currently drawn to the UK-EU summit in London, where both sides aim to improve relations after years of tension following the 2016 Brexit vote. Constructive agreements may be reached. As for the economic data, the market awaits April inflation statistics for the eurozone. The CPI is expected to rise by 0.6% month-on-month and by 2.2% year-on-year. Higher-than-expected inflation would push the pair higher, while weaker figures could trigger a downward reversal. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 241 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

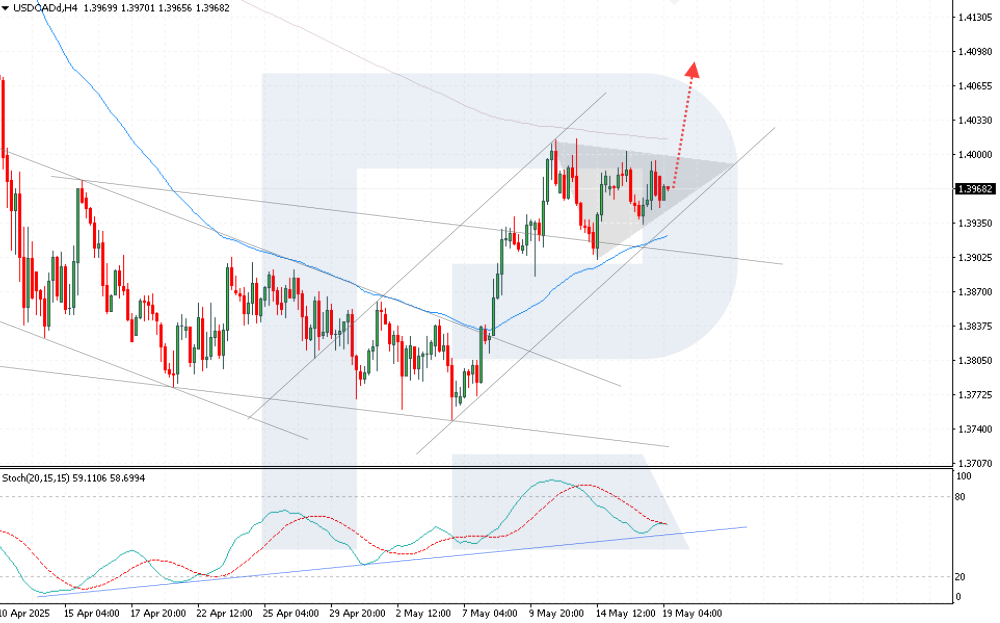

RBFX Support replied to RBFX Support's topic in Technical Analysis

Triangle on the chart, USDCAD poised for growth The USDCAD rate continues its correction, staying within a narrow range for six consecutive sessions. The current price is 1.3967. Find out more in our analysis for 19 May 2025. USDCAD technical analysis The USDCAD rate remains within the Triangle pattern. Today’s USDCAD forecast suggests a breakout above the pattern’s upper boundary and continued growth towards 1.4095. The US credit rating downgrade and weak economic data add to pressure on the US dollar. Read more - USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

The major update in Amibroker 6.93 c****ed, AFLWIZ.

⭐ Atomo12345 replied to ⭐ Atomo12345's topic in Amibroker

I found the file AmiBroker.6.20.1 Full (Crack).rar without password. But this is a 32 bit version and not a 64 bit version. Sorry, nothing to do. -

The major update in Amibroker 6.93 c****ed, AFLWIZ.

⭐ Atomo12345 replied to ⭐ Atomo12345's topic in Amibroker

The file AmiBroker.6.20.1 Full (Crack).rar is password protected. -

There is one from trade devil which was posted for download here. There is One by Zonevue, that can trade for you. Ther is one free from telegram channel made by Infinity. Now , when will you not trade a Supply and demand ?

-

@Ninja_On_The_Roof the ncat supply and demand pro that you have uploaded earlier, not able to download, could you upload it again here please.

-

There are many. You can certainly use the one from nCat. It can also auto trade for you as well when you enable it.

-

Did French fries come from the French?😂 Did French kiss come from the French as well?😂

-

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

Please recommend which supplly and demand indicator you personally use.

-

Thats what I said Nasdaq is a game of boxes , its an up and down swing, the reason is, it will complete a box everytime, small box and Big box. They call if sometime value fair gap but it is partly true , it is a box trade all the time. Read the book of the french trader it will explain to you what I mean. And if you understand the Box trade, all you need is a supply and demand indicator.

-

Learn crypto trading with Juliet Hatch

-

beepboopcomputer joined the community

-

⭐ aniketp007 reacted to a post in a topic:

tradingfuturesnow.com/

⭐ aniketp007 reacted to a post in a topic:

tradingfuturesnow.com/

-

I guess if you have a decent size of capital and trading on your own personal account. This would give you some extra rooms to survive and recoup but with prop firms, you would hurt yourself badly, especially with the intraday trailing. The thing with bots, you just don't know what the next trade is going to turn out. You are at the mercy of market and the bots themselves. You can be up $500 on your first trade out of the gate. The next one could wipe that $500 out, plus another $200, let's say, in red. Now, if you don't try then how would you know it won't win on the next one for you to recoup? You don't know. You cant. Same thing, if you dont try, then how would you know the next one is going to be a loser. You just don't. You can't. You don't have that crystal ball. One positive side with bots I must say is that...They have discipline, of which many of us often lack. Bots don't enter a trade just to enter a trade. Bots enter when and only when their criteria are met or with whatever internal settings they have. We, on the other hand, we click here. We click there. We chase. We FOMO. We force trades at times.

-

The major update in Amibroker 6.93 c****ed, AFLWIZ.

epajfl00 replied to ⭐ Atomo12345's topic in Amibroker

A download of a cracked version of Amibroker ver 6.20.1 x64 bit from this site is available; https://taingay-net.translate.goog/download-amibroker-6-20-1-full-crack-64-bit/?_x_tr_sl=auto&_x_tr_tl=en&_x_tr_hl=en-US Note: A full version of Amibroker 6.43.1 x64 bit is available, can someone use this cracked 6.20.1 version to crack the 6.43.1 version? @Atomo12345 has indicated that he can try. -

bryandarktuni reacted to a post in a topic:

Legendary Trader Auto Entry v3.0

bryandarktuni reacted to a post in a topic:

Legendary Trader Auto Entry v3.0

-

⭐ mangrad started following Can this be unlocked?

-

@apmoo Can this be unlocked? Dataload.zip

- Yesterday

-

Any luck with this file?

-

testify joined the community

-

⭐ mangrad reacted to a post in a topic:

Req: NT8 indicator

⭐ mangrad reacted to a post in a topic:

Req: NT8 indicator

-

coolombo reacted to a post in a topic:

orderflowlabs.com

coolombo reacted to a post in a topic:

orderflowlabs.com

-

saar420 joined the community

-

I told you guys all you need is a supply demand indicator a volume profile and limit order indicator by Pipflow.com, and read the book of the French trader and see and explain to you what is the market really doing

-

The major update in Amibroker 6.93 c****ed, AFLWIZ.

pashr replied to ⭐ Atomo12345's topic in Amibroker

Hi Any possibilities to get 64 bit version of Amibroker