All Activity

- Past hour

-

Casper99 reacted to a post in a topic:

Sniper Auto Trader

Casper99 reacted to a post in a topic:

Sniper Auto Trader

- Today

-

⭐ JDizzle22 reacted to a post in a topic:

HFT Algo HFT SPECTRE

⭐ JDizzle22 reacted to a post in a topic:

HFT Algo HFT SPECTRE

-

ynr reacted to a post in a topic:

tradingfuturesnow.com/

ynr reacted to a post in a topic:

tradingfuturesnow.com/

-

search shows there is no "educated" version of the HFT SPECTRE .DLL file on this website.

-

Hi all, Does anyone have this bot? IT wasn't included in the previous TWST.store post in April. https://www.twst.store/product-page/breakoutssniperbot-100-fully-automated-bot-for-nt8 Cheers

-

It's an indicator but you could automate the signals.

-

Kermit 1981 reacted to a post in a topic:

discotrading.com

Kermit 1981 reacted to a post in a topic:

discotrading.com

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Brent prices fall: US increases reserves, what happens next The rise in US crude oil inventories triggered a correction in Brent quotes, with prices possibly reaching the support level around 63 USD. Discover more in our analysis for 15 May 2025. Brent technical analysis Having tested the upper Bollinger band, Brent prices formed a Shooting Star reversal pattern on the H4 chart. Quotes currently continue their corrective wave as this pattern plays out. The Brent price forecast currently favours the US dollar, with quotes continuing to decline amid expectations of an Iran-US deal. Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

USDJPY on the verge of reversal: Double Bottom may trigger a rally to 149.05 The USDJPY rate continues to decline as sellers gear up for another attempt to test the key support level. The price currently stands at 146.03. Discover more in our analysis for 15 May 2025. USDJPY forecast: key trading points Weak US inflation data supported the Japanese yen The USDJPY pair remains under pressure amid ongoing global trade uncertainty USDJPY forecast for 15 May 2025: 149.05 Fundamental analysis The USDJPY rate has been declining for the third consecutive trading session. The US dollar is losing ground due to sustained uncertainty in global trade and speculation that the US administration favours a weaker dollar in the current negotiations. According to Washington, the relative weakness of Asian currencies gives regional exporters an unfair advantage over US companies. Additional pressure came from weak US inflation data. Chicago Federal Reserve Bank President Austan Goolsbee stated that the Fed needs more information to assess how tariffs impact domestic prices. He noted that the central bank should not react to short-term stock market volatility or political commentary and cautioned against drawing quick conclusions about long-term trends amid high short-term fluctuations. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 239 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

[b]Date: 15th May 2025.[/b] [b]The US Dollar, The Fed And Producer Inflation![/b] Lower inflation tends to have a negative impact on the US Dollar, particularly due to political pressure for the Federal Reserve to cut interest rates. However, the US Dollar has been increasing in value over the past week. The upward price movement is largely driven by less trade tensions and US economic deals with the Middle East. However, the producer inflation release will be key for the day. The US Dollar And Upcoming US Data The performance of the US Dollar is likely to depend on today’s economic data, which will be made public at 12:30 GMT. The US will release the monthly Producer Inflation, weekly unemployment claims and Retail Sales. Ideally, USD-buyers will be hoping for the producer inflation and retail sales to read higher than the current expectations, while the weekly unemployment claims to read lower. Analysts currently expect the producer price index year over year to fall from 2.7% to 2.5%. A reading above 2.5% could notably support the US Dollar, reinforcing the Federal Reserve’s previous guidance. On Wednesday, Fed Vice Chair Philip Jefferson stated that, despite the newly agreed lower tariff levels, inflation is still expected to rise, even if temporarily. He also told journalists that the economy may experience a slowdown as a result of the tariffs. Nonetheless, most economists are lowering the possibility of a recession. Some economists remain pessimistic, only lowering the possibility of a recession to 45%, while others are lowering it to 30%. Barclays is currently one of the only banks which advise the US is not likely to see a recession in 2025, and the current possibilities are no more than 10%. The Currency Market The US Dollar Index is trading lower on Thursday during the Asian Session. However, as the European market opens and the Asian session gets closer to its close, the US Dollar Index improves. If the US Dollar Index increases above 100.75, the price will be above the trend line and will form a breakout. As a result, the index will indicate a possible upward price movement. Currently, the best-performing currencies of the day are the Japanese Yen and Swiss Franc, while the worst are the US Dollar and Canadian Dollar. USDCAD 1-Hour Chart Based on the current performance of individual currencies, if the US Dollar were to increase in value, it would do so more easily against the Canadian Dollar. The Canadian Dollar has been the worst-performing currency of 2025 so far after the US Dollar. The US and the Middle East Over the past 2 days, President Trump has been undergoing a tour of the Middle East, including Saudi Arabia and Qatar. So far, the tour has been seen as a success. President Trump secured a comprehensive $600 billion investment commitment from Saudi Arabia, encompassing various sectors such as defense, energy, technology, and infrastructure. In Doha, Trump announced a landmark $200 billion agreement between Qatar Airways and Boeing for the purchase of 160 aircraft. The deal signs are positive for the US and even the US Dollar in the long term. However, these developments will not mean much if the producer inflation and retail sales do not beat expectations. In the short to medium term, this will be key. Key Takeaway Points: Despite falling inflation and rate cut pressure, the USD has strengthened, driven by easing trade tensions and Middle East deals. Producer inflation, unemployment claims, and retail sales will shape short-term USD performance. Stronger data could boost the currency. The US Dollar Index may break higher if it climbs above 100.75. The Canadian Dollar remains the weakest performer of 2025. Trump’s $800B in agreements with Saudi Arabia and Qatar support long-term USD sentiment, but near-term data remains critical. [b]Always trade with strict risk management. Your capital is the single most important aspect of your trading business.[/b] [b]Please note that times displayed based on local time zone and are from time of writing this report.[/b] Click [url=https://www.hfm.com/hf/en/trading-tools/economic-calendar.html][b]HERE[/b][/url] to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click [url=https://www.hfm.com/en/trading-tools/trading-webinars.html][b]HERE[/b][/url] to register for FREE! [url=https://analysis.hfm.com/][b]Click HERE to READ more Market news.[/b][/url] [b]Michalis Efthymiou HFMarkets[/b] [b]Disclaimer:[/b] This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

in general start with free courses before you jump in to paid ones, there are good ones out there

-

it will all fall down to spreads and execution during news really. and yeah they do allow it.

- 304 replies

-

- forex broker

- hotforex

-

(and 1 more)

Tagged with:

-

is this result refer to HFT SPECTRE?

-

-

This indicator is not published, but I've looked at it and it gives very good results. It should be unlocked.

-

Working well, anyway I think it's nice to use it only on Carnival day. As usual it's just another flashy NT8 add-on that doesn't help you make money Of course, I thank Apmoo with all my heart for their time and effort—even if the results aren’t exactly profitable.

-

what does it Do ?

-

Is it working, I tried it. It doesn't work. Did somebody make it work?

-

⭐ laser1000it reacted to a post in a topic:

tradingfuturesnow.com/

⭐ laser1000it reacted to a post in a topic:

tradingfuturesnow.com/

-

it mean on this forum, there's a search option

-

we need someone to fix it please

-

⭐ zbear reacted to a post in a topic:

SniperSlingshotv19

⭐ zbear reacted to a post in a topic:

SniperSlingshotv19

-

⭐ zbear reacted to a post in a topic:

discotrading.com

⭐ zbear reacted to a post in a topic:

discotrading.com

-

AllIn reacted to a post in a topic:

twst.store

AllIn reacted to a post in a topic:

twst.store

-

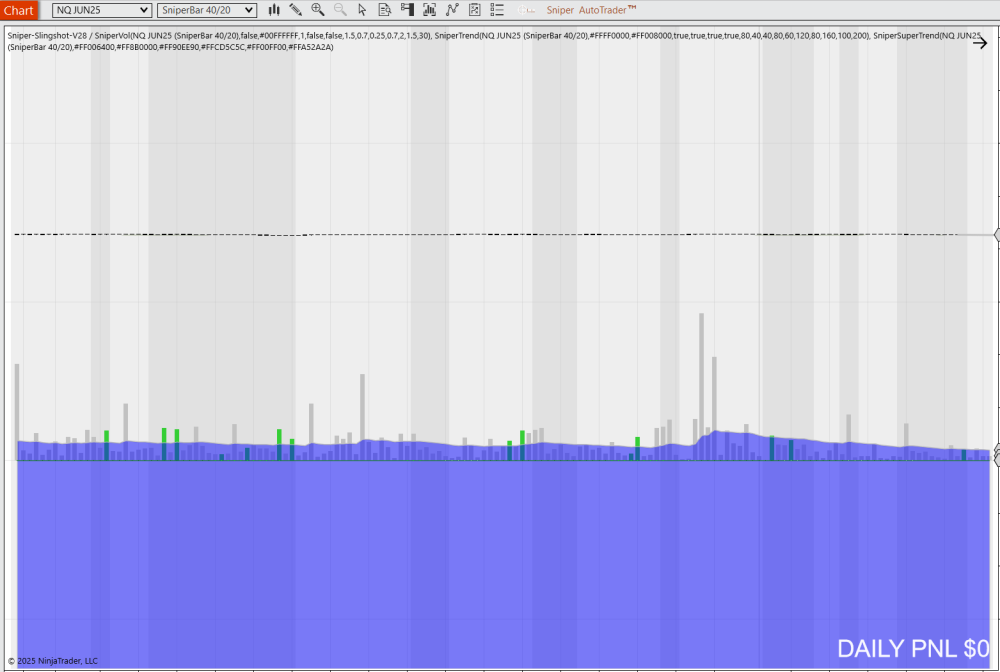

What are your atm and bot settings?

-

fxtrader99 reacted to a post in a topic:

Sniper Auto Trader

fxtrader99 reacted to a post in a topic:

Sniper Auto Trader

-

fxtrader99 reacted to a post in a topic:

tradingfuturesnow.com/

fxtrader99 reacted to a post in a topic:

tradingfuturesnow.com/

- Yesterday

-

Whats this mean? What website?

-

https://workupload.com/file/dSH5d4Wk7vt Thanks

-

https://workupload.com/file/H3eduZd7bcL

you can fix this indi please, thanks in advance @apmoo

-

https://workupload.com/file/hD4yhsg7tB8 Thanks

-

this version its working good. https://workupload.com/archive/Mym8dVtFb8 and this one its Version 28 need to fix https://workupload.com/file/eksLhYy3whE

-

I have this one, working fine without any prob. KISSORDERFLOW Click to Download

-

does this contains leg to leg profiles?