⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Past hour

-

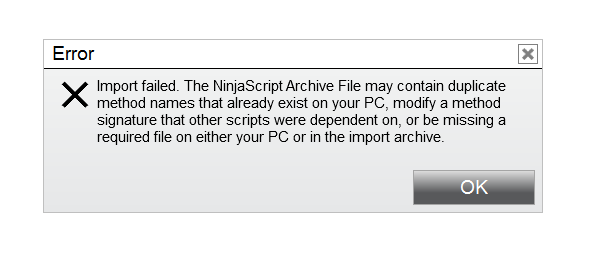

@N9T I installed your package on an edu NT8, the installation and indicators worked flawlessly. I think I misunderstood the AIO concept because when I import an indicator from @Luke SteelWolf's Ninza Reup and respond "No" to each replacement request, I still get the "This computer is not licensed" message. Just in case, I also imported VWAPflux (unedu), same procedure, got the same result. Don't know if anyone else is getting same result.

-

NQ Ultra - Futures Trading Bot // https://tradegreater.com/

Boka replied to luludulu's topic in Ninja Trader 8

@apmoo @redux Please help us to educate this algo.. thanks https://workupload.com/archive/uesmc9uEmD -

Did you remove conflicting packages beforehand?

-

⭐ htn4653 reacted to a post in a topic:

Holy Grail Algo need EDU

⭐ htn4653 reacted to a post in a topic:

Holy Grail Algo need EDU

-

In addition to mastering trading techniques, I recommend using a reputable broker. Hw.site has been my best experience because it provides real figures and offers valuable assistance and lessons from the very beginning.

- Today

-

mmicro reacted to a post in a topic:

Holy Grail Algo need EDU

mmicro reacted to a post in a topic:

Holy Grail Algo need EDU

-

Luke SteelWolf reacted to a post in a topic:

Ninza stuffs - AIO

Luke SteelWolf reacted to a post in a topic:

Ninza stuffs - AIO

-

ATRius started following NQ Ultra can someone please educate

-

Can someone please educate this one? It requires a license code in settings. let me know if this downloads https://1drv.ms/u/c/1cd8c9ed5b41c794/IQCMUkFbMiHgSKWH_GFAoWpBASIYQEXPnFHCRf6n1DKR7E4

-

- ninjatrader

- ninja trader

-

(and 2 more)

Tagged with:

-

vonita reacted to a post in a topic:

Holy Grail Algo need EDU

vonita reacted to a post in a topic:

Holy Grail Algo need EDU

-

I think we need to start with small while learning and choose any reputed broker like hfm, octa, exness, lmfx etc as our trade partner. Learn the skills carefully and pratice on demo or either with those small funds and grow.

-

N9T reacted to a post in a topic:

Holy Grail Algo need EDU

N9T reacted to a post in a topic:

Holy Grail Algo need EDU

-

Working beautifully! Thanks @N9T

-

AllIn reacted to a post in a topic:

Ninza stuffs - AIO

AllIn reacted to a post in a topic:

Ninza stuffs - AIO

-

AllIn reacted to a post in a topic:

Holy Grail Algo need EDU

AllIn reacted to a post in a topic:

Holy Grail Algo need EDU

-

ATRius joined the community

-

⭐ rcarlos1947 reacted to a post in a topic:

Holy Grail Algo need EDU

⭐ rcarlos1947 reacted to a post in a topic:

Holy Grail Algo need EDU

-

Traderbeauty reacted to a post in a topic:

Ninza stuffs - AIO

Traderbeauty reacted to a post in a topic:

Ninza stuffs - AIO

-

https://workupload.com/archive/TVZDvCuKbW @N9T @redux @kimsam @apmoo

-

⭐ ajeet reacted to a post in a topic:

Delta scalper

⭐ ajeet reacted to a post in a topic:

Delta scalper

-

-

I will say this again. I create my own version of this DeltaScalper. this is to mirror the indicator, it is not the same. Leaving the TV code for some that already asked for: //@version=6 indicator("Clean Color Custom Imbalance", overlay=true) // Inputs int volumePeriod = input.int(20, "Volume Lookback") float volumeMultiplier = input.float(1.5, "Volume Multiplier") // COLOR OPTIONS color bullLineColor = input.color(color.green, "Bullish Line Color") color bearLineColor = input.color(color.red, "Bearish Line Color") color bullLabelColor = input.color(color.green, "Bullish Label Color") color bearLabelColor = input.color(color.red, "Bearish Label Color") color textColor = input.color(color.white, "Text Color") // STYLE OPTIONS int lineWidth = input.int(2, "Line Width", minval=1, maxval=5) int lineLength = input.int(40, "Line Length") // Detection float avgVolume = ta.sma(volume, volumePeriod) bool highVolume = volume > avgVolume * volumeMultiplier float bodyRatio = math.abs(close - open) / (high - low) bool strongBullish = highVolume and close > open and bodyRatio > 0.6 bool strongBearish = highVolume and close < open and bodyRatio > 0.6 // Draw imbalances if strongBullish line.new(bar_index, low, bar_index + lineLength, low, color=bullLineColor, width=lineWidth) label.new(bar_index, low, "BULL", color=bullLabelColor, textcolor=textColor, style=label.style_label_up) if strongBearish line.new(bar_index, high, bar_index + lineLength, high, color=bearLineColor, width=lineWidth) label.new(bar_index, high, "BEAR", color=bearLabelColor, textcolor=textColor, style=label.style_label_down)

-

Hello, Have you got the setting?

-

Yes, just import my package. Remove all olders one that you may have first.

-

Luke SteelWolf started following Ninza stuffs - AIO

-

Luke SteelWolf started following N9T

-

You're the man, great job everyone! So, just to confirm: can all those indicators I showed you in the archive, plus the Infinity Engine, run using a single resource file?🔝

-

LoneBladeRGC started following N9T

-

I have created a separate post so others can easily refer to :

-

So, here is my Ninza package with what Ninza stuffs I have on my PC: https://workupload.com/archive/tE5ZmLngsx I can load all the indicators without any errors in the logs or the chart on a fresh uneducated NT. Solar thing didnt work. It was patched by Val but that one showed errors so I fixed it myself. Credits go their respective educators. Let me know if that works.

-

Thank you so much for what you are doing! I think this is a great and useful initiative for everyone—having the ability to manage all ninZa products with just a single resource file. I tried to do something myself, but had no luck. You guys are awesome!

-

The resource dll definitely needs to be looked into. I just didnt spend time on it since it was educated by kimsam. Will look into if after testing my exported package to a fresh NT instance doesnt work. I just need to find some time.

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

EURUSD: the euro gains strength, but what may halt the rise? The euro continues its attempts to strengthen against the USD, with the EURUSD rate currently testing the 1.1660 level. Find out more in our analysis for 20 January 2026. EURUSD technical analysis On the H4 chart, the EURUSD pair formed a Bullish Engulfing reversal pattern near the lower Bollinger Band. At this stage, the price continues its upward momentum, following the pattern signal. Since quotes remain within the ascending channel, they may move towards 1.1710. Amid potential growth in some eurozone economic indicators, the euro continues to strengthen. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Rising uncertainty in global markets supports XAUUSD XAUUSD prices continue to rise amid escalating geopolitical tensions around Greenland, currently trading at 4,710 USD. Discover more in our analysis for 20 January 2026. XAUUSD forecast: key trading points Demand for safe-haven assets strengthened amid the escalation of the situation around Greenland Investors fear the start of a large-scale trade confrontation between the US and Europe Geopolitical risks continue to rise, worsening expectations for global economic growth Fundamental analysis XAUUSD quotes are rising for the second consecutive trading session. Buyers confidently overcame the key resistance level at 4,635 USD, which previously restrained the bullish momentum. Gold receives sustained support due to growing demand for safe-haven assets amid escalating tensions around Greenland. The market reacts to increased pressure from US President Donald Trump, who once again asserts claims over Greenland. Investors fear that such rhetoric may trigger a large-scale trade confrontation between the US and Europe. Analysts emphasise that the current trade tensions differ in nature from last year’s tariff conflicts; however, the level of uncertainty for the global economy remains elevated. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 400 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

An attempt to assist others always deserves a "Like," regardless of whether it works or not.

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date:20th January 2026. Global Markets Volatile as US-EU Trade Tensions Rise and Japan’s Bond Yields Surge. Global financial markets entered the week under renewed pressure as escalating geopolitical tensions between the United States and Europe reignited fears of a fresh trade war. Investor sentiment weakened sharply after US President Donald Trump intensified rhetoric surrounding Greenland, threatening broad tariffs on several European nations just as Wall Street heads into a pivotal earnings season. The convergence of geopolitical risk, legal uncertainty around US trade policy, and rising global bond yields has pushed markets into a defensive posture, weighing on equities while supporting safe-haven assets and volatility-sensitive instruments. US Stock Futures Drop as Trade Risks Re-Enter the Spotlight US equity futures signalled a sharply weaker start to Tuesday’s session following the holiday closure. Dow Jones Industrial Average futures slid more than 1%, implying a drop of over 500 points at the open. S&P 500 futures declined around 1.2%, while Nasdaq 100 futures underperformed with losses exceeding 1.4%. The move reflects mounting concern that renewed trade frictions could undermine corporate earnings expectations, disrupt cross-border supply chains, and slow global economic momentum, particularly at a time when equity valuations remain stretched. US stocks are coming off a negative week, leaving markets more vulnerable to macro and geopolitical shocks. Greenland Tensions Reignite US–EU Trade War Fears Over the weekend, President Trump announced plans to impose tariffs on imports from eight European NATO members unless negotiations begin over the ‘complete and total purchase of Greenland’. Under the proposal, tariffs would start at 10% in early February and rise to as much as 25% by mid-year. European leaders swiftly rejected the threat, warning that such actions risk damaging transatlantic relations and triggering retaliatory measures. Reports suggest the EU is considering counter-tariffs worth up to $108 billion, raising concerns over a broader escalation that could weigh heavily on global trade and investment flows. Trump’s upcoming address at the World Economic Forum in Davos is expected to be closely scrutinised for further policy signals. Legal Uncertainty Adds Another Layer of Risk Markets are also watching a potential US Supreme Court ruling on whether the President’s use of the International Emergency Economic Powers Act to impose tariffs is constitutional. A decision could arrive as soon as this week. While US officials have expressed confidence that the policy will stand, any legal challenge to executive trade authority could significantly alter expectations around future tariffs, adding further volatility across equities, currencies, and commodities. Earnings Season Begins Under a Cloud of Uncertainty Beyond geopolitics, investor focus is shifting to a busy US earnings calendar. Major companies including Netflix, Intel, and Johnson & Johnson are set to report, with forward guidance expected to be more influential than headline results. Consensus forecasts point to S&P 500 earnings growth of roughly 12%-15% this year. However, lingering ‘Sell America’ sentiment, rising geopolitical risks, and tighter financial conditions suggest downside risks remain, particularly for multinational firms with significant overseas exposure. Asian Equity Markets Mixed as Political and Rate Risks Collide Asian equities mostly declined amid rising global risk aversion. Japan: The Nikkei 225 fell more than 1%, pressured by surging bond yields and election uncertainty. China: Mainland and Hong Kong markets edged lower, tracking global weakness. South Korea: The Kospi posted modest gains, bucking the regional trend. Australia: The ASX 200 slipped as external headwinds outweighed domestic factors. For FX and rates traders, Japan remains a key focal point, with bond-market volatility carrying potential implications for capital flows and yen dynamics. Japan’s Bond Rout Deepens, Sending Global Yield Shockwaves A sharp sell-off in Japanese government bonds intensified on Tuesday, pushing long-dated yields to record levels and adding to global market unease. Investors reacted negatively to Prime Minister Sanae Takaichi’s election platform, which includes a proposal to cut taxes on food without clearly identifying a funding source. The yield on Japan’s 40-year government bond surged beyond 4%, marking the highest level since the instrument was introduced in 2007 and the first time in over three decades that any Japanese sovereign maturity has reached such territory. Yields on both 30- and 40-year bonds jumped more than 25 basis points in a single session, the steepest move since the market turmoil following last year’s US tariff shock. A weak auction of 20-year bonds earlier in the day reinforced investor concerns about rising government spending, fiscal sustainability, and inflation risks. Since Takaichi took office in October, yields on Japan’s 20- and 40-year debt have climbed by around 80 basis points. Importantly for global markets, volatility in Tokyo spilled over into US Treasuries during Asian trading hours, with 30-year US yields rising by roughly 7 basis points, highlighting Japan’s growing influence on global rate dynamics. Market participants are increasingly alert to the risk that continued instability in Japanese bonds could reverberate across global fixed-income markets, particularly as Japan’s long-term yields now exceed those of Germany at comparable maturities. While some long-term investors see rising yields as improving value, especially on a currency-hedged basis, the broader concern is that bond markets are signalling discomfort with Japan’s fiscal trajectory. With a snap election scheduled for February 8, volatility in Japanese assets is expected to remain elevated. European Stocks Slide on Trade Concerns European equity markets closed sharply lower, led by export-heavy indices. Germany’s DAX and France’s CAC 40 suffered notable losses, while the UK’s FTSE 100 declined more modestly. European leaders warned that escalating tariffs could spark a damaging cycle of retaliation, further clouding the region’s already fragile growth outlook. Gold Holds Near Record High as Haven Demand Persists Gold prices remained just below record highs, supported by safe-haven demand and a softer US dollar. Silver, after briefly reaching an all-time high, eased slightly as traders locked in profits. Geopolitical uncertainty, rising bond volatility, and concerns over global growth continue to underpin defensive positioning, keeping precious metals in focus. Oil Prices Steady as Supply Concerns Offset Geopolitical Risks Crude oil prices stabilised, balancing geopolitical uncertainty against concerns that supply is outpacing demand. Brent crude hovered in the mid-$60s per barrel, while WTI remained below $60. Despite tensions surrounding US-EU relations, traders remain focused on increasing OPEC+ output and warnings from the International Energy Agency that a surplus could emerge this year. A weaker US dollar has provided some near-term support, but the broader outlook remains cautious. Central Banks and Inflation Data in Focus Looking ahead, markets are bracing for key macro events: Federal Reserve: Rates are widely expected to remain unchanged at the next meeting, as policymakers balance cooling labour markets against inflation still above target. Bank of Japan: This week’s policy meeting will be closely watched following the surge in bond yields. US Inflation Data: Upcoming releases of the Fed’s preferred inflation measure may shape expectations for the policy path ahead. Key Takeaways for Traders In the days ahead, market direction is likely to be driven by: Developments in US–EU trade negotiations Earnings guidance and analyst revisions Japanese bond market volatility and global yield spillovers Safe-haven flows into gold and FX markets Central bank communication and inflation trends With geopolitics, earnings, and monetary policy all in play, conditions point to continued volatility, placing a premium on risk management, flexibility, and cross-asset awareness. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Andria Pichidi HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

Where to invest depends on your goals, risk tolerance, and experience. Forex offers high liquidity and trading opportunities but carries significant risk and requires strong discipline. Other options include stocks, mutual funds, bonds, or long-term investments like ETFs. Beginners often benefit from diversified, lower-risk investments before exploring forex trading.

-

Learning forex from YouTube can provide basic knowledge, strategies, and market insights, especially for beginners. However, content quality varies and often lacks structure or mentorship. Taking a well-designed course can offer organized learning, practical guidance, risk management, and feedback. Combining YouTube resources with a reputable course is often the most effective approach.

- 12 replies

-

- forex

- forex forum

-

(and 1 more)

Tagged with: