All Activity

- Past hour

-

https://limewire.com/d/ZtDgq#7Eoa6mHci3

-

For those who are into LuxAlgo stuff... https://limewire.com/d/Fjjgw#Ev9IYyZLo5 https://www.luxalgo.com/?keyword=luxalgo&gad_source=1&gad_campaignid=11694848769&gclid=EAIaIQobChMI04zml5bTjQMVHz1ECB1tQwitEAAYASAAEgLsqPD_BwE

-

Ayy...It is with a Emu file that you need to use to activate Mbox before firing it up. Your PC might just flag this file as a virus. Just disable your anti-virus to download. And ohh yeah, if I must say, I don't need or feel obligated to check anything. Everyone in here should already have an understand that, by downloading anything "educated", they might inherit the given risk. Thats just the way it is. It is entirely up to each of us to do our diligent work before downloading anything and one must decide on his or her own to go forward. There wasn't ill intention on my end nor being sarcastic. I just stated the fact. I guess, this is where I must now shut up because for me, I quite don't like the tone and the unappreciated, ungrateful attitude.

-

⭐ Aurel88 reacted to a post in a topic:

orderflow-trader.com

⭐ Aurel88 reacted to a post in a topic:

orderflow-trader.com

- Today

-

Harrys reacted to a post in a topic:

HFMarkets (hfm.com): Market analysis services.

Harrys reacted to a post in a topic:

HFMarkets (hfm.com): Market analysis services.

-

From jhon we all expect a tangible sign of his closeness as we have supported him in this difficult period.

If you can tell him the forum thanks... but if he does not want to do it via the forum do it personally by contacting him on his TLG channel.Thanks

-

Jhon had said that he would give something in return after reaching 1000 users on tlg. But I don't see any sign... I would expect Jhon who I personally respect to give a gift to this community. He could give everyone the latest version of NT8 He should give this to this entire forum that supports him and loves him. Jhon don't disappoint this forum. Those who supported you in these phases expect a great gesture

-

samfourtimes started following Request indicator Pipflow advanced orderflow

-

If you hit your PC with a hammer, you'll do less damage than installing these files. The translation keeps the sarcastic tone of the original Italian sentence, emphasizing that installing the files would be more harmful than physically damaging the computer. "Come on, let's be serious... I don't want to argue because I appreciate that you offer a free service to all users, but please double-check what you post." I don't want to create controversy But I couldn't not write

-

hybrid76 reacted to a post in a topic:

Ultimate Scalper Pro & Ultimate Backdoor Needs Unlocking

hybrid76 reacted to a post in a topic:

Ultimate Scalper Pro & Ultimate Backdoor Needs Unlocking

-

Ultimate Scalper Pro & Ultimate Backdoor Needs Unlocking

⭐ laser1000it replied to TickHunter's topic in Ninja Trader 8

It only works with the original DLL or the clean, paid one. Anything else isn't worth bothering with. -

hybrid76 reacted to a post in a topic:

decryptic dll into code

hybrid76 reacted to a post in a topic:

decryptic dll into code

-

⭐ fryguy1 reacted to a post in a topic:

MBOX Wave Like It or Dislike It ?

⭐ fryguy1 reacted to a post in a topic:

MBOX Wave Like It or Dislike It ?

-

Ultimate Scalper Pro & Ultimate Backdoor Needs Unlocking

hybrid76 replied to TickHunter's topic in Ninja Trader 8

HOW to install? Just copy the dll? for me it is not working ... thank you -

Avt reacted to a post in a topic:

MZPack 3.18.23 for NT8

Avt reacted to a post in a topic:

MZPack 3.18.23 for NT8

-

We see the kind-hearted people like @apmoo helping us with the ability to use a tool. Is there a way to decrypt the code and learn the logic? Have you seen anyone able to decrypt the DLL?

-

I found this site which has a news guard with alerts https://ekedal.no/download.html News guard

-

I think you might be looking for this. Wish we could find it educated

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

[b]Date: 2nd June 2025.[/b] [b]Market Recap: Volatility, Tariffs, and Trade Uncertainty Define May's End and June's Start.[/b] May Ends with Mixed Markets and Renewed Trade Tensions Financial markets ended May on a choppy note, reflecting a volatile month filled with geopolitical tensions, shifting inflation expectations, and mounting speculation around central bank policy moves. As the dust settles, investors are turning their focus to June with caution, especially as trade disputes between the US and China intensify once again. Tariff-related anxieties were reignited following President Donald Trump’s online remarks accusing China of ‘totally violating’ a recent trade agreement. Although the full details remain unclear, the statement prompted a wave of market jitters. While the immediate market panic seen earlier in May, following the so-called ‘Liberation Day’ levies has subsided somewhat, economic uncertainty remains high. The US administration’s unpredictable trade stance — punctuated by calls to double steel tariffs and reimpose levies on Chinese imports — continues to weigh on investor sentiment. Trump’s Tariff Policy Back in Focus Despite the tense geopolitical backdrop, US Treasury yields edged lower, bolstered by a cooling in core inflation expectations and signs of slowing consumer spending. The 2-year yield dropped by 4 basis points to 3.897%, while the 10-year yield slipped by 1.8 basis points to 4.400%. Both yields are approximately 25 basis points higher compared to the start of the month, reflecting the complex interplay between haven demand and shifting monetary policy expectations. The softer inflation data renewed speculation that the Federal Reserve may consider rate cuts later in the year, a narrative that has provided a partial tailwind for bond markets. Wall Street closed the month with a strong performance overall, despite Friday’s subdued finish. The Dow Jones Industrial Average posted a modest gain of 0.13%, the S&P 500 dipped slightly, and the tech-heavy Nasdaq fell by 0.32%. However, on a monthly basis, equity markets recorded impressive gains. The Nasdaq rallied 9.56%, marking its best month since November 2023, driven largely by strength in technology and artificial intelligence-related stocks. The S&P 500 rose 6.15%, its best May performance since 1990, while the Dow added 3.94%. As June began, US stock futures pointed to a weaker open, with the S&P 500, Dow, and Nasdaq 100 futures all trading lower in early action. Investor caution is apparent, with market participants closely monitoring the evolving trade narrative and bracing for a new wave of economic data. The highlight of the week is the upcoming nonfarm payrolls report, expected to offer critical insights into labour market strength and the broader health of the US economy. Global Market Reaction: Asia Hit by Geopolitical Risks Global markets also responded to the trade drama and geopolitical risks. In Asia, major indices fell sharply. Hong Kong’s Hang Seng Index plunged more than 2%, Tokyo’s Nikkei 225 lost 1.6%, and South Korea’s Kospi declined by 0.4%. The renewed escalation between Beijing and Washington, coupled with concerns over China's manufacturing activity and the Russia-Ukraine conflict, amplified investor nervousness. Commodity Markets React: Gold, Oil, and the Dollar The foreign exchange market reflected the tension, with the US dollar experiencing fluctuations tied to trade developments. The dollar index (DXY) ended the month marginally higher at 99.441 but slipped early Monday as investors assessed the potential economic fallout from escalating tariff threats. The greenback weakened to 142.90 yen, while the euro edged up to $1.1420. Sterling and commodity-linked currencies like the Australian and New Zealand dollars also gained modestly. Oil prices initially declined to $60.78 per barrel but later reversed course, rallying after OPEC+ announced a modest output increase starting in July. US crude rose to $62.39, and Brent climbed to $64.19. Gold prices spiked to $3350 per ounce as some risk aversion returned, fiscal concerns and a weakening dollar continue to underpin the precious metal in the longer term. Analysts have noted that if tariff revenue falls short of expectations, the US may seek alternative fiscal measures, adding further pressure on the dollar and stoking demand for safe havens. The political landscape also added to the market complexity. President Trump’s sweeping tariff and tax proposals, including the controversial Section 899, are under congressional review. If passed, the bill could significantly reshape the US fiscal framework and investor strategy, especially as it proposes taxing investors from countries with so-called ‘unfair foreign taxes.’ Some senators have already voiced concerns over the projected $3.8 trillion increase in federal debt, and revisions to the bill appear likely. Meanwhile, company-specific developments also played a role in shaping market movements. Shares of Gap tumbled 20.2% after the retailer warned that new tariffs could cost up to $300 million annually. Nvidia, a key tech heavyweight, also fell 2.9% despite strong earnings, dragging the broader sector lower. On the positive side, Ulta Beauty surged 11.8% after beating expectations and raising guidance, while Costco climbed 3.1% on the back of solid quarterly results. Looking Ahead: Jobs Report and June Uncertainty In summary, May was a month of sharp swings and mixed signals across global financial markets. While equity indices posted strong gains, the broader outlook remains clouded by trade tensions, political risk, and questions about future Fed policy. As June began all eyes turned to key economic indicators and potential developments in US-China relations, which are likely to shape market sentiment in the weeks ahead. [b]Always trade with strict risk management. Your capital is the single most important aspect of your trading business.[/b] [b]Please note that times displayed based on local time zone and are from time of writing this report.[/b] Click [url=https://www.hfm.com/hf/en/trading-tools/economic-calendar.html][b]HERE[/b][/url] to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click [url=https://www.hfm.com/en/trading-tools/trading-webinars.html][b]HERE[/b][/url] to register for FREE! [url=https://analysis.hfm.com/][b]Click HERE to READ more Market news.[/b][/url] [b]Andria Pichidi HFMarkets[/b] [b]Disclaimer:[/b] This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

EURUSD starts the week steadily: all eyes on risk The EURUSD pair is hovering around 1.1358 on Monday as investors assess risk levels at the start of a new week. Find out more in our analysis for 2 June 2025. EURUSD forecast: key trading points The EURUSD rate is edging up modestly as overall market sentiment remains weak Concerns about deteriorating global trade relations re-emerge EURUSD forecast for 2 June 2025: 1.1390 and 1.1424 Fundamental analysis The EURUSD pair is trading close to 1.1358 at the start of the week and the new month. Market sentiment has deteriorated due to renewed concerns over global trade tensions. On Friday, Donald Trump said he might introduce 50% tariffs on steel and aluminium imports starting from 4 June. Meanwhile, US-China relations have worsened again as Beijing rejected Washington’s claims of breaching the temporary trade agreement. This has cast doubt on the likelihood of further trade talks between the two nations. Still, negotiations could resume as early as this week. Market focus now shifts to fresh US economic data, particularly Friday’s Non-Farm Payrolls report for May. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 251 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

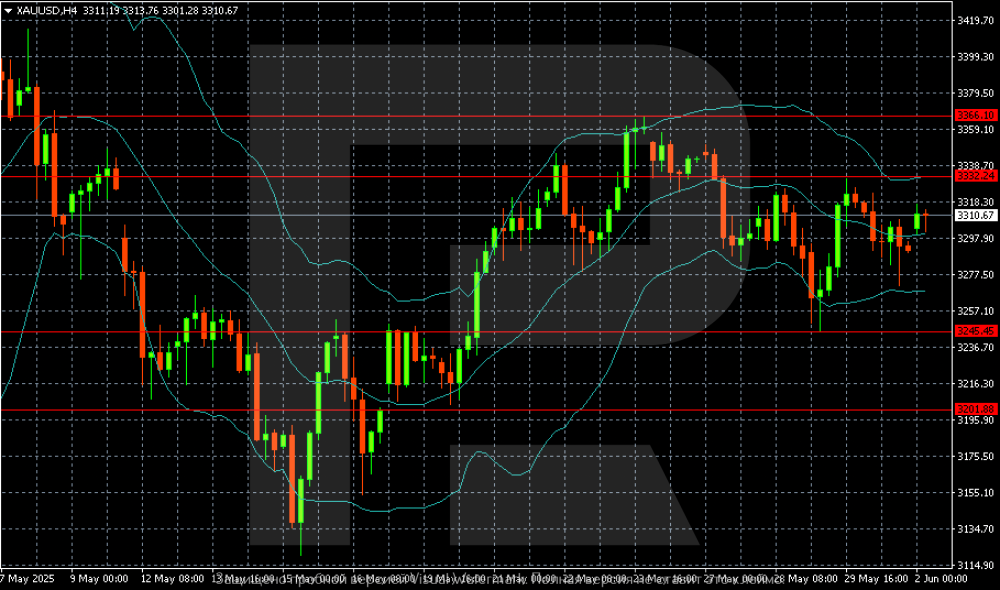

RBFX Support replied to RBFX Support's topic in Technical Analysis

Gold (XAUUSD) rises: the world seeks shelter from risk Gold (XAUUSD) prices have climbed to 3,310 USD as news flows grow increasingly concerning. Discover more in our analysis for 2 June 2025. XAUUSD technical analysis On the H4 chart, Gold (XAUUSD) is setting up for a gradual rise towards 3,332 USD. To maintain this upward momentum, prices must consolidate above that level and receive support from fundamental developments. Gold (XAUUSD) prices moved higher as external conditions deteriorated and market participants grew increasingly concerned about capital preservation. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

duyphung joined the community

-

Traderbeauty reacted to a post in a topic:

MBOX Wave Like It or Dislike It ?

Traderbeauty reacted to a post in a topic:

MBOX Wave Like It or Dislike It ?

-

Tradelion -Episodic Pivot masterclass Pradeep Bonde hi all, If anybody has this course, kindly share. https://fttuts.com/traderlion-episodic-pivot-masterclass/ thanks

-

⭐ epictetus reacted to a post in a topic:

nCatZorroFuturesTrader

⭐ epictetus reacted to a post in a topic:

nCatZorroFuturesTrader

-

⭐ laser1000it reacted to a post in a topic:

MBOX Wave Like It or Dislike It ?

⭐ laser1000it reacted to a post in a topic:

MBOX Wave Like It or Dislike It ?

-

⭐ laser1000it reacted to a post in a topic:

Anyone have News Indicator?

⭐ laser1000it reacted to a post in a topic:

Anyone have News Indicator?

-

Some books are too general. They talk a lot but give nothing useful. But I joined a free webinar and learned more in one hour than reading a full book

-

Please go to: Historical Quotes Downloader version 2.32.5 - Trading Platforms - Indo-Investasi.com

-

Thanks man, much appreciated

-

Another vote for Jhon Snow !!

-

Hi Jay, there are several educators here. Post the trials and you may get it fixed.

-

123evan joined the community

-

Don't tell me there's virus detected. Normal process. I have also included the TTPAlgo, which is meant to use with MBox only. https://limewire.com/d/A2Neh#XIDjmzYxUz

-

Could someone repost the MBOX 3025 from Val.