All Activity

- Today

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date: 17th July 2025. Global Markets Mixed Amid Bond Yield Moves, UK Jobs Data, and Japan Trade Concerns. Asian markets posted broad-based gains on Thursday, following a strong finish on Wall Street. European equities also opened higher across the board, while US stock futures remain narrowly mixed in pre-market trade. However, rising global bond yields and mixed economic data continue to weigh on market sentiment. Bond Yields Climb Globally Japanese Government Bonds (JGBs) closed stronger, pushing the 10-year yield down by 1.9 basis points. However, US Treasury yields quickly reversed early gains, with the 10-year yield climbing to 4.48%, up 2.4 basis points. Meanwhile, Germany’s 10-year Bund yield rose 1.2 basis points, and the UK’s 10-year Gilt added 2.6 basis points, reflecting market jitters around global inflation and interest rate expectations. UK Labour Market Data Strengthens Rate Cut Bets The UK labour market surprised to the downside, with the ILO unemployment rate rising to 4.7% in the three months to May, up from 4.6%. While total employment increased by 134,000 during the period, more recent data showed a drop of 41,000 payrolled employees in June, following a 25,000 decline the previous month. Jobless claims also rose by 25,900 in June. At the same time, wage growth showed signs of deceleration. Headline pay growth slowed to 5.0% from 5.4%, while regular pay (excluding bonuses) also eased to 5.0%. These figures, combined with recent inflation data, reinforce expectations that the Bank of England will cut interest rates in August. BoE Governor Andrew Bailey recently indicated that labour market conditions will be a key factor in the pace of monetary easing. Currency and Commodities Snapshot The US dollar briefly dipped below the 98 mark amid speculation that President Trump was considering removing Federal Reserve Chair Jerome Powell. However, the greenback quickly recovered, with the Dollar Index (DXY) currently at 98.71. Gold prices slipped by 0.4%, trading at $3332.65 per ounce. Crude oil prices remained stable, with WTI front-month futures slightly lower at $66.39 per barrel. The oil market continues to monitor US inventories and geopolitical tensions in the Middle East. Australian Job Market Weakens Australia’s labour market showed signs of softening as unemployment rose unexpectedly to a four-year high in June. Hiring activity nearly stalled, raising the likelihood that the Reserve Bank of Australia may cut interest rates at its upcoming meeting. Japan Slides into Trade Deficit as US Tariffs Bite Japan posted a trade deficit of 2.2 trillion yen (€13 billion) in the first half of the year, driven by a decline in exports amid ongoing US tariff pressure. June exports fell 0.5% year-over-year, following a 1.7% drop in May. Shipments to the US were particularly hit, declining 11%, with auto exports plunging 26.7%, following a 25% tariff introduced in April. With nearly 20% of Japan’s exports heading to the US, the country is pushing for favourable trade agreements. Meanwhile, Japan prepares for Upper House elections this Sunday. Weak public support for Prime Minister Shigeru Ishiba could jeopardise the ruling party’s majority unless a new coalition is formed. Recession Fears Mount in Japan Japan’s economy contracted in Q1 and may be headed for another contraction in Q2. Falling exports and weakening global demand are raising fears that the country may officially enter a recession in the coming months. Oil Prices Rebound Amid Supply Risks and Diesel Shortages After three consecutive days of losses, oil prices edged higher. Traders are weighing lower-than-usual crude and diesel inventories in the US and Europe against broader concerns about future supply gluts. Diesel shortages in particular have supported prices in the short term. ‘The market is currently buoyed by tight diesel supplies, but if OPEC+ production ramps up, we may see a bearish shift,’ said Zhou Mi, an analyst at Chaos Ternary Futures Co. US distillate stockpiles remain at their lowest seasonal level since 1996, despite a modest weekly increase. The futures spread between low-sulfur gasoil and Brent for September—a key indicator of diesel refining profitability—has jumped 7% this month. Geopolitical Risks in Kurdistan Add to Supply Concerns Drone strikes targeted several oil fields in Iraq’s semi-autonomous Kurdistan region on Wednesday. While the region has not exported crude since a pipeline closure over two years ago, the attacks highlight growing risks to global energy infrastructure. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Andria Pichidi HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

@roddizon1978 Your Ninjatrader machine ID most likely changed.

-

pygmalion5000 reacted to a post in a topic:

OGT NT8

pygmalion5000 reacted to a post in a topic:

OGT NT8

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Gold (XAUUSD) in consolidation: safe-haven assets out of favour for now Gold (XAUUSD) prices are hovering around 3,340 USD. Interest in the US dollar continues to rise. Find more details in our analysis for 17 July 2025. XAUUSD forecast: key trading points Gold (XAUUSD) quotes rose in response to uncertainty and fell once doubt was removed A rebound in the US dollar reduces gold's appeal for investors XAUUSD forecast for 17 July 2025: 3,360 Fundamental analysis Gold (XAUUSD) prices retreated to 3,340 USD per ounce, reversing the previous session’s gains. The metal came under pressure as the US dollar rebounded following reduced uncertainty surrounding the Federal Reserve Chairman: rumours about Jerome Powell’s possible dismissal were not confirmed. Donald Trump called such a move unlikely, although he again expressed dissatisfaction with current interest rate levels. Another factor was the neutral US Producer Price Index (PPI) data for June. The reading remained unchanged, signalling stable wholesale prices and easing concerns about strong inflationary pressure from tariffs. These new figures contrast with the previously recorded rise in consumer inflation. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 279 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Fundamental storm, waiting for EURUSD reaction Amid strengthening USD, the EURUSD pair may decline towards 1.1555. Discover more in our analysis for 17 July 2025. EURUSD technical analysis On the H4 chart, the EURUSD pair formed a Harami reversal pattern near the lower Bollinger Band. At this stage, the pair may continue its corrective wave in response to this signal. Given that the price remains within a descending channel, a further decline towards the nearest support at 1.1555 can be expected. Today’s EURUSD forecast favours the USD. Combined with EURUSD technical analysis, stronger US economic indicators suggest a likely decline towards the 1.1555 support level after a corrective move. Read more - EURUSD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

Thanks for your help. I've tried deleting different files but to no avail... the popup keeps appearing. The VAL file I'm seeing is [email protected]. Do you mean deleting this file? Maybe I'm doing something wrong.

-

⭐ aniketp007 reacted to a post in a topic:

Predator X Order Entry V3.0.0.2

⭐ aniketp007 reacted to a post in a topic:

Predator X Order Entry V3.0.0.2

-

roddizon1978 reacted to a post in a topic:

HFT SPECTRE Group Buy

roddizon1978 reacted to a post in a topic:

HFT SPECTRE Group Buy

-

-

BUMP! can we EDU the new version? doesn't work on my EDU ninja

-

Yeahh. I hope we figure it out eventually

-

justjames reacted to a post in a topic:

Predator X Order Entry V3.0.0.2

justjames reacted to a post in a topic:

Predator X Order Entry V3.0.0.2

- Yesterday

-

NEW "GA_EVO" Indicator need edu https://workupload.com/file/NsVTehPnt5V

-

Try RipperX AI Pro bot. It looks very "promising"🤪 If you happen to create a bot that works wonderfully, pulling in a boat load of money each and every day, consistently. Why would you even bother to create another and another? Yes, it is true that things can always be improved. There shall always be more rooms to be filled but still, I personally would not change 1 single darn thing if it aint broken. The whole point of trading is to make money. Period. So if my 1 bot, my creation, does a great job at that, I would just stop right there and harvest the fruits. They keep churning out bots after bots because most likely, they dont even use them to trade on their own. They must come up with one right after another, to make a living somehow.

-

Just remove one of the val's files in the folder.

-

techfo reacted to a post in a topic:

cotbase.com

techfo reacted to a post in a topic:

cotbase.com

-

Bene joined the community

-

They are all very suspicious to me. Why ? because the program i bought from them just stop, with no reason at all. Because most of them are token depended and if they change and work on their token server, your indicator will suddenly stop or not work. Probably they do it intentionally to get your attention or maybe they changed thing, we don't know, that's why it sucks.

-

Does anybody have an educated telegram to MT4 copier program Telegram Signal Copier | Telegram to MT4 | Telegram to MT5 | Telegram to cTrader

-

brokeyforamibroker

-

Are they? I didn't think they were, I had talked to one had a app, talked to the other and didn't? Both good who ever!

-

PredatorXOrderEntry_V3.0.0.1kM.dll this one works , maybe we can figure out why the plotmode doesnt reveal plots on the chart, Im using the PredatorIndicators_ANY dll that was in the last 3.0002

-

prodisoft reacted to a post in a topic:

orderflowlabs.com

prodisoft reacted to a post in a topic:

orderflowlabs.com

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

[b]Date: 16th July 2025.[/b] [b]Mixed US CPI Data Clouds Fed Outlook While Global Markets React to Tariff Jitters.[/b] US financial markets remained choppy following the release of June's CPI report, which presented a mixed inflation picture. While headline consumer prices rose 0.3%—the largest gain since January—core inflation cooled slightly, increasing by just 0.2%. This combination has left investors and policymakers without a clear signal on the direction of the US economy, tempering hopes for a Federal Reserve rate cut in the near term. Rate cut expectations for the September FOMC meeting slipped to 60%, down from 68% earlier this week. Fed fund futures now reflect a lower implied rate of -14 basis points for September, compared to -18.8 bps after the June jobs report and -29 bps following weaker-than-expected ADP data on July 2. The probability of a second cut in December has also decreased, with the December contract pricing in -44 bps, down from a fully priced -50 bps earlier. Inflation Drivers and Tariff Impact June's CPI surge was driven by a 0.9% increase in energy prices, including a 1.0% rise in gasoline costs. Other contributors included medical care services (+0.6%), tobacco (+0.5%), and apparel (+0.4%). Meanwhile, vehicle prices dragged on the index, with new vehicles falling by 0.3% and used vehicles declining by 0.7%. Year-over-year, headline CPI rose to 2.7%, while core CPI edged up to 2.9%. Economists attribute much of the price pressure to the Trump administration’s tariff increases, particularly in sectors like coffee, furniture, and pharmaceuticals. As Fed Chair Jerome Powell previously warned, the inflationary effects of these tariffs are beginning to show, and could continue building into the third quarter, especially as the August 1 tariff deadline approaches. Treasury Yields Rise, Nasdaq Hits Record Despite the cooler core reading, Treasury yields rose sharply, with the 10-year yield reaching 4.495%, the highest since June 11. This movement was partially driven by technical selling and growing concerns that tariff-induced price hikes could spill over into PCE inflation data. Meanwhile, the tech-heavy Nasdaq rallied to fresh record highs, supported by a strong performance from AI bellwether Nvidia. Global Central Banks in Focus The Bank of England is also facing inflation challenges. UK inflation unexpectedly accelerated, with headline CPI rising to 3.6% year-over-year and core CPI climbing to 3.7%. Services inflation held steady at a concerning 4.7%. BoE policymaker Catherine Mann warned that job insecurity is driving consumer caution and increased savings, which may weigh on growth sectors like retail and hospitality. While another rate cut in August is still likely, these inflation numbers may reduce the likelihood of a rapid easing cycle. Asia, Oil, and Commodities Asian equity markets were broadly under pressure as rising US yields and a stronger dollar weighed on investor sentiment. The dollar climbed to its highest against the yen since early April, driven by speculation that the Fed may delay any easing. Mainland Chinese blue chips fell 0.5%, while South Korea's KOSPI declined 1%. Taiwan’s tech-heavy index bucked the trend, rising 0.9%. Meanwhile, oil prices hovered near recent lows, with Brent crude trading at $68.96 a barrel. Despite rising global inventories, Morgan Stanley noted that much of the buildup occurred outside OECD nations, limiting its impact on futures pricing. The bank retained its Brent forecast at $65 for Q4 2025, but warned that post-summer demand might not be enough to prevent a renewed surplus. Gold regained ground, trading near $3,340 an ounce, supported by continued geopolitical tensions and strong central bank buying. Bitcoin, meanwhile, rebounded 1% after a recent pullback from its record high above $123,000. Looking Ahead Investors are now turning their attention to upcoming producer price data for additional clues on inflationary trends. Meanwhile, earnings season is ramping up, with mixed results from major banks like JPMorgan and Citigroup and more reports due from Goldman Sachs, Morgan Stanley, and Bank of America. As global markets continue to digest a flurry of data and geopolitical developments, the coming weeks may provide more clarity on central bank policy paths and broader economic trends. [b]Always trade with strict risk management. Your capital is the single most important aspect of your trading business.[/b] [b]Please note that times displayed based on local time zone and are from time of writing this report.[/b] Click [url=https://www.hfm.com/hf/en/trading-tools/economic-calendar.html][b]HERE[/b][/url] to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click [url=https://www.hfm.com/en/trading-tools/trading-webinars.html][b]HERE[/b][/url] to register for FREE! [url=https://analysis.hfm.com/][b]Click HERE to READ more Market news.[/b][/url] [b]Andria Pichidi HFMarkets[/b] [b]Disclaimer:[/b] This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

While on demo, try intentionally losing money for a day. You will see it's not that easy and will learn more about money management and risk management by this practice than from any course.

-

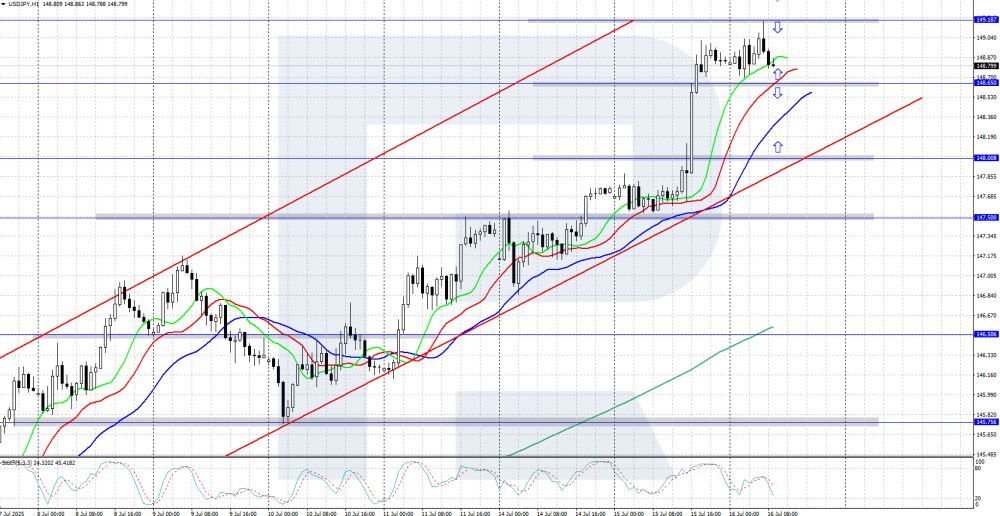

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

USDJPY jumps above 149.00 on US inflation data The USDJPY rate climbed into the 149.00 area as the dollar strengthened moderately after the release of US consumer inflation statistics. Find out more in our analysis for 16 July 2025. USDJPY technical analysis On the H4 chart, the USDJPY pair continues to climb confidently, hitting an intraday high at 149.18. The Alligator indicator is trending upwards, confirming the current bullish momentum. However, the Stochastic indicator signals overbought conditions, which may trigger a corrective pullback. The USDJPY pair climbed to the 149.00 area during the ongoing uptrend. Read more - USDJPY Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Rebound or failure? GBPUSD hangs in the balance In anticipation of data from the UK and the US, GBPUSD quotes may reverse and head towards the 1.3500 mark. Discover more in our analysis for 16 July 2025. GBPUSD forecast: key trading points UK Consumer Price Index (CPI): previously at 3.4%, projected at 3.4% US Producer Price Index (PPI): previously at 0.1%, projected at 0.2% GBPUSD forecast for 16 July 2025: 1.3500 Fundamental analysis The GBPUSD forecast for 16 July 2025 takes into account that the pair remains in a correction phase and is currently near the support level of the ascending channel. The UK Consumer Price Index reflects changes in the cost of goods and services for consumers and helps assess consumer behaviour trends and potential stagnation in the economy. Generally, if the CPI exceeds expectations, it has a positive impact on the national currency. The forecast for 16 July 2025 suggests the CPI for June 2025 may remain at 3.4%. Any increase would support the British pound. The US PPI is expected to rise to 0.2%, up from 0.1% previously. However, the increase is modest, and the actual figure may differ significantly from the forecast. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 279 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Can re upload files pls

-

Demo accounts can be good way to learn without risking any real money.

-

Can re upload files pls

-

There is a saying to invest what you can afford to lose in the trading markets so money management is important in considering while preserve your actual capital.