All Activity

- Past hour

-

нужно создать гугл диск с открытым доступом

- Today

-

ampf reacted to a post in a topic:

Indicators Repository

ampf reacted to a post in a topic:

Indicators Repository

-

Thank you very much @Playr101 I wil try to gather some that I have too and upload and hopefuly others may do the same. This way it overcomes the need to always need to ask to reupload an indicator.

-

Started a little something in that TG group. See if it picks up any.

-

⭐ mangrad reacted to a post in a topic:

Indicators Repository

⭐ mangrad reacted to a post in a topic:

Indicators Repository

-

I was recently looking at the traders award 2025 by HFM with monthly prizes, did anyone still used it so far.

-

Thanks for the explanation, so do you recommend the services to be applied to my hfm's mt5?

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date: 15th August 2025. Producer Inflation Hits 2-Year High, Fed Still Seen Cutting. The US Producer Price Inflation rises to its highest level since April 2022 triggering a sudden decline in stocks. Consumer inflation previously came in lower than expected. Economists still expect a rate cut in September 2025, so investors re-entered at the lower price. Due to this the NASDAQ, Dow Jones and SNP500 are all trading higher. A big factor of the day's fundamental analysis will be the Russia-US talks in Alaska. NASDAQ Regains Losses But Trails Behind The NASDAQ has been the best performing US index of 2025 and the previous years. However, since the Producer Price Index, the NASDAQ is struggling. The NASDAQ is still trading higher than the decline triggered by yesterday’s PPI but weaker than the SNP500 and Dow Jones. Prior to the PPI announcement the NASDAQ’s performance in 2025 was trading 5% higher than the SNP500 and 10% higher than the Dow Jones. The NASDAQ is also exposed to markets outside of the technology sector. As a result, investors are opting to invest in the SNP500 and Dow Jones which are known to be less risky and have a lower possibility of being overbought. Nonetheless, all indices are being positively influenced by the Federal Reserve’s potential move to cut interest rates and today’s meeting between President Trump and President Putin. If the meeting bears fruit, the market sentiment is likely to continue rising. Currently, on Friday 15th, 44% of the most influential stocks are increasing in value, which is relatively low. However, Amazon, Microsoft and NVIDIA are trading higher, supporting the NASDAQ, Dow Jones and SNP500. Dow Jones and SNP500 Outperform The NASDAQ The Dow Jones is trading 0.76% higher and the SNP500 0.24%. The Dow Jones is performing particularly well as investors believe the index may be trading below its intrinsic value and due to its exposure to defensive stocks. The USA30 is now trading at an all-time high and higher than the resistance levels which can be seen from earlier in the year and 2024. However, the price will largely depend on the outcome of today’s meeting between President Putin and President Trump as well as the follow up meeting with Ukraine’s leader Zelensky. In addition to this, the release of NVIDIA’s quarterly earnings report will also be vital to all US indices. Lastly, Warren Buffet is known to have recently purchased stocks within the Dow Jones which have declined in 2025. Mr Buffet is known to purchase stocks which are trading below their true value. Dow Jones 30-Minutes Chart The US, Federal Reserve And Inflation Weekly labor market data showed Initial Jobless Claims at 224,000, slightly below forecasts and the prior reading, while Continuing Claims fell to 1.953 million. Despite the weekly improvement, the broader labor market remains under pressure according to economists. However, this is not necessarily being shown in the actual data. As of yet, the NFP reading is not triggering any alarm bells, but is known as a lagging indicator. July wholesale inflation surged, with PPI up 0.9% month-on-month and 3.3% year-on-year, far above estimates. Core PPI matched the same gains. The data signal rising inflation risks and lessen chances of near-term Fed easing, though Chicago Fed President Austan Goolsbee still sees scope for policy softening this fall. Mr Goolsbee told journalists, the risks to employment is a particular concern for him. Key Takeaway Points: US Producer Price Inflation hits highest since April 2022, triggering a sudden stock market drop. NASDAQ underperforms SNP500 and Dow after PPI data despite strong 2025 gains. Dow Jones reaches all-time high on defensive stock exposure and perceived undervaluation. Rising PPI reduces odds of near-term Fed easing despite some officials still favoring policy softening. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Michalis Efthymiou HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

@kimsam did you a solution for this?

-

Thank you @laser1000it for the telegram link. It sad to see that this is not done more often. IT would be such a better solution in my opinion than using temporary links.

-

ampf reacted to a post in a topic:

Indicators Repository

ampf reacted to a post in a topic:

Indicators Repository

-

techfo reacted to a post in a topic:

HFT@SPECTRE@LITE@V23 New ..

techfo reacted to a post in a topic:

HFT@SPECTRE@LITE@V23 New ..

-

it already exists but is a waste time https://t.me/+M8SkQpmpY5phODhh

-

Bigthanks2u reacted to a post in a topic:

Pars Fortuna - You Can Thank Your Lucky Stars with Olga Morales

Bigthanks2u reacted to a post in a topic:

Pars Fortuna - You Can Thank Your Lucky Stars with Olga Morales

- Yesterday

-

ynr reacted to a post in a topic:

Indicators Repository

ynr reacted to a post in a topic:

Indicators Repository

-

Kmail reacted to a post in a topic:

https://12tradepro.com

Kmail reacted to a post in a topic:

https://12tradepro.com

-

Can anyone share 12tradepro automated trading system.(Educated). Thanks.

-

⭐ goldeneagle1 reacted to a post in a topic:

PredatorXOrderEntry_LT_V3.0.1.4.

⭐ goldeneagle1 reacted to a post in a topic:

PredatorXOrderEntry_LT_V3.0.1.4.

-

⭐ goldeneagle1 reacted to a post in a topic:

Ninjatrader8

⭐ goldeneagle1 reacted to a post in a topic:

Ninjatrader8

-

⭐ goldeneagle1 reacted to a post in a topic:

QuickTradeNinja

⭐ goldeneagle1 reacted to a post in a topic:

QuickTradeNinja

-

Post it and I'll take a look to see what the issue is

-

ampf started following Indicators Repository

-

I would like to know if would be possible like it happens on other forums to create a Telegram Group where indicators could be upload instead of having expiring links?

-

Even with the software available, it's not easy to do. That said, if it's really the one that works with just a click of a button, then it's a different story.

-

I have here a semiautotrader based on delta. There is a bug in the code. Please PM if someone can fix it for free. thanks

-

I agree with you, but not entirely....I don't know the software in subjet, but I don't think (it should be like this) that you can just click and completely clean the DLL....in the past, the Admin user had share here both the software used for the old DLLs and a nice, full tutorial....therefore it could be a disappointment for those looking for the simple click-and-go way that does everything.....We'll see if I have the soft available and the cleaning will be done

-

I joined a few demo trading contests just to test different platforms, and honestly it helped me learn quicker without pressure. While I'm focusing more on crypto these days, I keep wondering should I use axiom trade for solana trading since I'm already kind of used to their layout from those practice rounds. Would be cool to know if anyone's tried trading Solana there and how smooth it runs.

-

People hold on to something called hope, so its okay to ask.

-

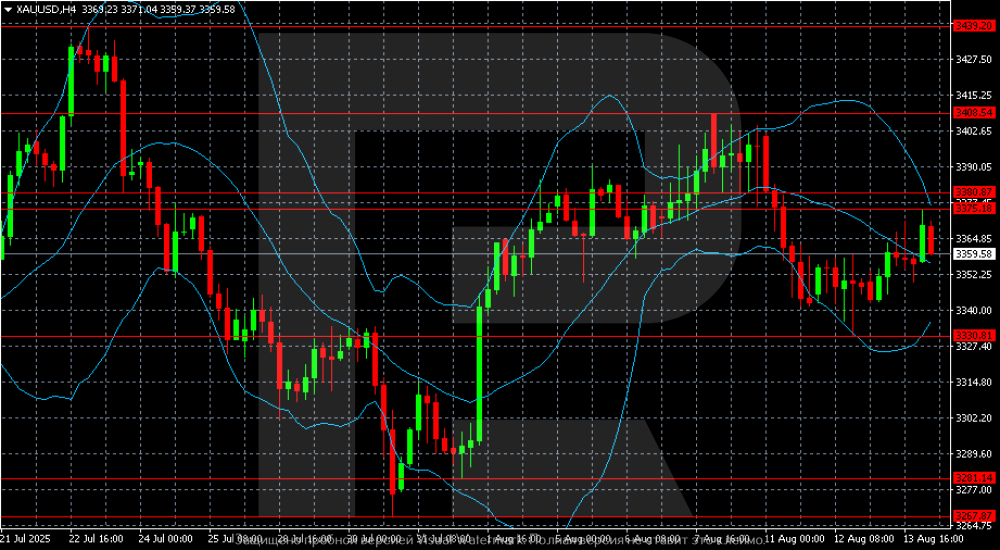

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Gold (XAUUSD) targets 3,380: Fed rate outlook supports prices Gold (XAUUSD) prices have been rising for the third consecutive day, hovering near 3,359 USD. Investors are betting on Federal Reserve policy easing and awaiting Friday’s news. Discover more in our analysis for 14 August 2025. XAUUSD technical analysis On the H4 chart, XAUUSD quotes remain within the 3,330-3,380 range. After falling from the July peak of 3,439, prices hit a low of 3,267 at the end of the month, from which recovery began. In early August, gold broke above 3,330 and tested 3,408 but failed to consolidate higher. Gold (XAUUSD) has shown solid growth and retains the potential to climb higher. Read more - Gold Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

btc just hit its ath today at 124k. alt coin season is kicking off strong..

- 315 replies

-

- forex broker

- hotforex

-

(and 1 more)

Tagged with:

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

JP 225 forecast: the index has formed an upward channel and targets a new all-time high The JP 225 stock index hit a new all-time high and continued its upward trajectory. The JP 225 forecast for today is positive. JP 225 forecast: key trading points Recent data: Japan’s current account for July totalled 1.348 trillion JPY Market impact: overall reaction for the broad equity market is neutral to restrained Fundamental analysis While the current account remains in surplus, it is significantly lower than both the consensus and the previous reading. The decline signals less favourable external conditions and higher import costs, which may limit corporate profit margins. At the same time, a likely soft yen partially offsets the effect by supporting exporters. As a result, the balance of factors for the index is mixed: there may be heightened sensitivity to news about global demand and energy prices. For the JP 225, this means a mixed backdrop: export-oriented industries benefit from a weaker yen in the short term, while energy-intensive and import-dependent segments face shrinking margins. The index’s further trajectory will depend on global trade trends, energy price dynamics, yen movements, and the Bank of Japan’s assessment of the balance between policy normalisation and support for economic growth. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 298 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date: 14th August 2025. Investors Flock to Riskier Assets After Soft US Inflation Data. Asian equity markets were mixed on Thursday, taking a pause after several sessions of strong gains driven by expectations of lower US interest rates. US stock futures also edged slightly lower, while Bitcoin surged over 3% to a new all-time high above $123,000, according to CoinDesk. Asian Markets Pause After Rally Japan’s Nikkei 225 fell 1.4% to 42,657.94, as investors took profits following its record-breaking run. The yen strengthened after US Treasury Secretary Scott Bessent told Bloomberg that Japan was “behind the curve” in raising interest rates, prompting speculation the Bank of Japan may be forced to act sooner. The dollar slipped to 146.55 yen from 147.39 yen, while the euro eased marginally to $1.1703. Across the region, Hong Kong’s Hang Seng Index dipped less than 0.1% to 25,597.85, while China’s Shanghai Composite rose 0.2% to 3,690.88. South Korea’s Kospi slipped 0.3%, Taiwan’s TAIEX dropped 0.4%, and India’s Sensex inched up 0.1%. In Australia, the S&P/ASX 200 gained 0.5% to 8,871.80. Stephen Innes of SPI Asset Management summed it up with a colorful metaphor: “Asian markets opened today like a party that ran out of champagne before midnight, the music still playing, but the dance floor thinning out.” Dollar Weakens on Rate Cut Bets The US dollar lingered at multi-week lows against major peers as traders ramped up bets that the Federal Reserve will resume cutting interest rates next month. The greenback fell the most against the yen after Bessent suggested the Bank of Japan may need to raise rates again soon, while the Fed should move aggressively in the opposite direction. The dollar dropped as much as 0.7% to 146.35 yen, its weakest since July 24. Sterling reached its highest level since late July at $1.3590, while the euro traded at $1.1703, just below Wednesday’s peak. Traders now see a Fed rate cut on September 17 as a near certainty, with some even pricing in a 50-basis-point move. Analysts say the shift in sentiment comes as signs of a cooling US labor market meet political pressure for policy easing. President Donald Trump has repeatedly criticized Fed Chair Jerome Powell for not cutting rates sooner, while Bessent openly called for “a series of rate cuts” beginning with a half-point move. Australia’s Labour Market Surprises Australia’s job market strengthened in July, with employment rising by 24,500 in line with forecasts, while the unemployment rate dipped to 4.2% from a 3½-year high of 4.3%. Full-time positions surged by 60,500, driven largely by record female participation. The stronger data lifted the Australian dollar to as high as $0.65685 before trimming gains. With wage growth steady at 3.4%, well below 2023 peaks, inflationary pressure from pay remains limited. This reduces the urgency for the Reserve Bank of Australia to cut rates again in September, although markets still expect a 25 bps reduction in November if inflation cools further. Wall Street Extends Record Run US equities continued their rally on Wednesday, buoyed by expectations of a September rate cut. The S&P 500 rose 0.3% to a record 6,466.58, the Dow Jones jumped 1% to 44,922.27, and the Nasdaq added 0.1% to an all-time high of 21,713.14. Falling Treasury yields supported rate-sensitive sectors, with homebuilders PulteGroup and Lennar each gaining more than 5%. In a major market debut, cryptocurrency exchange Bullish surged 84% on its first trading day after a $10 billion IPO, closing at $68 a share. Still, some analysts warn that valuations may be overstretched after the steep gains since April, with tariff-driven inflation risks lingering in the background. Bitcoin Leads Risk-On Sentiment Bitcoin climbed to $124,480.82 in the latest session before settling near $123,000, marking its first record high since mid-July. The rally has been fueled by expectations of Fed easing, a weaker dollar, increased institutional inflows, and a friendlier regulatory climate under Trump, who recently signed an executive order allowing crypto assets in 401(k) retirement accounts. Ether also gained, trading near its highest since November 2021. Year-to-date, ether is up 42%, outpacing bitcoin’s 32% advance. Analysts say a sustained break above $125,000 could open the door for a move toward $150,000. Looking Ahead Markets are awaiting US wholesale inflation figures for July, expected to rise slightly to 2.4% from 2.3% in June. In Europe, traders will monitor the eurozone’s flash Q2 GDP and the UK’s preliminary Q2 GDP. Attention will also turn to Fed Chair Jerome Powell’s upcoming speech at a central bank symposium in Wyoming, where investors will be looking for clues on the September policy decision. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Andria Pichidi HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

Binance will be the leader for quite sometime and that might be because of the others like poloniex, bittrex, cryptopia, ftx etc failed and some went bankrupt as well.