⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Past hour

-

ScramblerScholar joined the community

-

⭐ goldeneagle1 reacted to a post in a topic:

Metastock 18 end of day c*****d.

⭐ goldeneagle1 reacted to a post in a topic:

Metastock 18 end of day c*****d.

-

⭐ goldeneagle1 reacted to a post in a topic:

Metastock 18 end of day c*****d.

⭐ goldeneagle1 reacted to a post in a topic:

Metastock 18 end of day c*****d.

-

⭐ goldeneagle1 reacted to a post in a topic:

Metastock 18 end of day c*****d.

⭐ goldeneagle1 reacted to a post in a topic:

Metastock 18 end of day c*****d.

-

⭐ goldeneagle1 reacted to a post in a topic:

Metastock 18 end of day c*****d.

⭐ goldeneagle1 reacted to a post in a topic:

Metastock 18 end of day c*****d.

-

⭐ goldeneagle1 reacted to a post in a topic:

Metastock 18 end of day c*****d.

⭐ goldeneagle1 reacted to a post in a topic:

Metastock 18 end of day c*****d.

-

HWX started following Any body educated these file for me thanks

- Today

-

Ninza Resources..needed

-

babeonidi reacted to a post in a topic:

Metastock 18 end of day c*****d.

babeonidi reacted to a post in a topic:

Metastock 18 end of day c*****d.

-

babeonidi reacted to a post in a topic:

Metastock 18 end of day c*****d.

babeonidi reacted to a post in a topic:

Metastock 18 end of day c*****d.

-

⭐ goldeneagle1 reacted to a post in a topic:

Metastock 18 end of day c*****d.

⭐ goldeneagle1 reacted to a post in a topic:

Metastock 18 end of day c*****d.

-

⭐ goldeneagle1 reacted to a post in a topic:

Metastock 18 end of day c*****d.

⭐ goldeneagle1 reacted to a post in a topic:

Metastock 18 end of day c*****d.

-

fxtrader99 reacted to a post in a topic:

@@RenkoKings ImTREX

fxtrader99 reacted to a post in a topic:

@@RenkoKings ImTREX

-

-

i did everything but I cant find any ninza indicators on the add indicator list on multi timeframe fusion indicator anyone know what could be wrong

-

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

All, Please share if anyone have Zion Trading Algos latest version(v2.4.3).. Thanks https://www.ziontradingalgos.com/

-

-

please re upload the edu version of this please

-

weird, must have changed since i joined, didnt know users were paying that much, feel bad for those folks, because its not the holy grail and a lot of them have been losing lately

-

GannBaumring changed their profile photo

-

thewisefox joined the community

-

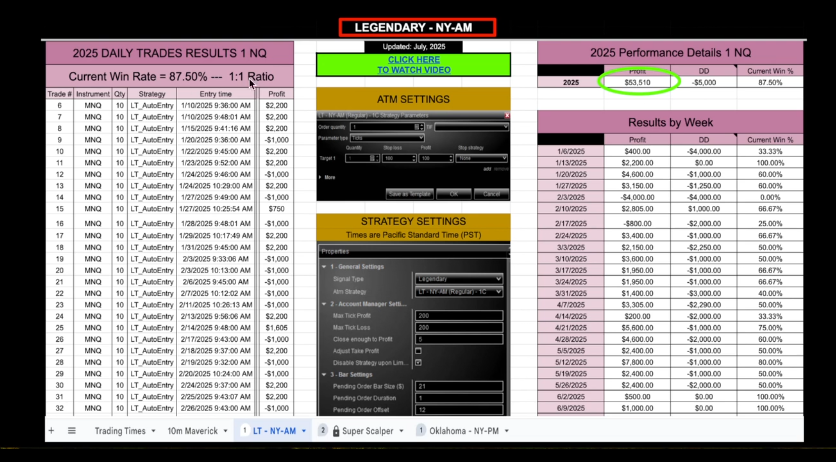

Admin is not letting to join discord.. asking to subscribe ---- $747/Month subscription fee https://stan.store/LegendaryTrader/p/get-access-now-utkjo

-

Pirate Trader's Markets And Mind

Victoire replied to roddizon1978's topic in Trading Systems and Strategies

Hi, Could you re upload the links please? Thanks -

This is the file iso for Metastock 11 rel time that contain the Downloader 11. You don't write it on a cd , but you can mounted the file with a program. https://www.mediafire.com/file/5fm2s0u9ehj19gp/Metastock_RT_11.iso/file

-

hi where can i get dowloader 11 for converting csv to meta stock format. please help me

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

JP 225 forecast: the index may enter a sideways channel The JP 225 stock index is trading within an uptrend, although it is currently undergoing a correction. The JP 225 forecast for today is positive. JP 225 forecast: key trading points Recent data: Japan’s current account totalled 4.483 trillion JPY Market impact: the effect on the Japanese stock market is mostly positive Fundamental analysis Japan’s current account surplus reached 4.483 trillion JPY, well above both the forecast of 2.468 trillion JPY and the previous value of 3.701 trillion JPY. This indicates that the inflow of foreign income – exports minus imports plus overseas investment returns – was stronger than expected. This is a positive sign for the economy: the external balance remains stable, and the country earns more foreign revenue and investment income. For the JP 225 index, however, the effect is mixed. A strong surplus can support the yen, and if the currency strengthens, exporters’ profits converted from USD or EUR into JPY will shrink, creating a short-term headwind for automakers, electronics, and industrial machinery producers. On the other hand, a stronger yen makes imported energy and raw materials cheaper, improving margins for domestic-oriented companies. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 361 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

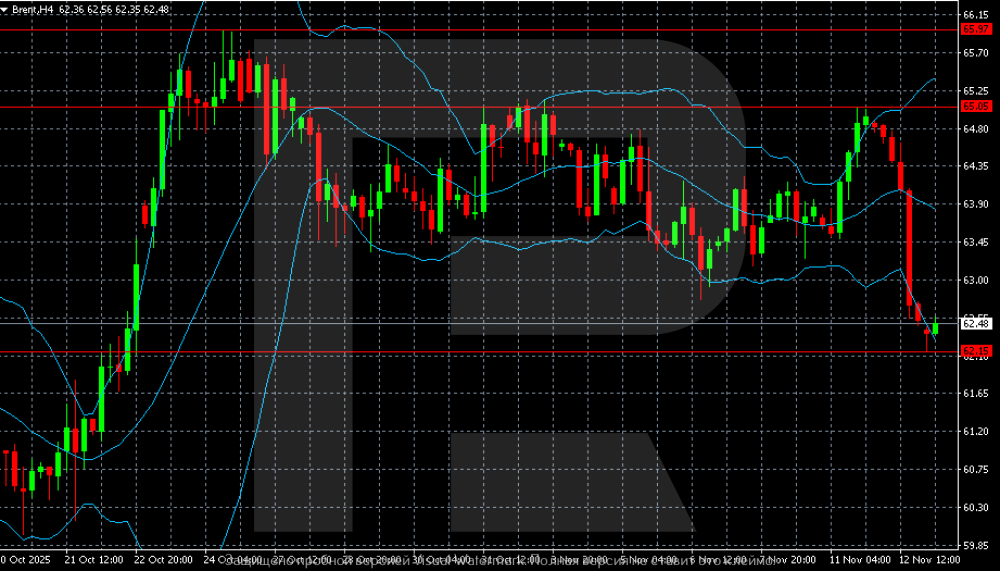

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

Brent at a three-week low: selling pressure persists Brent crude has fallen to 62.15 USD. The sector is in turmoil as producers push for higher output. Find out more in our analysis for 13 November 2025. Brent technical analysis On the H4 chart, Brent shows a sharp increase in its downward momentum. After a prolonged consolidation phase within the 63.50–65.00 range, prices broke below the lower boundary and dropped to 62.15, a key support area. The current value reflects a mild local rebound following a steep decline. Brent remains weak after a midweek sell-off. Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

thanks fxzero anyone re up SBS auto trader

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date: November 13, 2025. US Shutdown Ends, Fed Split on Rate Cuts, and UK Data Weighs on the Pound The longest government shutdown in the history of the US has officially come to an end. However, even with the shutdown over, today's inflation report may still be postponed. According to Goldman Sachs, the Bureau of Labor statistics will likely schedule the NFP Employment Change for early next week. Economists and analysts continue to expect the inflation rate to remain at 3%, with employment continuing to weaken. As a result, the stock market continues to rise, while the US Dollar remains unchanged. The price movement is largely due to its impact on interest rates. However, two members of the Federal Reserve officially came out opposing a rate cut in December. As a result, the possibilities of a rate cut fell from 66% to 52% according to the Chicago Exchange. Although many economists continue to advise that the Federal Reserve is still likely to cut rates in December. GBPUSD - Poor Economic Data Continues For the UK The British Pound continues to decline for a third consecutive day, with downward momentum gaining due to further poor data. The UK's employment data was originally triggering the downward price movement of the week. This includes the UK's Unemployment Rate rising to 5% and salary earnings falling 0.2% below expectations. However, today's UK Gross Domestic Product further increases the downward momentum. The UK's Gross Domestic Product fell from 0.0% to -0.1% and below previous expectations. The GDP expectations, which are also made public by the Office For National Statistics, also fell from 0.3% to 0.1%. Since the announcement at 07:00 (GMT), the price of the Pound fell 0.17%, but has since seen up-and-down volatility. A positive factor for the Pound is Health Minister Wes Streeting de-escalating the latest political tensions. Sources within the Labor Party also reported a possible leadership change, with Health Minister Wes Streeting emerging as a potential candidate. However, Mr Streeting has since advised he has no desire to oust the current UK Prime Minister. The British Pound is the worst performing currency of the week along with the Japanese Yen. The best performing currency remains the Swiss Franc and Australian Dollar. NASDAQ - Cisco Beat Earnings Expectations, But Fed Members Oppose a December Cut The NASDAQ and S&P 500 saw a day marked by contrasting performances between the first and second halves of the day. The NASDAQ rose in value during the Asian and US Sessions but fell during the US session. The decline was largely due to the comments made by two members of the Federal Reserve. Two Federal Reserve officials voiced opposition to another interest rate cut at the December meeting, adding uncertainty to the Fed's policy outlook. Previously, members had taken a neutral stance or advised that a cut was not certain. However, in recent weeks this is the first time members have outright opposed a rate cut. Comments from Susan Collins, President of the Boston Fed, and Raphael Bostic, President of the Atlanta Fed, indicate the rate-setting committee may be shifting away from what was previously expected to be a third consecutive rate reduction next month. If the Federal Reserve does not cut in December, the NASDAQ could decline between 4-7% according to JP Morgan's Strategists. NASDAQ (USA100) 30-Minute Chart A positive factor for the NASDAQ is the end of the US shutdown officially coming to an end as well as the latest positive earnings reports. Last night, Cisco Systems made public their earnings for the 3rd quarter. The company's revenue beat expectations by $11 million and earnings beat expectations by $0.02. In addition to this, an important factor for shareholders is the company's forward-guidance figures were significantly higher than previous data. Cisco stocks rose 3.14% on Wednesday and a further 7% after the announcement of the company's earnings. On Wednesday, 58% of the most influential stocks (weight above 0.50%) rose in value with AMD stocks witnessing the strongest gains (+9.00%). NASDAQ Component Performance - 12th Nov NASDAQ - Technical Analysis Even with the decline during yesterday's Asian session the price of the NASDAQ remains above most Moving Averages. The price is also trading slightly above the RSI's neutral level on the 30-minute timeframe. The NASDAQ continues to form higher highs and lows, but has not broken above the resistance level at $25,793.00. The price is almost forming a 'head and shoulders' price pattern, which would indicate a downward trend. This is something investors will continue to monitor, and if the price falls below $25,570.00, the 'head and shoulders' pattern will become more visible. However, if the price rises above $25,662.20, the pattern and bearish signal will fade, and buy signals will strengthen. Key Takeaway Points : US government shutdown ends, but key economic reports such as inflation and employment data may still face delays. Rate-cut expectations fell from 66% to 52% after two Fed officials publicly opposed a December reduction. Economists and analysts continue to expect the inflation rate to remain at 3%, with employment continuing to weaken. UK economic data disappoints, with GDP contracting by 0.1% and unemployment rising, pressuring the British Pound further. Cisco released its Q3 earnings, beating revenue estimates by $11 million and EPS by $0.02, with stronger forward guidance. Cisco's stocks rose 7.00%. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyze the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Michalis Efthymiou HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

Bitcoin Jackpot Bounty and Affiliate Program!

CryptoFluxor replied to JohnDyson's topic in Cryptocurrencies

Bitcoin Jackpot’s bounty and affiliate program aim to reward users for promoting the platform, but investors should exercise caution. Such schemes often lack transparency and carry potential risks. Always research thoroughly, verify legitimacy, and avoid committing funds without clear information on payout structures, regulatory compliance, and project credibility. -

Litecoin Cash: A Faster way Of Transaction

CryptoFluxor replied to Marty Landry's topic in Cryptocurrencies

Litecoin Cash claims to offer faster transactions, but it lacks significant adoption and developer support compared to major cryptocurrencies. Its network activity remains low, and trading volumes are limited. Without strong community backing or real-world use cases, Litecoin Cash struggles to prove its long-term value or reliability in the market. -

Ethereum (ETH) regained momentum, recovering losses as strong support formed near $2,500. Buyers are showing renewed interest, keeping the trend positive. If ETH sustains above this level, it may target $2,650 next. Meanwhile, LMGX also shows steady growth, attracting attention amid improving market sentiment.

-

svew joined the community

-

Hi, do you perhaps have V2? Still looking. Would really appreciate it!

-

Hello all, wondering if there is a manual or video on how to use this properly. Thanks

-

https://limewire.com/d/NRlcr#xmhaDqd4ux

-

AlphOmega Elliott Wave for Metastock 18. https://www.metastock.com/customer/support/download/updatesandpatches