All Activity

- Today

-

.. need to check it again.. its not easy to fix ..

-

Welcome to Indo-Investasi.com. Please feel free to browse around and get to know the others. If you have any questions please don't hesitate to ask.

-

@kimsam Dont forget this thread 😀 These iceberg detectors will be very useful

-

First I want to thank you for invitation to the discord group and taking in what you said about the collected money be used on other tools if you allow me the suggestion you could some polls about the possible tools could be purchased

-

Kermit 1981 reacted to a post in a topic:

nCatPriceFlowSignalPack

Kermit 1981 reacted to a post in a topic:

nCatPriceFlowSignalPack

-

yes we have a discord group of those that purchased. https://discord.gg/GCu6Rg7K The extra payment that are collected is used toward some other tools in the future.

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date: 06th May 2025. Wall Street Rally Ends | Fed Decision & Trade War Weigh. Wall Street’s Longest Rally Since 2004 Ends Amid Trade Uncertainty and Weak Tech Performance Wall Street’s nine-day winning streak—the longest since 2004—came to a halt as bullish momentum faded. Major US indices closed lower: the Nasdaq dropped 0.74%, the S&P 500 fell 0.64%, and the Dow Jones Industrial Average slid 0.24%. Despite easing concerns over tariffs, lingering uncertainty surrounding their long-term impact kept investors on the sidelines. A stronger-than-expected ISM services report, which included a sharp rise in prices paid, and optimistic remarks from Treasury Secretary Bessent, failed to lift sentiment. Apple led the market declines, while media and entertainment stocks—including Disney—fell after a 100% tariff was announced on imported films. Berkshire Hathaway also declined following Warren Buffett’s retirement announcement after six decades as CEO. Treasury Yields Climb as Rate-Cut Hopes Fade Treasury yields rose as upbeat economic data tempered expectations for rate cuts. The 2-year yield increased 1.2 basis points to 3.836%, the 3-year note ended 1 bp higher at 3.810%, the 10-year yield advanced 3.7 bps to 4.358%, and the 30-year yield climbed 4.2 bps to 4.830%. This marked the third straight session of yield increases. Despite a strong 3-year auction, bonds remained under pressure. US Dollar Index Slides Below 100; Greenback Faces Broad Weakness The US Dollar Index (DXY) slipped below the 100 mark, closing at 99.809 after touching a high of 100.030 and a low of 99.464. The dollar weakened against most G10 currencies and lost ground to several Asian counterparts as rate differentials failed to offer support. Nevertheless, stronger US economic data—including accelerated activity among US service providers—helped the dollar edge higher during the session, easing a rapid appreciation in Asian currencies spurred by optimism over potential trade agreements. Asia Forex Volatility Increases Amid Trade Hopes The greenback gained 0.2% after the ISM data release. The Taiwanese dollar dropped 0.1% after Monday's historic surge—the strongest since the 1980s. The yen also weakened slightly. Meanwhile, Taiwan’s currency saw its biggest inversion in over two decades as the spread between the spot rate and one-year NDFs hit 3,000 pips, signalling ongoing selling pressure on the US dollar. Global Market Reaction and Oil Rebound Equity index futures for the S&P 500 declined 0.4% after the index snapped its longest rally in nearly two decades. European and Asian markets mirrored the US retreat. Cash trading in Treasuries was halted during the Asian session due to a Japanese holiday. Oil prices rebounded slightly from four-year lows. US crude rose $0.74 to $57.87 per barrel, while Brent crude also gained $0.74 to settle at $60.97. However, WTI crude remained down 1.96% on the day, closing at $56.81 amid concerns about a global supply glut. OPEC+ announced it would increase output by 411,000 barrels per day starting June 1, contributing to a 4% drop in prices on Monday. Gold Surges on Chinese Demand; Equities Under Pressure Gold prices jumped 2.84%, reaching $3333.22 per ounce, driven by increased demand from China. Chinese markets rose after reopening from the Golden Week holiday. The Shanghai Composite added 0.7%, Hong Kong’s Hang Seng gained 0.4%, Taiwan’s Taiex edged up 0.2%, and Australia’s S&P/ASX 200 rose 0.2%. Tech Stocks Lead US Declines; Fed Decision in Focus On Wall Street, tech giants dragged the market lower. Apple fell 3.1%, Amazon dropped 1.9%, and Tesla lost 2.4%. Palantir sank more than 9% in after-hours trading following disappointing results, while Ford warned of a $1.5 billion profit hit due to tariffs, causing its stock to fall 2.5%. Netflix and Warner Bros. Discovery lost 1.9% and 2% respectively after President Donald Trump announced a 100% tariff on foreign-made films. Meanwhile, shoemaker Skechers soared 24.3% on news it would be acquired for $9 billion by 3G Capital. Trade War Escalates as Tariff Policies Create Market Turmoil Tariff-related volatility continues to dominate market sentiment. Trump’s unpredictable trade measures—often announced or reversed overnight—have undermined the dollar’s traditional role as a safe haven and forced investors to reconsider US exposure. A recent 145% tariff on Chinese imports has triggered a steep decline in shipping activity and logistics. According to a Caixin survey, China's services sector activity fell to its lowest non-pandemic level, pushing Chinese firms’ overall optimism to its lowest since records began in April 2012, prompting further job cuts. Outlook: Federal Reserve Decision and Inflation Risks Loom Attention now turns to Wednesday’s Federal Reserve meeting. The Fed is widely expected to keep interest rates steady after cutting them three times in 2024. With inflation hovering just above the 2% target and economic uncertainty lingering, policymakers are likely to maintain a cautious stance. The US economy contracted by 0.3% in Q1—the first quarterly decline in three years—raising concerns about tariff driven slowdown. Inflation fears are resurfacing, compounding market anxieties as investors await clearer guidance from the Fed and potential developments on the trade front. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Andria Pichidi HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

I don't see much reaction to your nCat gifts - so: I can’t thank you enough ! Thanks a million! to everybody: if you've got anything concerning nCats strategies, indicators - i.e. tutorials, templates - please upload!

-

-

Hi. Can you please reset the previous version?

-

offshorekeys joined the community

-

Kermit 1981 reacted to a post in a topic:

nCatVolatilityResponseTrader

Kermit 1981 reacted to a post in a topic:

nCatVolatilityResponseTrader

-

kimsam reacted to a post in a topic:

tradingtransformations.com

kimsam reacted to a post in a topic:

tradingtransformations.com

-

alodante reacted to a post in a topic:

ScalperIntel IFVG

alodante reacted to a post in a topic:

ScalperIntel IFVG

-

https://s3.amazonaws.com/kajabi-storefronts-production/file-uploads/sites/97767/themes/2161199240/downloads/e5002e5-d2e1-8ae6-ab32-0257c4bc4861_1.mp4 https://s3.amazonaws.com/kajabi-storefronts-production/file-uploads/sites/97767/themes/2161199240/downloads/127784-0773-f8b6-04b4-01106ffcdb4_2.mp4

-

ampf started following ScalperIntel IFVG and tradingtransformations.com

-

There is a possibility to schedule a presentation of this indicator here https://calendly.com/tradingtransformations/trading-strategy-audit but I will hardly have that possibility so soon. Anyone would be interested or in conditions to schedule and leave a review? Thanks

-

The newcommers lose money because they come with a mindset of becoming rich right over the night after joining this industry. They do not cater trading as a business and treat it like casino to push buttons to make money.

-

I guess the forex trading is better than the binary option trading in my opinion.

-

I see with binance and coinbase evolution, there are many brokers like lmfx who started offering spot digital currency trading and some like hfm also offer bitcoin cfd trading too.

-

⭐ laser1000it reacted to a post in a topic:

kissorderflow.com

⭐ laser1000it reacted to a post in a topic:

kissorderflow.com

-

Kermit 1981 reacted to a post in a topic:

nCat Bots Package

Kermit 1981 reacted to a post in a topic:

nCat Bots Package

-

craje joined the community

-

the guy lost channel by dcma

-

This is ScalperIntel IFVG needs to be educated. I have tried but asked for refund as it repainted a lot however someone may find useful. https://limewire.com/d/Jh9gG#qqFLQ4OFmQ

-

hybrid76 reacted to a post in a topic:

nCatOmniProfit

hybrid76 reacted to a post in a topic:

nCatOmniProfit

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

Markets hold breath ahead of Fed decision: EURUSD poised for growth The EURUSD pair is regaining ground, with bulls aiming to test the 1.1495 resistance level. Discover more in our analysis for 6 May 2025. EURUSD forecast: key trading points The ISM services PMI in the US rose in April, exceeding analyst expectations The Federal Reserve’s two-day policy meeting, concluding on Wednesday, will be one of the week’s key events Most market participants do not expect any change in the interest rate EURUSD forecast for 6 May 2025: 1.1615 Fundamental analysis The EURUSD rate is showing moderate recovery as buyers keep the pair above the key support level at 1.1265. The US ISM services PMI rose to 51.6 in April from 50.8 in March, beating the forecast of a drop to 50.6. Although a reading above 50.0 signals expansion, the upbeat data only briefly supported the US dollar. The main focus of the week is the Federal Reserve’s two-day meeting, which concludes on Wednesday. Investors are looking for signals regarding potential monetary easing. Despite strong US labour market data, most market players expect the Fed to leave rates unchanged. This supports a moderately bullish outlook for the EURUSD pair. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 234 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Technical Analysis

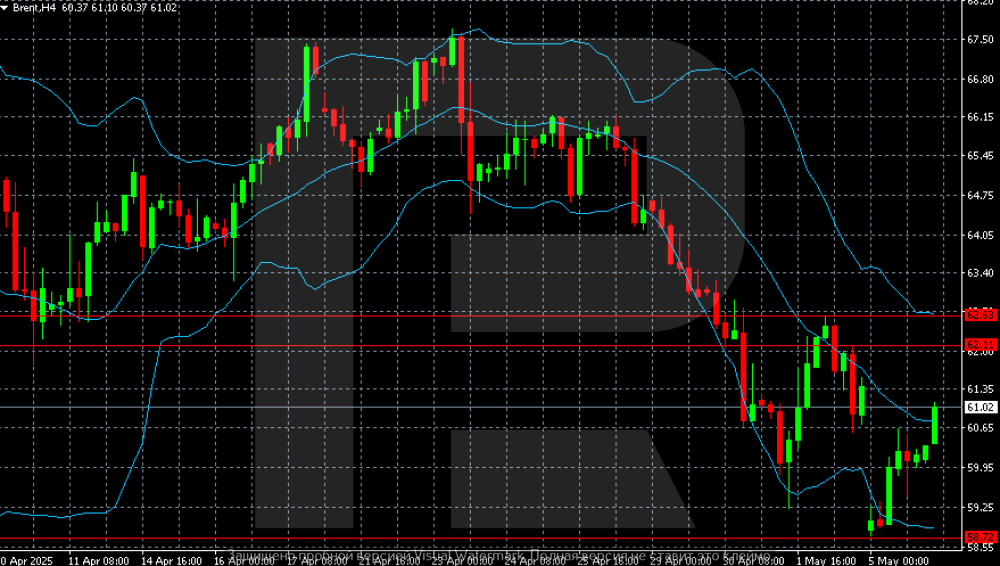

Brent rebounds slightly, but the sell-off is not over yet Brent oil has recovered to 61.17 USD. The sharp two-day drop has paused. Discover more in our analysis for 6 May 2025. Brent technical analysis On the H4 chart, Brent prices have rebounded from a local low of 58.72 and moved up towards 61.00. For the bounce to transition into a sustained reversal, prices must consolidate above 62.11. This would pave the way for further gains towards 62.63. Brent prices have recovered after a steep drop, but still trade near four-year lows. Read more - Brent Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

⭐ ajeet reacted to a post in a topic:

ninjastrategyloader.com

⭐ ajeet reacted to a post in a topic:

ninjastrategyloader.com

-

⭐ ajeet reacted to a post in a topic:

Ekitai & Seihai Need Unlocking

⭐ ajeet reacted to a post in a topic:

Ekitai & Seihai Need Unlocking

-

Channel got a copyright strike.

-

@leafpile Would you be available we could buy this from you?

-

I have older version

-

Thats of those things we like to hear. I think we could do another joint purchase to buy this as unfortunately the last one has already ended. I would like to ask here who would be interested in to.

-

Ich habe es am sim life (ES)am laufen mit beginn 15:30 Europäische Zeit am Laufen mit 2 tick target stopp, 3 tick. Wie auf seine letzten video aufnahmen. Ich weis nicht ob das einen sinn macht.Probiere es mal aus. Aber die r33 version sollte stabieler sein wie die voriege nersion habe ich irgendwo gelessen. (Bei MES hat es nicht funktioniert).