⤴️-Paid Ad- Check advertising disclaimer here. Add your banner here.🔥

All Activity

- Today

-

When you say everyone, which ones are you referring to?

-

HFMarkets (hfm.com): Market analysis services.

AllForexnews replied to AllForexnews's topic in Fundamental Analysis

Date: 26th January 2026. Are the US Eying A Weaker USD? The US Dollar Index has seen its strongest decline in eight months and has fallen to its lowest since September 2025. The downward price movement is due to threats of new tariffs on key trade partners, including the EU and Canada, as well as intervention talks between corporations to boost the Japanese Yen. A key question during the elections which is now resurfacing is whether the US is aiming for a weaker Dollar. The US president has been clear that he is looking to bring back manufacturing to the US. Countries looking to boost manufacturing and exports tend to benefit from a weaker currency, such as China, Japan and Korea. USDJPY - Are the US and Japan Coordinating Currency Intervention The Japanese Yen saw two major price movements, the first on Friday where the price rose 1.99% and another on Monday increasing a further 1.15%. The USDJPY is now trading at its lowest level since November 2025. The Japanese Government has intervened into the currency exchange on four occasions over the past three years. The Japanese government does not confirm if a price movement is due to intervention once it happens. However, government officials have been signalling intervention was imminent if the price did not quickly move in favour of the Yen. Investors should note that the decline in the USDJPY is causing the value of the US Dollar to decline in general. In the past week, the Japanese Finance Minister Mr Katayama, and the US Treasury Secretary, Mr Bessent have made comments about supporting the Yen against the US Dollar. For many investors watching the Dollar, signs that the US is willing to support a stronger Yen revive talk of coordinated action to push the US Dollar lower. As a result, the US Dollar is declining against all currencies as this move hurts sentiment towards the currency. The US Dollar is the worst performing currency of today and this year so far. The best performing currencies have been the Australian Dollar, New Zealand Dollar and Japanese Yen. Strategists also note that these three currencies are at a low risk from geopolitical tensions and tariffs. US Geopolitical Tensions and Gold The US over the past week has been the centre of both internal political crises as well as global ones. Investors are struggling to avoid pricing in the possibility of trade tariffs at some point in 2026. As a result, countries and institutions are limiting their exposure to the US Dollar. Gold’s price moves are also another indication that investors expect the value of the US Dollar to decline in the medium to long term. On Monday, Gold rose above $5,000 for the first time and is up 10% over the past six days. A key price driver is US Dollar weakness and geopolitical tensions. Risks of a US Shutdown? Funding expires on 30 January, and Congress has not yet passed a full budget or a new stopgap bill. As a result, investors are weighing the risk of another US Shutdown. This is another reason for the US Dollar’s decline and the upward price movement seen in metals. President Trump on Saturday threatened to impose 100% tariffs on Canada over that country's trade deal with China, even though he had previously called the agreement ‘a good thing’. How Long Can the US Dollar Index Fall? HFM - US Dollar Index Daily Chart Even though the current price of the Dollar seems to be relatively low, the price remains higher than that seen before the COVID lockdowns. Nonetheless, the price remains below the five-year average price and slightly below the ten-year average. Key support levels can be seen at 89.41, 91.89, and 94.55. Traders will expect the price to fall towards these levels if the currency remains under pressure. Trend-based indicators such as Moving Averages, Crossovers and the VWAP all indicate downward price movement. However, this will also depend on the Federal Reserve’s guidance on interest rates and the US budget developments. The Federal Reserve is due to announce its interest rate decision on Wednesday evening at 19:00 GMT. Key Takeaways: Dollar Index hits eight-month low amid tariff threats and speculation of coordinated yen-support intervention. Yen surges sharply; USDJPY falls to November 2025 lows as intervention signals intensify. Comments from Katayama and Bessent fuel expectations of US-Japan coordination weakening the dollar. Geopolitical tensions, shutdown risk, and gold’s record rally reinforce bearish sentiment towards the US Dollar. Technical indicators point lower, with key Dollar Index support at 94.55, 91.89, and 89.41. Always trade with strict risk management. Your capital is the single most important aspect of your trading business. Please note that times displayed based on local time zone and are from time of writing this report. Click HERE to access the full HFM Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click HERE to register for FREE! Click HERE to READ more Market news. Michalis Efthymiou HFMarkets Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission. -

luludulu reacted to a post in a topic:

complete bestorderflow need to edu

luludulu reacted to a post in a topic:

complete bestorderflow need to edu

-

⭐ goldeneagle1 reacted to a post in a topic:

Trading123 Cloud

⭐ goldeneagle1 reacted to a post in a topic:

Trading123 Cloud

-

this is the main indicator. https://workupload.com/archive/ssztPcBu8L

-

anyone has the main indicators??

-

Yea, SMM - Main and SMM - Dashboard are the indicators. The xml file is just a chart template.

-

@AllIn @Zack If you watch the video he just posted on the Youtube channel. Its a total overhaul of what he was working on in the past few weeks

-

It should have another .cs file or .zip file with the addons

-

dex reacted to a post in a topic:

Simple Market Metrics

dex reacted to a post in a topic:

Simple Market Metrics

-

Gérard Lenorman reacted to a post in a topic:

Tradingview premium Desktop version

Gérard Lenorman reacted to a post in a topic:

Tradingview premium Desktop version

-

ampf reacted to a post in a topic:

Ninza: Multi-Divergence Overlap

ampf reacted to a post in a topic:

Ninza: Multi-Divergence Overlap

-

Is it just me or does this look nothing like what he’s been teasing the last few weeks…

-

⭐ rcarlos1947 reacted to a post in a topic:

Ninza: Multi-Divergence Overlap

⭐ rcarlos1947 reacted to a post in a topic:

Ninza: Multi-Divergence Overlap

-

markscout reacted to a post in a topic:

Ninza OrderFlow Presentation 2

markscout reacted to a post in a topic:

Ninza OrderFlow Presentation 2

-

alodante reacted to a post in a topic:

Simple Market Metrics

alodante reacted to a post in a topic:

Simple Market Metrics

-

Thanks a lot guys been looking for this one for a while.

-

@apmoo @N9Tany luck we can get this working looks profitable and helpful Thanks

-

https://workupload.com/file/8rnmSjq7MAt

-

https://workupload.com/file/M9WnUpE9kHM

-

Chek ur dm?

-

This is uneducated version but this indicator is now Ninza ApexFlow Zignal with some extra features: https://workupload.com/file/UfmW7N9JM9w Ninza's product page: https://apex.nt8.ninza.co/

-

tradegr8 joined the community

-

It worked with every ninza indicator I threw at it, impressive! Just need the Infinity to work and try out some combos. appreciate the work you put it!

-

@apmoocan you take a look man?

-

roboforex Market Fundamental Analysis by RoboForex

RBFX Support replied to RBFX Support's topic in Fundamental Analysis

DE 40 forecast: the index tested support, but the uptrend remains intact The DE 40 stock index has completed its correction and is ready to resume growth. The DE 40 forecast for today is positive. DE 40 forecast: key trading points Recent data: Germany’s ZEW Economic Sentiment Index came in at 59.6 in December Market impact: the data creates a positive backdrop for the German equity market Fundamental analysis Germany’s ZEW Economic Sentiment Index rose to 59.6 points, significantly exceeding the forecast of 50.0 and improving markedly from 45.8 previously. For equity markets, this is primarily a positive signal, as the ZEW index is a leading indicator of sentiment and reflects improving expectations among professional analysts regarding economic dynamics in the coming months For the DE 40 index, the effect is typically more pronounced than for the broader market, as the index has a high weighting of global industrial and export-oriented companies whose performance is strongly linked to growth and order expectations. RoboForex Market Analysis & Forex Forecasts Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team- 404 replies

-

- anlaysis

- dailyanalysis

-

(and 3 more)

Tagged with:

-

Market Technical Analysis by RoboForex

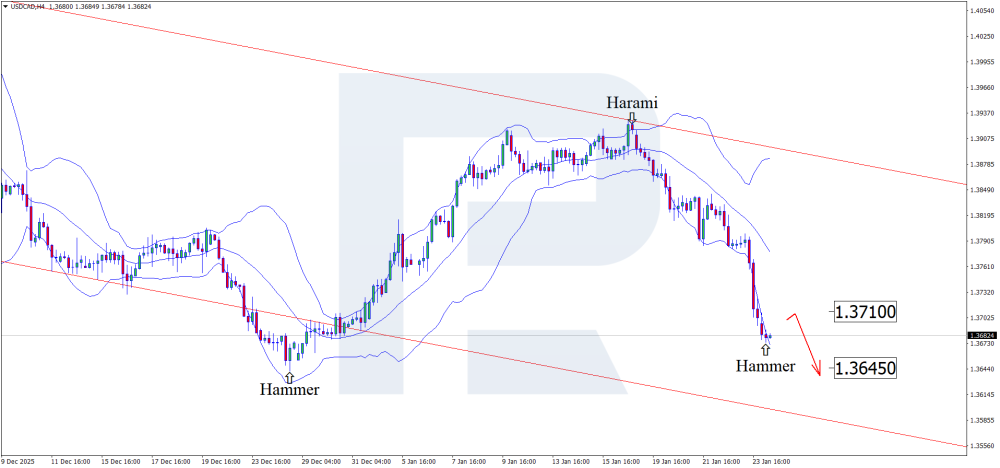

RBFX Support replied to RBFX Support's topic in Technical Analysis

Oil, BoC, and US tariffs: a perfect storm for a USDCAD decline The Canadian dollar continues to strengthen, with the USDCAD rate testing the 1.3690 level. Discover more in our analysis for 26 January 2026. USDCAD technical analysis On the H4 chart, the USDCAD pair formed a Hammer reversal pattern near the lower Bollinger Band. At this stage, it may develop a corrective wave following the signal. Since prices remain within a descending channel, a pullback towards the nearest resistance at 1.3710 can be expected. The Canadian dollar continues to strengthen amid expectations of the BoC interest rate decision. Read more - USDCAD Forecast Attention! Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews. Sincerely, The RoboForex Team -

vonita started following Praedox 2.0 - Trader's Assistant

-

lastest version predator traesaber version 3.6.0.0.0 need to edu

N9T replied to TRADER's topic in Ninja Trader 8

I am not planning to look into 3.6.1 if that's what you are asking. -

lastest version predator traesaber version 3.6.0.0.0 need to edu

m.dannytrader replied to TRADER's topic in Ninja Trader 8

He has a new version. Are you able to do that one? -

lastest version predator traesaber version 3.6.0.0.0 need to edu

N9T replied to TRADER's topic in Ninja Trader 8

So far, results with live market data don't look better. PredatorX doesn't take all the trades although the signals are generated and the conditions are green. Problem is there is no log. Could be a product issue. -

Thank you very much

-

Does anyone have this one? @N9T